In this article, we pit the Chase Sapphire Reserve® vs. Luxury Card trio. The Chase card is one of our top-ranked travel cards, setting the standard for rewards and benefits.

Luxury Card may be a name new to many of you — it is a collection of three premium World Elite Mastercards from Barclays Bank. They, too, offer excellent perks. It’s three against one in this showdown, so let’s get ready to rumble.

-

Navigate This Article:

All About the Chase Sapphire Reserve®

Weighing in at 13 grams of metal, the Chase Sapphire Reserve® card delivers value that far exceeds its annual fee. It caused quite a stir when it hit the scene in August 2016 with its colossal signup bonus, generous yearly travel credit, and bonus points for spending on travel and dining.

Social media was ablaze, with one 45-second video of a cardmember unboxing the card garnering more than 20,000 views. Chase scored a bonanza, exceeding its 12-month shipment forecast in only two weeks.

The card spurred issuers, including Citibank and American Express, to relaunch their premium cards. But the Chase Sapphire Reserve® card remains the travel rewards leader. That’s due, in part, to the bump in value its points receive when you redeem them for travel through the Chase website.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Chase Sapphire Reserve® and its little brother, the Chase Sapphire Preferred® Card, offer many travel protections to cover canceled and interrupted flights, lost luggage, and damage to a rental car.

The low end of its APR range is competitive with other cards targeting consumers with good to excellent credit. You can transfer your Ultimate Rewards points 1:1 to other loyalty programs such as Hilton Honors.

The Reserve is a Visa Infinite card, on par with Chase’s United Club Infinite Card. The Preferred card has not yet achieved Visa Infinite status, remaining a Visa Signature card for now. You can redeem the Preferred’s Ultimate Rewards points for 25% more value when used for travel purchases on the Chase website.

The Three Luxury Cards

Black Card LLC launched the Visa Black Card in 2008, rebranding it as a Mastercard in 2016. It added the Gold and Titanium versions in that same year, with different annual fees, rewards, and perks.

All three Luxury Cards are metal heavyweights (22 grams), composed of carbon fiber and stainless steel. The Gold version gets its sparkle from the addition of 24-karat gold.

The stated mission of Luxury Card is “to shape the industry through innovation, value, and service.” Read on to see how well these products have met the challenge.

- Ideal for those seeking a premium travel card that doubles as an everyday workhorse, paired with elevated service beyond the ordinary. Leave behind the hassle of juggling various cards and monthly statements, while finding peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 2% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- Annual Airline Credit—up to $200 in statement credits toward flight-related purchases including airline tickets, baggage fees, upgrades and more. Just pay for airline purchases with your Mastercard Gold Card and we will automatically apply the credit to your account. That’s it. No need to activate or designate an airline. The credit amount is available in full at the start of the calendar year.

- Up to a $100 application fee credit for the cost of TSA Pre✓® or Global Entry. Also, enjoy automatic enrollment in Priority Pass™ Select with access to 1,300+ airport lounges worldwide with no guest or lounge limits. Includes credits at select airport restaurants for cardholder and one guest.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Made with 24K Gold: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual Fee: $995 ($295 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$995 ($295 for each Authorized User added to the account)

|

Excellent

|

The Mastercard® Gold Card™ is the high-end member of the Luxury Card trio. It provides many of the same kinds of travel benefits as the Sapphire Reserve (albeit with a higher annual fee). It also delivers Luxury Card Travel perks when you stay at participating hotels and resorts.

You should receive next-day delivery of your new Mastercard® Gold Card™. You can redeem points for travel (airfare, hotel, and car rentals), a direct deposit to a US checking or savings account, a statement credit, a gift card/certificate, merchandise, or a unique experience.

- Ideal for those seeking a premium travel card that doubles as an everyday workhorse, paired with elevated service beyond the ordinary. Leave behind the hassle of juggling various cards and monthly statements, while finding peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 1.5% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- Annual Airline Credit—up to $100 in statement credits toward flight-related purchases including airline tickets, baggage fees, upgrades and more. Just pay for airline purchases with your Mastercard Black Card and we will automatically apply the credit to your account. That’s it. No need to activate or designate an airline. The credit amount is available in full at the start of the calendar year.

- Up to a $100 application fee credit for the cost of TSA Pre✓® or Global Entry. Also, enjoy automatic enrollment in Priority Pass™ Select with access to 1,300+ airport lounges worldwide with no guest or lounge limits. Includes credits at select airport restaurants for cardholder and one guest.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Black PVD-Coated Metal Card: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual Fee: $495 ($195 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$495 ($195 for each Authorized User added to the account)

|

Excellent

|

The mid-tier Mastercard® Black Card™ costs a little less than the Sapphire Reserve. Compared with the Mastercard® Gold Card™, this card offers slightly lower cash back rewards on non-travel purchases and a smaller annual airline credit.

Other perks remain the same, including free Priority Pass Select membership, Luxury Card Travel benefits, 24/7 concierge, and a reimbursement credit for the Global Entry application fee.

- Ideal for those seeking an introductory premium travel card that provides exceptional airfare redemption, access to hotel privileges and elevated service beyond the ordinary. Find peace of mind with protection benefits that exceeds standard credit cards.

- Flat-rate redemption value of 1% for cash back or 2% value for airfare redemption with no airline or seat restrictions and no blackout dates. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy. No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values.

- 24/7 Luxury Card Concierge®—Make requests the way you want by phone, email, SMS and chat in the app. Connect directly with a real agent and receive 24/7 assistance for tasks big and small. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

- Exclusive Luxury Card Travel® benefits—average value of $500 per stay (e.g., resort credits, room upgrades, free wifi, breakfast for two and more) at over 3,000 properties. Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Cell phone protection for eligible claims of up to $1,000 each year. Plus additional World Elite Mastercard® benefits.

- Members-only LUXURY MAGAZINE®.

- Brushed Metal Card Design: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

- Annual fee: $195 ($95 for each Authorized User). Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% introductory APR for the first fifteen billing cycles following each balance transfer that posts to your account within 45 days of account opening.

|

21.24%, 25.43% or 28.24%

|

$195 ($95 for each Authorized User added to the account)

|

Excellent

|

The Mastercard® Titanium Card™ has the lowest annual fee of the Luxury Card trio but still delivers valuable travel and concierge benefits. It pays a non-travel membership reward rate below that of the Mastercard Black Card and omits Priority Pass membership, Global Entry reimbursement, and the annual airline credit.

Similar to its two siblings, the Titanium entry provides cardmembers with Luxury Gifts from some of the world’s most iconic brand names. You also get LUXURY MAGAZINE, the exclusive publication covering various subjects, including travel, fashion, real estate, vehicles, and technology.

Top Alternative Elite Credit Cards

The following three cards spice up the competition for cardmembers who demand elite travel benefits and generous membership rewards. There’s even one from Chase for small business owners.

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$395

|

Excellent

|

The Capital One Venture X Rewards Credit Card gives you free, unlimited access to Capital One and Priority Pass lounges, offering relaxation rooms, high-speed wifi, and healthy, chef-inspired food.

As with Chase Sapphire Reserve®, this card provides primary collision damage waiver insurance for rental cars. It offers a generous anniversary miles bonus, plus many other travel, dining, and entertainment benefits. You can use the card to book your travel purchase through Capital One Travel.

- Earn 150,000 Membership Rewards® points after you use your new card to make $8,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 140 countries.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% – 29.24% Pay Over Time

|

$695

|

Excellent

|

Not to be outdone, The Platinum Card® offers attractive benefits and rewards through American Express Travel, including the widest variety of airport lounges via its Global Lounge Collection, including Priority Pass™, Centurion, and Delta Sky Club® lounges. The Platinum Card® directly competes with the Chase Sapphire Reserve®.

The Amex Platinum card weighs in at 17 grams and provides Membership Rewards® points and several statement credits, including Global Entry or TSA PreCheck fees, certain US streaming subscriptions, Uber, and more. You can receive around-the-clock assistance from American Express Travel and make travel arrangements through the Amex Travel website with minimal hassles.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That’s $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more – your points don’t expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

The travel protections from the Ink Business Preferred® Credit Card are on par with those from Chase Sapphire Reserve®. It may be the best business credit card for trip interruption and cancellation insurance and competes with cards such as the more expensive Delta SkyMiles® Reserve Business Card.

This business card provides primary collision damage waiver (CDW) insurance on vehicles you rent for business; otherwise, coverage is secondary in the United States but remains primary elsewhere. Cellphone theft and damage coverage extends to employees listed on the business owner’s monthly bill.

Who Issues the Luxury Cards?

Barclays Bank issues Luxury Cards under license with the card owner, Luxury Card LLC (renamed from Black Card LLC). The owner has offices in the US, Japan, China, and the Netherlands.

More than 8 million retailers in 210 countries accept Luxury Cards. The cards do not charge foreign transaction fees.

Is Chase Sapphire Reserve® a Luxury Card?

Chase Sapphire Reserve® delivers luxurious benefits, but it is not a product of Luxury Card LLC. The same is true for The Platinum Card®, the Capital One Venture X Rewards Credit Card, and the Ink Business Preferred® Credit Card.

All of the reviewed cards provide elite benefits and rewards centered around the needs of travelers. Each also charges an annual fee that ranges from moderate to outrageous.

Unless you travel frequently or want to save up points for an expensive trip, you may find these cards too rich for your budget. Several offer significant non-travel benefits (e.g., purchase protection, cellphone insurance, etc.), but you don’t have to endure three-digit annual fees to get these perks.

If you do travel often, you can easily justify owning any of these credit cards. Most offer access to airport lounges (a must for luxurious travel), trip and travel insurance, and hefty rewards for travel purchases. Sprinkle on travel credits and reimbursements, and you have luxury credit cards that justify their fees.

How Do I Get a Luxury Card?

The Luxury Card website is all too happy to take your application for any of its cards. You must be at least 18 years of age and reside in the US or its territories to apply. You may be ineligible for the card if you currently or previously had an account with Luxury Card.

More to the point, you must meet the cards’ credit and income criteria. While the issuer doesn’t spell out the exact requirements, we expect you will need a good to excellent credit score and a healthy income to qualify.

Barclays does a hard pull of your credit reports when you apply for any of its cards. Your credit score may slightly drop and you will see an annotation on your credit report that will remain for two years.

When you apply for an account, the issuer asks for your name, street address, date of birth, Social Security number, and other information that allows it to identify you. It may also ask to see copies of identifying documents and proof of citizenship.

How Do Luxury Card Benefits Compare to Chase Sapphire Reserve Benefits?

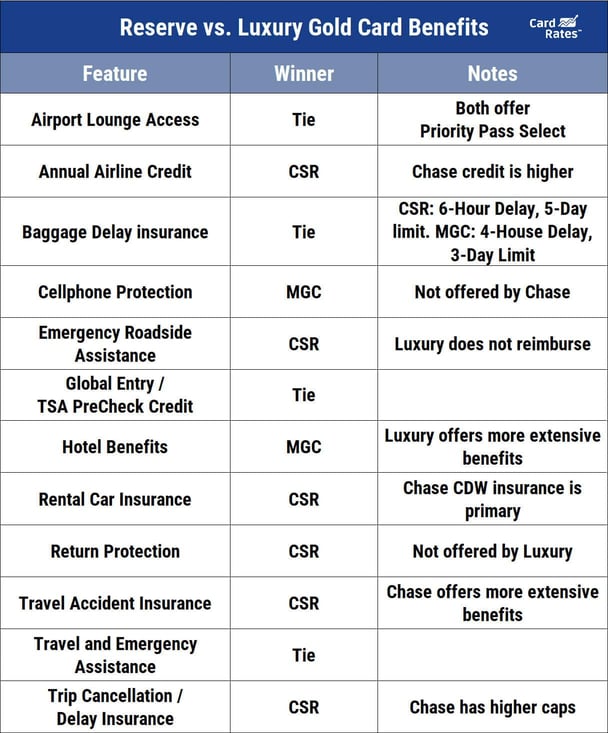

To give Luxury Card every advantage, I’ll compare the top-of-the-line Mastercard® Gold Card™ (MGC) benefits against those from Chase Sapphire Reserve® (CSR). I won’t compare rewards since they are subject to frequent change without notice.

Conclusion: Chase Sapphire Reserve® offers better benefits than the Mastercard® Gold Card™ and does so with a lower annual fee.

What Credit Score Do You Need to Get a Luxury Card?

Our friends at WalletHub estimate you need a credit score of 700 or higher to get a Luxury Card. We always point out that these are just estimates. You may be approved with a lower score or rejected with a higher score.

If your score is around 700, you may want to raise it to 720 before applying. You may do so quickly by signing up for Experian Boost or a similar service.

The same source pegs the minimum acceptable credit score for Chase Sapphire Reserve® at 750. We found that half of the card’s owners had a score above 760. You generally need a very good to excellent score for this card.

If you want a Sapphire card but are a little short on credit score, consider the Chase Sapphire Preferred® Card. NerdWallet puts its minimum score at 690.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

Bonus: The Chase Sapphire Preferred® Card delivers much of the goodness available from its Reserve sibling for a much smaller annual fee.

What is the Most Elite Credit Card in the World?

By most accounts, the award for elitism goes to the Centurion Card from American Express. You can’t even get the Centurion Card without an invite, although you can request Amex to consider issuing you one.

It helps to be a multimillionaire to get this card. Amex expects you to spend hundreds of thousands each year with it.

The annual fee is $5,000, and there is a $10,000 initiation fee (sort of a reverse signup bonus). It’s the card for someone who has everything.

Are the Luxury Credit Cards Worth It?

We think products other than Luxury credit cards offer better cost/benefit ratios. That’s not to denigrate any of the Luxury Mastercards. They each offer good rewards, and the top two provide a fair number of benefits.

It’s just that you can do better for less money.

In the end, value is in the eye of the beholder. The Mastercard® Gold Card™ certainly looks prestigious, and its heavy, gold-plated form certainly attracts looks. In other words, the card may be worth it to you.

We can make a stronger case for the Mastercard® Titanium Card™ because of its lower annual fee. But Luxury Card stripped it of several valuable benefits, and other cards cost less yet deliver more.

We have no problem justifying the Reserve’s annual fee. The card offers more than enough value to warrant the cost, especially if you travel frequently. We especially appreciate that its Chase Ultimate Rewards points are worth 50% more when you redeem them for travel at the Chase website.

The Chase Sapphire Preferred® Card, with its moderate annual fee, is a slam-dunk winner in the cost/benefit sweepstakes. It’s hard to find another credit card that gives you equal or better benefits for the same price.

Similarly, the American Express® Gold Card offers many Platinum-like features at a lower cost. The annual fee for the Amex Gold Card is less than half that of its Platinum siblings. Amex Gold is an excellent choice for cost-conscious travelers.

Your Credit Card to Match Your Lifestyle

In the battle of Chase Sapphire Reserve vs. Luxury Card, Chase is the winner. But even so, the Luxury Card trio has a lot to like. It’s one of the few card lines that still offers cellphone insurance, and the hotel benefits it provides are quite valuable.

And if you happen to prefer cards from Mastercard or already have an account at Barclays Bank, a Luxury Card may tick all your boxes.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![[card_field card_choice='68495' field_choice='title'] vs. [card_field card_choice='5909' field_choice='title'] ([updated_month_year] Comparison) [card_field card_choice='68495' field_choice='title'] vs. [card_field card_choice='5909' field_choice='title'] ([updated_month_year] Comparison)](https://www.cardrates.com/images/uploads/2018/02/chase2.png?width=158&height=120&fit=crop)

![[card_field card_choice='39321' field_choice='title'] vs. [card_field card_choice='31445' field_choice='title'] Review ([updated_month_year]) [card_field card_choice='39321' field_choice='title'] vs. [card_field card_choice='31445' field_choice='title'] Review ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/ink.png?width=158&height=120&fit=crop)

![[card_field card_choice='5853' field_choice='title'] vs. [card_field card_choice='5855' field_choice='title'] ([updated_month_year] Review) [card_field card_choice='5853' field_choice='title'] vs. [card_field card_choice='5855' field_choice='title'] ([updated_month_year] Review)](https://www.cardrates.com/images/uploads/2018/03/shutterstock_1190829136.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='68438' field_choice='title' link_type='none'] Review & Alternatives ([updated_month_year]) [card_field card_choice='68438' field_choice='title' link_type='none'] Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Citi-Secured-Credit-Card-Review.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='16924' field_choice='title' link_type='none'] Review & Alternatives ([updated_month_year]) [card_field card_choice='16924' field_choice='title' link_type='none'] Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Surge-Mastercard-Reviews.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='29774' field_choice='title']: Credit Score Needed for Approval ([updated_month_year]) [card_field card_choice='29774' field_choice='title']: Credit Score Needed for Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/02/reserve--1.jpg?width=158&height=120&fit=crop)

![Do You Need a Good Credit Score for the [card_field card_choice='29774' field_choice='title']? ([updated_month_year]) Do You Need a Good Credit Score for the [card_field card_choice='29774' field_choice='title']? ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/08/shutterstock_1161500566.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year]) [card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/unlimited-cover.jpg?width=158&height=120&fit=crop)