According to recent Federal Reserve data, American households carry an average credit card balance of just over $6,000, which can make the best credit cards to transfer high balances worthy of consideration.

If you’re not paying your balance off each month and are accruing hefty interest fees, these cards can help you save a lot of money and speed up your debt payoff efforts. And many of these cards offer great rewards programs that make them solid long-term additions to your wallet.

Overall | Longest 0% Period | Rewards | Low Ongoing APR | FAQs

Best Overall Cards For Transferring High Balances

If you have a high credit balance, a balance transfer card with 0% financing can be a great incentive to pay it off. Just be sure to pay the entire balance off before the introductory rate expires, when the variable APR can go as high as 27%. These cards offer long 0% intro periods, usually between 18 and 21 months long.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

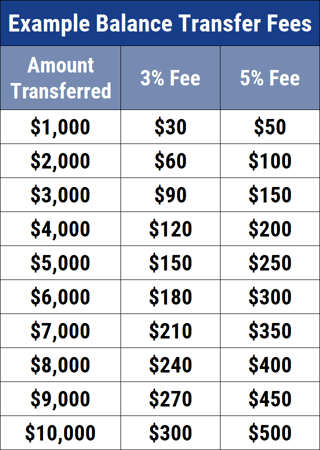

Note that any transfer you make will incur a balance transfer fee of usually 2% to 4% of each transfer. Still, this small percentage far outweighs the purchase APR of most cards being charged interest.

Balance transfers do not earn rewards and may take up to two or more weeks to process. You’ll want to continue to pay your current card so you don’t risk missing a payment and being charged a late payment fee.

Longest 0% APRs for Transferring High Balances

The following three cards offer the longest 0% transfer periods, a couple of which overlap with our best overall due to their, well, long 0% period. These are the longest deals in the industry that we are currently aware of.

- No Late Fees, No Penalty Rate, and No Annual Fee... Ever

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 19.24% - 29.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is an introductory balance transfer fee of $5 or 3% of the amount of the transfer, whichever is greater for balances transfers completed within 4 months of account opening.

- Stay protected with Citi® Quick Lock

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR Period 12 months on Purchases

|

0% Intro APR Period 21 months on Balance Transfers

|

19.24% - 29.99% (Variable)

|

$0

|

Excellent, Good Credit

|

Additional Disclosure: Citi is a CardRates advertiser.

Additional Disclosure: Citi is a CardRates advertiser. Additional Disclosure: The information related to this card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this product.

These cards all offer 0% APRs on new purchases too, though not all for the same length as their balance transfer offers. But the thing about the longest 0% APR cards is that the issuers don’t usually offer purchase rewards, which is the case with these cards. That leads us nicely to our next category…

Rewards Cards For Transferring High Balances

Transferring a high balance to a 0% interest balance transfer offer doesn’t mean you have to go without credit card rewards. Some balance transfer credit cards also pay cash back for new purchases, along with other benefits that can make having a credit card a little easier. Again, rewards aren’t applied to transferred balances, only new purchases.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

Additional Disclosure: Citi is a CardRates advertiser.

Some of these cards provide 0% financing on new purchases in addition to no-interest balance transfers, which means your total balance won’t incur interest fees. It really is the definition of an interest-free loan, and in fact, earning cash rewards means you’re actually being paid to use the card!

Of course, this fact remains true if you pay the balance in full each month on a rewards card thanks to the card’s grace period.

Low Ongoing APR Cards For Transferring High Balances

Before applying for a balance transfer credit card, you should calculate what your monthly payment will be during the no-interest period to ensure you can afford it if your goal is to pay off the balance entirely. Just divide the amount transferred by the number of months in the introductory offer, for example, $6,000 divided by 18 months equals $333.33 per month.

If you can’t afford that but can afford something close to it, you’ll still have paid off a good chunk of debt, but will have to pay interest when the introductory period ends. The following cards can make that a little less painful with low ongoing interest rates long after the promo period expires.

10. Chase Slate Edge℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

- Extended Warranty With Warranty Manager Service

- No annual fee, balance transfer fee, or cash advance fees

- Must meet eligibility criteria to join Digital Federal Credit Union

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

As low as 13.75%

|

$0

|

Average/Good

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

No matter which card you choose, your purchase APR will be determined based on your creditworthiness. Those with higher credit scores receive the best rates, but cards such as the Chase Slate Edge℠ will reduce your rate each year (no less than the prime rate) with responsible use.

And while not quite a 0% APR, the DCU Visa® Platinum Credit Card applies the same low rate to balance transfers and new purchases.

How Do I Transfer a High-Interest Credit Card Balance?

The first things to know before transferring a high-interest credit card balance are what your current balance and interest rate are. Is your current APR lower than what the rate could be after the 0% introductory period ends on the new card?

If not, then make sure you can afford the monthly payment to pay off the balance during the 0% period. If you don’t pay off the balance, and the new rate is higher than what you’re already paying, you could face a bigger debt by taking longer to pay off the original debt.

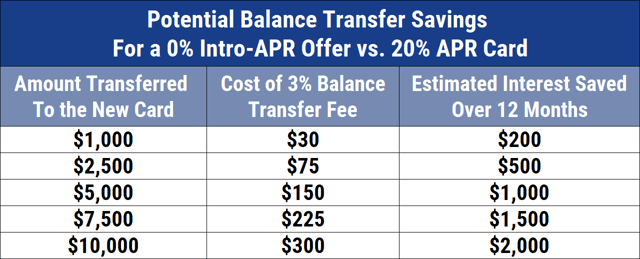

Sometimes, even with a higher interest rate, paying off a large chunk of the balance during the 0% intro period can still make transferring a high balance worthwhile, as displayed in the chart below.

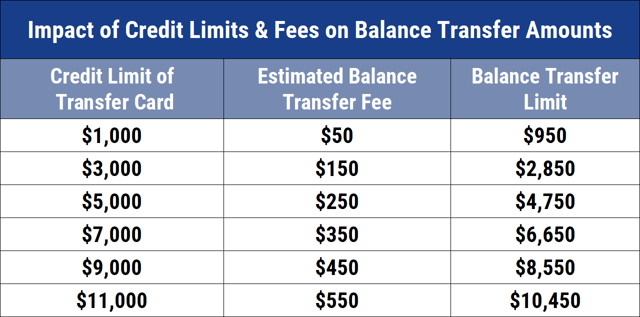

Also, be sure to know how much of a balance you can transfer and what your new credit limit is. The application process includes a credit check, so you may not be approved for a limit that meets your balance transfer needs. You can check your credit score for free from numerous sources to better understand the types of card offers you’ll qualify for.

Once you find a card that fits your needs, you can apply for the card online. If your application is approved, you’ll have to contact the new credit card company with a request to make the balance transfer. These are usually done over the phone or online, sometimes within the card application process itself.

You’ll need to give your new credit card company the account numbers of your old cards and tell them how much you want to transfer. It can take from a few days to a few weeks to process a credit card balance transfer.

Continue making payments on your old card until you get a confirmation that the transfer has gone through. Otherwise, you could face late fees and credit score damage.

Do Balance Transfers Affect Your Credit Score?

Applying for any type of credit usually results in an inquiry on your credit reports, which could stay on your reports for about two years and temporarily cause your credit scores to drop.

Hard inquiries are when a potential lender reviews your credit because you’ve applied for credit with them. If you’re “rate shopping” for a car or home loan, for example, all inquiries made within 45 days count as a single credit inquiry, according to FICO, one of the major credit scoring services. VantageScore only gives you 14 days to complete your rate shopping for it to count as a single inquiry.

One additional credit inquiry could take less than five points off a FICO score, though for many people, it may not affect their score at all. But if you have few accounts or a short credit history, inquiries can have a larger impact. The more credit inquiries you have, the greater the risk you may appear to lenders.

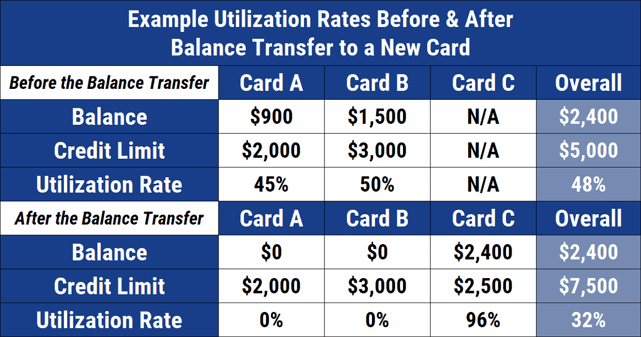

Opening a new credit card will cause the average age of your credit accounts to drop — which isn’t a good thing for a credit score — but you’ll have more available credit and your credit utilization rate will drop, which is a good thing for a credit score.

Credit utilization is the ratio of your outstanding credit card balances to your credit card limits. It measures how much of your credit limit you’re using.

Adding another credit card will increase your credit limit, and if you aren’t using the extra credit available to you, your utilization ratio will drop, which will improve a credit score.

If you have $10,000 in available credit and a balance of $5,000, your credit utilization rate is 50%, or half of the total credit available to you. Ideally, you should use about 30% or less of your credit limit. Credit utilization — or the amounts you owe — account for as much as 30% of a credit score.

Is Transferring Credit Card Balances a Good Idea?

If your goal is to get out of credit card debt within 18 months, then transferring a high credit card balance to one with 0% interest is a good idea — if you can afford the monthly payments to get the balance to zero before the regular purchase APR kicks in.

The transfer will allow you to avoid interest charges, which can seem like they’re taking most of your money without paying much of the balance down.

But if you can’t pay off the balance, or the majority of it, a transfer may not be a good idea. Balance transfer fees, which usually range from 3% to 5%, can eat up some of the savings of an intro 0% APR.

Add that to whatever the new APR rate is when the 0% introductory period ends, and you could be paying a higher rate than you were on your old card.

Don’t be late with any payment due on the new credit card. Even just one late payment could trigger an end to the low introductory rate.

You should use the 0% introductory time to get a handle on your spending if that’s what got you into this situation in the first place. If you’re increasing or even just maintaining your old spending habits and adding debt to a credit card, then you’re not going to get out of debt.

Paying off a balance transfer without interest is a good start, but adding more debt will only leave you in another hole to dig out of.

What if My Balance Exceeds the New Credit Limit?

There’s a chance that if you’re approved for a balance transfer credit card, it won’t be for the credit limit you wanted. The average credit limit is $8,071, according to Experian data, which you’ll notice is less than the average American household credit card debt.

It may also be lower than you need because it was set based on the credit issuer’s assessment of your credit.

Don’t despair. Whatever the new limit is, you can transfer up to that limit and start paying it down at 0% interest during the introductory period. This will at least move part of your credit card debt from a high-interest card and help you pay down some of your debt.

You can then work on a plan to pay off the remaining debt on the old card. If you make regular, on-time payments on the new card, your new credit card may automatically increase the credit limit.

Or, you can call and ask for a higher limit from the start and explain that you’ll be performing a balance transfer. This may help sway the credit card company’s decision to extend you a higher limit.

If your limit increases later and you want to move more money from an old card, be sure to check if a balance transfer has a higher fee than it typically does during the first few months of opening an account.

If it’s outside that timeline, the transfer could be subject to the variable APR that the 0% intro period moves to when the overall timeline, such as 18 months, ends.

Aim to Pay Your Balance Off Before the Intro Period Ends

Transferring debt from an old credit card to a new one with a 0% introductory rate is a smart way to pay off a credit card balance. The key is to pay it off before the introductory period ends. If you don’t, the interest charge could be higher than what you were paying before, and you’re still stuck paying back credit card debt.

However, you may go into a balance transfer offer knowing you’re unlikely to pay off the entire balance before the zero-interest deal ends. That’s OK as long as you expect to pay interest when the deal expires.

Some credit cards have low ongoing APRs after the intro period ends, as we’ve highlighted above, which could still make a balance transfer worthwhile if it’s lower than the interest rate on your old card.

Be sure to do your homework and compare transfer fees and 0% intro periods to find the best balance transfer card that allows you to make the most affordable monthly payment to pay off the debt before the 0% intro period ends. It will be a tough goal to accomplish every month, but when those 18 or so months are over, you can breathe a little easier with all of that debt off your chest.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Balance Transfer Cards With High Limits ([updated_month_year]) 7 Balance Transfer Cards With High Limits ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Balance-Transfer-Cards-With-High-Limits.jpg?width=158&height=120&fit=crop)

![3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year]) 3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/Balance-Transfer-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year]) 9 Best Balance Transfer & Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/btandrewards.png?width=158&height=120&fit=crop)

![9 Best 0% Balance Transfer Credit Cards ([current_year]) 9 Best 0% Balance Transfer Credit Cards ([current_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_1495481012.jpg?width=158&height=120&fit=crop)

![7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year]) 7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/fair-credit-limits-art.jpg?width=158&height=120&fit=crop)

![16 High Limit Credit Cards for Excellent Credit ([updated_month_year]) 16 High Limit Credit Cards for Excellent Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/highlimitcover.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for High Credit Scores ([updated_month_year]) 9 Best Credit Cards for High Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Best-Credit-Cards-for-High-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)