We are always pleasantly surprised when we write an article about the best credit cards for free car rentals. It seems that many cardholders are familiar with free car rental insurance but not the discounts or free rentals available from some top credit cards.

When you have a card that delivers both, the cost of renting a vehicle becomes much more affordable. I’ve always thought that driving a nice rental was a treat. Driving it for substantially less is, well, priceless.

Best Cards For Free Car Rentals

These are eight nifty credit cards that offer the best combination of free or discounted rentals and free collision damage waiver (CDW) insurance. If you frequently rent a car for personal or business reasons, these cards can save you a bundle.

The key to receiving the maximum value of this benefit is to follow the rules for booking the car with your credit card (not a debit card or gift card) and specifying your insurance needs.

The Chase Sapphire Preferred® Card is our top card for car rental benefits. You get free discounts, upgrades, and special offers when you book a rental at least 24-hours in advance from Avis, National, and Silvercar and pay for the rental with this Visa card. If you enroll in National’s Emerald Club, you’ll get a free Executive-level membership that provides special discounts and faster checkout.

Alternatively, you can book a rental at the Chase Travel site and apply your ultimate rewards points to pay for the rental at a rate of $1.25 per point. The site’s Travel Benefits page lets you book rentals online and receive upgrades, discounts, and other promotions. Primary CDW (covering the vehicle’s actual cash value) is free when you decline it from the rental company and use points to pay.

You can use your reward miles from the Capital One Venture Rewards Credit Card to pay for travel purchases, including car rentals. To book a new car reservation, go online to the Capital One Rewards Center and redeem your miles. Simply multiply the cost of the car rental by 100 to get the number of miles you’ll need.

For example, if your rental will cost $200, you’ll need 20,000 miles to pay for it. You can use miles to pay for taxes and fees also. When you rent an eligible vehicle with the Venture card, you will receive secondary CDW car rental coverage for theft or collision.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Car rental rewards from Chase Sapphire Reserve® mirror those from the less-expensive Chase Sapphire Preferred® Card, except that the Ultimate Rewards points you use when booking via the Chase site are worth $1.50 each. The card also provides free CDW when you decline it at the rental counter, good for up to $75,000 car rental coverage per rental.

You get one set of benefits when you use the card to directly book from Avis, National, or Silvercar, or another set if you book through Chase. The only way to find out which will provide you the best deal is to compare quotes from both options. The card also offers travel insurance for flights and baggage.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One VentureOne Rewards Credit Card shares similar car-related benefits with the Capital One Venture Rewards Credit Card. The main difference between the two cards is the reward structure each uses. You can apply your miles to pay for all your travel purchases, including a car rental.

You earn bonus miles when you use VentureOne to rent a car via Capital One Travel. The card provides secondary CDW insurance against theft or collision when you use it to rent an eligible vehicle.

- Earn 150,000 Membership Rewards® points after you use your new card to make $8,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 140 countries.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% Pay Over Time

|

$695

|

Excellent

|

The Platinum Card®, an American Express card, lets you enroll for free in the Avis, Hertz, and National elite membership clubs, giving you access to discounts and special deals on car rentals made with advance via American Express Travel.

You can use the Pay with Points programs to pay for a car rental at Amex Travel using your Platinum Card points. Each point is worth between $0.007 and $0.0085 when used this way. You get free CDW secondary insurance when you pay for your entire rental with The Platinum Card® and decline CDW when signing the car rental agreement.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

You earn bonus points when you book a car rental via the Bank of America Travel Center with the Bank of America® Travel Rewards credit card. You can redeem points for a statement travel credit to pay for previous car rentals (up to 12 months back) as well as the cost of parking lot or garage fees, tolls, and bridge fees. Each redeemed point for car rentals is worth one cent.

As a Visa Signature card, this travel card covers theft, damage towing, and loss of use charges for any rental car paid for with the Bank of America Travel Rewards card. You must decline the car rental company’s insurance at the counter to get the Visa Signature card’s free coverage. This secondary coverage is good for up to 15 consecutive days from the start of the rental. The card also provides other types of travel insurance.

7. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

Chase Freedom Flex℠ rewards you with bonus points on car rentals you book through the Chase Ultimate Rewards website. You can redeem Freedom points to pay for car rentals you book at the rewards site. If you are short of points, you can make up the difference with cash.

The Chase Freedom Flex℠ makes it easy to rack up Chase Ultimate Rewards by offering rotating bonus categories and high cash back rates on common spending categories. Use this card wisely, and more than just your car rental will be covered.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The rental car benefits offered by Chase Freedom Unlimited® match those of its fraternal twin, Chase Freedom Flex℠. You use the Chase Ultimate Rewards website to book an eligible car rental and pay for it with the card or with points you’ve already earned. You’ll earn bonus points if you pay for the rental with the card.

You also get free CDW coverage on rentals when you decline the insurance offered by the rental agency. This secondary insurance runs up to 31 days and is available in any country. In the U.S., you must first file any claims through your auto insurance policy and then through your credit card insurance. The reverse applies to rentals abroad.

How Can I Use a Credit Card to Earn Free Car Rentals?

The road to free car rentals is paved with credit card rewards. Whether in the form of miles, points, or cash back, you can use your rewards to pay for a car rental either in advance or after the fact. Depending on the card, you may earn enough rewards to pay for a rental with a signup bonus alone.

The savings don’t end there. Some cards enhance the value of rewards when you use them for travel-related expenses, including car rentals. That makes it easier to save up rewards for a new rental later on.

You can earn free car rentals by redeeming credit card rewards earned on certain cards.

Your card may also have deals with specific rental companies that give you access to special discounts and free upgrades. You may have to book your rental through the credit card’s travel agency, but some cards also provide discounts on cars booked directly through the rental car company.

For example, The Platinum Card®, which is an American Express card, gives you free elite-level memberships with Hertz, Avis, and National, which are all large car rental agencies available at most airports. Membership provides you with special deals and higher service levels, such as the ability to go directly to your car without having to first check in at the rental counter. You may be able to rent a full-size car at a mid-size price or receive a discount on any vehicle available.

Free CDW can save you as much as $20 or $30 per day, depending on the rental company and the vehicle model. Just remember to decline CDW, sometimes called Loss Damage Waiver, when renting the car. Also, be aware of any limitations on CDW coverage.

What is the Best Credit Card to Use When Renting a Car?

The dynamic duo of Chase Sapphire Preferred® Card and Chase Sapphire Reserve® are the only cards in this review that offer primary car rental CDW coverage. This reduces the likelihood that you’ll have to file a potentially premium-raising claim with your private insurer. That puts the Chase siblings at or near the top of our list for renting a car.

The Chase cards differ from each other in three important ways that affect the overall economics of renting a car:

- The maximum CDW coverage from Chase Sapphire Reserve® is $75,000, compared with the actual cash value for Chase Sapphire Preferred® Card.

- When you redeem points to pay for a car rental booked via Chase, your points are worth more. The Reserve card inflates point value by 50%, whereas the Preferred card features a 25% increase in point value.

- The Reserve card offers special car rental discounts and upgrades when you book through Chase.

The remaining seven cards provide secondary CDW insurance. Of these, we rate Capital One Venture Rewards Credit Card and Capital One VentureOne Rewards Credit Card highest.

Should You Buy Insurance When Renting a Car?

If your credit card offers free CDW insurance, you should NOT buy CDW insurance when renting a car. Doing so will disqualify your card’s CDW coverage, and you’ll be on the hook for the car rental agency premiums.

The situation is different when it comes to liability coverage, which most credit cards don’t provide. Liability insurance, not CDW, covers damage suffered by others.

If you have a large umbrella liability policy (i.e., $1 million and up), you’re probably fine declining the coverage offered by the rental company. However, if your current personal auto insurance policy offers minimal coverage, you may do well to take the liability policy offered by the car rental company.

You can likely decline rental car coverage if you have a large umbrella policy.

If you own separate homeowner or tenant insurance, you may have additional liability protection that you can apply to your car rental. Whenever you use liability insurance from a source other than the car rental company, you most likely will have to pay out any claims first and then await reimbursement.

Liability insurance from the rental agency typically costs $15 to $20 per day. Be aware that your own policy may be limited to domestic rentals only.

What’s the Difference Between Primary and Secondary Coverage?

Most credit card CDW insurance is secondary, meaning that the card will cover only the costs that your primary car rental insurance doesn’t. In practice, this means you must first file a claim with your personal auto insurance company — often a slow process.

The Sapphire cards reviewed above offer CDW as a primary benefit that will pay for damage and theft without the need for you to first shell out the money and wait to be reimbursed. Simply call the number on the back of the card to file a claim.

With primary coverage, you don’t file a claim with your personal insurance policy. That’s a good thing because you won’t have to worry about subsequent rate increases or a higher deductible. In addition, primary rental car insurance is usually generous and will cover all your related costs, whereas secondary insurance frequently has lower limits and lower rental duration.

The Platinum Card® from American Express offers optional premium car rental CDW protection, in which you pay a flat fee (around $20 to $25) for up to 42 consecutive days of deductible-free coverage rather than a daily fee like a rental agency charges. This policy doesn’t include liability, disability, or uninsured/underinsured motorist coverage.

Do Any Credit Cards Offer Car Rental Discounts?

A few of the credit cards reviewed here offer car rental discounts. The discounts may be offered by the card company when you book the rental at the card’s marketplace site, or by the rental company when it accepts your card.

The following credit cards facilitate rental discounts via free elite-status memberships to car rental programs:

- Chase Sapphire Preferred® Card and Chase Sapphire Reserve®: You get free elite membership with Avis, Silvercar, and National, which offer discounts, upgrades, promotions, and savings on premium car rentals.

- The Platinum Card®: Free membership with Avis, Hertz, and National, giving you access to special discounts and upgrades.

In addition, Chase Sapphire Reserve® offers special discounts when you book the rental via Chase’s website.

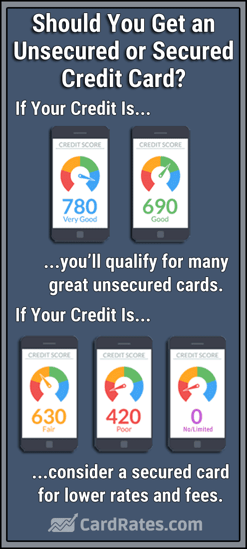

What Credit Score is Needed to Get a Travel Rewards Card?

Travel rewards cards usually require a good credit score, equal to 670 or higher. But we’ve seen many forum comments indicating that scores as low as 600 are sometimes accepted, depending on the applicant and the credit card company.

When you complete the application process, it will require a hard inquiry, but you can increase your approval chances by recruiting a cosigner with a good credit score. Both you and the cosigner are equally liable for paying the monthly bill.

You can also ask to be an authorized user of someone else’s credit card. You’ll have the right to use the credit card, but only the owner is held liable for payments.

You can also ask to be an authorized user of someone else’s credit card. You’ll have the right to use the credit card, but only the owner is held liable for payments.

If you simply need to increase your credit score, make sure you make all your payments on time and reduce your outstanding debt. Your debt-to-income ratio should not exceed 36% and your credit utilization ratio should be well below 30%.

If you have bad credit or no credit at all, you may have to start with a secured credit card. These are cards with credit limits backed by your cash deposit held in a special account by the card issuer. Secured cards are easy to get since the cash collateral protects the credit card company against loss.

Eventually, you can be upgraded to an unsecured card if you pay your bills on time. Many issuers will automatically review your credit card usage after five or six months and offer you an unsecured card to replace your secured card. If you agree, your deposit will be refunded.

Another way to establish credit is through a credit-builder account. You can open one at a bank, credit union, or online provider. It works like this:

- You take out a small loan (around $1,500) and deposit the proceeds into the sponsor’s account.

- Every month you make another payment until the loan is fully repaid. The payment is reported to the three major credit bureaus, which helps you establish a credit history.

- The sponsor returns the money to you when the loan is repaid.

This way, you get a chance to boost your credit score as each credit bureau records your on-time payments. This will help you qualify for an unsecured credit card, maybe even one of the travel cards featured in this review.

Finally, consider fixing your credit score by removing inaccurate derogatory information from your credit reports. You can do this yourself or hire a credit repair company to do the hard work for you. In either case, clearing mistakes from your credit reports can give your score a quick boost.

Does Credit Card Car Rental Insurance Provide Enough Coverage?

Let’s clarify that “enough” rental car coverage doesn’t necessarily equal total auto rental coverage. First, we need to explain the different scenarios that CDW insurance may address:

- Theft of the rental vehicle.

- Damage to the rental vehicle.

- Loss-of-use cost to the rental car company while the vehicle is under repair.

- Towing charges.

- Diminished value of the repaired vehicle.

- Administrative costs.

The provisions of the CDW insurance that comes with your credit card should be fully disclosed by the card issuer. Specifically, it should address which cost components are included or excluded from insurance coverage.

The last two items on the cost list are seldom covered by credit card CDW insurance. You may have to comb through a lot of fine print to learn which costs are covered. In the worst-case scenario, you may even consider speaking to a customer representative to track down the information.

The Sapphire cards offer primary rental car insurance, which means they usually cover all costs related to theft or physical damage. The other seven reviewed cards provide secondary CDW, meaning that they kick in only after your auto insurance. The insurance coverage may be limited in a number of ways, including:

- A cap on the amount of reimbursement per incident.

- The cost components covered.

- Geographical limitations.

- Limited rental periods.

Credit card rental insurance does not provide liability, disability, or uninsured/underinsured motorist auto rental coverage. Your own auto insurance policy probably does provide at least some of this insurance coverage, but if it doesn’t, you can buy additional insurance when you sign your rental agreement at the counter.

How We Rank The Best Credit Cards For Free Car Rentals

Our rankings are the result of a structured process that evaluates the nature, scope, and value of the insurance, the rewards offered by the card, the card’s annual fee, and any limits imposed on the rental car coverage. Our top pick, Chase Sapphire Preferred® Card, offers primary insurance included in the price of a moderate annual fee, as well as points worth 25% more when redeemed for free car rentals.

We recommend that you visit the websites of cards you find interesting (just click on the SEE DETAILS button to be directly transferred) and take the time to read each card’s terms and details before applying.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Best Secured Credit Cards For Car Rentals ([updated_month_year]) 5 Best Secured Credit Cards For Car Rentals ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Best-Secured-Credit-Cards-For-Car-Rentals.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying a Car ([updated_month_year]) 7 Best Credit Cards for Buying a Car ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Credit-Cards-for-Buying-a-Car-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards With Car Rental Insurance ([updated_month_year]) 9 Best Credit Cards With Car Rental Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-With-Car-Rental-Insurance.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards For Paying Car Insurance ([updated_month_year]) 5 Best Credit Cards For Paying Car Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Best-Credit-Cards-for-Paying-Car-Insurance.jpg?width=158&height=120&fit=crop)

![3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year]) 3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/carbuy--1.jpg?width=158&height=120&fit=crop)

![11 Car Loans For No Credit History ([updated_month_year]) 11 Car Loans For No Credit History ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Car-Loans-For-No-Credit.jpg?width=158&height=120&fit=crop)

![7 Car Loans Easy to Get Online ([updated_month_year]) 7 Car Loans Easy to Get Online ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Car-Loans-Easy-to-Get.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Free Hotel Stays ([updated_month_year]) 7 Best Credit Cards for Free Hotel Stays ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-Free-Hotel-Stays-Feat.jpg?width=158&height=120&fit=crop)