No annual fee credit cards are among the most appealing to many consumers these days. Having to pay an annual fee can be a disincentive for applying for an otherwise appealing card. Below, we’ve compiled a list containing our picks for some of the best no annual fee credit cards out there today.

Looking at the cardholder agreements that come with new credit cards can be a bit intimidating, full as they are with descriptions of the copious fees for using the cards’ features. On the plus side, many of the fees that come with a credit card can be avoided through responsible credit card use. Simply paying off your balance every month, for instance, can eliminate the need to pay interest fees, and skipping the cash advance will also let you skip the fee.

Unfortunately, some credit cards come with one particular fee that often can’t be avoided: the annual fee. A fixture of many premium credit cards, the annual fee pays for the various perks and rewards enjoyed by cardholders. That said, a wide variety of issuers offer credit cards — many with valuable rewards like cash back on every purchase — that don’t charge annual fees. Regardless of where you fall on the credit score range, you can likely find the annual-fee-free card for you.

Good Credit | Fair Credit | Poor Credit | No/Limited Credit

Although building — or rebuilding — credit can be a slow process, it’s definitely worth the time it takes to develop a strong credit history. Those with good credit enjoy many of the best perks in credit, including the best interest rates and the lowest fees — even annual fees.

Since those with good credit represent a low credit risk, they’ll have access to a greater number of premium credit cards than their lower-credit counterparts. This includes a variety of cards that have no annual fee but still offer solid perks and rewards.

Cash Back Cards

Cash back rewards programs give you back a portion of what you spend on qualifying purchases. Most programs reward you with a flat-rate percentage of your purchases as a statement credit, while others also offer bonus cash back on purchases in certain categories.

As an added perk, these cards also have good signup bonuses with attainable minimum spending requirements, giving you even more bang for your — well, no buck, because these cards don’t have any annual fees.

CASH BACK RATING

★★★★★

4.8

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

|

|

|

|

|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

CASH BACK RATING

★★★★★

4.9

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

CASH BACK RATING

★★★★★

4.8

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

|

|

|

|

|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

Of course, if you carry a balance on your cards, you’ll be expected to pay interest fees, which can really eat into any rewards. Pay your card off, in full, every month to avoid paying interest fees on your purchases.

Travel/Airline Miles Cards

For those who travel frequently, either for business or for pleasure, credit cards offering travel rewards can really pay off. Cardholders can earn miles for every dollar spent, then redeem those miles for travel purchases like airline tickets and hotel stays.

To make the most of your travel card, look for programs that allow you to redeem your miles without blackout dates or travel restrictions. Those with good credit can also find travel cards with signup bonuses for extra savings.

AIR MILES RATING

★★★★★

4.9

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

|

|

|

|

|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

AIR MILES RATING

★★★★★

4.9

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

BEST OVERALL RATING

★★★★★

4.9

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

|

|

|

|

|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

If you’re likely to travel out of the country, look for credit cards that don’t charge foreign transaction fees. These are additional fees tacked onto any purchase made in a foreign country or foreign currency.

Foreign transaction fees are a combination of issuer and bank fees, and can be charged before or after your purchase is converted to US currency. If your card charges foreign transaction fees, be prepared to pay an average of 3% more for purchases made abroad.

Although those with good credit will have the best options, if your credit falls in the “fair” range you may still qualify for a good everyday card or valuable rewards card that charges no annual fee.

Everyday Card

Whether you’re establishing your fledgling credit or working on smoothing a bumpy credit history, responsible use of a credit card can be a great way to build a healthy credit profile.

BEST OVERALL RATING

★★★★★

4.5

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

|

|

|

|

|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

A good everyday card for those with fair credit will report to the credit bureaus each month and has no annual fee. Choosing a card with no annual fee and paying off the balance each month will allow you to show good credit behavior without adding another expense to the budget.

Rewards Cards (Fee Dependent on Credit)

Fair credit applicants whose hearts are set on a rewards card may still have some options. As with many things in life, however, those options come with a caveat: only qualified applicants will actually qualify for a $0 annual fee.

8. Credit One Bank® Platinum Visa®

This card is currently not available.

Best Overall Rating

★★★★★

N/A

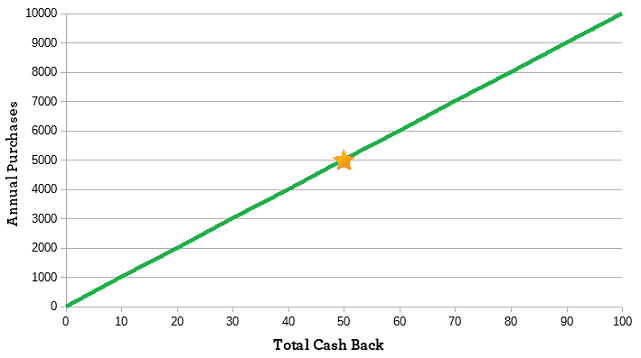

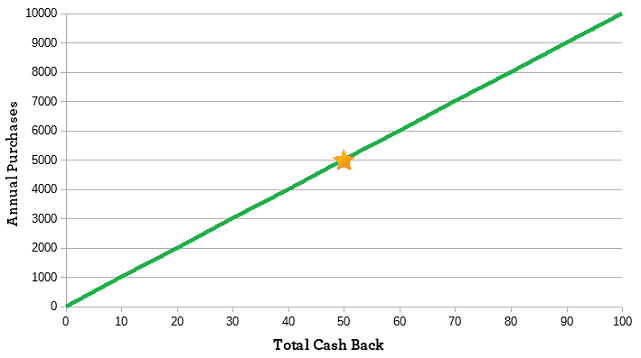

If you apply for a fair-credit rewards card but don’t qualify for the no annual fee offer, you’ll need to determine if the perks and rewards offered by the card are worth the annual fee. This will largely depend on how much you are likely to purchase over the course of the year.

As the graph shows, if you earn 1% cash back on your purchases, it would take $5,000 worth of purchase rewards to earn enough cash back to pay for a $50 annual fee. So, if you are unlikely to spend — and pay off — $5,000 in a year, the card’s rewards are unlikely to cover the annual fee.

As all those with poor credit eventually find, a low credit score equates to a high credit risk to lenders and credit card issuers. High credit risk means higher fees and interest rates, and often includes annual fees.

Even if your credit score plants you firmly in the “bad credit” category, you don’t necessarily need to resign yourself to paying an annual fee. Several options exist for obtaining credit cards without annual fees, including both unsecured and secured cards.

The main difference between unsecured and secured credit cards is, as the name implies, the “secured” part. Secured credit cards require cardholders to put down a deposit as security against defaulting on their credit card bill. Unsecured cards require no deposit but may have higher credit requirements.

Unsecured Cards

If you have poor credit and don’t want to pay an annual fee, but would rather not put down a deposit, your options are a bit limited. In fact, some of the options may require you to meet certain credit qualifications to actually avoid paying an annual fee.

Your credit score may be too low to qualify you for a no annual fee offer. In some cases, your best bet may be to pay the fee, then use the card — responsibly — for six months or so, until your credit improves and you can qualify for a better offer.

BAD CREDIT RATING

★★★★★

4.3

- Easy application! Get a credit decision in seconds.

- Build your credit history – Fingerhut reports to all 3 major credit bureaus

- Use your line of credit to shop thousands of items from great brands like Samsung, KitchenAid, and DeWalt

- Not an access card

|

|

|

|

|

|

N/A

|

N/A

|

See Issuers Website

|

$0

|

Poor Credit

|

BAD CREDIT RATING

★★★★★

4.3

- Now with higher credit limits

- Increase your access to available credit

- Higher limit than before, still no security deposit required!

- Greater access to credit than before

- Less than perfect credit is okay

- Mobile account access at any time

|

|

|

|

|

|

N/A

|

N/A

|

35.9%

|

$175 - $199

|

Bad, Poor Credit

|

In addition to paying your balance in full every month to avoid interest fees, be sure to pay your credit card bill on time every month, as well. Not only is this good credit behavior, but you’ll also avoid paying late fees on your card payments.

Secured Cards

Secured credit cards represent less risk to an issuer than unsecured cards because the deposit ensures you won’t default on your card. This means you may have more options for obtaining a credit card that doesn’t charge an annual fee.

With secured cards, the credit limit of your card will be equal to your initial deposit. Since larger credit limits are better for your utilization rate and, thus, your credit score, it may behoove you to make a significant deposit. Your initial deposit is completely refundable.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

|

|

|

|

|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

- No credit score required to apply.

- No Annual Fee, earn cash back, and build your credit history.

- Your secured credit card requires a refundable security deposit, and your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

- Automatic reviews starting at 7 months to see if we can transition you to an unsecured line of credit and return your deposit.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get an alert if we find your Social Security number on any of thousands of Dark Web sites. Activate for free.

- Terms and conditions apply.

|

|

|

|

|

|

N/A

|

10.99% Intro APR for 6 months

|

28.24% Variable APR

|

$0

|

New/Rebuilding

|

13. Citi® Secured Mastercard®

This card is currently not available.

Additional Disclosure: The information related to Citi® Secured Mastercard® has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.

The deposit you make when opening your secured credit card is kept in a special savings account, which is inaccessible to you while your account is open. Most secured card issuers will reevaluate your credit after 12 to 18 months, and may refund your deposit and upgrade your secured card to an unsecured card automatically if your credit has improved.

Considered by some issuers to be almost as significant as having poor credit, having no credit, or very limited credit, can make it difficult to find a good credit card, let alone one without an annual fee. That said, options do exist for cards you can use to build your blossoming credit that won’t put an annual dent in your budget.

Business & Consumer Cards

When it comes to building your credit, whether personal or business, the most important ingredient is time. Using a credit card is a good way to help the process, but it certainly won’t happen overnight. Finding a good credit card that doesn’t charge an annual fee can help make the credit-building process a bit more affordable, especially over several years.

NO/LIMITED CREDIT RATING

★★★★★

4.7

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

|

|

|

|

|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

15. Capital One® Spark® Classic for Business

This card is currently not available.

No/Limited Credit Rating

★★★★★

N/A

Additional Disclosure: Information for this card not reviewed by or provided by Capital One.

While your business and personal credit histories exist separately, your personal credit can influence your business credit. Be sure to use both consumer and business credit cards wisely and responsibly to build healthy credit for you and your company.

Student Cards

As notoriously ill-funded as the proverbial starving artist, the average college student likely has about as much of a credit history as they have spare cash to pay an annual fee. Thankfully, a number of issuers offer cards that don’t require a credit history or an annual fee.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! So you could turn $50 cash back into $100. Or turn $100 cash back into $200. There’s no minimum spending or maximum rewards. Just a dollar-for-dollar match.

- Earn 2% cash back at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.

- Redeem your rewards for cash at any time.

- No credit score required to apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee and build your credit with responsible use.

- 0% intro APR on purchases for 6 months, then the standard variable purchase APR of 18.24% - 27.24% applies.

- Terms and conditions apply.

|

|

|

|

|

|

0% Intro APR for 6 months

|

10.99% Intro APR for 6 months

|

18.24% - 27.24% Variable APR

|

$0

|

Fair/New to Credit

|

While having no credit history makes you a credit risk to card issuers, having no history is still better than having a bad history, so use your credit card responsibly to avoid damaging your credit history. And remember, no annual fee doesn’t mean no fees at all, so pay your balance in full every month to avoid paying interest fees on your purchases.

When comparing the nearly endless stream of credit card offers out there, it can often seem as though paying fees simply goes hand-in-hand with using a credit card. Whether you’re paying annual fees, interest fees, or transfer fees, the costs of using a credit card really can add up quickly.

Fortunately, that’s not the case for all credit cards. With a little research — and a lot of responsible credit card behavior — you can enjoy the perks and rewards of a credit card without paying an arm and a leg in fees, annual or otherwise.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![13 Best No-Annual-Fee Credit Cards ([updated_month_year]) 13 Best No-Annual-Fee Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/03/best-no-annual-fee-credit-cards.jpg?width=158&height=120&fit=crop)

![7 Best No-Annual-Fee Credit Cards with Rewards ([updated_month_year]) 7 Best No-Annual-Fee Credit Cards with Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/No-Annual-Fee-Credit-Cards-with-Rewards.jpg?width=158&height=120&fit=crop)

![7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year]) 7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/credit-cards-for-fair-credit-with-no-annual-fee-feat.jpg?width=158&height=120&fit=crop)

![7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year]) 7 No-Annual-Fee Credit Cards For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_1092414950-1.jpg?width=158&height=120&fit=crop)

![5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year]) 5 Credit Cards For Bad Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Credit-Cards-For-Bad-Credit-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year]) 14 Best Rewards Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Rewards-Credit-Cards-with-No-Annual-Fee-Feat.jpg?width=158&height=120&fit=crop)

![7 Secured Credit Cards With No Annual Fee ([updated_month_year]) 7 Secured Credit Cards With No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_29251765.jpg?width=158&height=120&fit=crop)

![7 Best No-Annual-Fee Cards For Excellent Credit ([updated_month_year]) 7 Best No-Annual-Fee Cards For Excellent Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Best-Credit-Cards-For-Excellent-Credit-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)