The PayPal Prepaid Mastercard® is among the most popular offerings in the reloadable debit card market, no doubt benefiting from its high name recognition.

PayPal has built its reputation pioneering online money transfers between individuals and between individuals and businesses. Its prepaid debit card is a natural extension of its services, allowing for seamless PayPal transfers of money between the card and a PayPal cash account.

As we will explain, it’s easy to get and open a PayPal prepaid card account.

-

Navigate This Article:

You Can Get a PayPal Prepaid Card In a Couple of Ways

The easiest and cheapest way to obtain a PayPal Prepaid Mastercard® is by filling out an online application. It takes only a second to enter the required data — your name, address, and email address. You can also indicate your direct deposit preferences.

After you choose a card design among the five offered, you’ll be invited to review the cardholder agreement before signing it. At this point, you can register the card, activate it, set a PIN for it, and fund your card. There is no fee for opening the card account online.

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

The other way to acquire a PayPal debit Mastercard is by purchasing one at a retail location. You’ll be charged an initial purchase fee of up to $4.95 by the retailer.

The card you obtain will be temporary and will be replaced by a permanent custom card mailed to you. You must register and activate the card and set its PIN before you can use it for most purposes. You can perform these steps online or over the phone.

What Is a PayPal Prepaid Card?

The PayPal Prepaid Mastercard® is a reloadable debit card issued by Bancorp Bank. You can use it to pay for purchases anywhere a Mastercard debit card is accepted. It also allows you to withdraw cash at ATMs and transfer money to and from other accounts, including your checking account or PayPal account.

The card carries a 16-digit account number, expiration date, and PIN, similar to what you’d see on a bank debit or credit card. The chip on the card keeps track of your balance and other important data that facilitate your transactions.

Because the PayPal card is a debit card, you must have money in your account to make purchases with it. The card account is neither a bank account nor a PayPal cash card account, although you can transfer money among these accounts if you have them.

You don’t need a credit score or credit history to get the card because it’s not a credit card. You don’t need a bank account either, which makes it a valuable resource for consumers who have reservations about banks and the fees they charge.

Many folks like the idea of paying for purchases with a prepaid debit card because it’s safer than cash — you can get a refund if your card is lost or stolen. That’s certainly not true for cash.

How Does a PayPal Prepaid Card Work?

You can use the PayPal Prepaid Mastercard® to make purchases online, over the phone, in stores, and in apps.

You fund the card with cash at a Netspend Reload Network location (which also accepts prepaid Visa cards), through direct deposits, and by mobile deposit on the PayPal mobile app.

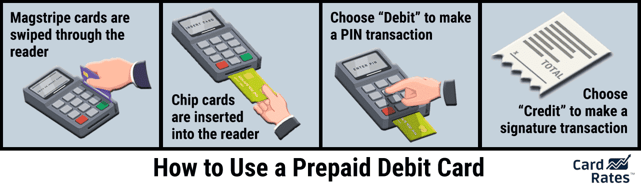

When you want to make an in-store purchase, you can insert, swipe, or tap the card on the electronic terminal. You can then choose between a debit and credit transaction:

- Debit transaction: This is a real-time transaction that requires you to enter your secret PIN. After you enter your PIN, the transaction will be verified and the money immediately removed from your card balance. If your balance is insufficient for the purchase, the transaction will be declined.

- Credit transaction: This choice is poorly misnamed because credit doesn’t enter into the transaction. Rather, this is a transaction that the merchant batches with other credit transactions for end-of-day submission and processing. Your charge takes two or three days to go through.

Another common misnomer is “prepaid credit card.” A prepaid account is always a debit card — prepaid credit card has no real meaning. A gift card is also a prepaid debit card, but differs in one important way: You can’t reload a gift card.

The PayPal debit card lets you earn cash back rewards on select purchases and access to personalized offers. You can freely transfer funds between the prepaid account and your PayPal cash card up to your PayPal balance. The PayPal debit card charges a low monthly fee — there is no pay-as-you-go option.

When you own this prepaid card, you are eligible to open a PayPal high yield savings account administered by Bancorp Bank and insured by the FDIC for up to $250,000. The savings account has no minimum balance requirement. You withdraw funds from this high yield savings account to the PayPal prepaid card account, with a maximum of six transfers per month.

The annual percentage yield (APY) on the savings account is paid quarterly and depends on the balance in the account.

The card offers other useful benefits. You can use the PayPal mobile app to check your card balance, deposit checks, review recent transactions, receive Anytime Alerts, and find nearby reload locations.

In addition, you and a friend can both receive a credit through the card’s Refer-A-Friend program. To qualify, your friend must order, register and load their card with at least $40.

Which Stores Sell PayPal Prepaid Cards?

The card is widely available at stores, including drugstores, gas stations, supermarkets, convenience stores, dollar stores, Western Union Reload+ locations, and Walmart stores. These are all members of the Netspend Reload Network.

You’ll have to pay for the card when you buy it in-sore, but you can sign up and receive the card for free online:

- Move money from your PayPal account to fund your prepaid card account.

- Earn cash back and personalized offers, just for using your card.

- With Direct Deposit, you can get paid faster than a paper check.

- Card issued by The Bancorp Bank, Member FDIC. Card may be used everywhere Debit Mastercard is accepted.

- Click PayPal Prepaid Mastercard® for additional features & program details, and to request a Card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

Variable Monthly Fee

|

Not applicable

|

You will receive the card within seven to 10 business days, after which you’ll need to activate it before it can be used to make purchases.

How Do I Load Money Onto a PayPal Prepaid Card?

You can load money onto your PayPal card in three ways — direct deposit, at a Netspend location, or via mobile check deposit. In addition, you can transfer up to $300 per day, or $2,000 per rolling 30 days, from your PayPal cash account to the card account, subject to your PayPal balance.

- Direct deposit: You can have checks from the government (including your Federal tax refund or state tax refund) and your employer directly deposited into your card account at no cost. Direct deposit speeds up payments — as much as two days faster than deposits to a standard bank checking account.

- Netspend reload: You can add cash to your card at more than 130,000 Netspend Reload Network locations. The location’s operator can assess a fee of up to $3.95 per load. The maximum amount per load is $500.

- Mobile check load: You can use your PayPal app to scan and load a check to your card account. The standard service is free or you can pay extra to expedite the load.

You are allowed to have up to $15,000 on deposit on your PayPal card.

How Do I Withdraw Funds From the PayPal Prepaid Card?

You can withdraw cash from the card at MoneyPass ATM locations throughout the country or over the counter (OTC) at financial institutions and at Netspend Reload Network locations. PayPal charges nothing to check your balance online or via Anytime Alerts (text messages or email).

The fees to withdraw money are:

- OTC cash withdrawal at a financial institution: $3.00 withdrawal fee.

- OTC cash withdrawal at a Netspend Reload Network location: Withdrawal fee is the greater of 2.75% of the withdrawal amount or $4.00.

- ATM withdrawal: $2.50 transaction fee, waived at MoneyPass ATM locations. There is a small transaction fee of $0.50 to check your card balance at an ATM.

- All fees are subject to change, please review your cardholder agreement.

You can avoid a fee by opting to receive cash back when you make a debit purchase at a participating retail store. The issuer places a cap of $5,000 on your daily combined withdrawals and purchases. ATM withdrawals are limited to $325 per transaction and $940 per day.

Does the PayPal Prepaid Card Offer Cash Back?

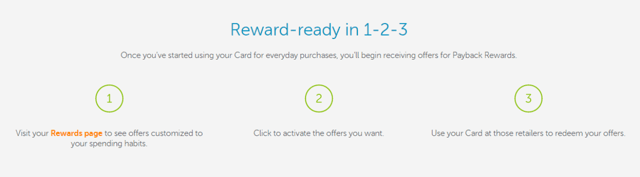

You can earn Payback Rewards for eligible purchases made with select merchants. Your reward offers are tailored to your spending habits and can be redeemed for cash back to your card account. Payback Rewards is an optional program.

Plus, through PayPal’s refer-a-friend program, you can a friend can receive a credit to your accounts.

Consider the PayPal Prepaid Mastercard® For Your Spending Needs

The PayPal Prepaid Card is available online for free and at specified retail locations for a small fee. The card is especially valuable to consumers who hold PayPal cash accounts since they can transfer funds between the cash and card accounts for free and in real-time.

Combined with its direct deposit service, low monthly fee, cash back rewards, and special offers, the PayPal Prepaid Mastercard® may offer everything you’re looking for in a prepaid card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![“Do Prepaid Cards Work For PayPal?” ([updated_month_year]) “Do Prepaid Cards Work For PayPal?” ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/09/Do-Prepaid-Cards-Work-For-PayPal.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for PayPal ([updated_month_year]) 8 Best Credit Cards for PayPal ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-PayPal-Feat.png?width=158&height=120&fit=crop)

![Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year]) Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Apply-For-a-Prepaid-Card.jpg?width=158&height=120&fit=crop)

![How Does a Prepaid Credit Card Work? ([updated_month_year]) How Does a Prepaid Credit Card Work? ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/How-Does-a-Prepaid-Credit-Card-Work.jpg?width=158&height=120&fit=crop)

![8 Types of Prepaid Cards & #1 Card For Each ([updated_month_year]) 8 Types of Prepaid Cards & #1 Card For Each ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Types-of-Prepaid-Cards.jpg?width=158&height=120&fit=crop)

![Where Can I Get a Prepaid Visa Card? ([updated_month_year]) Where Can I Get a Prepaid Visa Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Where-Can-I-Get-a-Prepaid-Visa-Card.jpg?width=158&height=120&fit=crop)

![What Is a Prepaid Card? ([updated_month_year]) What Is a Prepaid Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/What-Is-a-Prepaid-Card_-1.jpg?width=158&height=120&fit=crop)

![7 Virtual Prepaid Card Options ([updated_month_year]) 7 Virtual Prepaid Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Virtual-Prepaid-Card.jpg?width=158&height=120&fit=crop)