The traditional way to pay rent is with a paper check that you mail to your landlord, and the money is withdrawn directly from your checking account. However, in some circumstances, you can pay rent with a credit card instead.

There are pros and cons to charging such an important recurring expense. Prior to pursuing this option, learn what they are — and proceed prudently.

Yes, But Not All Landlords Will Accept Credit Cards

Merchants have to pay interchange fees when accepting credit cards as a form of payment, which can be a couple of percentage points per transaction. Therefore, if your rent is $1,500, that fee may be $30.

Because many landlords don’t want to assume that cost, they’ll stick to the tried and true paper check system. There are legal reasons for rejecting credit cards as a method of payment, too.

Many landlords don’t want to pay the interchange fees associated with credit card payments.

If the credit card you use has a cosigner, that person may be considered a tenant even when he or she is not on the lease. That adds an unwanted layer of complication to the tenant-landlord arrangement.

Accepting payment via a credit card also puts the landlord at greater risk. For cardholders, credit cards have valuable consumer protection.

After paying your landlord with the card, you can dispute the charge and the money may be credited to your account. It’s nice for you, but not the landlord.

A landlord may also simply not feel comfortable with you borrowing money for the rent. It could be a sign that you can’t afford the rent with available funds, and may be reason enough to reject plastic payments.

Why and How Landlords May Accept Credit Cards

If you really want to pay your rent with a credit card, it doesn’t hurt to ask your landlord if you can. You may be able to sweeten the deal by offering to add the interchange fee to the cost of your rent.

Paying the rent with a credit card is usually an option when you live in a large building complex that is professionally managed by a third-party company. They may even assume the interchange fee because checks coming from dozens, if not hundreds, of tenants are a hassle to collect and deposit.

Electronic transfers with a card are far easier. There’s no need to wait for the check to arrive, and the manager won’t have to hand-deliver a large number of checks to the bank. Credit cards also reduce potential security risks associated with paper checks, as mail can be lost or stolen, causing delays.

If your landlord or the property management company doesn’t want to accept credit cards as payment, you may be able to use a business that acts as a transaction intermediary. It takes your payment through your credit card, then turns around and sends a check on your behalf.

RadPad will accept your credit card as payment (for a fee) and mail your landlord a check.

Quite a few companies do this, including PlacePay, RadPad, and Plastiq. With PlacePay, landlords can choose to landlord, you can choose to pay the transaction fees for tenants, but most likely you will be paying even more for your rent.

Benefits of Paying Rent with a Credit Card

The most common reason to pay rent with a credit card is to earn rewards, especially when you’re interested in a major signup bonus. If you open a new credit card account that offers significant points or cash as an introductory welcome, you can come out ahead by quite a bit.

For example, a credit card may come with 60,000 bonus points that will be available to you after you charge at least $3,000 in the first three months of opening the account. Those points could be worth up to $750 in travel rewards.

Presuming your rent is $1,500, you’d hit that mark in two months. Even if you had to pay $60 in total interchange fees, your net profit would be $690. After that, you could simply pay by check and avoid any extra fees.

You may also consider paying with a credit card for convenience. Your account can be automatically charged each month, so you’ll know your rent will always be paid on time.

No more, “Oops, I forgot to send the check!” when you look at the calendar and it’s well past the first of the month. Another benefit of being able to charge rent is your own peace of mind.

Unfortunately, extreme and unexpected financial problems can pop up. You may suddenly lose your job and need some time to obtain another position. Paying with a credit card and then sending a partial payment to the credit card company for a month or two can help you feel secure.

Drawbacks of Paying Rent with a Credit Card

Although you can continue to charge your rent with a card after claiming a signup bonus, it’s unlikely the rewards will exceed the interchange fees after that. If the interchange fees will be your responsibility, you’ll have to factor them into the equation.

For instance, if you’ll be charged 1.7% to use a credit card that offers 1.5% cash back, you won’t turn a profit. Some credit cards do have higher rewards, such as 5% cash back, but it usually tops out at $1,000 or $1,500 per quarter.

Working the system so you always make money isn’t simple — and sometimes it’s not even possible.

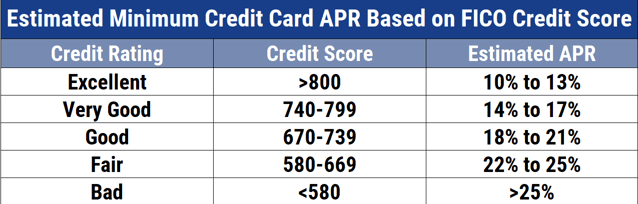

It’s also perilously easy to fall into debt when you use a credit card to cover a large expense on a regular basis. You would have to be exceptionally careful to pay the debt on time to avoid late fees, a hiked-up interest rate, and damage to your credit.

You could end up paying over 25% interest on any unpaid balance from your rent payments.

Also critical is to delete the balance entirely, rather than pay in installments, so interest isn’t applied to the unpaid portion. In fact, the resulting debt and interest costs can quickly turn into a terrible situation.

Six months’ worth of $1,500 rent is $9,000. If you were to only send the minimum payments, you’d barely make a dent in the principal and the amount you’d pay in financing fees would be astronomical.

With an interest rate of 20%, it would take 27 years to pay off and cost roughly $16,660 in financing fees.

Weigh the Pros and Cons Before Asking Your Landlord

Clearly there are benefits and drawbacks to using a credit card for rent payments, so weigh each before you approach your landlord with the proposition. If you’re certain you’ll come out ahead financially or will only charge your rent under extreme duress and have exhausted other options, it can make sense.

Otherwise, the old-fashioned way is best. Write a check.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Tips: Paying Rent or Mortgage with Credit Cards ([updated_month_year]) 7 Tips: Paying Rent or Mortgage with Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/rent--1.png?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![How to Pay Your Credit Card Bill in [current_year] How to Pay Your Credit Card Bill in [current_year]](https://www.cardrates.com/images/uploads/2021/11/How-to-Pay-Your-Credit-Card-Bill.jpg?width=158&height=120&fit=crop)

![6 Ways to Pay Student Loans With a Credit Card ([updated_month_year]) 6 Ways to Pay Student Loans With a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Pay-Student-Loans-With-a-Credit-Card.jpg?width=158&height=120&fit=crop)

![How to Pay Bills With a Credit Card ([updated_month_year]) How to Pay Bills With a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/How-to-Pay-Bills-With-a-Credit-Card.jpg?width=158&height=120&fit=crop)

![9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year]) 9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/Beverly-9Best.jpg?width=158&height=120&fit=crop)

![Which Credit Card Should I Pay Off First? ([updated_month_year]) Which Credit Card Should I Pay Off First? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Which-Credit-Card-Should-I-Pay-Off-First_.jpg?width=158&height=120&fit=crop)