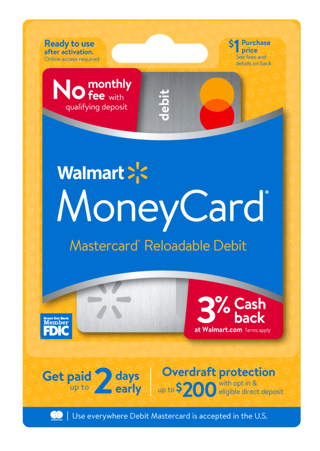

The Walmart MoneyCard® is one popular card, eliciting several hundred thousand internet searches every month. I know several Walmart shoppers, and they are as rabid fans of their store as I am of my football team. Walmart designed the MoneyCard for them.

The card is a demand deposit account that offers several advantages, including cash back rewards on Walmart purchases, that warrant your attention. Green Dot issues the Walmart card as either a Mastercard or Visa debit card, making it widely accepted anywhere on the planet.

A Solid Prepaid Card For Walmart Shoppers

The Walmart MoneyCard® is an open-loop reloadable debit card optimized for Walmart shoppers. This MoneyCard review reveals several attractive features, including cashback rewards, optional overdraft protection, a high-yield savings account, and family accounts.

- Waive your monthly fee when you direct deposit $500+ in previous monthly period. Otherwise, $5.94 a month.*

- Earn 3% cash back at Walmart.com, 2% cash back at Walmart fuel stations, & 1% cash back at Walmart stores, up to $75 each year.*

- Earn 2% interest rate on up to $1,000 balance in your savings account. Plus, get chances to win cash prizes each month!*

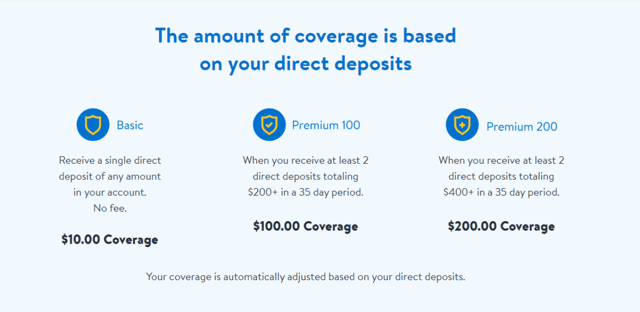

- Get peace of mind with three coverage levels, up to $200, for purchase transactions with opt-in & eligible direct deposit.*

*Please see site for full terms and conditions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Walmart MoneyCard® is a debit card offer.

Unlike a credit card, the Walmart MoneyCard® doesn’t offer purchase financing, which is why it doesn’t require a credit check for approval.

How to Earn Cash Back Rewards

While you can use the card wherever merchants welcome Mastercard or Visa cards, it offers cash back rewards only for Walmart in-store, Walmart fuel station, and online purchases. Online bill payments, gift card purchases, person-to-person transfers, teller or cash withdrawals, and ATM transactions do not qualify for cash back rewards.

You receive your rewards in one annual chunk, and the most you can earn is $75 per year. The card will subtract returns, reversals, cancellations, or disputes involving a qualifying purchase that has earned a cash back reward from your rewards balance. You can also earn rewards at the pump of a Murphy or Walmart fuel station.

You can redeem your cash back rewards when the rewards year ends, assuming your account is in good standing and has a positive balance. You have up to one year to claim your cash back rewards before they expire, and you must redeem all of your rewards at once (i.e., the card does not permit partial redemption).

Only accounts in good standing earn cash back rewards. To remain in good standing, you must pay your monthly fee by the due date unless it is waived with qualifying direct deposits. After registering your Walmart MoneyCard® and Walmart verifies your identity, you can participate in the cash back rewards program.

How To Opt-in For Overdraft Protection

The Walmart MoneyCard® will decline any transactions that create a negative account balance by default. However, you can opt-in for up to $200 of overdraft protection, which may require a $15 application fee.

Customers who have payroll or government-eligible direct deposit transactions are eligible for the basic overdraft option. You can obtain additional coverage by receiving at least $200 in qualifying direct deposit transactions over a rolling 35-day period.

Overdraft protection covers only purchases, and it does not cover ATM withdrawals, bill payments made within the Walmart MoneyCard® mobile app, or sending money to others. You can opt out of overdraft protection at any time.

You have 24 hours after an overdraft transaction to return your card balance to at least $0, or else you will face a $15 fee. But you won’t trigger an overdraft fee for any transaction less than $5 or one that overdraws your account by no more than $10, including any Walmart MoneyCard® transaction fees.

You’ll receive no more than five overdraft fees per monthly statement, and your optional savings account doesn’t cover overdrafts.

How to Get a High-Yield Savings Account

When you have a Walmart MoneyCard® in good standing, you have the option to open a savings account with a deposit of up to $1,000 and earn a 2% APY. The savings account has no required minimum deposit and no fees to open or maintain it.

The Walmart MoneyCard® is the only way to transfer money into or out of your savings account. The savings account pays interest once per year on each enrollment anniversary, based on the average daily balance of the previous 365 days, up to a maximum of $1,000 on deposit.

The account must be in good standing and have a positive balance. The 2% APY may change at any time after you open the account.

How Family Accounts Work

After activating your card, you can add up to four family accounts to your Walmart MoneyCard® account. You own any family accounts you create, but each family member must be a US citizen or legal resident and at least 13 years old.

You can only add family cardmembers if your card is activated and in good standing. Cardholders must provide identifying information, including their name, date of birth, email address, and Social Security number.

Each family account has a balance separate from that of the account holder, and family accounts are not eligible for overdraft protection. If a family account has a negative balance, Walmart may deduct the negative amount from the primary account, any other family account, or the optional savings account.

How Do I Get a Walmart MoneyCard?

You can apply for a Walmart MoneyCard® account online or at a Walmart Moneycenter located inside the stores.

You must be at least 18 years old, a United States citizen or permanent resident, and provide proof of identity. This will include your name, date of birth, Social Security number, and mobile phone number to obtain, register, and use your MoneyCard.

To access all the card’s features, you must download the mobile app and complete a mobile or email verification process.

You can order the MoneyCard online for free and receive it within two weeks. You must deposit money via a bank transfer and activate the card before using it. Follow the Apply Now button below to be directed to the application:

- Waive your monthly fee when you direct deposit $500+ in previous monthly period. Otherwise, $5.94 a month.*

- Earn 3% cash back at Walmart.com, 2% cash back at Walmart fuel stations, & 1% cash back at Walmart stores, up to $75 each year.*

- Earn 2% interest rate on up to $1,000 balance in your savings account. Plus, get chances to win cash prizes each month!*

- Get peace of mind with three coverage levels, up to $200, for purchase transactions with opt-in & eligible direct deposit.*

*Please see site for full terms and conditions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Walmart MoneyCard® is a debit card offer.

If you prefer, you can purchase a limited-use starter card at a Walmart Moneycenter store for a one-time $1 fee. You must then activate the starter card online or via the Walmart MoneyCard® mobile app before using it.

The starter card imposes usage limits that do not allow you to:

- Make purchases at merchants that use a manual imprint machine

- Access cash from tellers

- Make purchases at merchants outside of the US (including internet websites based outside the US)

- Make mobile deposits

- Order checks

- Use the bill payment service

- Make person-to-person transfers

- Opt for overdraft protection

If Walmart cannot verify your identity, you will be allowed to make Walmart purchases with the initial money deposited to the starter card, after which the issuer will cancel the account. In effect, the MoneyCard becomes a gift card under these circumstances.

How Much Is a Walmart MoneyCard?

You can obtain the Walmart MoneyCard® online for free, but it will cost you $1 to buy it at a Walmart location.

The card will waive its monthly fee if you make at least $500 in eligible direct deposits during the previous statement period.

Statement periods begin when the card assesses your monthly fee and continue until your following monthly fee.

Family accounts are not charged additional monthly fees, but their eligible direct deposit transactions do not count toward the monthly fee waiver for the primary account holder.

How Does the Walmart MoneyCard App Work?

The Walmart MoneyCard® app gives you 24/7 access and control of your money from virtually anywhere. With features like Slide for Balance, you can take a peek at your account balance with just one swipe.

The app allows you to:

- View account history

- Deposit checks

- Deposit cash at Walmart stores

- Instantly lock and unlock your card

- Transfer money to the card from another checking account

- Make individual or recurring digital payments

- Receive text alerts to keep track of your account

You can download the app for free via the Apple Store or Google Play.

How Do I Activate the Walmart MoneyCard?

You can activate your Walmart MoneyCard® online or over the phone at 1-877-965-7848. If you purchase the card at a Walmart location, you can go online to register the starter card, thereby gaining partial functionality. You would then activate the personalized card when it arrives in the mail.

Registration and activation both require the following information:

- The card’s 16-digit number

- The expiration date

- The CVV (Card Verification Value)

- Your Social Security number

You must enter identifying data (i.e., name, date of birth, mobile phone number) when you purchase the card online or register a store-bought card online.

Once activated, you can set up a PIN to allow debit purchase transactions. To get your PIN, you must provide the same data required to activate the card plus the last four digits of your Social Security number.

Unfortunately, the Walmart MoneyCard® cannot be obtained without a Social Security number.

How Do I Manage the Walmart MoneyCard?

You can manage your Walmart MoneyCard® online or via the mobile app. You can also receive text notifications by adding your mobile number — just log in to your account and select Account Settings to enter your phone number.

You can load, withdraw, and transfer money with the card, and you can also use it to pay bills.

How to Check Your Walmart MoneyCard Balance

You can view your balance and transaction history online or anywhere else via the mobile app. You can also receive your balance and transaction information via a text message by texting the following commands to 96411:

- To get your balance, text “BAL Last4″ to 96411 (where Last4 is the last four digits of your card number).

- To check your transactions, text “HIST Last4” to 96411 (where Last4 is the last four digits of your card number).

You can view both pending and posted transactions. Merchants create pending transactions at the point of sale to hold the money in your account for the purchase. When the card pays the merchant, the transaction will enter “posted” status.

How to Transfer Money

You can transfer money from your MoneyCard to another person. You cannot transfer money from your MoneyCard to another account (unless it’s a MoneyCard account), but you can transfer money from an external account to the card.

If you want to transfer money to another individual in the US, you must have their mobile phone number and email address. Recipients must have a Walmart MoneyCard® to receive a transfer from another MoneyCard account. If the recipient doesn’t have the card, they can go online to get one, register it, and then use the temporary card number to accept the transfer.

You can transfer money to another MoneyCard with the following steps:

- Log in to your account

- Navigate to Pay Bills and People

- Select Pay People

- Go to Send Money

- Enter the recipient’s name, email address or mobile phone number, memo, and the amount to send

- Hit Continue to review the information

- Select Send Money to complete the transaction

You can use the MoneyCard to send money to recipients via Western Union, Ria, or MoneyGram. Recipients will receive the transferred money in their Walmart MoneyCard® account.

You can use the MoneyCard’s Online Bill Pay Service to set up a one-time or recurring payment to your landlord or any other company or person. There is no fee to use this service.

How to Add Money to Your Card

You have a few ways to add money to your MoneyCard, including cash, bank transfer, direct deposit, and mobile check deposit.

You can load cash (or a cashed check) onto your card in several ways:

- Mobile app: You use the app to create a secure deposit code and show it to the cashier at any Walmart store to deposit the money.

- Walmart Rapid Reload: Tell the cashier you want to deposit cash to your card, then swipe your card at the register of any participating Walmart store. The fee is $3, and reload limits apply.

- MoneyPak: Purchase a MoneyPak at a store near you and visit MoneyPak.com to reload your MoneyCard. You enter your MoneyPak number and the MoneyCard account number to transfer the cash. You will have to verify your mobile phone number to perform the load.

- Load checks at Walmart: Walmart check cashing allows you to cash a preprinted check (such as a government or payroll check) at the Walmart checkout lane and then deposit the money via Walmart Rapid Reload. Fees apply to Walmart check cashing.

- Payroll and benefits direct deposits: You can load money to your MoneyCard via the qualifying direct deposit of payroll and benefits checks. You will have to supply the Green Dot Corporation bank routing number (124303120) and your card account number to your payroll department or federal benefits agency to set up direct deposits.

- Tax refund direct deposits: You can use Form 8888 to request that the IRS deposit your refund directly to your MoneyCard. Fill in the Green Dot Corporation bank routing number (124303120) and your card account number. Make sure to check the “Checking” box.

- Mobile check deposit: You can deposit checks made out to you via the Walmart MoneyCard® app for no charge. It works by photographing both sides of the check and transmitting the photos to your MoneyCard. You must sign the check and write “for mobile deposit only” on it.

You can load personal checks written to you. Also, you can deposit commercial preprinted checks issued by a US business, such as:

- Cashier’s checks

- Insurance agency checks

- Money orders

- Payroll checks

- Rebate checks

- Stock dividend checks

Additionally, you can load government-issued checks, including tax refunds and federal, state, and municipal government checks.

Another way to load money to your MoneyCard is to go online or use the mobile app to transfer money from your financial services account. Follow these steps:

- Select Bank Transfer from the main menu

- Link other accounts to your MoneyCard

- Enter the amount you wish to transfer and when you want to transfer it

- Verify the transfer

- Confirm the transfer

You can also set up recurring payments from your checking account to your MoneyCard. Walmart MoneyCard® bank transfers are always free.

How to Contact Customer Support

You can chat with customer service by clicking the “Get help” link on the Walmart MoneyCard® website. You can also call (877) 937-4098 to speak to Customer Support or use the MoneyCard app to report a lost or stolen card or dispute a transaction.

What Is the Cash Withdrawal Limit?

You can withdraw money from your Walmart MoneyCard® at an ATM or a bank teller’s window. The limit on ATM withdrawals is $500 a day, whereas $1,500 a day is the cap on bank teller withdrawals. You cannot withdraw cash from foreign ATMs.

You can also withdraw money at a Walmart checkout line. The limit is $1,000 per day, and Walmart reserves the right to reduce your withdrawal limits for security purposes.

For more details about the MoneyCard’s limits, check the cardholder agreement.

What Is the Payment Network?

The issuer of the Walmart MoneyCard®, Green Dot Bank, uses both Visa and Mastercard to process the card’s payments.

The payment network facilitates transactions between card issuers and merchants. The networks use virtual payment infrastructures and charge interchange fees to merchants for processing transactions. The four big card payment processors in the US and Puerto Rico are Visa, Mastercard, Discover, and American Express.

You’ll find either the Mastercard or Visa logo adorning the front of the Walmart MoneyCard®.

Consider Getting the Walmart MoneyCard

The Walmart MoneyCard® is a no-brainer for loyal Walmart shoppers. It offers up to $75 a year in cash back rewards for Walmart purchases, access to a high-yield savings account, and optional overdraft protection, among other features.

As with all prepaid debit cards, this one does not require a credit check or a financial services account. The Walmart MoneyCard’s fees are competitive with the best prepaid cards, and its customer service is highly rated.

Prepaid cards are a viable alternative for consumers who don’t use banks and credit cards. You can use them to perform many of the same functions as checking accounts and credit cards without accruing debt or overdraft fees. Some prepaid cards even offer referral bonuses.

Before selecting any prepaid debit card, make sure you read the cardholder agreement and understand the costs you’ll face.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Walmart Credit Card: Bad Credit OK? ([updated_month_year]) Walmart Credit Card: Bad Credit OK? ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/01/Walmart-Credit-Card.jpg?width=158&height=120&fit=crop)

![Can I Use My Walmart Credit Card Anywhere? 3 FAQs ([updated_month_year]) Can I Use My Walmart Credit Card Anywhere? 3 FAQs ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/can-i-use-my-walmart-credit-card-anywhere--1.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for Walmart Shopping ([updated_month_year]) 9 Best Credit Cards for Walmart Shopping ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Walmart-Shopping.jpg?width=158&height=120&fit=crop)

![Surge Credit Card: Review & 5 Alternatives ([updated_month_year]) Surge Credit Card: Review & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/surgecard.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='31445' field_choice='title']: Review & Alternatives ([updated_month_year]) [card_field card_choice='31445' field_choice='title']: Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/preferred.png?width=158&height=120&fit=crop)

![Chase’s [card_field card_choice='39321' field_choice='title']: Review & Alternatives ([updated_month_year]) Chase’s [card_field card_choice='39321' field_choice='title']: Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/inkcash.png?width=158&height=120&fit=crop)

![[card_field card_choice='22068' field_choice='title']: Review & Alternatives ([updated_month_year]) [card_field card_choice='22068' field_choice='title']: Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/09/caponesavor2.png?width=158&height=120&fit=crop)

![Cerulean Credit Card: Review & 3 Alternatives ([updated_month_year]) Cerulean Credit Card: Review & 3 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Cerulean-Credit-Card-Alternatives-Feat.jpg?width=158&height=120&fit=crop)