If you’re a new immigrant to the U.S, an international student, or other noncitizen, you may be on the lookout for credit cards without Social Security number (SSN) requirements. While these cards aren’t widely available, they do exist.

They can allow you to spend easily, earn rewards, build credit, protect against fraud, and enjoy several other perks. Let’s dive deeper into nine credit cards without SSN requirements that are sure to make your financial life easier.

Consumers | Businesses | Students

How to Apply | FAQs & Ranking Methodology

Consumer Cards without SSN Requirements

If you don’t have a Social Security number, it’s highly likely that you have no credit score or very limited credit history. Fortunately, a few issuers may approve you despite your credit situation and lack of a SSN.

You can easily apply for them online with your Individual Taxpayer Identification Number (ITIN) or your nine-digit passport number in lieu of a SSN and receive an approval decision quickly.

- No annual or hidden fees. See if you're approved in seconds

- Be automatically considered for a higher credit line in as little as 6 months

- Help build your credit through responsible use of a card like this

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Monitor your credit score with CreditWise from Capital One. It's free for everyone

- Get access to your account 24 hours a day, 7 days a week with online banking from your desktop or smartphone, with Capital One's mobile app

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Average, Fair, Limited

|

The Capital One Platinum Credit Card may give you access to a higher credit line when you consistently pay your bill on time. You can choose the monthly payment date that works best for you and pay online, via check, or at a local branch.

In addition, there’s no annual fee and you’ll be backed by fraud coverage if your card gets lost or stolen. The Capital One Platinum Credit Card can help you build credit and meet your future financial goals.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn't expire for the life of the account. It's that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

The Capital One QuicksilverOne Cash Rewards Credit Card will reward you with unlimited cash back on every purchase. You don’t have to sign up for rotating categories and can start earning right away. There’s no limit to how much cash you can earn, and your rewards won’t expire for the life of your account.

As a Capital One customer, you’ll also receive access to the CreditWise® app, which can help you keep track of your credit. This is especially beneficial to those who are new to credit and learning the ropes.

- No annual or hidden fees. See if you're approved in seconds

- Building your credit? Using the Capital One Platinum Secured card responsibly could help

- Put down a refundable security deposit starting at $49 to get a $200 initial credit line

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

- Enjoy peace of mind with $0 Fraud Liability so that you won't be responsible for unauthorized charges

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

You’ll find it easy to build credit with the Capital One Platinum Secured Credit Card. It differs from a prepaid card because it reports to the three major credit bureaus on a regular basis.

As long as you make the minimum security deposit, you’ll get a $200 credit line to start. The Capital One Platinum Secured Credit Card does not come with an annual fee and can be used at millions of locations globally.

Business Cards without SSN Requirements

If you own or manage a business but don’t have a SSN, no worries, because a few business cards don’t require one for approval. They instead allow you to apply with your ITIN or Employer Identification Number (EIN).

And, if you own a business, you may already have your EIN. This is great news if you need a credit card to fund a variety of business-related expenses.

The Capital One Spark Cash Select for Good Credit can be obtained with a Tax ID or ITIN. It pays generous cash back rewards and offers free employee cards that allow you to easily track your employees’ spending. You can also set customized limits for employee cards.

You also get all the customary features, such as security alerts, customer support, $0 fraud liability, and the ability to set up AutoPay.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

The Ink Business Preferred® Credit Card requires good to excellent credit, but you get perks and rewards worthy of prime customers. Think a generous signup bonus, flexible redemption options, free employee cards, and several travel benefits.

There are no foreign transaction fees, 1:1 transfers to participating travel partners, and a variety of insurance benefits.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Cash® Credit Card, can be acquired with an ITIN instead of your Social. It offers a signup bonus, free employee cards, various reward redemption options, and fraud protection to help keep your business finances secure.

This card can help you build business credit as your business and access to capital grow. You’ll get insight into your business spending with detailed quarterly reports.

Student Cards without SSN Requirements

If you’re an international student, you may want a credit card you can use while you study in the U.S. Fortunately, you have a few great options available to you.

They don’t require stellar credit or even a SSN to apply. You can use one of these cards to build your credit and earn rewards in the process.

This card is currently not available.7. Chase Freedom® Student credit card

The Chase Freedom® Student credit card — the first student offer from Chase — comes with a smalls signup bonus after you make your first purchase within three months of opening your account, and cash back rewards on everything you buy.

This student card comes with a bevy of perks and can help young adults build credit over time with responsible use.

Specifically designed for international students who want to build credit in the U.S., the Deserve® EDU Mastercard offers an unlimited 1% cash back on every purchase.

While the Deserve Edu Mastercard® doesn’t require a SSN, you will need to prove that you attend a college or university and have enough income to make the minimum monthly payments.

How to Apply for a Credit Card without a SSN

The easiest way to apply for a credit card without a SSN is to get an ITIN. To do so, you’ll need to complete an IRS Form W-7.

The form will ask you to provide your proof of identity through a passport or a government-issued ID from your home country. You can also use the Alien Registration Number from your green card, student ID, or work visa.

Once you submit your W-7 by mail or through an appointment at an IRS Taxpayer Assistance Center (TAC), you’ll get your ITIN within seven weeks. Only specific TACs provide W-7 documentation review. You can call 844-545-5640 to schedule an appointment.

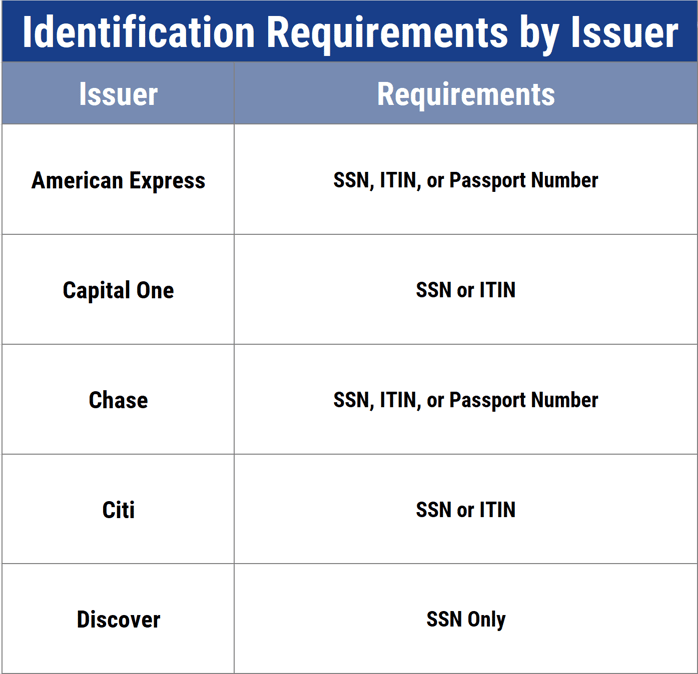

Here’s a brief overview of the forms of ID that popular credit card issuers may accept.

A prepaid card is another option if you’re still unable to get approved for a credit card. These cards allow you to make purchases online and everywhere else credit cards are accepted, but you load the money you spend onto the card — it isn’t a traditional line of credit.

Alas, it won’t help you build credit, which is a big downfall of prepaid cards when you’re trying to establish a credit history.

Can a Non-U.S. Citizen Apply for a Credit Card?

If you move to the U.S. for school, work, or indefinitely, you may wonder if you can apply for a credit card. Since you probably don’t have a SSN, your choices will be limited, but several credit cards may be available to you.

The Capital One Platinum Credit Card is an example.

Keep in mind that while you may not need a SSN, you will have to provide another form of ID, such as an ITIN or passport number. Each credit card issuer has its own rules for non-U.S. applicants, so do your research before you apply.

Going to a bank branch and speaking with a representative directly to help answer your questions may be a good option if there’s a local branch to you. Otherwise, you can call customer service for assistance.

How Can Immigrants Build Credit?

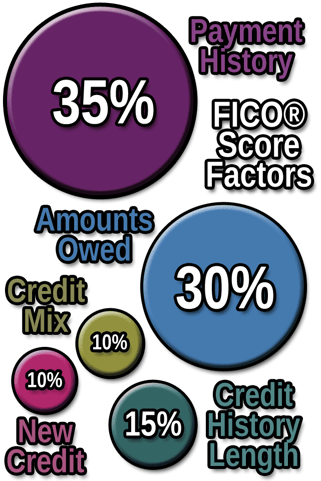

One of the best ways to build credit as an immigrant is through a credit card. As long as you make payments on time and in full, you can build a strong credit history.

Why is it important to build credit?

Whether you’re in the U.S. for a short period or for several years, there will likely come a time when you need to purchase a car, a home, or take out a personal loan for any other reason. A solid credit history will help you get approved for a loan if you don’t have the cash to pay upfront.

When you have limited credit or no credit at all, lenders will view you as a risk and may be less likely to lend money to you. You’ll also pay higher interest rates and fees on the very same loan that a person with good credit would.

In short, bad credit is expensive and makes loan and credit approval more difficult.

Another way immigrants can build credit is by paying other bills, such as rent and utilities, on time. Sometimes, landlords and service providers can report payment history to the credit bureaus, which will help establish a credit history.

Another option is to get a credit-builder loan, which is essentially a savings account you pay into each month, and your payments are reported to the credit bureaus. After you make your final payment as agreed to in your loan terms, your total payment sum will be given back to you. This is a great way to build savings and credit.

Read this article for other ways to build credit without a credit card.

Can an ITIN Number be Used as a SSN?

You may be able to use an ITIN instead of a SSN on a credit application. Many credit card issuers, such as Capital One and Chase, will accept your application if you have an ITIN, or an EIN if you’re applying for a business credit card.

You should understand, however, that an ITIN is not the same thing as a SSN. ITINs were created in 1996 by the IRS so that foreign individuals can pay their taxes.

An ITIN will also allow you to open bank and credit accounts, secure a driver’s license, and can serve as proof of residency.

A SSN differs from an ITIN in that it’s used to keep track of your lifetime earnings and number of years you work. You can apply for a SSN if you’re a U.S. citizen or an eligible U.S. resident.

Ranking Methodology

Our list of credit cards without SSN requirements first looks at banks that allow individuals to apply for a credit card without a Social Security number. We then evaluated factors such as the APRs and terms of each card, the rewards offered, the ability to build credit through credit bureau reporting, and overall customer satisfaction. Our editorial integrity process ensures our rankings are not compromised by advertiser influence.

You should consider credit cards without SSN requirements if you’re from a different country yet want to thrive financially in the U.S. They can make it easy for you to fund one-time and daily purchases, establish a credit score, and earn rewards for your spending habits.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Prepaid Cards Without SSN Requirements ([updated_month_year]) 3 Prepaid Cards Without SSN Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/Prepaid-Cards-Without-SSN-Requirements.jpg?width=158&height=120&fit=crop)

![7 Credit Card Requirements & Minimums to Apply ([updated_month_year]) 7 Credit Card Requirements & Minimums to Apply ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/req.png?width=158&height=120&fit=crop)

![[card_field card_choice='5853' field_choice='title'] Credit Score Requirements ([updated_month_year]) [card_field card_choice='5853' field_choice='title'] Credit Score Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/shutterstock_465713531.jpg?width=158&height=120&fit=crop)

![Capital One Credit Score Requirements By Card ([updated_month_year]) Capital One Credit Score Requirements By Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/caponecredit.png?width=158&height=120&fit=crop)

![Citi Double Cash Credit Score Requirements ([updated_month_year]) Citi Double Cash Credit Score Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Citi-Double-Cash-Credit-Score.jpg?width=158&height=120&fit=crop)

![How to Get a Black Card – American Express® Requirements ([updated_month_year]) How to Get a Black Card – American Express® Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/03/How-to-Get-a-Black-Card-2--1.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='5861' field_choice='title'] Review & Deposit Requirements ([updated_month_year]) [card_field card_choice='5861' field_choice='title'] Review & Deposit Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/08/shutterstock_680176312.jpg?width=158&height=120&fit=crop)

![7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year]) 7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-5--1.jpg?width=158&height=120&fit=crop)