For truck drivers, road trip spending quickly adds up at places such as fuel stops and diners. Plus, with fuel prices at near record highs, it only makes sense to be rewarded for everyday purchases using credit cards.

Truck drivers may enjoy cash back programs and auxiliary benefits such as travel interruption insurance and emergency roadside assistance, depending on the card. Here, we review our favorite credit cards for truck drivers.

Continue reading to learn more about the best credit cards for truckers, their benefits, and the steps required to qualify and apply for one.

-

Navigate This Article:

Best Personal Cards For Truck Drivers

Credit cards like the Discover it® Cash Back and the Capital One Quicksilver Cash Rewards Credit Card allow trucks to save with no annual fees and cash back opportunities just for spending on the road.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back is highly rated. Its number one benefit is its unlimited cash back match program, which allows you to enjoy a dollar-for-dollar match of all cash back earned by the end of the first year of owning the card. For example, if you earn $300 in cash back rewards, Discover will match your $300 for a total of $600.

Another benefit to using the Discover it® Cash Back is its tiered cash back program. Expect to earn bonus cash back rewards on quarterly rotating categories when you activate. These categories can include everyday purchases at select retailers, e.g., restaurants, but bonus cash back is capped at a spending limit. Earn 1% cash back amount on all other purchases. You will earn rewards faster if you’re a frequent spender in those bonus categories, which change quarterly.

This card also has no annual fee and a solid balance transfer program with a 0% introductory APR, allowing you to transfer balances from one more high APR card to the Discover it® Cash Back. A regular APR will apply after the introductory period ends.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

The Capital One Quicksilver Cash Rewards Credit Card is a top-rated card offering a well-rounded set of perks, starting with unlimited cash back on every purchase and a one-time cash bonus upon joining, with a minimum spent on qualifying purchases.

This is a great card option for anyone, as its purchase rewards are simple to earn and redeem. All purchases earn the same rate of cash back, which can be redeemed for cash, gift cards, PayPal, and Amazon purchases, among other things, and your rewards never expire for the life of your account.

Need new equipment for your truck? Eligible items will qualify for extended warranty coverage when purchased with your card.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® is one of our favorite credit cards for truck drivers, offering new cardholders a special signup bonus.

Rounding out its benefits are additional cash back opportunities when purchasing at restaurants or drugstores, plus even more cash back on travel purchased through Chase Travel. It also comes with an introductory APR on purchases and balance transfers from account opening, followed by a respectable variable APR.

Cardholders also pay no annual fee, and cash back rewards do not expire. Accumulate as much cash back as you want and redeem whenever you’re ready. In short, we recommend the Chase Freedom Unlimited® if you’re a trucker with heavy spending on all your road trips at gas, grocery, drugstore, and restaurants.

- Earn 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening.

Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024. - Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou® Points are redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% – 29.24% (Variable)

|

$95

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Premier® Card is an excellent credit card for truck drivers. It offers multipliers for every dollar spent on select categories, including airlines, hotels, gas stations, and supermarkets, followed by lower points on all other purchases.

To add, if you spend a minimum in purchases within the first three months of card ownership, you can earn bonus Citi ThankYou program points. Citi ThankYou is a Rewards program that allows you to earn points good toward purchasing flights, hotels, and other travel-related expenses booked through the platform.

ThankYou points can also be used to pay for merchandise, make charity donations, or convert into statement credits to shave a few dollars off your outstanding balance.

- Discover one of Citi’s best cash back rewards cards designed exclusively for Costco members

- 4% cash back on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter

- 3% cash back on restaurants and eligible travel purchases

- 2% cash back on all other purchases from Costco and Costco.com

- 1% cash back on all other purchases

- No annual fee with your paid Costco membership and enjoy no foreign transaction fees on purchases

- Receive an annual credit card reward certificate, which is redeemable for cash or merchandise at U.S. Costco warehouses, including Puerto Rico

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.49% (Variable)

|

$0

|

Excellent

|

Additional Disclosure: Citi is a CardRates advertiser.

The Costco Anywhere Visa® Card by Citi is a highly versatile cash back card. The highest cash back rates extend to everyday purchases at gas and EV charging stations (up to a maximum amount per year, followed by a lower flat rate percentage after that).

Another benefit to using this card is its laundry list of extras. These extras include travel emergency assistance, worldwide car rental insurance, travel accident insurance, and theft purchase protection with select retailers. This perk eliminates the need to sign up for costly add-ons.

As with most other recommended credit cards for truck drivers, it also charges no annual fee. However, it comes with a disclaimer that you must be an active Costco member.

- If you’re already a Navy Federal member, you can find out if you prequalify for our More Rewards American Express® card before you submit an application

- Earn 3X points at restaurants, food delivery, supermarkets, gas and transit, and 1X points on everything else

- No annual fee, no balance transfer fee, no foreign transaction fees, and no cash advance fees

- Points can be redeemed for cash, travel, gift cards, and merchandise

- Cardholders get roadside assistance plus up to 25% off car rentals with car rental loss & damage insurance included

- Must be a member of Navy Federal Credit Union to qualify – if you’re already a member, you can see if you prequalify before you submit an application

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

14.90% – 18.00% (Variable)

|

$0

|

Average to Good

|

The More Rewards American Express® Card is one of our preferred cards, offering an excellent reward program that assigns points with multipliers when spending at restaurants, supermarkets, gas stations, and other venues.

This card also has a very generous fee structure. It charges no annual, balance transfer, foreign transaction, or cash advance fees.

In short, we highly recommend the More Rewards American Express® Card for truckers who want to be generously rewarded for everyday purchases on long road trips.

- Earn unlimited 1.5% cash back on every purchase, every day

- No rotating categories or limits to how much you can earn, and cash back doesn’t expire for the life of the account. It’s that simple

- Be automatically considered for a higher credit line in as little as 6 months

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- Help strengthen your credit for the future with responsible card use

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$39

|

Average, Fair, Limited

|

The Capital One QuicksilverOne Cash Rewards Credit Card allows you to earn unlimited cash back at the same flat rate, no matter the retailer. This card is similar to other Quicksilver cards, but it doesn’t require excellent credit for approval.

Outside of unlimited cash back on every purchase, card members will automatically be considered for a higher credit line in as little as six months. This card is perfect for those who want a no fuss card without rotating categories or tiered earnings to track.

You can also conduct balance transfers to this card, which only requires a small fee on the amount transferred within the introductory period.

Best Business Cards For Truck Drivers

Although not directly geared toward truckers, business cards like the Ink Business Unlimited® Credit Card and Capital One Spark Miles for Business offer many road-related perks, such as higher cash back rewards when spending at gas stations, welcome bonuses, no annual fees, and free employee cards with customized spending limits for trucking company owners.

Here are our preferred business cards for truck drivers:

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% – 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Unlimited® Credit Card is one of the most well-rounded business cards, starting with unlimited cash back across all spending categories, no annual fee, a 0% introductory APR offer on purchases, and a one-time cash bonus after reaching a minimum spend within the first three months of account opening.

Another benefit of this card is inclusion in the Chase Ultimate Rewards program, a portal that allows you to redeem rewards for hotel stays, airline tickets, and other travel-related expenses. You can even turn eligible past purchases into statement credits. Plus, points never expire, so you can use them whenever convenient.

This card also includes auxiliary protections such as extended warranty, emergency assistance services, purchase protection, and more. These protections are included at no extra cost, saving you time and money signing up to individual providers.

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won’t expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck® or Global Entry

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

26.24% (Variable)

|

$0 intro for first year; $95 after that

|

Excellent, Good

|

The Capital One Spark Miles for Business is a highly rated card with a diversified mix of perks, including unlimited cash back, a one-time welcome bonus, and higher cash back percentages when booking hotels and rental cars through Capital One Travel.

Cardholders will also enjoy a one-to-one transfer of miles to several loyalty programs, along with a one-time statement credit to pay for TSA PreCheck or Global Entry, allowing you to breeze through airport security lines faster.

These perks are offered along with a waiving of the annual fee for the first year. Just keep in mind that there is no 0% introductory APR period on purchases and balance transfers, which many other business cards do offer.

- Earn a $750 bonus when you spend $6,000 in the first 3 months of account opening

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

- No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won’t expire for the life of the account

- Redeem your cash back rewards for any amount

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.49% – 24.49% (Variable)

|

$0

|

Excellent

|

The Capital One Spark Cash Select for Excellent Credit is a no-annual-fee, everyday reward card that offers flat rate cash back on every purchase with no maximums. Points never expire for the life of the account, so you can use them five years from now without issues.

This card excels with travel booked through the Capital One travel platform. Use it to pay for hotels and rental cars and automatically receive one of the highest cash back percentages in the industry.

Rounding out this card’s benefits include a one-time welcome bonus, $0 fraud liability, free employee cards, and customized spending limits for every employee. If you have a large fleet, it’s very easy to keep track of everyone’s expenses.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That’s $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more – your points don’t expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

The Ink Business Preferred® Credit Card is an upgrade to the Ink Business Unlimited® Credit Card. It offers a much higher welcome bonus and points earnings, up to the maximum allowable.

All the benefits of this card focus heavily on travel. For example, it charges no foreign transaction fees, and cardholders can redeem points through Chase’s rewards portal to stretch the value of their points even further.

This card charges a $95 annual fee (versus no annual fee for the Ink Business Unlimited® Credit Card). However, it is very well worth it if you spend enough to out-earn the annual fee.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% – 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Cash® Credit Card is one of our favorite business cards for truck drivers. This no-annual-fee card offers a tiered rewards program that awards points on purchases in select business categories, such as internet, cable, and phone, up to a maximum for every account anniversary year. A lower cash back percentage is assigned to all other purchases.

One of the biggest draws of using this card is its 0% introductory APR on purchases. Employee cards and Zero Liability protection can be provided for no additional cost so that you will never have to pay for any unauthorized charges.

This card is an excellent choice if you want to be rewarded heavily for office-related expenses.

- Earn a $250 statement credit after you spend $3,000 in purchases on your Card in your first 3 months.

- Earn 2% cash back on all eligible purchases on up to $50,000 per calendar year, then 1%. Cash back earned is automatically credited to your statement.

- Buy above your credit limit with Expanded Buying Power. Make business purchases over your credit limit with no penalty or enrollments, and still earn cash back on those purchases. Terms apply.

- 0% introductory APR on purchases for 12 months from the date of account opening, then a variable APR applies

- Get an application decision in as little as 30 seconds

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

18.49% – 26.49% Variable

|

$0

|

Good/Excellent

|

The Blue Business Cash™ Card is an excellent choice for truck drivers. It offers generous cash back and a welcome statement credit after spending a minimum on purchases within the first three months of account opening.

As with most business cards, this card offers expense management tools such as free employee cards, auto expense categorization using QuickBooks, and easy-to-read online statements that allow you to view your purchases and generate expense reports.

The Blue Business Cash™ Card also provides travel-related benefits such as auto rental damage insurance and free Global Assist Hotline access, a concierge service that assists with lost passports, missing luggage, and other travel mishaps where you could use a helping hand.

14. Costco Anywhere Visa® Business Card by Citi

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Citi is a CardRates advertiser.

The Costco Anywhere Visa® Business Card by Citi is highly versatile, offering a tiered rewards program that awards the highest cash back percentage on eligible gas or EV charging (up to an annual maximum), as well as restaurants and travels booked through Costco.

All cash back with his card is awarded annually at the close of your February billing statement. It is distributed as a credit card reward certificate that can be redeemed for Costco purchases, merchandise, or cash back. You can present the card as your membership ID at the counter, which is nice if you frequently leave it at home.

Other benefits this card offers include but are not limited to no foreign transaction fees, lost package protection, and travel concierge services. These third-party add-on services offer peace of mind for frequent domestic and international travelers. If you are an existing Costco member (or thinking of becoming one) and a big fuel spender, we highly recommend the Costco Anywhere Visa® Business Card by Citi.

What Are the Benefits of Using a Credit Card for Truckers?

There are many benefits to using truck credit cards:

- Rewards. You can earn cash back, points, or miles simply by using a credit card to make purchases. These rewards can accumulate to earn you free hotel stays, statement credits, gift cards, and myriad other things.

- Point Multipliers. If you are a big spender at retailers like supermarkets and gas stations, point multipliers can take effect (depending on the card). For example, the More Rewards American Express Credit Card offers the most points when spending at restaurants, supermarkets, and gas stations. If you are a long-haul truck driver already used to spending time in these locations, your points can accumulate quickly.

- Building Credit History. According to FICO, payment history makes up 35% of your credit score. With every on-time payment, you can gradually help increase your credit score.

- Balance Transfers. Today, many credit cards accept balances from other cards and offer 0% introductory APRs for several months (generally between 15 and 24). This promotional period lets you focus on paying down debt without worrying about interest charges.

In short, accumulating rewards, building a credit history, and 0% APR balance transfers are three credit card benefits for truck drivers that pay immediate dividends.

How Do I Qualify and Apply for a Credit Card?

These are the general steps to qualify and apply for a credit card:

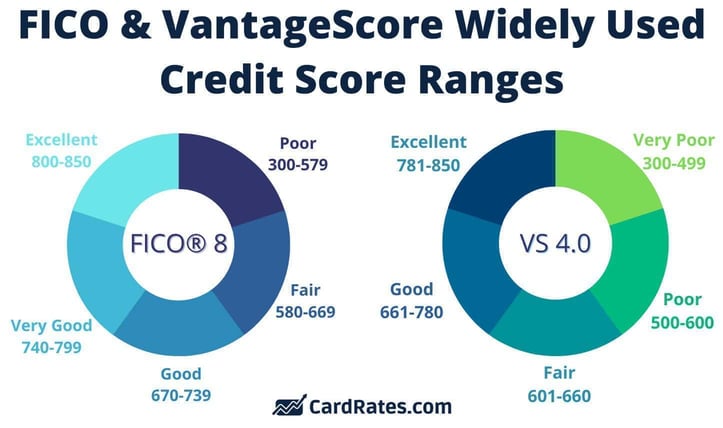

Understand the Credit Scoring Requirements

Almost all business cards require a 670 or higher credit score. The higher your score, the lower the interest rates and the greater the value of reward programs you qualify for.

One of the best ways to check your credit score (free!) and check your credit reports for errors. If you notice any errors, such as incorrect account balances or false late payments, seek dispute resolution with the creditor or credit bureau.

If you have a bad credit score (300 to 580 range), you are unlikely to qualify for any of the cards above, so we recommend improving your credit. A credit repair company may be able to help.

Choose The Right Card

Not all credit cards are created equal. They fall into several categories, including fleet, fuel, and rewards cards. For example, businesses with several company vehicles can use a fleet card to purchase fuel, track expenses, and enjoy related rewards.

Some of the more popular fleet cards include the ExxonMobil FleetPro, Shell Fleet Navigator card, and the RTS fuel card.

In turn, general-purpose cards like the Discover it® Cash Back focus more on rewards, with cardholders earning more cash back when making purchases in select quarterly categories or at retailers such as supermarkets and gas stations.

One card may award 3x points on eligible purchases, whereas the other may only grant 2x points on the same purchases, so you want to choose the right card based on your spending habits.

Apply & Wait

Once you’ve chosen the best card for you, the next step is to apply. Credit card applications can be finished in minutes by answering a few basic questions regarding your personal and income information.

Most issuers render an instant approval decision online, but sometimes, you’ll see a screen that says your application is pending further review. This means the issuer may need more information, but this doesn’t happen too often.

You’ll see your card details and available credit limit if you’re approved. The issuer will typically mail your card within three to seven business days. Once you receive it, you can activate it and begin using it. Some issuers allow you to begin using the card before it arrives via virtual card numbers you can access in your online account or by adding your new card to a digital wallet.

What Is the Best Credit Card for a Trucking Business?

The best credit card for a trucking business offers truck-specific benefits, such as fuel discounts, fuel management tools, and various rewards.

For example, long-haul road trips require you to refuel and stock up at gas stations, so earning 2X or 3X points for every gas purchase allows you to earn points quickly. Just don’t fall into the habit of overspending.

All in all, the best credit card for a trucking business depends on your business’ spending habits and the availability of rewards programs that maximize earnings within those categories.

What’s the Minimum Credit Score for a Credit Card?

The minimum credit score for a business credit card depends on the issuer and type of card. Cards with the best rewards require good to excellent credit with average scores of 670 or higher.

These cards offer everything from basic rewards programs (points, cash back, miles) to airport lounge access, trip cancellation insurance, cellphone protection, concierge services, fuel purchase protection, and extended warranty coverage.

Truckers with lower credit scores in the 600 to 669 range can apply for credit cards with basic cash back programs but with limited perks.

If you have the time, try to boost your credit score before applying for a credit credit card. A 45-point bump can easily mean the difference between a basic and a premium rewards card with much better rewards and perks.

Find The Perfect Card for Your Trucking Operation

Whether you’re a short or long-haul truck driver, many credit cards offer a nice blend of rewards for making everyday purchases. From diesel fuel to balance transfer opportunities, we highly recommend researching and comparing at least three credit cards on the list to find the right one for your needs.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best First Credit Cards, No Credit Needed ([updated_month_year]) 7 Best First Credit Cards, No Credit Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/firstcard.png?width=158&height=120&fit=crop)

![9 Credit Cards that Use Equifax Credit Reports ([updated_month_year]) 9 Credit Cards that Use Equifax Credit Reports ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/equifax2.png?width=158&height=120&fit=crop)

![9 Best Credit Cards for No Credit ([updated_month_year]) 9 Best Credit Cards for No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/10/nocredit.jpg?width=158&height=120&fit=crop)

![7 Best Secured Credit Cards: No Credit Check ([updated_month_year]) 7 Best Secured Credit Cards: No Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/Best-Secured-Credit-Cards-with-No-Credit-Check.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for Low Credit Scores ([updated_month_year]) 5 Best Credit Cards for Low Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/credit-cards-for-low-credit-scores-feat.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for New Credit Users ([updated_month_year]) 5 Best Credit Cards for New Credit Users ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-New-Credit-Users-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for High Credit Scores ([updated_month_year]) 9 Best Credit Cards for High Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Best-Credit-Cards-for-High-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)