Has it ever occurred to you that you could use a credit card to buy a car? Astute readers of CardRates.com will recall that we’ve addressed this exciting possibility, explaining when cards can and cannot help pay for a car purchase. If you are contemplating acquiring one of the best credit cards for buying a car, it makes sense to understand the different rewards and promotions first.

Getting a new card with an introductory period of 0% APR purchases means that you can avoid the card’s interest cost for an extended period. Then there’s the possibility of earning cash back, points, or miles, depending on which card you use.

So, put down those car brochures for a minute and consider choosing a credit card to help pay for your next set of wheels.

Overall | 0% APR | Cash Back | Miles | FAQs

Best Overall Card for Buying a Car

We’ve chosen the Discover it® Cash Back as the best overall card for buying a car. This card’s average credit limit is $3,000, but the limit can go as high as $20,000 — that can pay for a brand new car!

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

Cardholders are eligible to receive cash back rewards on top of a promotional introductory APR. It’s also good to know that the Discover it® Cash Back card is a little forgiving — paying late won’t raise your APR, you won’t be charged an over-limit fee, and there is no late fee on your first late payment.

Any dealership that accepts credit cards is likely to accept this one, as do 11 million merchants nationwide representing 97% of places accepting credit cards.

Best 0% APR Cards for Buying a Car

For many, a credit card with an introductory 0% APR on purchases for new cardmembers is the greatest thing since sliced bread. This is a promotion that operates for a set period from the date you open the account.

During the introductory period, you pay no interest on your card balance. Many cards offer introductory periods of 12 months or more. If you use your card to buy a car, introductory periods give you extra time to pay down your balance and escape all interest charges on your purchase.

The following 0%-APR cards scored the highest in our evaluation:

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn unlimited 1.5% cash back on all purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 1.87%-2.62% cash back on every purchase with Preferred Rewards.

- No annual fee.

- No limit to the amount of cash back you can earn and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Before you select a 0% APR card, make sure you understand the regular APR that will kick in when the introductory period ends. Any balance remaining after the period ends will begin accruing interest charges. Clearly, an APR of 18% will cost you less than will a 29.99% APR.

That’s important if your original car purchase transaction on the card was large, so read the fine print before selecting a card. While you’re at it, check out all the benefits the card offers, as this can be a tiebreaker if you’re choosing between similar cards.

Best Cash Back Cards for Buying a Car

Let’s be honest — few things bring a smile to a face faster than a pile of money. A cash back card can facilitate smiles by giving you a cold hard cash refund on your credit card purchases. But not all cash back cards are equal.

Some offer a flat cash back rate on all purchases. Then there are the cards that offer different reward tiers on different merchant categories. Finally, there are cards that offer bonus cash back on purchases from quarterly rotating categories of merchants. Here are our top-recommended cash back cards for buying a car:

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

Since no cards offer bonus cash back for car purchases, you may want to consider a card with a high flat rate on all purchases. Another thing to look for is a card that offers a generous introductory cash back bonus for a set amount spent on purchases during the first three months after opening the account.

Because purchasing a car on your credit card can involve a large purchase, you may want a cash back card with the most generous introductory bonus. We’ve considered all these factors to come up with our recommended cash back cards.

Best Miles Cards for Buying a Car

Travelers often prefer miles cards because some may be more rewarding than the cash back variety. With these cards, you earn a specified number of frequent flyer miles for each dollar you spend on purchases.

When you look at how valuable those mile rewards are, they may be worth more to you than cash. A lot depends on how the miles are awarded — flat rate, multiple tiers, or rotating categories. We recommend the following miles cards for your car purchase:

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

You will earn the base miles reward on car purchases, which may nudge you toward a miles card with the highest flat rate. Another consideration is any extra value you can get when you redeem your miles. Some card issuers add extra value when you redeem your miles for travel. Another perk that some travel miles cards offer is to provide 1:1 transfer of your miles to a travel partner’s mileage program.

Do Car Dealers Take Credit Cards?

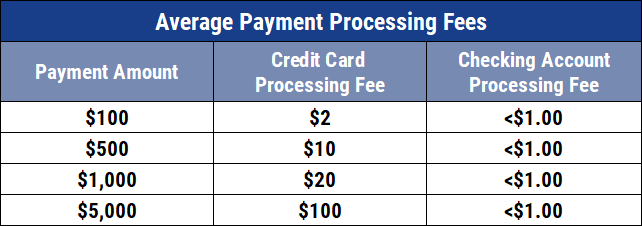

It depends. You see, car dealers must pay a processing fee on all credit card sales. The processing fee may be as low as 1% or as high as 4%, which translates to a $400 fee on a $10,000 purchase.

The processing fee for using credit to purchase a car may be higher than the dealer wants to pay.

Since many dealerships earn only a 5% profit on their sales, a 4% credit card fee would be unwelcome. So, don’t assume every dealer will accept your credit card when purchasing a car. Alternatively, a dealer may limit the amount you can charge on your card.

Naturally, the amount you can charge on the car purchase also depends on your credit limit and balance. You’ll get the most utilization from your card if it has a zero balance and a high credit limit. Even so, you may not be able to purchase the car entirely on your card.

In that case, you can use the card to make a down payment, subject to your credit limit and any dealer restrictions. Ideally, the down payment will help you earn your introductory signup bonus on a new credit card.

This requires that you time the acquisition of your new card such that you can use it to purchase a car within the first three months of opening the account.

Using your credit card for your down payment means that you don’t have to spend any cash on your car purchase until the next billing period. It also means you can spread repayment of the down payment over multiple months.

If you are using a new card, those months may be part of a 0% APR introductory period, which means it costs you nothing to stretch out your payments. For your sake and the sake of the dealership, find out ahead of time whether it will accept a credit card and if any limits apply.

How Much Can You Put on a Credit Card When Buying a Car?

Assuming your car dealer accepts credit cards, the amount you can put on the card when buying a car will depend on your available credit limit (i.e., card limit minus balance) and any purchase limits applied by the dealer. In some cases, these limits will not present any problem, and you will be able to charge the amount you desire on the car purchase.

However, you may find a dealer that imposes no limits on credit card use only to discover that your credit limit is lower than you would like. You then have a couple of options:

- Ask for a higher limit: You can speak to a representative of the credit card issuer and request a higher spending limit. The success of your request will depend on a few factors, such as how well you’ve been making monthly payments. For example, you may improve your chance of getting a higher limit if you always make relatively large payments each month, or better yet, always pay the entire balance. It’s also helpful to have a clean record of on-time payments. If the issuer considers you creditworthy, it may be more willing to increase your limits.

- Consider a charge card: Charge cards are similar to their credit card cousins, in that both allow you to charge purchases. However, you are expected to repay a charge card’s full balance each month unless you sign up for an optional revolving charge program, such as American Express Pay Over Time. What makes a charge card attractive when buying a car is that the card’s credit limit is flexible. That means you may be able to spend more at the dealership with a charge card, and you may be able to work out a higher limit just for the car purchase.

If you take the charge card route, you must repay the full balance in the following month, unless the card offers extended payments. But here’s an interesting alternative. You may want to use a charge card for the purchase, and then transfer the balance to a credit card during an introductory 0% APR balance transfer promotion.

You will have to pay a one-time transfer fee, typically 3%, but will otherwise avoid interest until the introductory period ends.

When is the Best Time to Buy a Car?

As with the timing of many things in life, proper timing of a car purchase can really pay off, saving you hundreds or even thousands. Here are a few tips:

- Shop when dealer traffic is sparse. Often, that’s Monday through Wednesday. This works because when the salesperson isn’t rushed, you stand a better chance of snagging a deal. Normally, dealerships are busiest on the weekends, leaving less time for a salesperson to negotiate with you. On a quiet Monday, a salesperson who wants to make the most of the day may offer you a sweeter deal.

- Be aware of sales deadlines. Car salespeople are assigned sales goals for the month and the year. As the month or year ends, you may find that a behind-quota salesperson is motivated to close sales even if the profit margin is a little lower. The last three days of the month and last three months of the year can be desperate times for car salespeople, but happy times for you.

- Watch for holiday sales, which often feature deep discounts. Black Friday and New Year’s Eve are great times to buy a car. Sale prices are in full gear, and sales quota deadlines loom large in the salesperson’s psyche. Typically, dealerships promote sales for Presidents’ Day, Memorial Day, Independence Day, Labor Day, Thanksgiving, Christmas, and New Year.

- Shop when new models come out. That’s a great time to pick up the remaining current year models. Dealership lots need to free up space for new models and may be willing to offer you a good deal to take a current model off their hands.

When shopping for a car with a credit card, your timing equation should include using a new card with a 0% APR promotion and an introductory bonus deal for new cardmembers. That means timing the acquisition of a new card so that it arrives just before you finalize your car purchase.

Pay Your Balance to Avoid Costly Interest

The introductory 0% APR promotion that many cards offer is a great way to avoid interest. Of course, you can avoid interest altogether — just pay your balance every month.

This is a great idea if you can afford it, and many financial advisors would tell you that if you can’t afford it, you may be spending too much. If you resolve to always pay your balance in full, you not only avoid costly interest, you also exhibit financial discipline that keeps you ahead of your bills.

While paying your entire balance is ideal in terms of minimizing interest expense, it’s not always feasible. There are times when the ability to spread out payments is important. That’s especially apropos if you are using your card to buy a car, which can involve a sizable chunk of change.

Imagine you get a shiny new credit card with a 15-month introductory period of 0% APR on purchases and a $20,000 credit limit. You use the card to pay for a $20,000 car. You would have to repay $1,333 a month to completely pay off the card in 15 months.

For many, that’s just impossible, and only the ability to stretch out payments once the 15-month period expires makes feasible the car purchase with a credit card.

A credit card can be a good way to pay for some or all of a car purchase. You can use it for the down payment and then stretch out the payments. If you have a high enough credit limit, you can even put the whole purchase on the card.

We’ve reviewed the best credit cards for buying a car, both cash back and miles types. It pays to do considerable research before settling on your next car — and card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year]) 3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/carbuy--1.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying Gift Cards ([updated_month_year]) 7 Best Credit Cards for Buying Gift Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Best-Credit-Cards-for-Buying-Gift-Cards-Feat.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying Money Orders ([updated_month_year]) 7 Best Credit Cards for Buying Money Orders ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Buying-Money-Orders-Feat.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards After Buying a House ([updated_month_year]) 12 Best Credit Cards After Buying a House ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/Best-Credit-Cards-After-Buying-a-House.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards With Car Rental Insurance ([updated_month_year]) 9 Best Credit Cards With Car Rental Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-With-Car-Rental-Insurance.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards For Free Car Rentals ([updated_month_year]) 8 Best Credit Cards For Free Car Rentals ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-Credit-Cards-For-Free-Car-Rentals--1.jpg?width=158&height=120&fit=crop)

![5 Best Secured Credit Cards For Car Rentals ([updated_month_year]) 5 Best Secured Credit Cards For Car Rentals ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Best-Secured-Credit-Cards-For-Car-Rentals.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards For Paying Car Insurance ([updated_month_year]) 5 Best Credit Cards For Paying Car Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/07/Best-Credit-Cards-for-Paying-Car-Insurance.jpg?width=158&height=120&fit=crop)