If no one has told you — and you’ve yet to discover it for yourself — credit card debt can be expensive. And, the longer you carry that debt, the more expensive it can get.

For example, on a card with a typical 17% annual percentage rate (or APR), a $500 purchase could cost you almost $100 extra in interest fees — and could take nearly two years to pay off — if you only make the minimum payment. That means the great suit that was on sale for $500 could actually cost you $600 by the time it’s paid off.

At the same time, you may not realize just how much those credit card purchases are costing you if you don’t bother to do the math. Happily, there’s an easy solution to high interest fees: pay off your entire balance each and every month.

Avoid Interest By Paying in Full

Without question, the best way to manage your credit cards is to pay off your balances in full each month. If you always pay your balance in full then your interest rate becomes irrelevant. In fact, I have no idea what the interest rates are on any of my credit cards because I don’t carry balances.

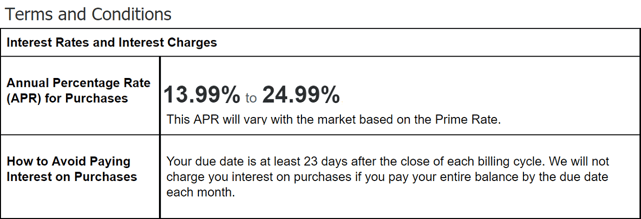

That’s because the grace period offered by most credit cards allows you to skip the interest altogether by paying your balance in full every statement period. In other words, as long as you pay your balance in full before the due date for that billing cycle, you won’t be charged any interest on that balance.

Your credit card’s grace period can be found in your cardholder agreement or terms and conditions documentation.

Of course, if your credit card debt has gotten out of hand, then you do need to be concerned about interest rates. In this scenario, a higher interest rate means more money out of your pocket — and into your credit card issuer’s pocket.

If possible, it’s a good idea to reduce your interest fees and lower your costs. If you’re looking for ways to reduce your credit card interest rate, here are two options which may help.

Option #1: Ask Your Card Issuer for a Reduction

It almost sounds too good to be true, but you can sometimes score a lower interest rate on a credit card simply by asking for one. Before you pick up the phone to give your card issuer a call, it can help to do a little prep work up front.

- Check your credit reports and scores. Your credit card interest rate is typically based, at least in part, on the condition of your credit reports and credit scores. When you have good credit, you represent a lower risk to lenders. As a result, lenders are generally willing to offer you better rates and terms. Don’t go into a negotiation with your card issuer if you have poor credit because you’ll have less leverage and are less deserving of a lower rate.

You can claim a free copy of your three credit reports once every 12 months at AnnualCreditReport.com. While checking your reports, be sure all of the information reported about you is accurate. If there are errors on your credit reports, they could be lowering your scores. - Improve your credit (if you can). Anything you can do to improve your credit before you make the request for a higher limit could be helpful. For example, if you pay down a portion of your credit card balance, you may lower the balance to limit ratio on your credit reports. A lower ratio is good for your credit scores. Even if you can only afford to lower that ratio by a few points it could be enough for a credit score boost, which means more leverage for you.

- Look up your payment history. Take a look at the payment history of your credit card before you call the issuer. Have you always made all of you payments on time? If so, be sure to bring up your flawless history as a selling point whenever you call your card issuer and negotiate a lower interest rate. If you’re constantly missing payments, your issuer may be more interested in shuttering your account than in reducing your interest rate.

- Review your current rates and fees. Before you call your card issuer, review your recent statements. You’ll want to write down the interest rate on your account and any fees you’re being charged currently. Knowing this information can be helpful in two ways. First, if you have no idea what you’re currently paying then what are you going to ask for? Second, if your card issuer does offer you an interest rate reduction, you’ll better understand what kind of savings opportunity that new, lower rate could bring you.

- Compare offers from competitors and be realistic. It can be helpful to know what your card issuer’s competitors are offering before you reach out to ask for a lower interest rate. If you find a similar card with lower interest rates you should mention that you’re aware of a better deal during your call.

You should also be realistic with your expectations. Card issuers are under no obligation to change the terms of your account. And, you’re under no obligation to continue being a customer. Your business is portable and you should always remember that.

Option #2: Apply for a New Credit Card

Despite your best efforts, you can’t force your card issuer to change the terms of your agreement. No matter how prepared you are before you make the call, there’s a chance your card issuer will deny your request for a lower rate. If this happens, you may want to consider opening an alternative credit card and taking your business elsewhere.

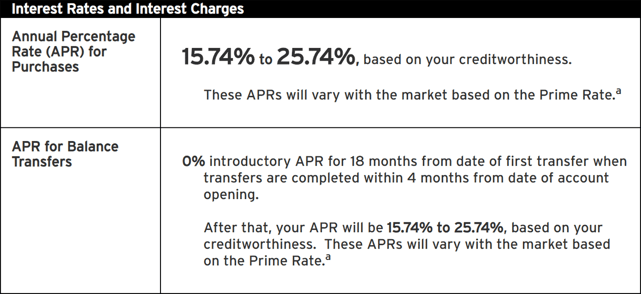

Depending on the condition of your credit, you may be able to qualify for a balance transfer credit card with a low-interest introductory offer. For those with good credit, balance transfer offers can provide a 0% APR on transferred balances for a year or more.

Some introductory offers will only apply to one type of transaction, such as solely new purchases or balance transfers.

Make sure to include any potential fees when doing the math for a balance transfer. For instance, many cards charge balance transfer fees that can run between 3% and 5% of the total transferred balance.

If you qualify for a balance transfer offer, consider coupling your new, lower rate with an aggressive debt elimination plan. By using these two strategies together, you may finally be able to eliminate your credit card debt once and for all.

Keep in mind, you don’t have to close your existing credit card account when you open a new one. If you pay off your full balance, the higher interest rate on your old account won’t cost you any extra money. You only have to worry about credit card interest fees whenever you carry a balance on your account.

Furthermore, closing your old account could backfire and raise your overall balance-to-limit ratio on your credit reports. The result could be lower credit scores. Leave the existing account open. Who knows? The card issuer may eventually come back and offer you a lower rate now that they’ve seen your usage drop and their revenue eliminated.

The main exception is in cases of an annual fee; if your existing card charges an annual fee, consider whether the card is worth hanging on to after your debt has been paid off.

The Real Cost of a Credit Card

Credit card interest can be a costly consequence to charging purchases you can’t pay off in a timely manner. No matter how alluring the card rewards, store discounts, or sale prices, high interest fees will usually cost you more than whatever discount or rebate you receive. For best results, pay your balance in full each month to avoid expensive interest fees.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year]) 3 Ways: Get a Lower Interest Rate on Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/lowerinterest.png?width=158&height=120&fit=crop)

![How to Calculate Credit Card Interest: 3 Steps to Find Your Rate ([updated_month_year]) How to Calculate Credit Card Interest: 3 Steps to Find Your Rate ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/how-to-calculate-credit-card-interest.jpg?width=158&height=120&fit=crop)

![APR vs. Interest Rate: Is There a Difference? ([updated_month_year]) APR vs. Interest Rate: Is There a Difference? ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/APR-vs-Interest-Rate-Feat.jpg?width=158&height=120&fit=crop)

![6 Ways to Save on Credit Card Interest Fees ([updated_month_year]) 6 Ways to Save on Credit Card Interest Fees ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Ways-to-Save-on-Credit-Card-Interest-Fees.jpg?width=158&height=120&fit=crop)

![3 Ways to Avoid Interest Charges on Credit Cards ([updated_month_year]) 3 Ways to Avoid Interest Charges on Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Ways-to-Avoid-Purchase-Interest-Charges-on-Credit-Cards-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Flat Rate Cash Back Credit Cards ([updated_month_year]) 9 Best Flat Rate Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/03/Best-Flat-Rate-Cash-Back-Credit-Cards.jpg?width=158&height=120&fit=crop)