In the past, people had to turn to big banks or perhaps their local credit union if they wanted to open a credit card account. Today, more financial technology companies, or fintechs, offer credit cards. This has opened up the field and given consumers more choices.

Fintech credit cards can have many benefits, including low interest rates and high rewards rates. In addition, these cards often come with intuitive mobile apps and easy-to-use websites. If you’re looking for the best fintech card, here are some options to consider.

1. The SoFi Credit Card

The SoFi Credit Card earns unlimited 2% cash back on every purchase and has no annual fee. This means you don’t need to keep track of specific categories that earn higher cash back rates. You can earn an even higher rate if you book travel through SoFi Travel powered by Expedia.

The SoFi Credit Card includes other perks such as mobile device protection, free credit score monitoring, and no foreign transaction fees. This card also comes with Mastercard ID theft protection. But keep in mind that your points are only worth 0.5 cents each if you redeem them for a statement credit. You must use them on SoFi’s products to realize the full value.

Best Card Like the SoFi Credit Card: The Citi Double Cash® Card

The signature perk of the Citi Double Cash® Card is its 2% cash back on every purchase. With this card, you earn 1% when you spend and 1% when you make a payment. The card has no cap on how much cash back you can earn and no categories to remember. Just swipe your card and make payments to earn cash back.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Double Cash® Card comes with additional perks, including a 0% balance transfer offer and no annual fee. You also receive the same Mastercard ID theft protection as with the SoFi Card. Unlike the SoFi Card, though, you don’t have to redeem them on one of Citi’s products to receive the full point value.

2. M1 Owner’s Reward Card

The M1 Owner’s Reward Card is a card from M1 that earns 1.5% cash back on every purchase. In addition, M1 Plus members can earn 2.5%, 5%, or 10% cash back from select merchants.

However, to earn the higher rates, you must pay an annual fee to be an M1 Plus member. But the real limitation with this card is that the 2.5% to 10% categories are capped at $200 per year.

Aside from this, the M1 Owner’s Card doesn’t have many bells and whistles. The only other notable feature is that it allows you to invest your cash back with your M1 account automatically. If you’re already an M1 customer, this may be a nice perk.

Best Card Like the M1 Owner’s Reward Card: Capital One Venture Rewards Credit Card

While the Capital One Venture Rewards Credit Card is technically a travel card, it has some similarities with the M1 Owner’s Reward Card. For example, it carries the same annual fee as an M1 Plus membership, which you need to get the highest cash back rates with the M1 card. In addition, Capital One gives you access to Capital One Offers, where you will often find additional cash back offers.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$95

|

Excellent, Good

|

And you receive even more value from the Capital One Venture Rewards Credit Card, as it includes a signup bonus. Plus, you can earn a higher base reward rate with this card, which is even higher when booking a trip through Capital One Travel.

3. Self Secured Visa

The Self Secured Visa is a secured credit card that aims to help people build credit. You must have a Self Credit Builder Account and at least $100 in savings to be eligible for the card. In addition, you must make at least three on-time monthly payments.

You can then use your savings to secure the card and start building credit. Self reports to the three major credit bureaus — Experian, TransUnion, and Equifax, so on-time payments can help raise your credit score.

While the Self Visa credit card is an interesting concept, the fact that you must wait at least three months before you can open it is a bit limiting. Other secured cards are available right away, which is even more important if you need to start building your credit.

Best Card like the Self Secured Visa: Discover it® Secured Credit Card

The Discover it® Secured Credit Card is a viable alternative if you want a credit card without a waiting period. If approved, you can start using this card right away. Plus, there is no annual fee, and the card is light on other fees.

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

Another good thing about this card is that your security deposit is refundable. After making consecutive on-time payments after a set period, you may receive a refund for your deposit and upgrade to an unsecured card. In the meantime, you can still earn cash back on eligible purchases and get a Cashback Match at the end of your first year.

4. Secured Chime Credit Builder Visa® Credit Card

The Secured Chime Credit Builder Visa® Credit Card has no annual fees and no minimum security deposit required.1 You must have a Chime® Checking Account and receive a qualifying direct deposit of $200 to be eligible to apply.2

You can open the account and start building your credit when you make on-time payments.3 With this card, you move money from your Chime® Checking Account into your Credit Builder secured account, and you use that money as your security deposit.

While this setup isn’t as prohibitive as some alternatives, the direct deposit requirement means not everyone will be eligible.

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Credit Builder Visa® Credit Card is issued by Stride Bank, N.A.

Best Card Like the Secured Chime Credit Builder Visa® Credit Card: The OpenSky® Secured Visa® Credit Card

The OpenSky® Secured Visa® Credit Card has a higher maximum credit line than many secured cards we’ve seen (subject to approval). This could make it a good choice if you want to build credit with more than just small purchases. To begin using your card, transfer funds into your account equal to at least the minimum security deposit.

- New feature! Earn up to 10% cash back* on everyday purchases

- No credit check to apply. Zero credit risk to apply!

- Looking to build or rebuild your credit? 2 out of 3 OpenSky cardholders increase their credit score by an average of 41 points in just 3 months

- Get free monthly access to your FICO score in our mobile application

- Build your credit history across 3 major credit reporting agencies: Experian, Equifax, and TransUnion

- Add to your mobile wallet and make purchases using Apple Pay, Samsung Pay and Google Pay

- Fund your card with a low $200 refundable security deposit to get a $200 credit line

- Apply in less than 5 minutes with our mobile first application

- Choose the due date that fits your schedule with flexible payment dates

- Fund your security deposit over 60 days with the option to make partial payments

- Over 1.4 Million Cardholders Have Used OpenSky Secured Credit Card To Improve Their Credit

- *See Rewards Terms and Conditions for more information

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

25.64% (variable)

|

$35

|

Poor

|

Another benefit of this card is that the security deposit is refundable. You can upgrade to the unsecured OpenSky Gold Card after six months and have your security deposit refunded. You may also qualify for a credit line increase after six months of responsible use.

5. Petal® 2 Visa® Credit Card

The Petal 2 Visa has no annual or foreign transaction fees, and it earns cash back on every purchase. With this card, you also earn bonus cash back rates, which are even higher than the standard rate.

These are available through periodic Petal offers. If you want a low-fee card that earns cash back and helps you build your credit, this one is worth a look.

The Petal 2 Visa doesn’t have many downsides, but better choices may be available depending on your needs. For example, the card has no intro APR or signup bonus. Another card may serve you better if you’re looking for some incentives.

Best Card Like the Petal 2 Visa: The Capital One Quicksilver Cash Rewards Credit Card

The Capital One Quicksilver Cash Rewards Credit Card earns a similar cash back rate to the Petal 2 Visa, and you earn an even higher cash back rate when you redeem with Capital One Travel. This card also includes a signup bonus and a low intro APR offer, after which the standard APR applies. Plus, there is no annual fee or foreign transaction fees. Rewards don’t expire with this card, and you can redeem cash back in any amount.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One Quicksilver Cash Rewards Credit Card includes additional benefits, including up to six months of free Uber One membership. You can use your rewards on Amazon.com, among several other options, and access additional perks, including Capital One Dining and Capital One Entertainment.

6. Upgrade Cash Rewards Visa

The Upgrade Cash Rewards Visa is a card that allows you to earn cash rewards and pay off your card similar to an installment loan. You can use your card to earn cash back on every purchase, and your balances turn into installment loans you pay with monthly payments.

This helps you build credit while making your payments more manageable. You can also earn higher cash back rates by shopping with your card via Dosh.

While this card has many nice features, you can’t earn the signup bonus unless you open a checking account with Upgrade and make purchases with your debit card. In addition, the card has no intro APR deals available.

Best Card Like the Upgrade Cash Rewards Visa: The Chase Freedom Unlimited®

The Chase Freedom Unlimited® card has a cash back rate similar to the Upgrade card. While the card itself doesn’t have an installment loan feature, it is one of several cards eligible for the My Chase Plan. This service allows you to pay for any purchase over $100 in equal monthly payments. In addition, purchases don’t accrue interest. Instead, you pay a small fee on the purchase amount.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® card also has a signup bonus, higher cash back rates on purchases in common spending categories, and even higher rates in the first year. Plus, it offers a low intro APR. The card has no annual fee, but it does charge foreign transaction fees.

7. Cred.AI Unicorn Card

The Cred.AI Unicorn Card is a hefty metal credit card that functions similarly to a debit card. If you sign up for Credit.AI’s Deposit Account and link it to the Unicorn Card, it works as a debit card, and it will prevent you from overspending.

Linking the Deposit Account allows you to avoid interest or fees on the credit card by managing automatic payments in the background. In addition, no credit check is needed to apply.

However, this card does lack some features you might expect, including a welcome offer or the ability to earn rewards. You also won’t earn any interest on cash in your Deposit Account.

Best Card Like the Cred.AI Credit Card: The Discover® Cashback Debit

The Discover® Cashback Debit is a reloadable card, meaning it can also prevent overspending. Similar to the Credit.AI card, it doesn’t require a credit check. But unlike the Credit.AI card, this account allows you to earn cash back on qualifying purchases.

- Cashback – Earn 1% cash back on up to $3,000 in debit card purchases each month

- No. Fees. Period. That means you won’t be charged an account fee on our Cashback Debit account.

- Early Pay – Get your paycheck up to two days early with no charge

- No Credit Impact – You can apply without affecting your credit score.

- Fraud Protection – You’re never responsible for unauthorized debit card purchases. If you suspect someone else has used your debit card without your permission, let us know.

- Member FDIC

- Fee-free overdraft protection

- No minimum opening deposit and no minimum balance

- Add cash into your account at Walmart stores nationwide

- Cash access at over 60,000 no-fee ATMs nationwide

- 100% US-based customer service available 24/7

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

$0

|

No Credit Needed

|

Other benefits of the Discover® Cashback Debit include an extensive ATM network and security benefits such as fraud protection and early paycheck deposits. It also has an excellent mobile app and online experience, making it easy to reload your account as necessary.

What is a Fintech Credit Card?

A fintech credit card is issued by a bank or credit union that partners with a financial technology company, similar to a co-branded credit card. Some of these cards are designed for digital use, with intuitive mobile applications and online platforms.

Fintech companies offer customers a seamless digital experience, allowing them to track spending, manage their accounts, and make payments from their mobile devices. In addition, they offer advanced features such as transaction notifications, reports on spending patterns, and automatic savings tools.

The best credit cards from fintech companies often have excellent rewards, low fees, and sleek interfaces, especially for their mobile apps. Fintechs tend to have more transparent fee structures compared to traditional bank cards. They often have low or no annual fees, and tend to include easy-to-understand pricing.

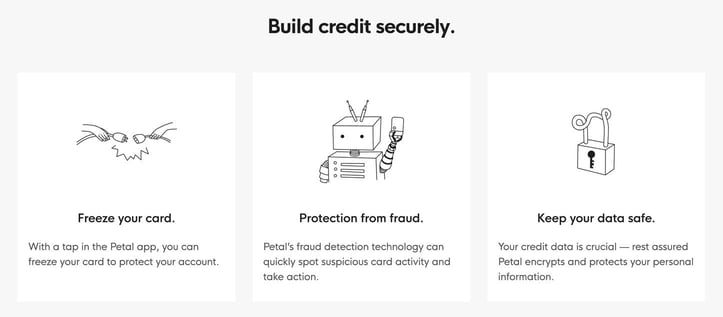

Are Fintech Credit Cards Secure?

Fintech companies are required to adhere to the same financial regulations and security standards as traditional banks. This includes adherence to various laws specially designed to protect customers and keep their data safe.

Fintechs may leverage strong encryption technologies such as 256-bit encryption and secure socket layer (SSL) protections. These technologies help ensure your data is securely transmitted between you, your bank, merchants, and other parties.

Fintechs often provide additional security measures, such as two-factor authentication (2FA) and biometric login. They may also include fraud monitoring to help spot any unauthorized use of your account or information.

These technologies work around the clock to reduce your risk. In addition, real-time notifications can help you monitor your spending, especially if a large transaction takes place somewhere suspicious.

Overall, fintech credit cards are just as safe, if not safer, than those available from traditional banks. Generally, cardholders have little reason to worry about their personal or financial information when using one of these cards.

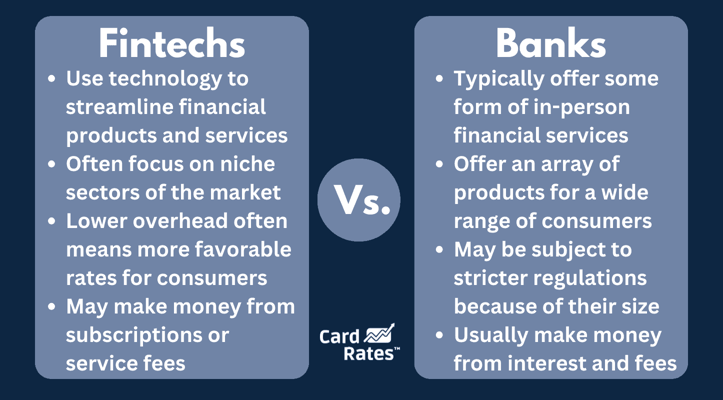

How Are Fintechs Different From Banks?

Fintechs differ from banks that provide customers with financial products and services — in-person or online. A fintech company may use technological innovation to streamline products and services, improve user experience, and offer favorable rates to customers.

Another big difference is their business models. Banks typically offer a diverse set of products and services, including deposit accounts, loans, and credit cards. They usually make money on interest and fees from these products and services.

Conversely, fintechs often focus on niche sectors of the market, such as mobile payments, peer-to-peer loans, or robo-advisory services. These companies can make money in many different ways, including from subscriptions or charging one-off fees to use their services.

Banks are also subject to strict regulations because of their size and importance to the overall economy. We saw the repercussions of bank failures during the 2008 financial crisis, and regulators don’t want a repeat of those events. The government also regulates fintechs, but they may not face the same level of scrutiny as banks.

What is the Best Fintech Company?

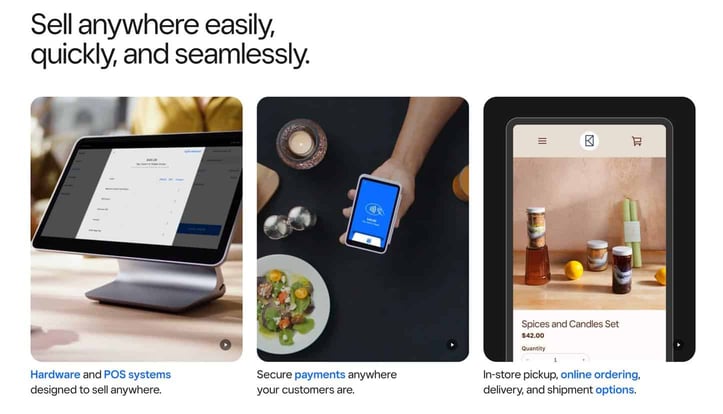

While “best” is a subjective term, some fintech companies stand out for offering better products and services. For example, Square is well known for making payment services more accessible for small businesses. Plaid has also been a key player, as it simplifies connecting bank accounts to various products and services.

Other examples include Chime, Revolut, and Monzo, which are fintechs that challenge the traditional banking model.

Also, remember that fintechs are financial technology companies, but they typically aren’t banks. Many partner with banks to provide you with an account or other financial services. Then, they use their interface to provide a streamlined experience for customers.

What is the Most Valuable Fintech?

Fintech companies provide a range of services to customers, from payment processing to mobile banking. The most valuable fintech in the world is Ant Group, which is an affiliate company of Chinese conglomerate Alibaba. It operates Alipay, a valuable payment network in China.

Stripe is the most valuable fintech company based in the United States, valued at approximately $50 billion. Stripe helps make it easier for businesses to collect payments from customers.

Revolut is the third-most valuable fintech at about $33 billion. The company offers mobile banking services, currency exchange, and international transfers. As a result, Revolut has become a go-to for frequent international travelers.

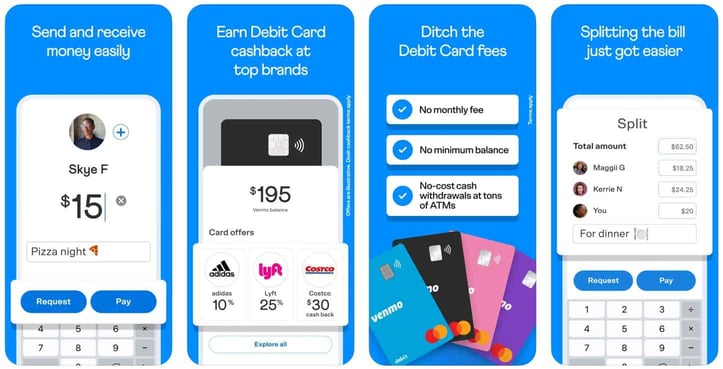

Is Venmo a Fintech Company?

Venmo is a fintech company and payment provider with a popular mobile payment app. It provides a platform for digital transactions which allows people to send and receive money electronically.

Venmo has a mobile-first approach, providing users with a simple app that allows them to easily manage their transactions. The Venmo app enables person-to-person payments, making it easy to send money to friends, merchants, or family members.

The app also has a social aspect, which allows you to publicly share your transactions with friends. These features have made Venmo one of the most popular mobile payment apps in the US.

How Can I Apply for a Fintech Credit Card?

You can typically apply for a fintech credit card through the credit card issuer’s website or mobile app. You will need to provide additional information so the company can verify your identity.

Fintechs Will Ask For:

- Name

- Address

- Birth date

- Social Security number

Fintech companies may ask for additional financial information, including your income and employment information. In some cases, they may perform a credit check, especially if you are applying for a credit card. Some fintechs use alternative assessment methods, which may require additional information.

Fintechs May Also Need:

- Income information

- Employment status

- Permission to perform a hard credit check

Once you apply, you can wait for the approval decision. Sometimes, approval is instant. If approved, you should receive a notification via email or in the fintech company’s app. You can then activate your card, set up your online account, and personalize your settings.

Weigh the Pros and Cons of Fintech Cards

Fintech companies have changed the personal finance landscape, offering products and services that streamline and improve customer experiences. Many fintechs offer credit and debit cards, which provide high reward rates and other interesting features. For example, the M1 Owner’s Reward Card lets you automatically invest your cash back, and the Self Credit Builder Card is ideal for building credit.

Still, these cards often lack some of the bells and whistles you get with traditional credit cards. Many fintech credit cards often lack signup bonuses, or low intro APR offers. Secured credit cards from fintechs may have waiting periods or not offer upgrades to unsecured cards.

While the best fintech cards have some intriguing features, they typically aren’t a direct replacement for credit cards from traditional banks. This is because traditional banks offer many services, including deposit accounts and loans, that you may not find with fintechs.

Consider each of the alternatives in this article before signing up.

Disclosures:

1Money added to Credit Builder will be held in a secured account as collateral for your Credit Builder Visa card, which means you can spend up to this amount on your card. This is money you can use to pay off your charges at the end of every month.

2To apply for Credit Builder, you must have received a single qualifying direct deposit of $200 or more to your Chime Checking Account. The qualifying direct deposit must be from your employer, payroll provider, gig economy payer, or benefits payer by Automated Clearing House (ACH) deposit OR Original Credit Transaction (OCT). Bank ACH transfers, Pay Anyone transfers, verification or trial deposits from financial institutions, peer-to-peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, cash loads or deposits, one-time direct deposits, such as tax refunds and other similar transactions, and any deposit to which Chime deems to not be a qualifying direct deposit are not qualifying direct deposits.

3On-time payment history can have a positive impact on your credit score. Late payment may negatively impact your credit score. Chime will report your activities to Transunion®, Experian®, and Equifax®. Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Apple Pay Credit Cards ([updated_month_year]) 9 Best Apple Pay Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Apple-Pay-Credit-Cards.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying Gift Cards ([updated_month_year]) 7 Best Credit Cards for Buying Gift Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Best-Credit-Cards-for-Buying-Gift-Cards-Feat.jpg?width=158&height=120&fit=crop)

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards for Building Credit ([updated_month_year]) 12 Best Credit Cards for Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/BUILD.jpg?width=158&height=120&fit=crop)

![4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year]) 4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/biznocredit.png?width=158&height=120&fit=crop)

![3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year]) 3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/Balance-Transfer-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year]) 7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/credit-cards-for-fair-credit-with-no-annual-fee-feat.jpg?width=158&height=120&fit=crop)

![7 Same-Day Credit Cards for Poor Credit ([updated_month_year]) 7 Same-Day Credit Cards for Poor Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Same-Day-Credit-Cards-for-Poor-Credit.jpg?width=158&height=120&fit=crop)