There’s no doubt about it: Credit card interest rates are going up, and these rate hikes can hurt consumers who don’t pay off their card balances every month.

Rates are rising because the Federal Reserve hiked its benchmark federal funds rate earlier this year. Consumers don’t pay this rate directly, but when it goes up, market rates — the rates consumers do pay — also tend to move higher. In the article below, we’ll dive into important things to know — and actions to take — when interest rates rise, as well as seven options for rising credit card interest rates.

Interest Rates Have Risen More than 2 Percentage Points

In November, the Fed decided to hold its benchmark rate in the 2 to 2¼% range. Two years ago, the rate was near zero, a difference of 2 percentage points.

Card rates are significantly higher than the federal funds rate because banks add a profit margin, known as the spread.

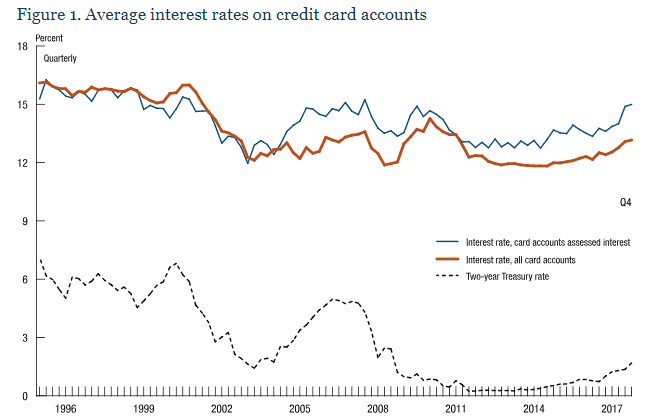

The average card rate at the end of 2017 was about 13%, according to a July 2018 Fed study. That rate tracked the two-year Treasury, which had turned slightly and slowly upward since 2013, leaving spreads unchanged.

The average doesn’t mean everyone who has a card pays 13%. In fact, the Fed study also found that average card rates for people who were charged interest were closer to 15%. And that was before this year’s rate hikes.

Average interest rates on credit card accounts. Source: Federal Reserve Board, Form 2835a, Quarterly Report of Credit Card Plans.

How much interest you’ll pay if you carry a balance depends on your credit score, your payment history, the types of cards you have, among other factors.

“Interest rates charged vary considerably across credit card plans and borrowers, reflecting the various features of the plans and the risk profile of the cardholders,” the Fed stated.

The Fed may not be finished with its rate hikes. It’s powerful Federal Open Market Committee constantly monitors inflation, employment, and other measures of economic activity to make decisions about when to raise (or lower) the federal funds rate.

What To Do When Your Card Rate Rises

There’s no one best thing you should do if your card’s interest rate rises. Rather, there are a variety of actions you could take, each with pros and cons.

Here are seven options to consider:

1. Do Nothing

With most credit cards, you’ll pay zero interest if you pay your balance in full every month. In that case, it doesn’t matter whether your rate is higher or lower. You may want to shop for a new card to get better rewards or lower fees, but you won’t need to shop for a lower rate card.

2. Pay the Higher Rate

If you carry a balance and you can afford to pay the higher rate, you may want to just do so. Why? Maybe you carry a balance only rarely or only for a short time. Maybe your balance is low or you intend to pay it off soon. Maybe your card has low fees or a rewards program that you love. Whatever the reason, a higher rate doesn’t necessarily mean you have to dump your card.

3. Pay off Your Balance

If you’ve been carrying a balance and your rate rises, that may be a good incentive to pay off your card to lower or eliminate your monthly interest expense. If you never carry a balance again, you won’t be affected by your card’s higher rate.

4. Ask for a Lower Rate

If you normally carry a balance and are struggling to make your monthly card payment, you may want to call your card issuer and ask for a lower rate. If your card company wants to keep you as a customer, it may lower your rate as a courtesy. Ask when the lower rate expires so you can revisit your options and decide what to do next when that happens.

5. Transfer Your Balance to Another Card

If you have several cards and your rate rises on a card on which you carry a balance, call your card issuers and ask them about their balance transfer offers. Find out how much you can transfer, what rate you’ll be charged, and how much the transfer will cost.

You can call your issuers or visit their website to see which balance transfer offers you may qualify for.

Some cards offer very attractive programs to entice you to transfer an existing balance.

6. Shop for a New Balance Transfer Card

If you carry a balance and don’t have another card with an attractive balance transfer offer, a higher rate may be an incentive to apply for a new balance transfer card.

When you shop for a balance transfer card, look for a low promotional rate and balance transfer fee. Some cards offer a 0% initial rate and no balance transfer fee. Ask how long your promotional rate will last and what your full rate will be when that rate expires.

Transferred balances typically don’t earn rewards, so you can make those perks a low priority when you compare cards. Here are a few of our favorites:

Additional Disclosure: Citi is a CardRates advertiser. Additional Disclosure: Citi is a CardRates advertiser.

You might need to call your card issuer to transfer your balance and you should continue to make your payment until the transfer is complete.

Don’t make a habit of using balance transfer cards to juggle more debt than you can afford. A better approach is to reduce your spending—radically, if necessary—until you can pay off all your card balances every month.

7. Close Your Account

Rising card rates can be a good incentive to review all your cards and make sure you’re happy with them. If you have a card that you don’t need, you can stick it in a drawer and not use it. If it has an annual fee, you may want to call the card issuer and cancel it. Keep in mind that canceling cards can affect your credit score.

Your Interest Rate is Just One Factor to Consider

There’s no right number of credit cards that you should have. Some people manage with just a few. Others want and use dozens to maximize their rewards. Card rates are just one factor, albeit an important one, you should consider when you choose which cards you want to apply for and use most often.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year]) What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/what-is-apr.jpg?width=158&height=120&fit=crop)

![What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year]) What is a Good Credit Card APR? 5 Best Low APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/good-apr2.png?width=158&height=120&fit=crop)

![Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year]) Apply For a Prepaid Card: 5 Best Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Apply-For-a-Prepaid-Card.jpg?width=158&height=120&fit=crop)

![7 Options to Get Cashback on a Credit Card ([updated_month_year]) 7 Options to Get Cashback on a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Cashback-Credit-Card.png?width=158&height=120&fit=crop)

![Credit Card Reconsideration: Phone Numbers, Tips & Options ([updated_month_year]) Credit Card Reconsideration: Phone Numbers, Tips & Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/recon.jpg?width=158&height=120&fit=crop)

![Citi Credit Card Preapproval Options ([updated_month_year]) Citi Credit Card Preapproval Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Citi-Credit-Card-Preapproval.jpg?width=158&height=120&fit=crop)

![Capital One Quicksilver Card: Review & Options ([updated_month_year]) Capital One Quicksilver Card: Review & Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Capital-One-Quicksilver-Card-Review.jpg?width=158&height=120&fit=crop)