Though many likely think of wealthy Fortune 500 CEOs when they hear the words “business owner,” the vast majority of businesses are not major corporations. In fact, 99.7% of all US businesses are small businesses — almost half of which are home-based businesses.

Despite this contrast, it can sometimes seem that the majority of business credit products are aimed at the heavy hitters, rather than the everyday small business. When you’re working out of a home office, who wants to pay a $500 annual fee for travel rewards you rarely use?

Not so with the Ink Business Cash® Credit Card. A no-annual-fee card with up to 5% cash back in useful business categories, the Ink Business Cash® Credit Card is designed for lower-revenue businesses that want a reliable, affordable way to save on everyday business expenses. In the article below, we take a deep dive on the Chase Ink Business Cash® Credit Card, looking at the card’s reward offerings, signup bonuses, and other benefits. We’ll also provide an overview of what it takes to qualify for this card.

Rewards | Signup Bonus & Benefits | Qualifying

Earn Cash Back on Every Purchase

One of the most alluring aspects of the Ink Business Cash® Credit Card is its purchase rewards. The card’s main cash back bonus category is appropriately business-focused, with cardholders earning 5% cash back on purchases made at office supply stores, as well as on internet, cable, and phone services. While robust, these savings are only good on up to $25,000 in combined category purchases each year.

In-office rewards aren’t the only way to save with the Ink Business Cash® Credit Card, however, as cardholders can also earn 2% bonus cash back on gas station and restaurant purchases, though this bonus tier also has a $25,000 purchase maximum each account anniversary year. All other purchases made with the card, including category purchases over the annual bonus rewards limit, will earn unlimited 1% cash back.

Ink Business Cash® Credit Card purchase rewards are earned as cash back that can be redeemed for a statement credit or deposited into an eligible Chase bank account. Those who own a card with Chase Ultimate Rewards®, such as the Chase Sapphire Preferred® Card or Chase Sapphire Reserve® can expand their redemption options by transferring their Ink Business Cash® Credit Card purchase rewards to an existing Ultimate Rewards® account.

The benefit to turning your cash back into Ultimate Rewards® is that you can potentially increase your per-point value. Essentially, cash back redemption gives you a flat-rate value of 1¢ per point, while redeeming rewards for travel or turning them into frequent flyer or hotel loyalty points can often net you 4¢ per point or more. So, the same $10 in cash back rewards could be worth $40 in travel.

Enjoy a Signup Bonus & 0% Intro-APR Offer

For most credit cards, the lack of an annual fee would also indicate the lack of a signup bonus — or, at the very least, the lack of a decent signup bonus. But here’s another place where the Ink Business Cash® Credit Card stands out from the crowd.

Not only does the fee-free business card come with a really solid signup bonus, but, better yet, the spending requirement for that bonus is actually reasonable, being realistically reachable for many small business owners. Just remember that you need to reach the required minimum within the first three months after opening your account to earn the bonus.

As nice as a pile of cash back can be, however, that may not be the most valuable bonus for some new cardholders. Instead, the introductory 0% APR offer available with the Ink Business Cash® Credit Card can end up being more lucrative for the small business owner who may need to carry a balance on their card, perhaps during that ever-important first year, when expenses (and profits) can be difficult to predict.

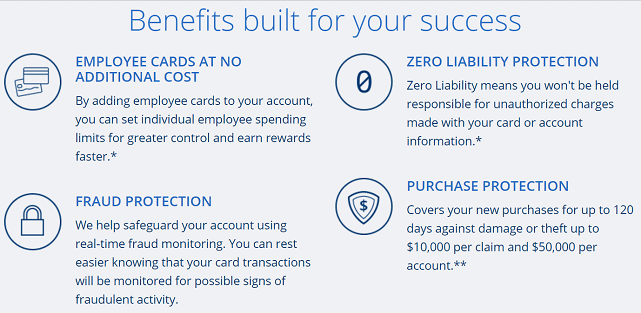

Beyond the signup and introductory perks, the Ink Business Cash® Credit Card comes with a range of additional cardholder benefits, many of which can give you — and your business — a little extra peace of mind. Zero Liability protection, for instance, ensures you won’t have to worry about being held liable for unauthorized card purchases.

The Ink Business Cash® Credit Card has a number of cardholder benefits beyond its purchase rewards.

The Ink Business Cash® Credit Card comes with some reassurance for the road, as well, offering travel and emergency assistance services, including legal and medical referrals. You’ll also receive an auto rental collision damage waiver when you decline the rental company’s collision insurance and charge the rental to your card. Your coverage will act as primary insurance provided you are renting the vehicle for business purposes.

Excellent Credit Required to Qualify

If a no-fee rewards business card sounds a little too good to be true, that’s because it might be — for some applicants, at any rate. The reason? The Ink Business Cash® Credit Card card isn’t available to just anyone, and we don’t just mean because it’s a business card. You’ll not only need to have a business to qualify for the card; you’ll also need excellent credit, too.

Of course, that’s not to say you won’t be approved if you have a credit score more firmly in the “good” range than the “excellent” one. However, the card is marketed specifically to those with excellent credit, and the typical Ink Business Cash® Credit Card cardholder has a credit score above 720.

You can avoid having your personal credit impact your approval chances by using your business’s credit instead of your own, though this won’t be an option for most new businesses that have yet to establish business credit. Be sure to apply with your business’s Employer Identification Number (EIN), rather than your personal Social Security Number, to have your Ink Business Cash® Credit Card card report on your business credit profile.

Expand Your Savings with the Ink Business Cash® Credit Card

Although the US is certainly home to a fair share of multimillion-dollar global corporations, the typical American business doesn’t have boardroom meetings and stock options. Instead, most US business owners are home-grown hard-workers building their business from the ground up.

At the same time, these small businesses still have many similar financing needs as their larger kin, including reliable revolving financing to handle the unpredictable expenses that come with building a business. Unlike cards that cater to the seven-figure crowd, the Ink Business Cash® Credit Card is ideal for smaller businesses that want to save on their everyday costs.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![[card_field card_choice='39321' field_choice='title'] vs. [card_field card_choice='31445' field_choice='title'] Review ([updated_month_year]) [card_field card_choice='39321' field_choice='title'] vs. [card_field card_choice='31445' field_choice='title'] Review ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/ink.png?width=158&height=120&fit=crop)

![[card_field card_choice='5853' field_choice='title'] vs. [card_field card_choice='5855' field_choice='title'] ([updated_month_year] Review) [card_field card_choice='5853' field_choice='title'] vs. [card_field card_choice='5855' field_choice='title'] ([updated_month_year] Review)](https://www.cardrates.com/images/uploads/2018/03/shutterstock_1190829136.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='68495' field_choice='title'] vs. [card_field card_choice='5909' field_choice='title'] ([updated_month_year] Comparison) [card_field card_choice='68495' field_choice='title'] vs. [card_field card_choice='5909' field_choice='title'] ([updated_month_year] Comparison)](https://www.cardrates.com/images/uploads/2018/02/chase2.png?width=158&height=120&fit=crop)

![[card_field card_choice='31445' field_choice='title']: Review & Alternatives ([updated_month_year]) [card_field card_choice='31445' field_choice='title']: Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/preferred.png?width=158&height=120&fit=crop)

![[card_field card_choice='22068' field_choice='title']: Review & Alternatives ([updated_month_year]) [card_field card_choice='22068' field_choice='title']: Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/09/caponesavor2.png?width=158&height=120&fit=crop)

![[card_field card_choice='68438' field_choice='title' link_type='none'] Review & Alternatives ([updated_month_year]) [card_field card_choice='68438' field_choice='title' link_type='none'] Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Citi-Secured-Credit-Card-Review.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='16924' field_choice='title' link_type='none'] Review & Alternatives ([updated_month_year]) [card_field card_choice='16924' field_choice='title' link_type='none'] Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Surge-Mastercard-Reviews.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year]) [card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/unlimited-cover.jpg?width=158&height=120&fit=crop)