Attention Walmart shoppers! Are you earning all the rewards you should for spending your hard-earned dollars at Walmart?

You may be surprised to learn that the best credit cards for Walmart shopping extend beyond the co-branded cards issued by Walmart. Read on to learn who gives you the best deal on your Walmart purchases.

Walmart Card | Cash Back | Travel | Bad Credit | FAQs

Let’s First Look at Walmart’s Co-Branded Cards

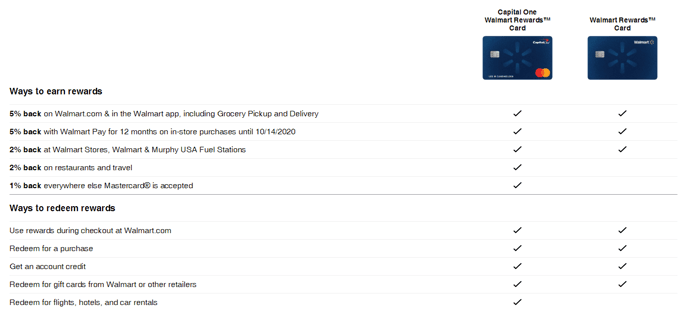

Walmart recently introduced a new credit card, the co-branded Capital One® Walmart Rewards™ Card. At first glance, it looks like an attractive offer, but is it the best one for rewards?

Consider the introductory reward available to new cardmembers for the first 12 months, in which you earn 5% back, but only when you pay for Walmart store purchases with the Walmart Pay app. After the introductory period expires, you receive 5% back only for online purchases at Walmart.com or in the Walmart mobile app.

Consider the introductory reward available to new cardmembers for the first 12 months, in which you earn 5% back, but only when you pay for Walmart store purchases with the Walmart Pay app. After the introductory period expires, you receive 5% back only for online purchases at Walmart.com or in the Walmart mobile app.

Otherwise, you earn 2% back on in-store, travel, and dining purchases, and 1% on all other purchases. You can redeem your rewards to cover a purchase on Walmart.com, apply as a statement credit to reduce your account balance, purchase gift cards at Walmart and other stores, or pay for flights and hotels. The card offers additional benefits, including no annual fee, $0 fraud liability, security alerts, and instant locking if your card is stolen, lost, or misplaced.

The other card offer is the closed-loop Walmart Rewards™ Card, which can only be used at Walmart stores, Walmart.com, and Sam’s Club locations. This card is aimed at consumers with fair credit or worse.

The regular reward rate of only 2% back on in-store purchases prevents us from designating the Capital One® Walmart Rewards™ Card as your best choice for Walmart shopping, which is why we look below at cards we consider superior.

Best Cash Back Cards for Walmart Shopping

Many consumers like the flexibility of cash back rewards, and those rewards should be as generous as possible. Consumers also like credit cards they can earn maximum rewards at more places than just one store.

For these three reasons, the following three cards offer a lot to like.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

As you can see, you can earn superior cash back rewards with cards that are honored well beyond the confines of Walmart and Walmart.com. Unless you do all your shopping at Walmart, you may prefer the simplicity of using a card that earns comparable or better rewards at more places.

Best Travel Cards for Walmart Shopping

The Capital One® Walmart Rewards™ Card provides 2% rewards for travel and dining purchases. You can match and exceed those rewards with other cards.

If you are a Walmart shopper who wants more travel benefits from a card, check out the following travel cards.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

With the co-branded Walmart card, you redeem your reward points for travel at the rate of a penny per point, and there is no provision for transferring rewards to affiliated programs. As you can see, the best travel cards in our review provide better options.

Best Cards for Walmart Shopping with Bad Credit

The new Walmart Mastercard is unlikely to approve bad credit applicants. Here are three alternatives available to consumers who have bad credit or thin credit histories.

- Greater access to credit than before - $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you'll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

- PREMIER Bankcard credit cards are for building credit.

- Start building credit by keeping your balance low and paying all your bills on time each month.

- When you need assistance our award-winning US-based Customer Service agents are there to help.

- Credit Limit Increase Eligible after 12 months of consistent responsible account management.

- We report monthly to the Consumer Reporting Agencies to help you build your credit.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See Provider Website

|

See Provider Website

|

Fair/Poor

|

- No credit check to apply

- Adjustable credit limit based on what you transfer from your Chime Checking account to the secured deposit account

- No interest* or annual fees

- Chime Checking Account and qualifying direct deposit of $200 or more required to apply. See official application, terms, and details link below.

- The secured Chime Credit Builder Visa® Card is issued by The Bankcorp Bank, N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted.

- *Out-of-network ATM withdrawal and OTC advance fees may apply. View The Bancorp agreement or Stride agreement for details; see back of card for issuer.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

None

|

The Walmart Mastercard denies applicants for a number of reasons, including monthly income, past due accounts, charge-offs, and non-discharged bankruptcies. Our recommended alternatives for consumers with bad credit have more lenient acceptance qualifications.

Is a Walmart Credit Card a Good Idea?

While the Capital One® Walmart Rewards™ Card is not a bad idea, the real question is how it stacks up against the competition. In this regard, the Walmart card may not be your best choice.

Let’s start with rewards. After the introductory period ends, the most you will earn for in-store Walmart purchases is 2%. Our review indicates that other cards offer more generous rewards on an ongoing basis.

Some cards offer 5% or higher rewards for both in-store and online purchases, without forcing you to use a mobile app when shopping at the store. And although Walmart’s 5% introductory rate is good, it lasts only one year and forces you to use the Walmart Pay app. Other cards offer generous rewards without making you use an app.

You’ll only receive 5% cash back in Walmart stores when you use the Walmart Pay app, and the promotion is only valid for one year.

Then there’s the question of redemptions, especially for travel. The best travel cards offer rewards on flights and on dining, just as the Walmart card does. But some of our reviewed cards let you receive high redemption values and/or transfer your rewards to airline and hotel partners.

If you travel a lot, you’d like your card to offer as many travel-related perks as possible, such as automatic travel, baggage, or rental-car insurance. The Walmart card falls short in these areas.

If you have bad credit, you may have no choice but to seek out one of the other cards we recommend. But as we point out, that’s not necessarily a bad thing in this competitive market.

What is the Best Credit Card for Grocery Shopping?

Walmart stores sell many types of products, including groceries. But if you want the maximum rewards for grocery shopping, you should consider the following cards:

- Discover it® Cash Back: This card provides bonus cash back in rotating shopping categories each quarter. One category almost always includes groceries.

- Blue Cash Preferred® Card from American Express: Provides 6% cash back on annual purchases up to $6,000 from selected merchant types, including grocery stores. This excludes superstores that sell groceries. Remaining purchases earn 1%. The caveat, however, is that this card charges a $95 annual fee.

- Target RedCard™: The Target RedCard provides an unlimited 5% savings on Target and Target.com purchases, including groceries. Unlike the Walmart card, it has no 12-month limits. The card charges no annual fee.

- Costco Anywhere Visa® Card by Citi: If you prefer Costco to Walmart, this card offers various cash back tiers, including bonus cash back on purchases (including groceries) from Costco and Costco.com. You can use this no-annual-fee card anywhere Visa is accepted.

- Bank of America® Cash Rewards: This card offers multiple cash back tiers, including 2% cash back at grocery stores on up to $2,500 in combined quarterly purchases, excluding superstores but including wholesale clubs. This card charges no annual fee.

Before picking a card, our advice is to consider your grocery shopping habits, including where you like to shop and whether you want rewards in other categories besides groceries.

Will the Walmart Credit Card Build Credit?

Your Walmart credit card gives you the opportunity to build your credit. Whether you actually achieve a higher score depends on how you use the card.

If you use it responsibly, your credit score can increase because the Walmart card reports your credit activity to the three national credit bureaus — Experian, TransUnion, and Equifax. Your payment history is recorded in the credit report of each credit bureau, and derogatory items can hurt your credit score. These include delinquent accounts, collections, defaults, and bankruptcies.

Here are some tips for using the Walmart card (and any other credit card) to build and maintain a good credit score:

- Pay your bills on time each and every month, without fail. You will avoid late fees and improve your credit history.

- Try to keep a low balance on your credit cards and pay them off as soon as possible. This controls your credit utilization ratio, which is your balance divided by your total credit limit. Ideally, you will want to keep the ratio below 30%, preferably below 20%.

- Don’t close a credit card account even if you no longer use the card. The reason is that 10% of your credit score depends on the average age of your credit accounts. When you close a card, you reduce your average account age and can hurt your score.

- Elect to receive online electronic statements every month. By doing so, you can also track your current FICO credit score each month.

As we always advise, check your credit history reports at least once a year and dispute any mistakes or omissions. Removing mistakes from your credit reports can immediately boost your credit score.

You can request your three credit reports once a year for free from AnnualCreditReport.com.

Is It Easy to Get Approved for a Walmart Credit Card?

Walmart offers two credit cards:

- Capital One® Walmart Rewards™ Card

- Walmart Rewards™ Card

If you have average credit or better, you can easily be approved for either card. However, things change if your credit score is bad.

Only the Walmart Rewards™ Card welcomes consumers with bad credit. The Capital One® Walmart Rewards™ Card requires you have a FICO credit score of at least 650, but the Walmart Rewards™ Card is available to consumers with a lower score.

You’ll mostly earn the same rewards as the Mastercard, but the Walmart Rewards™ Card can only be used at Walmart, Walmart.com, Sam’s Club, and Sam’s Club gas stations. Therefore, you won’t earn the 2% on dining and travel or 1% everywhere else the Mastercard is accepted.

If you have bad credit, expect a very low initial credit limit. The purchase APR on the Walmart Rewards™ Card equals the highest one on the Mastercard, which features lower APRs for customers who are more creditworthy.

Note that your application for the Capital One card applies to both cards. Even if you are denied the Mastercard, you may be approved for the Walmart Rewards™ Card.

As with many store cards, the Walmart Rewards™ Card is easy to get. It then falls to you to decide whether you want it, as it is useful only for Walmart-related purchases. Neither card charges an annual fee.

You May Find More Value with a Non-Walmart Option

Our review shows that you have options when it comes to the best credit cards for Walmart shopping. The introductory offer from the Capital One® Walmart Rewards™ Card offers 5% back for the first 12 months, but you must use your Walmart Pay app at the Walmart store to get it. Your reward for in-store purchases drops to 2% after the first year of card use.

Our review highlights several cards you may prefer to own that are at least as rewarding as Walmart’s, and, oftentimes, superior.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Walmart Credit Card: Bad Credit OK? ([updated_month_year]) Walmart Credit Card: Bad Credit OK? ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/01/Walmart-Credit-Card.jpg?width=158&height=120&fit=crop)

![Can I Use My Walmart Credit Card Anywhere? 3 FAQs ([updated_month_year]) Can I Use My Walmart Credit Card Anywhere? 3 FAQs ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/06/can-i-use-my-walmart-credit-card-anywhere--1.jpg?width=158&height=120&fit=crop)

![Walmart MoneyCard: Review & Alternatives ([updated_month_year]) Walmart MoneyCard: Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Walmart-MoneyCard-Review.jpg?width=158&height=120&fit=crop)

![5 Facts About the Shopping Cart Trick for Credit Cards ([updated_month_year]) 5 Facts About the Shopping Cart Trick for Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/carttrick.png?width=158&height=120&fit=crop)

![8 Best Credit Cards for Online Shopping ([updated_month_year]) 8 Best Credit Cards for Online Shopping ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/online.png?width=158&height=120&fit=crop)

![7 Best Credit Cards for Shopping ([updated_month_year]) 7 Best Credit Cards for Shopping ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-Shopping-Feat.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards For Christmas Shopping ([current_year]) 8 Best Credit Cards For Christmas Shopping ([current_year])](https://www.cardrates.com/images/uploads/2021/11/Best-Credit-Cards-For-Christmas-Shopping.jpg?width=158&height=120&fit=crop)