The best credit cards after buying a house can help you move into your new home with style. Whether you need to upgrade old appliances, furnish your new living room, or give your bedroom a modern makeover, these cards can increase your spending power and pay you rewards in return.

After all, purchasing a new home is a defining moment in your life. So why not take that moment to redefine your financial portfolio by adding a new and improved credit card to your wallet?

With the cards listed below, you can earn cash back, rewards points, or take advantage of an extended period of no-interest financing — which is perfect if you need to make a big purchase for the new house.

Cash Back | Housewares/Home Improvement | 0% Financing | Groceries | FAQs

Best Simple Cash Back Cards For New Homeowners

make it easy to earn cash rewards for your eligible purchases. Think of this as a rebate for everything you buy — usually in the form of a percentage back for your total spend.

You can typically redeem your cash back for a direct deposit into a linked bank account or as a statement credit for your outstanding balance.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One Quicksilver Cash Rewards Credit Card is a flat-rate cash back card, which means there are no rotating categories with quarterly activations to worry about. Simply use this rewards credit card to buy whatever you want and need, and you’ll earn a percentage of each eligible purchase back.

New cardholders can take advantage of a signup bonus that nets them bonus cash back. Capital One also features its Eno assistant that issues free virtual card numbers to help protect your account from fraud.

The Chase Freedom Unlimited® is a little different in that it’s marketed as a cash back card, but it actually issues Chase Ultimate Rewards points. These points can be redeemed for cash back, of course, but they can also be used toward travel reservations, merchandise, gift cards, and one-of-a-kind experiences.

While this is technically a flat-rate rewards card, you’ll earn bonus cash back when you use your card to book travel through Chase or at restaurants and drugstores. This card is a cash-back generating machine if you use it responsibly.

Additional Disclosure: Citi is a CardRates advertiser.

The only thing better than earning cash back is earning cash back twice. With the Citi Double Cash® Card, you can do just that. It starts when you earn cash back at the time of your purchase and again when you pay your credit card bill.

As they would with many Citi credit cards, new cardholders may qualify for an introductory 0% balance transfer offer that allows them to pay down existing credit card debt without pesky finance charges. This can help you consolidate expensive credit card debt and monthly payments. Terms apply.

Best Home Rewards Cards For New Homeowners

After dealing with a mortgage lender and all of the hurdles associated with mortgage approval, you deserve to have some fun while turning your new house into a home. Whether that’s a total makeover, some new appliances, or updated furniture, the cards below can help you earn cash back on your home improvement purchases.

And, unlike a co-branded store credit card, you can use these cards anywhere you choose and still reap the rewards of being a loyal customer.

The Discover it® Cash Back card is one of the best cash back cards on the market and will serve new homeowners well. Discover starts by offering its Cashback Match program to new cardholders, which matches all of the cash back you earn during your first year with the card.

Cardholders can also earn cash back at places homeowners love — including grocery stores and restaurants — especially after a long day of furniture shopping when you don’t feel like cooking.

Additional Disclosure: Bank of America is a CardRates advertiser.

Bank of America isn’t just a large mortgage lender — the Bank of America® Customized Cash Rewards credit card is also a great tool for new cardholders. Cardholders can go beyond their typical cash back earnings and score bonus cash back when they shop at home improvement and furnishing stores as well as wholesale clubs and select online shopping destinations.

That’s a great way to fill your new home with pretty things while filling your bank account with cash back. Plus, you don’t need a Bank of America account to qualify for this card. Anyone can apply by clicking the link above. Just note that you will need good credit or excellent credit for consideration. Your new card’s credit limit and variable APR will depend on your credit history.

Amazon.com makes it easy to get whatever you need for your new home, and the Amazon Prime Rewards Visa Signature Card is a great way to save money during your online shopping trips. This card offers cash back on all everyday purchases, but you can earn an above-average amount of cash back when you charge purchases at Amazon.com or Whole Foods Markets.

An Amazon Prime membership is required to qualify for this card. You must also have good credit or excellent credit. There is no other annual fee for card membership, and the card issuer won’t tack on any hidden fees or charges.

Best 0% Financing Cards For New Homeowners

Cash back is great for your everyday purchases, but you may want to consider a card with a promotional financing offer if you’re in the market for a big-ticket item. These cards allow you to pay off big purchases and everything in between interest-free over several months.

7. Wells Fargo Platinum card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Wells Fargo Platinum card regularly offers a promotional period without interest charges that extends beyond one year. All cardholders can also enjoy cellphone insurance and free access to their monthly FICO Score without paying an annual fee.

This card’s 0% APR promotion also typically extends to balance transfers, making it easy to pay off existing debt without the finance charges. You may have to pay a balance transfer fee to move the debt over from the existing card, but that fee is usually much smaller than what you’d pay in interest charges.

(The information related to Wells Fargo Platinum card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

- For a limited time, get a special 0% introductory APR on purchases and balance transfers for 21 billing cycles. After that, the APR is variable.

- Enjoy Cellphone Protection Coverage of up to $600 annually when you pay your monthly cellphone bill with your card

- View your credit score anytime, anywhere in the mobile app or online banking. It's easy to enroll, easy to use, and free to U.S. Bank customers.

- Fraud Protection detects and notifies you of any unusual card activity to help prevent fraud

- Choose your payment due date

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 21 billing cycles

|

0% for 21 billing cycles

|

18.74% - 29.74% (Variable)

|

$0

|

Excellent Credit

|

Additional Disclosure: The information related to this card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this product.

The U.S. Bank Visa® Platinum Card regularly changes the terms of its promotional periods but typically offers one of the longest 0% APRs in the industry. New cardholders can expect to avoid paying interest for just shy of two years after they activate their card.

That’s a big deal if you’re looking to make a very large purchase for your new home. Avoiding financing charges for that long can save you thousands over the life of the promotion. Remember that your card’s credit limit is based on your credit score and information on your credit report obtained from at least one credit bureau.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® has a great interest rate, no annual fee for card membership, a flat and unlimited cash back rate, and a generous signup bonus. And new cardholders can take advantage of an introductory 0% APR on all new purchases for more than a year after activating their card.

This card’s offers change and rotate regularly, so the length of your promotional period may change depending on when you apply. Be sure to research all potential promotions to make sure you’re getting the best deal possible.

Best Grocery Rewards Cards For New Homeowners

If your mortgage lender drained your wallet with closing costs, you may want to consider one of the rewards cards below. These cards will help you stock your refrigerator while you replenish your bank account.

These cards pay bonus cash back for grocery store purchases, which means you’ll get money back for one of the biggest ongoing expenses you’ll have in your new home.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One SavorOne Cash Rewards Credit Card was a big shift for the credit card company as it introduced the first card offering for foodies.

All cardholders can earn unlimited bonus cash back on dining and grocery store purchases while new cardholders can also take advantage of an extended 0% APR promotional period. That’s a great way to fill your belly without draining your budget.

- Earn $250 back in the form of a statement credit after you spend $3,000 in purchases on your new Card within the first 6 months of Card Membership.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year on purchases (then 1%). Also earn 6% cash back on select U.S. streaming subscriptions.

- Earn 3% cash back on transit, including U.S. gas stations, taxis/rideshare, parking, tolls, trains, buses, and more. All other purchases earn 1% cash back.

- $120 Equinox Credit - Use your Blue Cash Preferred Card to pay for Equinox+ at equinoxplus.com and receive $10 in monthly statement credits. Enrollment required.

- 0% intro APR for 12 months from the date of account opening, then a variable APR applies

- $0 intro annual fee for the first year, then $95

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

19.24% - 29.99% Variable

|

$0 intro annual fee for the first year, then $95

|

Excellent Credit

|

The Blue Cash Preferred® Card waives its annual fee for your first year with the card and provides statement credit opportunities on certain everyday purchases. The card’s generous cash back rate exceeds industry standards when it comes to its grocery store earning rate for all purchases up to $6,000 each year.

Even when the annual fee kicks in for year two, the grocery store cash back rate alone makes this card valuable if you have several mouths to feed. You can earn the same rewards rate for eligible streaming subscriptions as well, which will keep the kids entertained when they aren’t eating you out of house and home.

- Earn 10,000 Membership Rewards® points after you spend $2,000 in qualifying purchases on the card within your first 6 months of card membership

- Earn 2X points at U.S. supermarkets on up to $6,000 per year in purchases (then 1X) and 1X points on other eligible purchases

- Use your card 20 or more times on purchases in a billing period and earn 20% more points on those purchases (less returns and credits)

- 0% introductory APR for the first 15 months from the date of account opening, then a variable APR applies

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

N/A

|

18.24% - 29.24% Variable

|

$0

|

Good

|

The Amex EveryDay® Credit Card from American Express is similar to its Blue Cash Preferred® Card sibling above — but this card doesn’t charge an annual fee.

In exchange for the fee-free account, you won’t earn the same rewards or perks as the Preferred card, but this offering still beats many competing cards in terms of rewards earned on grocery purchases.

Can I Get a Credit Card After I Buy a House?

Buying a new home isn’t cheap. Aside from the purchase price and down payment, the cost of inspections and closing cost fees alone can run into the thousands. And that’s before you start the move-in process. It’s no wonder why many homeowners want to add a new credit card to their wallets after making their home purchase.

Adding a mortgage to your credit report may cause a drop in your credit score. That’s because a new large debt is added to your name, which may cause lenders to pause if you’re asking for more credit.

But that doesn’t mean you can’t qualify at all for a new credit card after purchasing a home. Many cards have no minimum credit score requirement, and some will even consider your application if you have bad credit — which isn’t likely if you just successfully purchased a home.

You can generally qualify for a credit card after buying a house as long as your mortgage has closed.

A new card will help you build credit when used responsibly, and you may qualify for one of the cards listed above that can reward you with cash back for every purchase you make for your new home. You may also receive an offer that includes a 0% intro APR promotional period that waives all interest rate charges for an extended period after activating your card.

If you’re having trouble qualifying for a new credit card after purchasing your home, you can consider adding a secured credit card to your wallet. These cards aren’t just for consumers who have bad credit. Many people use them to set — and stick to — a monthly budget. A secured credit card is a great starter credit card as well.

Most secured credit card offerings allow you to choose your credit limit based on your refundable security deposit amount. A secured card issuer will usually match your credit limit to the amount of your deposit. For example, a security deposit of $2,000 will net you a card with a $2,000 credit line.

Whether you’re building credit or building a new home, a secured card or traditional unsecured credit card can boost your spending power, earn you rewards, and help make your new house a home that you’ll want to spend the rest of your life in.

Should I Apply For a New Credit Card Before I Buy a House?

You should avoid applying for any new credit or loans while you’re nearing — or in the middle of — the mortgage process.

That’s because your mortgage lender has extremely strict guidelines to follow when considering an application from a potential borrower. Any change to your credit score, or the addition of more debt to your credit report, can take you out of consideration for a home loan.

Even if you’re a year or more out from applying for a mortgage, you should still be very careful with any new debt you add to your monthly payment obligations. After all, credit can both help or hurt your chances of getting a home — and if you add too much debt to your name, it can create a problem that takes quite some time to resolve.

Your mortgage lender can terminate your pending home purchase if you take on new debt after your mortgage prequalification.

This is especially true if you’re in the mortgage application process. Don’t take your prequalification as a sure thing. Your lender can — and will — rescind your mortgage offer if you add new debt to your credit report before you close on your loan.

Your best bet is to wait after you have your loan completed, and the keys to your new home in your pocket, before applying for a new credit card or personal loan.

Should I Use a Credit Card For Home Improvements?

Credit cards are a great way to finance home improvements — especially if you have a credit card that offers bonus cash back or other rewards for purchases made at home improvement or furnishing stores.

Just consider the total financing cost of your project before you swipe your card to pay for your bathroom remodel or another task. If you’re going to incur interest charges as you pay down the debt over time, you may find a better interest rate through a home improvement loan or personal loan than if you finance the purchase through a credit card.

Average personal loan interest rates can go as low as 4.95%, whereas the average credit card interest rate can hover around 20%. If you’re financing a large project that you’ll need multiple years to pay off, you could save thousands of dollars in interest charges by taking out a loan. PersonalLoans.com offers loans of up to $35,000 for people with good to excellent credit:

- Loan amounts range from $1,000 to $35,000

- All credit types welcome to apply

- Lending partners in all 50 states

- Loans can be used for any purpose

- Fast online approval

- Funding in as few as 24 hours

But if you’re taking on smaller projects or you’re purchasing new furniture or appliances, consider looking for a credit card that offers a 0% APR promotion for new cardholders. These cards allow you to skip the interest charges on all new purchases for an extended period — with some cards offering promotional periods for as long as 20 months.

That means none of the purchases you make with the card during that period will incur financing charges. Keep in mind that any balance you carry after your promotion ends will start racking up interest fees right away, so do your best to pay off your credit card debt while the clock is ticking.

Can You Pay For Home Repairs With a Credit Card?

Many home repair businesses and contractors accept payment via credit cards. You can also buy supplies at any home improvement store using any major credit card.

Major home improvement stores — including Home Depot and Lowes — also subcontract installation work to local businesses but accept payment for the job in-house. This means that you can use your credit card or apply for a store credit card to finance your job.

If you’re a do-it-yourself sort of person, consider a card like the Bank of America® Customized Cash Rewards credit card. A Bank of America account isn’t mandatory for applicants and all cardholders can earn cash back for all purchases made at home improvement stores, home furnishing stores, or wholesale clubs. You’ll receive your cash back as a paper check, statement credit, or as a direct deposit into any Bank of America checking or savings account.

Using a credit card to cover your home repairs is a great way to finance a larger job and repay the debt through your monthly payment. If you leverage a card with a 0% introductory APR rate, you can get even more done since you won’t have to worry about finance charges for several months.

Which Credit Card Bonus Categories Are Best for New Homeowners?

Category-based bonuses are a popular and easy way for consumers to maximize their cash back and bonus point earnings on purchases they regularly make. Every card has different categories that it offers to entice consumers. The card that’s best for you will vary based on your regular spending habits.

Bonus categories typically offer a greater cash back return than the standard cash back rate. For example, a card may pay 1.5% cash back on everyday purchases and 5% cash back on gas station and drug store purchases. These cards offer some big earnings potential if you buy a lot of gas and aspirin.

If you’re a new homeowner and you’re ready to roll up your sleeves and get to work on your new house, here are a few rewards categories you may want to look for:

- Home improvement stores: Whether they’re buying lumber, plants, or patio furniture, homeowners have projects to dream about at a home improvement store. When you take advantage of this as a rewards category, you can boost your cash back potential on every purchase you make for your home.

- Home furnishing stores: A new home deserves a few new pieces of furniture. With this category, you can finance your furniture purchase and get extra cash back for anything you buy.

- Grocery stores: Furniture and home improvement purchases are, hopefully, things you don’t have to worry about again for several years. Groceries, on the other hand, are an expense you’ll always have. With this category, you can stock your new refrigerator with snacks and entrees and not have buyer’s remorse when you get the bill.

- Online shopping: This category is diverse and easy to use. Instead of shopping at your favorite electronics store, you can earn cash back by placing an order online. And since many retailers allow you to shop online and pick up items in-store, you can maximize your cash back without going too far out of your way.

- Wholesale clubs: These big warehouse stores have it all — from bulk food to home goods, furniture, and more. When you activate this category, you can earn extra cash back at these one-stop-shopping destinations.

Keep in mind that only certain cards have rotating rewards categories. A majority of the cash back credit cards on the market offer a flat and unlimited rate of cash back no matter where you shop.

If you’re looking to boost your earnings for certain purchases, make sure the card you’re applying for rewards you for your regular shopping.

Can I Pay My Mortgage Payment Using My Credit Card?

Not every mortgage lender allows customers to pay their monthly payments using a credit card. Those that do will likely add a transaction fee to the bill that equals a percentage of the amount you’re charging.

In some cases, that can increase your bill by $50 or more. If you don’t pay that debt off by the end of your next billing cycle, the interest charges can add even more to the expense.

You may have to go through a third-party service to pay your mortgage with a credit card, and you’ll be charged hefty fees for the convenience.

Even if your lender doesn’t accept credit cards as payment for your monthly mortgage bill, you can look at third-party services that let you make purchases using your credit card for an added fee.

These companies will charge your card for the bill — plus its fee — and then send a paper check to your mortgage company for the amount of the bill. Aside from the fee that you’re charged, there’s also a processing time in which the company sends the check to your lender. This can sometimes take between seven and 10 business days to complete.

These services are meant to help consumers who may have trouble paying a bill one month — not as a regular means for paying your mortgage payment.

Typically, credit cards aren’t a great method to pay these large bills, as the transaction fee will almost always eclipse the amount of cash back or bonus points you’d earn.

Can a Credit Card Extend Your Purchase Warranty?

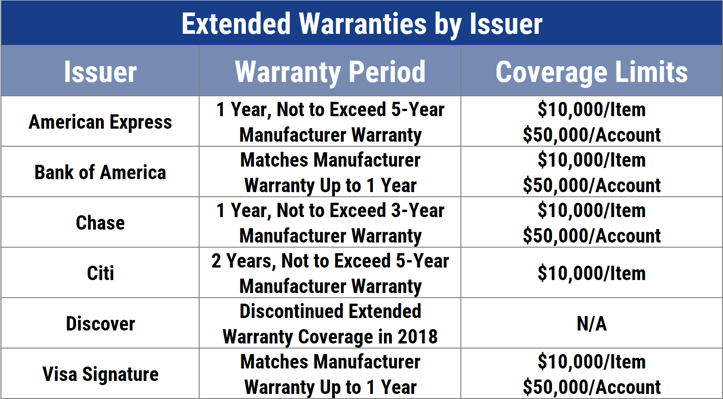

Many popular credit cards offer purchase protection or extended warranties for items purchased using your card.

To qualify for this benefit, you simply have to charge the full purchasing price of the item to your credit card. This was a standard benefit for cardholders several years ago that has become rare in recent years.

Every card that offers purchase warranties has varying levels of coverage, and some offer a broader scope of coverage than others. With purchase protection, you may get extended warranties that add time to the typical manufacturer’s warranty and cover the cost of repairs or replacement of larger purchases.

You may also have price protection that will reimburse you the difference if you find the same item available at a lower price within a certain time frame after your purchase.

Other protections may cover the cost of travel expenses if you have to cancel a trip. You may also be able to cover the cost of rental car insurance when you pay your rental fees using your credit card.

If you’re looking to purchase new appliances or other major electronics for your new home, one of these cards is a great tool for adding to your peace of mind if an item malfunctions or breaks. Warranties are never a bad thing to have — and if you can extend your warranty at no additional cost, it’s always a good thing.

What’s the Best Way to Charge a Big Purchase For Your Home?

The downpayment on your home isn’t the only big expense you’ll have when it comes to owning your own personal dwelling. You may choose to upgrade or remodel portions of your new home or add new appliances or furniture. Maybe your home needs a new air conditioner or roof repairs.

Either way, you can cover these costs with a good credit card and often get extra cash back and added time to repay your debt.

If you’re planning a big purchase, you can consider applying for one of the cards listed above to truly maximize your spending power. This allows you to strategize the best path for your purchase. If you know you’ll need time to repay your debt, you can go with a card that has a long introductory period for new cardholders with no interest charges on all eligible purchases.

If you can repay the debt quickly, you may want to lean toward a card with a large signup bonus and/or bonus categories that offer cash back for the purchase you’re going to make.

The signup bonus is an often overlooked tool for many new homeowners. These offers can add a substantial amount of cash back or bonus points to your account when you reach certain spending thresholds within your first three to six months of using your card. If you have a large purchase planned within that time frame, you may be able to reach your spending threshold right away and earn a large reward payout to use toward the bill.

The Chase Freedom Unlimited® card, for example, offers a cash back signup bonus when you meet certain spending thresholds during your first three months with the card. Along the way, you can also earn a flat and unlimited amount of cash back and take advantage of a promotional period with no interest charges for new purchases.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

Even better, this card currently charges no annual fee for card membership. That’s a great way to earn, save, and make your house more comfortable without breaking the bank. Applicants generally need a good credit score to qualify for this card.

Find the Best Credit Cards After Buying a House Online

Purchasing a house is a rite of passage into adulthood. It’s also the first sign you’re becoming more like your parents. Thankfully for you, you have financial tools that weren’t available to mom or dad when they bought their first house.

The best credit cards after buying a house make it easier to finance a large purchase or home improvement jobs. With the right card, you can take advantage of extended periods without interest charges and earn cash back for purchases at home improvement, home furnishing, and grocery stores. That means you can stock up your new home and make it exactly as you’ve dreamed.

In other words, you can rip out that old shag carpeting like the one Mom used to have and add your own personality to the place.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Credit Cards for Buying Money Orders ([updated_month_year]) 7 Best Credit Cards for Buying Money Orders ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Buying-Money-Orders-Feat.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying Gift Cards ([updated_month_year]) 7 Best Credit Cards for Buying Gift Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Best-Credit-Cards-for-Buying-Gift-Cards-Feat.jpg?width=158&height=120&fit=crop)

![3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year]) 3 Do’s & Don’ts: Buying a Car with a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/carbuy--1.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying a Car ([updated_month_year]) 7 Best Credit Cards for Buying a Car ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Credit-Cards-for-Buying-a-Car-Feat.jpg?width=158&height=120&fit=crop)

![11 Best Credit-Building Credit Cards ([updated_month_year]) 11 Best Credit-Building Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/build.png?width=158&height=120&fit=crop)

![How Many Credit Cards Should I Have for Good Credit? ([updated_month_year]) How Many Credit Cards Should I Have for Good Credit? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/howmany.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards For Building Credit ([updated_month_year]) 7 Best Credit Cards For Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-For-Building-Credit.jpg?width=158&height=120&fit=crop)