Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

Homeowners may be tempted to tap their home equity to pay off their card debt. After all, home prices have skyrocketed, and interest rates for home loans are higher than they were yet still lower than most credit card rates.

But should they?

The answer isn’t as obvious as it may appear.

You Would Put Your Home at Risk

A home equity loan or home equity line of credit (HELOC) is a type of debt that leverages the equity in your home. “Equity” is the portion of your home’s value that exceeds the combined balances on your mortgage and any other home loan that you have.

If your home was worth $350,000, for example, and you had a first mortgage of $200,000 and a second mortgage of $50,000, your equity would be $100,000.

A home equity loan will usually have a fixed term, rate, and payment, while a HELOC will typically have a variable rate and flexible payment.

To qualify, you’ll need good credit and a significant chunk of equity in your home.

With either option, there’s no need to refinance your primary mortgage or sacrifice the rate, term, or payment you secured for that loan.

Because home loans typically have lower rates than credit cards do, borrowing against your home to pay off card debt could mean big savings in interest expense.

That’s good, but there’s also a serious risk: You could lose your home.

Card debt can be secured or unsecured. Home loans are, by definition, secured by your home. That’s why they charge a lower rate. But if you miss a payment for this type of loan, your lender could foreclose and take your home in lieu of repayment.

With card debt, a missed payment could trigger a late payment fee or higher interest rate, but your home will never be at risk.

You May Incur an Upside-Down Mortgage

Another concern is a housing market downturn. Whenever your home declines in value, you can end up owing more for your home loans than your home is worth. This situation, sometimes referred to as an underwater or upside-down mortgage, can make selling your home difficult.

In a market downturn, adding a second loan or HELOC can increase the likelihood of owing more than the value of a home.

You should also keep in mind that home loans typically involve fees and closing costs. Loans advertised as having “no closing costs” typically have higher annual percentage rates (APRs) that fold the costs into the rate.

Either way, the cost will offset some of your interest savings. You may end up paying more than you expect, and paying off your debt may take longer.

If you habitually use your cards to charge more than you can afford to spend, using a home loan to zero out your card balances may create a perverse incentive for you to continue to overspend. Over time, you could end up with more debt, which could damage your finances and your credit scores.

3 Other Ways to Pay Off Card Debt

Fortunately, there are other strategies that can help you pay off card debt.

1. Prioritize Paying Down Your Cards

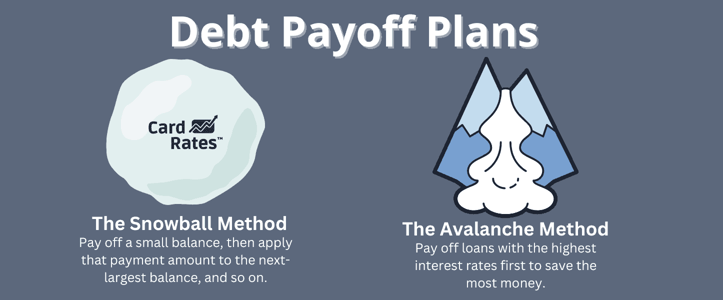

Paying off your card debt from your current income may seem challenging, but many people do it and maybe you can, too. Two popular methods, known as the avalanche and the snowball, may help you get started.

Method #1: Avalanche

To use this method, make a list of all your card balances along with the APRs you’re paying for each balance. Rank the balances, starting with the highest APR to the lowest.

Every month, make at least the minimum payment for every card to avoid late payment fees and penalty interest rates, and make the biggest payment you can toward the card with the highest APR. When your highest APR card is paid off, repeat the process until you finish paying off the balances on your list of cards.

Compared with the snowball method, the avalanche may save you money and enable you to pay off your card debt sooner.

Method #2: Snowball

To use this method, make a list of all your card balances and put them in rank order, starting with the smallest balance.

Every month, make at least the minimum payment for every card to avoid late-payment fees and penalty interest rates, and make the biggest payment you can toward the card with the smallest balance. When that card’s paid off, repeat the process until you finish your list of cards.

Compared with the avalanche method, the snowball may give you a bigger motivational boost since you’ll eliminate your smallest balances before you tackle your larger ones.

If you’re not sure which method you want to use, start with one to pay off your first card and then try the other to pay off your second card. Then continue to alternate or stick with whichever method you prefer.

2. Get a Balance Transfer Card

Another way to pay off card debt is to use a balance transfer card that has a low or 0% promotional rate for up to 24 months. This type of card allows you to transfer your current balance(s) from your current card(s) to the new balance transfer card.

This approach isn’t a perfect solution, but it could help you consolidate multiple card payments and pay off your debt faster.

Balance transfers come with a few caveats:

- The amount you can transfer may be capped.

- Promotional APRs typically have expiration dates, after which your card’s full APR will be applied to any portion of your balance that you haven’t paid off.

- Balance transfers usually involve fees of 3% to 5% of your transferred balance. For a $5,000 transfer, 3% to 5% equals $150 to $250. This fee is typically charged to your card, so your balance will be slightly higher after you transfer it.

Always read the footnotes and fine print before you accept a balance transfer offer. Be sure you understand the fees and the APRs for a transferred balance and any new purchases. You should plan to pay off your balance before your promotional APR ends.

If you’re approved for a new balance transfer card, you may also get some other nice benefits, such as no annual fee, a low or 0% promotional APR for new purchases, or an enticing rewards program.

3. Apply for a Personal Loan

Using a personal loan to pay off card debt may make sense if your loan has a lower rate and a monthly payment you can afford. One advantage of this approach is the opportunity to consolidate multiple payments into one payment, which could make your debt easier to manage.

Suppose you had three cards with a combined balance of $20,000 and a combined APR of 27.99%. Each month, you make three payments that total $1,098. You don’t make any new purchases with those cards. After two years, you’ll have paid $5,641 in interest.

Now, imagine that you applied for a personal loan of $20,000, which you use to pay off your cards. With a two-year term and 11% APR, your monthly payment will be $932. At the end of two years, you’ll have paid $2,372 in interest expenses. You also may be charged a variety of fees for your loan. Combined, the interest and fees will probably be less than $5,641.

Debt Consolidation Advantages & Disadvantages

Whether you use a home loan, personal loan, or balance transfer card, debt consolidation has some general advantages and disadvantages.

Advantages may include:

- A lower combined APR.

- A fixed rate and term.

- Fewer payments each month.

- Paying off your debt sooner.

- Paying less in interest expense.

- Freeing up funds to pay off other debt, build savings, or meet other financial needs.

Disadvantages may include:

- Not paying off debt as quickly as you want — or at all.

- Not realizing the interest savings you expect.

- Paying fees.

Consider Other Options

A home loan may seem like a good way to pay off card debt; however, this strategy involves significant costs and risks. Homeowners should consider other options, such as the avalanche or snowball repayment methods, balance transfer cards, or a personal loan, before they decide to place their home at risk to pay off card debt.

![9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year]) 9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/Beverly-9Best.jpg?width=158&height=120&fit=crop)

![6 Best Loans to Pay Off Credit Card Debt ([updated_month_year]) 6 Best Loans to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/loans.png?width=158&height=120&fit=crop)

![How to Pay Off Credit Card Debt ([updated_month_year]) How to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/02/How-to-Pay-Off-Credit-Card-Debt.jpg?width=158&height=120&fit=crop)

![5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year]) 5 Best Credit Card Loans to Pay Off Your Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/loans2.jpg?width=158&height=120&fit=crop)

![11 Best Credit Cards to Pay Off Debt ([updated_month_year]) 11 Best Credit Cards to Pay Off Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Best-Credit-Cards-to-Pay-Off-Debt-Feat.png?width=158&height=120&fit=crop)

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)