Move over, cash back credit cards! Make room for prepaid debit cards with cash back rewards. Prepaid debit cards don’t require credit checks for approval, yet they let you conveniently make purchases and pay bills.

Moreover, they’ll never charge you for overdue payments or overdrafts. When you add cash back to the mix, you have a winning solution for consumers who dislike credit (and possibly banks).

Best Prepaid Debit Cards With Cash Back Rewards

The following prepaid debit cards offer cash back rewards on select purchases. They allow you to load money to spend, withdraw, or transfer. They’re not credit cards, so you can get them even if you have limited or bad credit.

- Cashback – Earn 1% cash back on up to $3,000 in debit card purchases each month

- No. Fees. Period. That means you won’t be charged an account fee on our Cashback Debit account.

- Early Pay – Get your paycheck up to two days early with no charge

- No Credit Impact – You can apply without affecting your credit score.

- Fraud Protection – You’re never responsible for unauthorized debit card purchases. If you suspect someone else has used your debit card without your permission, let us know.

- Member FDIC

- Fee-free overdraft protection

- No minimum opening deposit and no minimum balance

- Add cash into your account at Walmart stores nationwide

- Cash access at over 60,000 no-fee ATMs nationwide

- 100% US-based customer service available 24/7

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

No Credit Needed

|

The Discover® Cashback Debit is our top pick for reloadable cash back cards. You can earn cash back on every purchase you make, up to $3,000 spent per month. This debit card is attached to a no-fee Discover® Checking Account, so it’s best for people looking for a full-featured account rather than a traditional prepaid card.

This card has no monthly fees, insufficient funds fees, or in-network ATM fees. This debit card is a great option for anyone who needs a checking account and doesn’t want to pay dearly for the privilege.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

The NetSpend® Visa® Prepaid Card lets you earn cash back rewards for offers at select merchants when you make eligible purchases. You receive reward offers based on your shopping habits. The Payback Rewards program is optional, and you can opt-out online.

The more you use Payback Rewards, the more personalized offers you’ll receive. The card updates its reward offers regularly and posts the cash back from your redeemed offers to your account at the end of the following month. The rewards are not available as a check or other direct payment method.

- Greenlight is a debit card for kids, managed by parents

- Parents set flexible controls and receive real-time alerts while kids monitor their balances, set goals, and learn how to manage money

- Feel secure knowing Greenlight blocks unsafe spending categories

- Receive Mastercard’s Zero Liability Protection

- Upload a photo of your choice to create a unique custom card

- Debit cards are FDIC-insured up to $250,000

- Easily turn your Greenlight card on or off and receive real-time spending notifications

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

See Pricing

|

Not applicable

|

The Greenlight – Debit Card For Kids offers cash back on all purchases and the option to auto-invest the rewards to pay for college — or anything else. Alternatively, you can apply your cash back to your card balance or send it to your e-wallet.

Your cash back rate depends on how much you spend in a billing cycle. The top rate applies when you spend $4,000 or more monthly on purchases. Lower rates apply for monthly spending above and below $1,000.

- Waive your monthly fee when you direct deposit $500+ in previous monthly period. Otherwise, $5.94 a month.*

- Earn 3% cash back at Walmart.com, 2% cash back at Walmart fuel stations, & 1% cash back at Walmart stores, up to $75 each year.*

- Earn 2% interest rate on up to $1,000 balance in your savings account. Plus, get chances to win cash prizes each month!*

- Get peace of mind with three coverage levels, up to $200, for purchase transactions with opt-in & eligible direct deposit.*

*Please see site for full terms and conditions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Walmart MoneyCard® is a debit card offer.

The Walmart MoneyCard® from Green Dot Bank offers cash back rewards for shopping at Walmart, online or in-store, and at Walmart gas stations. Its cash back rates vary depending on how you spend your money at Walmart. You can earn up to $75 annually via cash back rewards.

Walmart credits cash back to your card balance at the end of the reward year. A reward year is a 12-month period in which your card remains in good standing. Cash back rewards typically accrue to your balance promptly after your qualifying purchase transaction posts but could take up to 30 days.

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

The PayPal Prepaid Mastercard® lets you receive your paychecks and/or government benefits up to two days before payday. The card provides cash back offers from specially selected merchants. NetSpend sponsors PayPal’s Payback Rewards program.

The card does not have interest, late fees, or minimum balances. You can use it everywhere merchants accept Mastercard®, including grocery stores, ATMs, online subscriptions, utility companies, and other purchases. The card is an excellent reloadable option for paying bills.

- Get rewarded with unlimited 1% Cash Back when you spend money in stores or online. The funds are available to add to your account as soon as the transaction settles with us, so you don’t have to wait to enjoy the rewards.

- Get your tax refund and direct deposits up to 2 days faster than standard electronic deposits.

- You can withdraw your money without a fee at over 37,000 MoneyPass® ATM locations nationwide.

- Can’t find your Serve card? No need to worry – you can quickly freeze it while you look for it and unfreeze it when you find it. And for extra reassurance, know you won’t be held responsible for fraudulent charges.

- With Emergency Assistance, you can get select access to select emergency coordination and assistance services when you’re traveling more than 100 miles from home.

- Amex Offers provides a range of offers – shopping, dining, and more – from places you love. It’s easy and free.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

Not applicable

|

The Serve® American Express® Prepaid Debit Account offers unlimited cash back on every dollar you spend shopping in stores or online. Unlike some competing cards, this card pays cash back when a transaction settles — you don’t have to wait until the end of the following month.

You can redeem and use the cash back only for future purchases. You cannot redeem your rewards for money or otherwise exchange them for currency. The card charges monthly and reloading fees, reducing your net cash back savings.

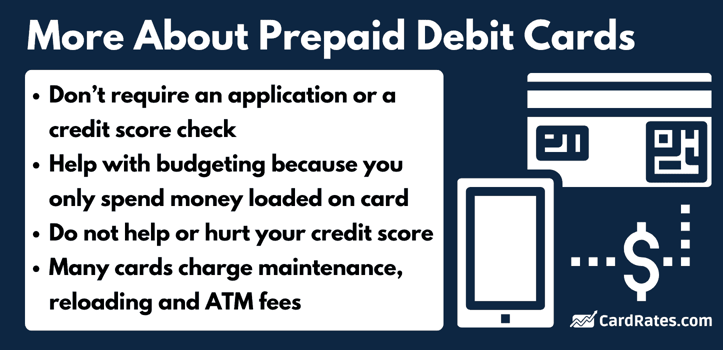

What Is a Prepaid Debit Card?

This type of card requires you to preload money to fund electronic transactions. It may or may not link to a bank account, and you do not need a good (or any) credit score to get one.

You can use a prepaid card for purchases, bill payments, transfers, and ATM withdrawals up to the card’s balance. It generally doesn’t offer the option of overdrawing, and you can’t use it for certain types of transactions, such as hotel bookings or car rentals.

One of its key advantages is that it allows you to control spending, which can be helpful for budgeting. On the downside, prepaid debit cards often come with various charges, including activation, monthly maintenance, and ATM fees. Moreover, using a prepaid debit card doesn’t help you build your credit history.

How Do I Get a Prepaid Debit Card?

Getting a prepaid debit card is easier than obtaining a credit card. Here are the steps for getting one:

- Research issuers: Different financial institutions and retailers offer prepaid debit cards with varying fee structures and features. Do some research to find the one that best fits your requirements. We recommend the ones reviewed above if you want cash back rewards.

- Apply for a card: You can often find prepaid debit cards at grocery stores, convenience stores, and big-box retailers. Banks and credit unions may also offer them. Many issuers allow you to order a prepaid debit card online, which they then mail to your address.

- Read the terms and conditions: Be sure to read and understand the card’s fee structure, limitations, and other terms.

- Identify yourself: While prepaid cards don’t require a credit check, you still need to supply some form of acceptable identification (typically a driver’s license, passport, or other official document) to comply with legal requirements. You must be at least 18 and provide your name, date of birth, Social Security Number, and contact info to verify your card. Minors 13 or older can become authorized users of their parents’ debit cards.

- Activate your card: You can activate your card when you receive it. Call the phone number on the sticker or activate the card online. You must provide the 16-digit card number, expiration date, and 3-digit security code. You can set a secret PIN during this process.

- Load money: After activating the card, you’ll need to load money onto it. You can do this in many ways, including direct deposits, bank transfers, or cash loads at retail locations.

- Start using: Your prepaid debit card is ready to use once activated and loaded with money. You can use it for making purchases, paying bills, or withdrawing cash from ATMs up to your loaded balance.

Following these steps, you can quickly obtain a prepaid debit card that suits your financial requirements and spending habits.

How Do I Earn Cash Back With a Prepaid Card?

Cash back prepaid cards provide rewards when you purchase eligible goods or services. Some cards offer rewards as points you can cash and deposit to your card account. Others can mail you a check or transfer money to a bank account.

Reward rates depend on the issuer and possibly the type of purchase or the amount you spend during the month. For example, a prepaid debit card may pay you 3% cash back for in-store purchases but only 1% when buying online items.

Several cards offer cash back only when you make a purchase through an exclusive offer. You don’t get cash back if you don’t take advantage of the offer. Some cards are co-branded with merchants (e.g., the Walmart MoneyCard) and earn rewards only when you purchase items from the retailer.

Cards may limit the amount of cash back you can earn within a billing cycle or a year. For example, the Discover it® Cash Back limits the amount of cash back you can earn to $30 per month, and the Walmart MoneyCard® limits you to $75 per year.

Depending on the card’s rules, you may be able to redeem your cash back as soon as the purchase transaction posts, at the end of the next month, or once per year on the anniversary date.

Cash reloads, withdrawals, bill payments, and transfers do not earn cash back — you collect rewards only through eligible purchases.

What Fees Do Prepaid Debit Cards Charge?

Below is a chart outlining the common types of fees associated with prepaid debit cards, along with explanations and example amounts.

| FEE TYPE | EXPLANATION | EXAMPLE AMOUNTS |

|---|---|---|

| Activation Fee | Charged when you first purchase and activate the card. | $3 to $10 |

| Monthly Maintenance Fee | This recurring monthly fee is for keeping the account active. It is an alternative to a per-use fee. | $0 to $10 per month |

| Per Use Fee | The card charges a fee every time you make a purchase or transaction using the card. It is an alternative to a monthly maintenance fee. | $0.50 to $2 per transaction |

| Reload Fee | A cash reload fee for adding money to the card balance. | $2 to $5 per reload |

| ATM Withdrawal Fee | This charge is for withdrawing money from an ATM. Fees may differ if the ATM is out-of-network. | $1 to $3 per withdrawal |

| Balance Inquiry Fee | A fee for checking the card balance at an ATM. | $0.50 to $1 per inquiry |

| Foreign Transaction Fee | This charge is for making purchases or ATM withdrawals in a foreign currency. | 2% to 3% of the transaction |

| Inactivity Fee | The issuer charges you if you do not use the card for a certain period, usually after 90 to 180 days of inactivity. | $2 to $5 per month |

| Card Replacement Fee | A fee for replacing a lost or stolen card. | $5 to $10 per replacement |

| Over-the-Counter Cash Fee | A fee for withdrawing cash at a bank teller instead of an ATM. | $2 to $5 per withdrawal |

| Paper Statement Fee | The issuer may charge you if you request a physical statement mailed to you. | $1 to $3 per statement |

Your card’s actual fee structure may differ from the general information in the chart. Some prepaid debit cards minimize fees while others lard them on. You can find all the costs specified in the cardmember agreement.

What Is the Best Prepaid Debit Card With No Fees?

Our favorite no-fee card is the Bluebird® American Express® Prepaid Debit Account, even though it does not pay rewards. With no annual or monthly fees, no bill pay fees, no transaction or purchase fees, and no initial card fee if you order online, the card can save users a lot of money.

There are no ATM fees if you use one of its MoneyPass® ATM locations. Additionally, the card provides valuable personal finance and money management tools.

You can use the card’s Insight® app to categorize, track, and set spending limits for up to four separate cards. The mobile app and online interface let you manage your account from anywhere with an internet connection. The BlueBird Card is an excellent resource for exercising good budgeting and money management habits.

How Do I Add Money to a Prepaid Card?

There are several ways to load money onto a prepaid debit card, including:

- Online bank transfer: Visit the card’s website and log in to your account. Find the section where you can add funds to your card, often labeled as “Load Funds,” “Add Money,” or something similar. Select the option to transfer money from your bank account by filling in the necessary information, including the amount you want to transfer and your bank account details. Finish by reviewing your information and confirming the transfer.

- Direct deposit: Log on to your card’s website to find the account and routing numbers for direct deposits. Provide these numbers to the payer (i.e., employer, government benefits program, or another institution depositing money into your account). The funds will automatically load onto your card according to the payment schedule.

- Cash load at retail locations: Visit a participating retail site that allows prepaid card cash loading. Hand the cashier your card and the cash you want to load. You may have to pay a small fee for this service. The cashier will load the funds and give you a receipt. Alternatively, you can purchase a cash reload pack from the cashier. Enter the pack’s unique code online or in your mobile app.

- Mobile app: If your card issuer has a mobile app, download it from the App Store or Google Play. Open the app and log in to your account. Navigate to the section where you can add funds. Follow the on-screen directions to add money using your preferred method, which may include linking a bank account, using a debit card, scanning a paper check, applying a reload pack, or transferring from another account.

- ATMs: Some ATMs can accept cash deposits. Find one on your debit card’s network and tap or insert your card. Input your Personal Identification Number (PIN) when prompted. Follow the ATM’s directions to insert your cash. Some ATMs may require you to put the money in an envelope, while newer machines may allow direct cash feeding. The ATM will count the money and ask you to confirm the deposit amount. When you do so, the ATM will load the funds onto your prepaid card and print a receipt. Fees and limits may apply.

Always double-check your balance via the card’s website or mobile app to verify the deposit.

How Do Prepaid Debit Cards Compare to Secured Credit Cards?

Debit cards and secured credit cards share the same size and overall appearance. Each has the issuer’s name, a 16-digit account number, an expiration date, and a security code. They may be plastic, carbon fiber, or metal.

Some people even refer to the secured variety as a prepaid credit card. But their differences far outnumber their similarities, as the following chart reveals:

| FEATURE | PREPAID DEBIT CARD | SECURED CREDIT CARD |

|---|---|---|

| Purpose | Spending only the money you load | Building or repairing credit history |

| Credit Check | Not required | Usually required |

| Initial Deposit | Required to load funds for spending | Necessary as a security deposit |

| Bank Account Required | No, but some methods for loading funds may require one | Yes, for paying the monthly bill |

| Monthly Fees | Fees may apply and vary by provider. Some cards charge by the use instead. | May apply, varies by provider |

| Interest Rates | No interest, as you are using your own money | Often higher than unsecured cards |

| Overdraft Fees | Generally not applicable | Not applicable but may have late fees |

| Credit Building | Does not build credit history | Regular use and payment can build credit |

| ATM Withdrawals | Generally possible, often with fees | Cash advances are possible, but they incur fees and interest |

| Usage Limitations | Limited to the amount loaded onto the card | Limited to the security deposit or credit limit |

| Reloadable | Yes, you can reload with more funds | No, you pay off the balance to free up credit |

| Cash Back/Rewards | Sometimes offered | Several cards offer rewards |

| Minimum Age Requirement | Usually 18, but minors can be authorized users | Typically 18 |

| Issued by | Various providers, including banks and independent firms | Commonly, issuers are banks and credit unions |

Unbanked individuals will invariably prefer prepaid debit cards. If you do have a bank account, you can get either or both types of cards. To build credit, you must choose the credit card option.

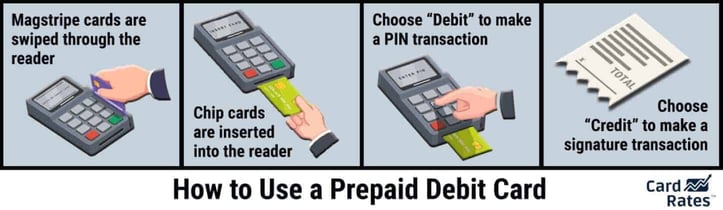

Do I Need a PIN to Use a Prepaid Debit Card?

Yes, PINs are typically needed to make in-person transactions. They are secret four-digit codes that add a layer of security to card use.

Most prepaid debit cards let you add a PIN to your card when you activate it. You can use the PIN when you withdraw money from an ATM or make a PIN purchase at a store keypad. But note that some cash back debit cards do not offer rewards for PIN purchases.

You usually choose a PIN when you first use the card. Create a PIN that is easy to remember but not entirely obvious. Avoid PINs likely to be among the first tried by a card thief, such as 1111 or 1234.

Once you assign your PIN, insert or tap your reloadable prepaid card onto a compatible ATM, enter the PIN, and withdraw cash. You can request an amount up to either the balance on your card or the maximum daily limit.

Most prepaid cards do not charge ATM fees when you use an in-network machine, but you’ll face added fees for out-of-network ATM withdrawals.

Can I Build Credit With a Prepaid Debit Card?

Using prepaid debit cards will not help you build or rebuild your credit because they do not extend credit. Prepaid debit cards do not report activity to the credit bureaus. The credit bureaus track your credit history which generates your credit scores.

Prepaid debit cards let you spend only the money you’ve already loaded onto the card. You’re not borrowing money you’ll repay later, which is a requirement to establish credit. Because a reloadable prepaid card is not a line of credit, it doesn’t demonstrate that you can responsibly borrow and repay money.

What Are the Pros and Cons of Prepaid Debit Cards?

Prepaid debit cards offer numerous benefits and drawbacks. The value of these cards depends on your financial needs and how you plan to use them. Here’s a breakdown of their pros and cons.

Pros of Prepaid Debit Cards

Prepaid debit cards are attractive for the following reasons:

- No credit check: Since you’re not borrowing money, no credit check is necessary, making these cards available to consumers with poor, limited, or no credit history.

- No overdraft fees: You can only spend what you have loaded onto the card, eliminating the risk of overdraft fees.

- Easy to obtain: Prepaid debit cards are readily available online and at various retail locations.

- Budget-friendly: They are an excellent budgeting tool since you can only spend what you have loaded onto the card.

- Safer than cash: You can easily replace most lost or stolen prepaid cards without losing your money.

- Online and in-store purchases: These cards usually carry a major card network logo (i.e., Visa®, Mastercard®), making them practical for online and in-store transactions.

- No bank account required: Prepaid cards are Ideal for unbanked individuals, as they can still perform most financial transactions.

The most robust demand for prepaid debit cards comes from unbanked consumers and folks with bad credit. But anyone can use prepaid cards, regardless of banking or credit status.

Cons of Prepaid Debit Cards

Prepaid debit cards have several drawbacks:

- Don’t Build Credit: Issuers of prepaid debit cards do not report your activity to credit bureaus, so they won’t help improve your credit score.

- Fees: Many prepaid cards impose various charges, such as activation, monthly maintenance, reload, and ATM withdrawal fees.

- Limited features: These cards often lack the perks and protections you get with traditional credit cards, such as travel insurance and fraud protection.

- No interest earnings: Unlike a savings account, the money you load onto a prepaid card does not earn interest.

- Loading inconvenience: Depending on the card, reloading money may be inconvenient and incur a fee.

- Limited protection: While safer than cash, these cards usually offer fewer consumer protections against unauthorized transactions than credit cards.

Even if you feel conflicted about prepaid debit cards, remember that getting one is not a significant financial decision. They don’t affect your credit, don’t create debt, and charge moderate to low fees. You can get one and try it out — if you don’t like it, there’s no harm done.

Add a Prepaid Cash Back Debit Card to Your Financial Toolbox

Prepaid debit cards can help many consumers manage their money more effectively. They are a boon to folks who want to avoid debt or have imperfect credit. They are also great for individuals who get the heebie-jeebies whenever they deal with a bank.

Another way to think of a prepaid debit card is as a reloadable gift card. You can add a family member or friend as an authorized user and periodically add money for them to use. If you want to incorporate prepaid debit cards into your lifestyle, we recommend you start with those in this review because they all provide cash back rewards.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Prepaid Debit Cards for Bad Credit ([updated_month_year]) 7 Best Prepaid Debit Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/08/shutterstock_609135914-edit1.jpg?width=158&height=120&fit=crop)

![7 Best Prepaid Debit Cards With Direct Deposit ([updated_month_year]) 7 Best Prepaid Debit Cards With Direct Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Prepaid-Debit-Cards-with-Direct-Deposit--1.jpg?width=158&height=120&fit=crop)

![7 Prepaid Debit Cards With Mobile Deposit ([updated_month_year]) 7 Prepaid Debit Cards With Mobile Deposit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Prepaid-Debit-Cards-With-Mobile-Check-Deposit.jpg?width=158&height=120&fit=crop)

![5 Best Prepaid Debit Cards For Vacations ([updated_month_year]) 5 Best Prepaid Debit Cards For Vacations ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Prepaid-Debit-Cards-For-Vacations.jpg?width=158&height=120&fit=crop)

![12 Free Prepaid Debit Cards ([updated_month_year]) 12 Free Prepaid Debit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Free-Prepaid-Debit-Cards.jpg?width=158&height=120&fit=crop)

![8 Prepaid Debit Cards Without a Bank Account ([updated_month_year]) 8 Prepaid Debit Cards Without a Bank Account ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Prepaid-Debit-Cards-Without-Bank-Account.jpg?width=158&height=120&fit=crop)

![8 Prepaid Debit Cards with Free Reload Options ([updated_month_year]) 8 Prepaid Debit Cards with Free Reload Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/01/Prepaid-Debit-Cards-With-Free-Reload.jpg?width=158&height=120&fit=crop)

![5 Prepaid Debit Cards With Chips ([updated_month_year]) 5 Prepaid Debit Cards With Chips ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Prepaid-Debit-Cards-With-Chips.jpg?width=158&height=120&fit=crop)