The answer to “Do you need a good credit score for the Chase Sapphire Reserve®?” is an emphatic yes — most approved holders of the Chase Sapphire Reserve® have a very good to excellent credit score.

If you want to get your hands on this prestigious card, we’ve got a lot more to say about qualifying for this popular card from Chase, and we provide alternatives if your credit isn’t quite up to par.

Applying | Alternatives | FAQs

Most Approved Applicants Have Excellent Credit (and Earn Over $100k Annually)

We freely admit that the Chase Sapphire Reserve® is loaded with goodies. It should be, given its hefty annual fee. If that doesn’t send you running, know that you may receive benefits and perks whose value exceeds the annual fee and then some.

Benefits start with the generous bonus point offer available when you sign up and purchase the required amount during the first three months. You’ll receive hefty points on every dining and travel purchase worldwide, and those points are worth even more when you redeem them for travel via the Chase Ultimate Rewards program with no blackout dates or restrictions.

You’ll also earn a travel credit as a statement credit, up to the annual limit, for travel charged on the card. This is an annual travel credit, not just for the first year.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Speaking of getting your Chase Ultimate Rewards points, the portal gives you access to Shop through Chase®, which allows you to shop online at 400 popular stores while earning extra rewards on special deals. You can also use your points to pay for orders on Amazon.com or for a gift card from more than a dozen top businesses. It’s easy to transfer your points 1:1 to any of Chase’s travel partners.

You may like how the card gives you exclusive access to select events and experiences like the Sundance Film Festival and other award-winning destinations. Get in on the leading online charity auctions at Charitybuzz, or learn the cooking secrets from the world’s master chefs such as Curtis Stone and Melissa King.

You can also use your points, which never expire while the account remains open, for limited-time promotions with a variety of merchant partners. And if all of these possibilities make your head spin, relax! Just contact the Chase Customer Service specialist (available 24/7) or the Visa Infinite Concierge — these folks live to serve.

When you’re on the go, turn to your Chase Mobile® app to manage your points, monitor your account, create personalized alerts, and lock/unlock your card instantly. Just download the app to your phone or tablet and set up your sign-in — passcode, facial recognition, or fingerprint.

You May Still Be Denied if You Have Excellent Credit

Even with a perfect credit score, you may fall victim to the Chase 5/24 Rule, which we discuss below. In addition, you can’t get a card if you’re younger than 18 (19 in Alabama, 21 in Puerto Rico).

By applying for the card, you give Chase permission to pull your credit reports and obtain other information as well. All cards are subject to credit approval. As mentioned earlier, you are more likely to receive approval if you have a good or excellent credit score.

Getting Preapproved for a Chase Credit Card

Without a doubt, Chase has earned its leading place among the issuers of the most popular credit cards. The two sets of Chase siblings, Sapphire and Freedom, satisfy a wide swath of owners.

But Chase has many more cards at the ready, whether you are a business, a student, a cash back fan, or someone looking to transfer balances. However, Chase doesn’t offer a secured credit card. It offers cards ranging from the premium variety with high annual fees that are targeted to consumers with great credit to no-annual-fee cards for most everyone else.

It’s easy to apply for a Chase credit card. Perhaps the simplest way is to click on the link in a CardRates.com review. But if you’d like to check online for preapproval, you can head over to the Chase website page dedicated to preapproval offers.

Just enter a few data items and you’ll be presented with one or more offers. This exercise doesn’t create a hard pull, so it keeps your credit score intact.

There is a chance that Chase may be unable to make you an offer on the spot. This can happen if you’ve recently applied for a card from Chase or even if you already own one.

Don’t let that discourage you — you can still contact Chase directly or, if you feel like perambulating, stopping by a Chase branch. After all, there are more than 5,200 locations in 26 states. Most branches are open despite the COVID-19 crisis.

You can simply walk up to a teller and ask to be prequalified for a card from Chase. But it’s also possible that a bank employee will suggest preapproval during unrelated transactions. It was once true that a teller could get you around the Chase 5/24 Rule, but sadly, this is no longer the case.

Another route to obtaining a Chase credit card is through the U.S. Postal Service, which may regularly deliver offers from Chase that frequently include special terms and bonuses. If you are a card churner, you may live for these mailings. On the other hand, if you regard these letters as a waste of paper, you can go to the Opt-Out Prescreen website to suppress further offers.

If your credit score is just a little below Chase’s requirements, know that you can take some steps to boost your score and help improve your chances for approval, including:

- Making sure you always pay your credit card bills on time. Failure to do so can result in a degraded credit history, higher costs, and a lower score.

- Refrain from applying too frequently for new credit within a short period, as recorded in your credit history.

- Reduce your credit utilization ratio to below 30%. The lower your CUR, the better your chances for approval.

- Create a good mix of credit accounts, such as a mortgage, revolving accounts, and installment accounts.

- Check out Experian Boost, a program that can immediately raise your FICO score.

Even if you don’t qualify for a Sapphire card, you’ll have better chances of acquiring another Chase card, such as the Freedom or Freedom Unlimited, by raising your credit score above 680.

3 Alternatives to the Chase Sapphire Reserve®

When it comes to credit cards, Chase is nothing if not versatile. There are plenty of desirable Chase cards from which to choose, all charging a much lower annual fee. Here are three of our favorites:

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

Our research indicates that you need a credit score of at least 645 to qualify for the Chase Sapphire Preferred® Card. The average score among cardholders is 736.

We like this card because it offers many of the same benefits as the Chase Sapphire Reserve card for a much smaller annual fee. You get a generous signup bonus offer, points for travel and dining, and most of the advantages of using Chase Ultimate Rewards points.

If you like to travel, this card’s got you covered with trip cancellation/interruption/delay insurance, baggage delay insurance, auto rental collision damage waiver, travel and emergency services, and no foreign transaction fees. However, you do not get an annual travel credit as you do with the Reserve®.

You can shop with confidence knowing you have purchase protection and extended warranty coverage. In addition, you can transfer your points 1:1 to more than a dozen travel and hotel partners.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

Chase Freedom Unlimited® requires a minimum score of 636. The card features cash back rewards that come to you at a flat rate for all eligible purchases, so you don’t have to contend with complicated rotating merchant categories or quarterly activations.

You never lose your rewards while you keep your account open. You may also qualify for special offers from partners like DoorDash and Lyft.

While you have the redemption option for cash back rewards as a statement credit or a direct deposit, you can also use them to shop at Amazon.com, make payments through Chase Pay®, and buy a gift card or certificate. Or select the redemption option for travel at the Chase Travel portal.

3. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

The Chase Freedom Flex℠ is similar to its Unlimited brother, except for its rewards scheme. You get high, limited cash back in quarterly revolving bonus categories that you activate.

This rewards credit card features contactless Tap to Pay that’s easy to use, faster than swiping, and dynamically secure. In addition to purchase protection and extended warranty coverage, this rewards credit card provides $0 liability protection, real-time fraud monitoring, and automatic fraud alerts via text, email, or phone.

The card charges no annual fee, but there are fees for cash advances, balance transfers (if permitted), foreign transactions, late payments, and returned payments. You can earn up to $500/year through the Chase Refer-a-Friend promotion.

Is it Hard to Get Approved for the Chase Sapphire Reserve® Card?

It’s not hard to get the Chase Sapphire Reserve® as long as you have excellent credit and don’t fall victim to the Chase 5/24 Rule (see below). But Chase reserves the right to consider additional factors before offering you the card.

One of these factors relates to your annual income. You see, the Chase Sapphire Reserve® belongs to the rarefied Visa Infinite® class of super-premium credit cards.

All cards in this class offer a high credit limit, which means you must receive income sufficient to qualify for that limit. A Reddit survey found that the average reported income for cardholders was $117,438. While that’s a tidy sum, it’s probably less than the average earnings for holders of the American Express® Centurion® Card.

Another roadblock imposed by Chase involves your total credit limit when you own multiple Chase credit cards. While the exact formula is tightly guarded, Chase and most banks assign a maximum credit limit for every card customer.

When you have multiple Chase cards, the bank totals each card’s credit limit to see how much headroom remains. If it’s less than the minimum credit limit for the Chase Sapphire Reserve®, you may face rejection when you apply. However, you may be able to shift your credit limits from other Chase cards to make everyone happy.

One more stumbling block is Chase’s elephant-like memory. Whereas credit reports from the three major credit bureaus (Experian, TransUnion, and Equifax) keep derogatory information for up to 10 years, Chase Bank has no such time limit. If you ever had bad experiences with Chase (such as a discharged account), you may be blacklisted from the bank’s most prestigious cards.

What Credit Score Do I Need for the Chase Sapphire Reserve®?

The average FICO score for approved applicants is 766, and the majority have scores above 770. That’s in the very-good-to-excellent range of scores. But here’s an interesting twist: We’ve seen information indicating that the lowest approved credit score is 580. So, it appears that low-score applicants occasionally breach this card’s defenses, according to apocryphal reports.

One survey of cardholders found that less than 10% had scores below 719. So, don’t be surprised if your application is rejected when your score is below 680.

Half of all applicants with scores beneath 600 were rejected on the spot. If your score is not at least 600, you may want to save the hard pull on your credit report and apply for a less demanding card.

On the other hand, if you’re feeling lucky, about 70% of applicants with credit scores between 600 and 679 say they were instantly approved. Applicants who aren’t immediately accepted may receive a pending notice. If that’s you, know that your chances of eventual approval are better than 50/50.

All this talk about the required credit score shouldn’t blind you to other criteria that Chase may use when considering your application. We’ve already mentioned how the 5/24 Rule, annual income, credit limits, and derogatory information factor into Chase’s decision.

However, Chase reportedly pays attention to a couple of other factors while mulling your fate. For example, while Chase may examine all three of your credit reports, it apparently has a soft spot for Equifax, at least in many regions. In other words, if you plan to clean up your credit reports before applying, do the Equifax report first.

Another sticking point may be your credit utilization ratio (CUR) — the ratio of credit used to credit available. Now, this is interesting because CUR already accounts for 30% of your FICO score. The fact that Chase singles it out for additional scrutiny means that the bank is really sensitive about how much credit you use.

Usually, a ratio above 30% is considered too high. But you can have a good credit score even if your CUR is above that threshold. However, Chase may reject you despite your high credit score if your CUR is above the 30% mark. If that happens to you, try reducing your CUR by paying down some debt and then reapplying. Some folks who reported following that advice were accepted on the second attempt.

Should I Get a Chase Sapphire Reserve® or Chase Sapphire Preferred® Card?

Personal disclosure: I’ve owned the Chase Sapphire Preferred card for several years, and it’s my favorite card. The cash back I earn greatly exceeds the annual fee. The annual fee is probably the biggest contrast between the two cards.

We can make a case that the 80/20 rule applies here: The Chase Sapphire Preferred® Card gives you about 80% of the benefits of the Chase Sapphire Reserve® for only 20% of the annual fee. If you have no problem paying the higher fee, you’ll certainly get more value from the Chase Sapphire Reserve®.

However, you won’t get everything, like the TSA precheck reimbursement or the annual travel credit. So, the question boils down to what you get for the higher fee and whether it’s worth it.

Here is a simple checklist to help you decide which one is best for you:

The Chase Sapphire Preferred® Card is, well, preferred when it comes to its lower annual fee and APR. However, the Chase Sapphire Reserve® rewards card offers a higher bonus rate for travel redemptions through Chase. It noses out the Chase Sapphire Preferred® Card by offering a TSA precheck reimbursement credit and providing travelers free airport lounge access.

Benefits aren’t the only consideration: It’s easier to qualify for the Chase Sapphire Preferred® Card, where the average score of approved cardholders is 741 compared to 766® for Chase Sapphire Reserve cardholders. Also, as we discuss below, the Chase Sapphire Reserve® offers a higher credit limit.

Can I Get the Chase Sapphire Reserve® If I Already Have the Chase Sapphire Preferred® Card?

The fine print drops the hammer — you can’t get the Chase Sapphire Reserve® if you currently own any Sapphire credit card. Since the only other one available is the Chase Sapphire Preferred® Card, your quest for both cards just hit a landmine.

You can request an upgrade to the Chase Sapphire Reserve® card by calling the number on the back of your Chase Sapphire Preferred card and finding out whether you’re eligible. You don’t earn a new cardmember bonus by switching Sapphire products.

If you were a previous holder of a Sapphire rewards credit card, you can’t rejoin the clan for 48 months from the date you received your last new-cardmember bonus. The wait time used to be 24 months but was doubled in 2020.

Does Chase Approve Applications Instantly?

Generally, the higher your credit score, the more likely you’ll be instantly or eventually approved. According to a knowledgeable Reddit user who compiled reports from thousands of people, approximately 84% of all Reserve credit card applicants received approval, leaving 16% who got denied.

Chase offers four possible fates when you apply for a card:

- Instant approval

- Instant denial

- Pending decision, eventually approved

- Pending decision, eventually denied

Chase hardly ever instantly denied applicants with scores above 780, whereas 50% of those with scores below 600 were shot down immediately. In the range between 600 and 780, applicants were likely to receive a pending status, with the majority eventually receiving approval.

What is the 5/24 Rule?

Chase has a blanket, if unwritten, policy known as the 5/24 Rule that limits you to five new credit accounts within a 24-month period. We’re talking about any five credit or charge accounts, not just the ones from Chase. If you flunk the rule, then no card for you, even if you’re proudly sporting that 850 FICO score.

This rule apparently originated in 2015 with the introduction of the Chase Sapphire Preferred® Card. The rule expanded in May 2016 to most Chase cards — rumor has it that some co-branded cards may be exempt.

Why did Chase create the 5/24 Rule? After all, if you have a good credit score, enough income, and a reasonable credit utilization ratio, why can’t you apply for more than five cards before Chase gets on your case?

We believe one of the main reasons is to discourage abuse of introductory bonuses. In theory, you can open a new credit card as often as you like and earn the initial signup bonus by spending the required amount on purchases during the first three months. In return, you rack up cash back, miles, and/or points.

So, what’s the problem? Well, rather than letting a dozen or two credit cards pile up on your desk, you will probably cancel many of the cards after you receive the bonus. Good for you, but bad for the credit card company. Those bonuses are loss leaders — the bonuses you earn are worth more than the usual rewarded amounts.

A card issuer offers these bonuses to reel you in. Eventually, they hope you’ll pay some interest on unpaid balances. In fact, they live for that prospect.

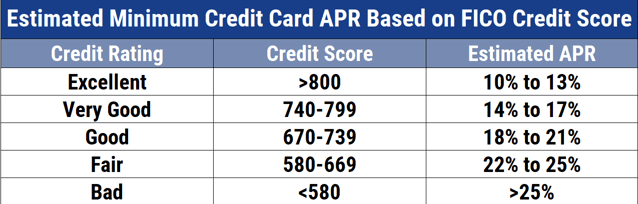

With APRs averaging around 20%, cards can generate phenomenal income when you use them to finance purchases over two or more months.

High APRs generate a lot of income for credit card companies if the debt isn’t paid off within the card’s grace period.

Chase, in particular, is known for its generous signup bonuses, so it has the most to lose when consumers milk the bonuses and then cancel the cards before the next annual fee kicks in. In this light, the Chase 5/24 Rule makes a lot of sense. It discourages wholesale bonus milking and credit card churning.

In fact, it’s slightly puzzling that every card issuer doesn’t participate in a similar program. Perhaps antitrust rules get in the way, but surely the 5/24 Rule could help prevent all issuers from lavishing welcome bonuses on folks who will be leaving within the year.

We understand that, as the consumer and beneficiary of signup bonuses, you probably couldn’t care less about helping credit card issuers make their profits. But remember, the issuers will pass onto you any card-churning losses they incur, perhaps in the form of higher fees or APRs.

Another problem with card churning is the possible negative impact on your credit score. We say possible because the net effect isn’t so clear.

On the one hand, opening up multiple accounts within a short period is a negative that will temporarily depress your score. But consider that new cards give you additional credit and a lower CUR (assuming you don’t go on a shopping spree every time you get a new card). A lower CUR helps your score, so the combined effect of new accounts may be a wash.

The other aspect of a drawer full of cards is that canceling them will tend to lower the average age of your credit accounts. That’s another negative, though once again not an earth-shattering one.

The solution for no-annual-fee cards is simply not to cancel them. Just keep them locked up in a safe place or you can downgrade your cards that carry an annual fee, but that won’t help the average age of your accounts.

Is there a Welcome Bonus on the Chase Sapphire Reserve®?

Yes indeed, the Chase Sapphire Reserve® has a hefty signup (or welcome) bonus. This card currently offers significant bonus points after you spend a predefined amount on purchases in the first three months.

Both cards in the Chase Sapphire line are great options for the frequent traveler. If you take advantage of Chase Ultimate Rewards®, the bonus points earned from your Chase Sapphire Reserve® are worth $.015 each, or $750 toward airfare, cruises, car rentals, and hotels.

Both cards in the Chase Sapphire line are great options for the frequent traveler. If you take advantage of Chase Ultimate Rewards®, the bonus points earned from your Chase Sapphire Reserve® are worth $.015 each, or $750 toward airfare, cruises, car rentals, and hotels.

In comparison, the points earned from the Chase Sapphire Preferred® Card are worth only $.0125 each through Chase. Naturally, if redeemed elsewhere, those extra points are an additional benefit.

Note that Chase Sapphire® cards do not offer new cardholders an introductory 0% APR for a specified number of months after opening the account. In other words, you’ll pay interest on any part of the $4,000 introductory purchase amount you don’t fully repay in the current billing cycle.

Nonetheless, the welcome bonus is found money if you had already planned to purchase a big-ticket item. You can use the welcome bonus to reduce the price of that $4,000 planned vacation to $3,250. On the other hand, spending $4,000 solely for the sake of earning a bonus may not make a whole lot of sense.

What Will My Credit Limit Be?

The importance of card credit limits is to protect cardholders from falling into too much debt. It also helps card issuers control the percentage of delinquent accounts that must be written off.

In other words, issuers expend a lot of brainpower to formulate their credit limitation policies. An issuer’s ideal limit is one that allows cardholders to finance purchases over multiple billing cycles (thereby incurring interest charges) but not so high as to send the account into default.

The Chase Sapphire Reserve® reportedly has a minimum credit line of $10,000. If your credit score doesn’t support this credit limit, chances are you won’t be approved for this card.

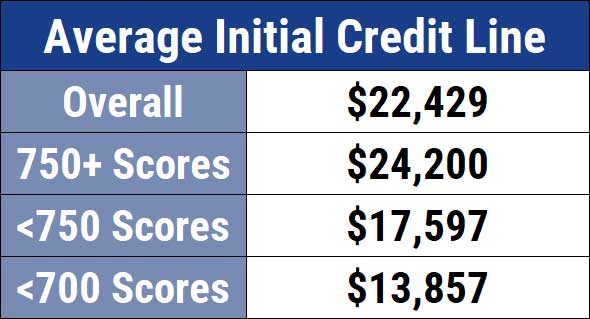

The average initial credit line for Chase Sapphire Reserve® cardholders is $22,429, but that number varies for different FICO score ranges. This reflects the correlation between credit score and initial credit line.

For approved applicants with credit scores of 750 or higher, the average initial credit line is $22,429. That average falls to $17,597 for scores below 759 and $13,857 when scores drop below 700. Reports indicate that some Chase Sapphire Reserve® cardholders receive initial credit limits between $30,000 and $60,000, but rumors persist of limits as high as half a million dollars.

By way of comparison, the Chase Sapphire Reserve® has a minimum credit limit of $5,000 and only 10% of cardholders have credit limits exceeding $20,000.

If you are an average consumer, you have to ask yourself whether you need a five-figure credit line on a single travel credit card and whether that privilege is worth a hefty annual fee. On the other hand, if you are a wealthy individual, you may actively pursue high credit limits for their convenience and, let’s face it, status. For the well-heeled cardholder, the ability to make a big-ticket purchase with a simple swipe is a true convenience.

Of course, high credit limits increase the denominator (i.e., credit available) of CUR, thereby decreasing the ratio itself. In this way, a high limit helps to boost your credit score — if you control your spending — because CUR accounts for 30% of your FICO score.

How Does the Rewards Rate Compare to Other Premium Cards?

The Chase Sapphire Reserve® offers 50% more rewards value if you redeem your points for travel on Chase Ultimate Rewards®. So how does this rewards rate compare to those of close competitors? The quick answer: Quite well, especially for the frequent traveler.

Perhaps the most exclusive premium card right now is the Centurion® Card from American Express that offers 1X points on all purchases and 1.5X points on purchases exceeding $5,000. You get a 50% rebate on points redeemed for airfares.

Perhaps the most exclusive premium card right now is the Centurion® Card from American Express that offers 1X points on all purchases and 1.5X points on purchases exceeding $5,000. You get a 50% rebate on points redeemed for airfares.

This is a charge card with astronomical fees. Although this card provides abundant perks, its point rewards are rather meager. You may want this card for its prestige and almost unlimited credit line, but points are not its strong suit.

The Mastercard® Gold Card™ charges an annual fee of just $5 under a cool grand. That gets you a 22-gram metal card with 1X points on all purchases and a 2% bonus on airline redemptions and cash back.

In many respects, this travel credit card offers premium benefits that are similar to those of the Chase Sapphire Reserve®, but at twice the annual fee.

The Platinum Card from American Express carries the same annual fee as the Chase Sapphire Reserve®. You earn 5X points on flights and prepaid hotels booked through Amex Travel, 1X on all other purchases.

The Platinum Card from American Express carries the same annual fee as the Chase Sapphire Reserve®. You earn 5X points on flights and prepaid hotels booked through Amex Travel, 1X on all other purchases.

As you would expect, this card offers many perks. Bear in mind that this is a charge card, meaning you must pay your balance in full each month.

The Mastercard® Black Card™ has a comparable annual fee, yet offers no welcome bonus. You can earn a 2% redemption rate on airfare purchases, but only those booked through its travel affiliate. Add to that the card’s rather meager rewards and you end up with a bit of a stinker.

Given these alternatives, the Chase Sapphire Reserve® remains our favorite premium card. But do you really need a high-fee card?

Perhaps, if you truly do travel a lot and have a weakness for free lounge access. Otherwise, Chase and its competitors offer many very good cards with annual fees between $0 and $99 for consumers with good-to-excellent credit.

The Chase Sapphire Reserve® is an Excellent Card for Excellent Credit

Well, we started this article by asking, “Do you need a good credit score for the Chase Sapphire Reserve®?” As we’ve documented, most approved applicants have very good to excellent credit, but sometimes Chase approves applicants with credit scores that are average or less.

If you are going to pay a premium annual fee and you are a frequent traveler, you should get the best card in its category, and that’s the Chase Sapphire Reserve®. However, we also like the card’s little brother, the Chase Sapphire Preferred® Card, with its generous perks and affordable annual fee. Either Chase Sapphire card would make for a great primary travel rewards credit card.

And for you folks who refuse to pay a yearly fee, check out the Chase Freedom Flex℠ and Chase Freedom Unlimited® cards. Both offer good travel rewards and even some benefits, including introductory 0% APR for purchases, not available on the Sapphire cards.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![[card_field card_choice='68495' field_choice='title'] vs. [card_field card_choice='5909' field_choice='title'] ([updated_month_year] Comparison) [card_field card_choice='68495' field_choice='title'] vs. [card_field card_choice='5909' field_choice='title'] ([updated_month_year] Comparison)](https://www.cardrates.com/images/uploads/2018/02/chase2.png?width=158&height=120&fit=crop)

![[card_field card_choice='39321' field_choice='title'] vs. [card_field card_choice='31445' field_choice='title'] Review ([updated_month_year]) [card_field card_choice='39321' field_choice='title'] vs. [card_field card_choice='31445' field_choice='title'] Review ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/ink.png?width=158&height=120&fit=crop)

![[card_field card_choice='5853' field_choice='title'] vs. [card_field card_choice='5855' field_choice='title'] ([updated_month_year] Review) [card_field card_choice='5853' field_choice='title'] vs. [card_field card_choice='5855' field_choice='title'] ([updated_month_year] Review)](https://www.cardrates.com/images/uploads/2018/03/shutterstock_1190829136.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='29774' field_choice='title']: Credit Score Needed for Approval ([updated_month_year]) [card_field card_choice='29774' field_choice='title']: Credit Score Needed for Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/02/reserve--1.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='29774' field_choice='title' link_type='none'] vs. The Luxury Card ([updated_month_year]) [card_field card_choice='29774' field_choice='title' link_type='none'] vs. The Luxury Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Chase-Sapphire-Reserve-vs.-Luxury-Card.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='5856' field_choice='title'] Review, Credit Score & Rewards ([updated_month_year]) [card_field card_choice='5856' field_choice='title'] Review, Credit Score & Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/shutterstock_119978758.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='5859' field_choice='title']: Review & Credit Score Needed ([updated_month_year]) [card_field card_choice='5859' field_choice='title']: Review & Credit Score Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/01/shutterstock_1023516253-1.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year]) [card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/unlimited-cover.jpg?width=158&height=120&fit=crop)