The Capital One Savor family of cards was designed for consumers with active lifestyles. The cards focus on dining, entertainment, and groceries — categories that allow users to earn bonus rewards on both everyday and special-occasion purchases.

The Capital One® Savor® Cash Rewards Credit Card is the bigger earner, offering higher rewards rates and extra perks, but also charging an annual fee. The Capital One SavorOne Cash Rewards Credit Card, on the other hand, has slightly lower rewards rates but never charges an annual fee.

While the rewards and fees may vary between cards, qualifying for either card will be easiest when you have good to excellent credit. See the credit scores needed, potential credit limits, and other important details about the Savor family below.

(All information in this article for the Capital One® Savor® Cash Rewards Credit Card not reviewed by or provided by Capital One.)

Credit Scores | Credit Limits | Rewards & Perks | FAQs | How It Compares | Pre-Qualifying

670 Credit Score or Better is Best for Approval

So far as advertising is concerned, the Capital One® Savor® Cash Rewards Credit Card and the Capital One SavorOne Cash Rewards Credit Card are both marketed toward consumers with good to excellent credit. In general, this means FICO credit scores of around 670 and up — which actually seems to align fairly well with the data from cardholder reports.

Capital One® Savor® Cash Rewards Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Information for this card not reviewed by or provided by Capital One.

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

Of course, as is often the case, reports can be found of cardholders who were approved with scores below 670, so a lower-than-typical credit score isn’t necessarily enough to garner a rejection. That said, high credit scores — 750 and up — seem to be the most likely to get an instant approval.

As with most banks, Capital One will look at more than just your credit scores when deciding whether to approve your application, and your entire credit profile will be considered. Moreover, each credit card issuer has its own peculiarities when it comes to credit card applications — we’re looking at you, Chase 5/24 Rule — and Capital One is no exception.

In Capital One’s case, the bank will reportedly only allow potential cardholders to apply for one Capital One credit card per six-month period (this is said to apply to personal and business cards). Several reports indicate that Capital One will deny otherwise high-scoring applicants due to the “number of bank card tradelines.”

Additionally, Capital One limits how many of its own branded cards you can have to two personal cards per cardholder. This limit reportedly doesn’t include co-branded cards or discontinued cards, and may not apply to business cards, either.

Minimum Credit Limit of $2,000 for Approved Applicants

As we’ve seen, a good credit score is the best way to improve your chances of getting approved for the Capital One® Savor® Cash Rewards Credit Card. But, that’s not the only upside to having good credit when you apply — those high credit scores can also help you unlock a large credit limit at approval.

According to the card’s terms and conditions, the lowest credit limit you should receive after being approved for a Capital One® Savor® Cash Rewards Credit Card is $2,000. So, no matter what credit score you have, if you’re approved, you should be given a spending limit of at least that much.

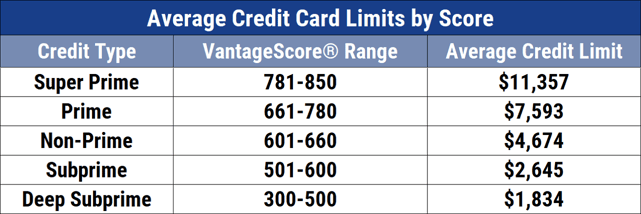

However, if that seems like an awfully low limit, don’t panic — many online reviewers report being approved for much higher limits, including multiple reports of applicants being offered an initial limit of $30,000. In the general credit card market, this is well above average for even cardholders with excellent credit:

In most cases, users reporting high initial credit limits also report having high credit scores at the time of application, with a score of 720 or higher most often associated with a five-figure starting limit. That said, a few reports can be found of applicants with scores in the 600 range receiving high initial credit limits.

Users interested in the no-fee Capital One SavorOne Cash Rewards Credit Card have an even lower starting limit than the Capital One® Savor® Cash Rewards Credit Card offers, with the terms and conditions stating that approved applicants will receive a minimum credit limit of $1,000. As with the Capital One® Savor® Cash Rewards Credit Card, however, reports of new applicants receiving higher starting limits are easy to find.

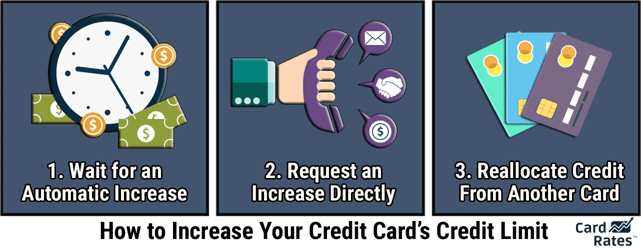

If you’re unhappy with the initial credit limit you’re offered, you’re not entirely out of luck. Capital One is known for offering unsolicited credit limit increases on a regular basis to consumers who pay on time each month and keep their account in good standing.

Cardholders who don’t want to wait for a credit limit increase can contact Capital One and ask for a larger credit line. Requesting an increase from Capital One typically results in a soft credit pull that won’t impact your credit scores.

To qualify for a credit limit increase with Capital One, your account will need to be in good standing and at least three months old. Additionally, you can only receive one credit limit increase (or decrease) every six months. It also helps if you use your card regularly and have good credit or have shown credit improvement in the last six months.

Earn 4% Cash Back on Dining & Select Entertainment

The options for great rewards cards are quite abundant for consumers with the good to excellent credit needed to qualify for a card from the Savor family, making the rewards offered by the Capital One® Savor® Cash Rewards Credit Card and the Capital One SavorOne Cash Rewards Credit Card a key part of the decision to apply for either card.

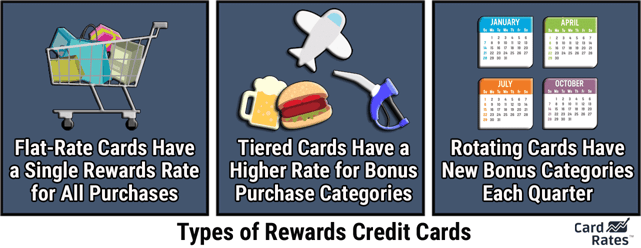

Both Savor cards offer tiered cash back rewards, with a base unlimited rate of 1% cash back on non-category purchases. And, unlike some tiered cards, all of the bonus categories for the Savor cards are unlimited, without annual or quarterly spending caps.

The bonus categories for the no-fee Capital One SavorOne Cash Rewards Credit Card include 3% cash back on grocery store purchases, 3% cash back on select entertainment, 3% back on dining purchases, and 1% cash back on everything else.

Paying the annual fee for the Capital One® Savor® Cash Rewards Credit Card unlocks higher bonus rewards rates for the top categories; cardholders earn 4% cash back on entertainment and dining — with the same 2% cash back on grocery store purchases.

Capital One’s definitions of each bonus category are fairly standard, providing many of the expected merchant types in each category. Note that the dining category doesn’t specifically mention food delivery services, and the entertainment category deliberately excludes streaming services.

Capital One defines “dining” as:

“Purchases at restaurants, cafes, bars, lounges, fast-food chains, and bakeries.”

While some issuers will specify that bars and lounges won’t count as dining purchases, both Savor cards should provide bonus cash back on these purchases. Your daily cup of coffee should also qualify.

Capital One defines “entertainment” as:

“Ticket purchases made at movie theaters, sports promoters (professional and semi-professional live events), theatrical promoters, amusement parks, tourist attractions, aquariums, zoos, dance halls, record stores, pool halls, or bowling alleys. This excludes golf courses, collegiate sporting events, and non-industry entertainment merchant codes like cable, digital streaming, and membership services.”

Basically, any activity that requires purchasing a ticket — with the noted exception of college sporting events — will likely qualify under Capital One’s definition, but digital entertainment, like streaming or software purchases, will not earn bonus cash back.

Capital One defines a “grocery store” as:

“A supermarket, meat locker, freezer, dairy product store, and specialty market. Excludes superstores like Walmart® and Target®.”

As you can see, most discount retailers are excluded from the definition. Additionally, while not specifically mentioned, wholesale or price club purchases — such as those made at Costco or Sams — will also likely be excluded from Capital One’s definition of “grocery stores” and will not earn bonus rewards.

One important thing to remember when it comes to bonus category definitions (for any issuer, not just Capital One) is that, in the end, it all comes down to how the merchant is coded in the network. And yes, merchants are generally coded at the network level, not by the issuing bank, so your card issuer has little to no control over how a particular merchant codes.

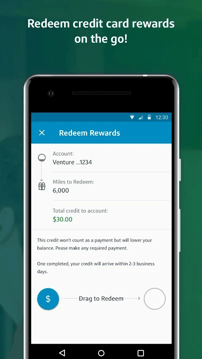

Once you’ve earned your cash back rewards, of course, you’ll need to redeem them. Capital One makes this fairly easy, with the option to redeem cash back rewards either through the online banking portal or through the mobile app. There is no minimum threshold to redeem rewards with Capital One.

You can redeem rewards right from the Capital One® mobile app.

Capital One allows you to redeem your Savor rewards in the mobile app using one of three options: Redeem a Purchase, Redeem for a Gift Card, or Credit Your Account. Redeeming toward a purchase or as an account credit will have similar results in that you’re reducing your credit card balance.

Redeeming your rewards through the online banking portal will return slightly different options, starting with the choice of: Cash or Gift Cards. If you select Cash, you’ll have the option to: Get Account Credit, Get Check by Mail, or Redeem for Purchases.

In general, cash applied to a purchase or as account credit should show up within two to three business days. Gift cards purchased with rewards may take as long as three weeks to arrive by mail.

In addition to manually redeeming your rewards, Capital One also offers the option to set up automatic rewards redemption, though you’ll need to sign in to online banking (not the mobile app) to set it up. This can be a good option for cardholders who forget to regularly cash out their rewards.

Both Savor cards also come with a range of non-rewards cardholder perks, including the basic Capital One benefits like $0 fraud liability and 24/7 account access. Other perks will vary based on the level of card you receive, with the most benefits available to World Elite Mastercard® cardholders.

Capital One® Savor® Cash Rewards Credit Card FAQs

Although the stories of credit card churners who open new cards every month may make it seem like little thought need go into choosing a new card, those churners are very much the minority. The average cardholder has only a few credit cards, making the decision to add a new card much more impactful overall.

So, if you’re going to go through the bother of getting a new credit card, you should make sure that card fits your needs. And that applies to more than just the rewards. Be sure the card’s network, fees, and even its look meet your wants and needs. There are plenty of credit card options out there, so you don’t need to settle for a card that doesn’t fit the bill.

Is the Capital One® Savor® Cash Rewards Credit Card a Visa or a Mastercard?

TL;DR: Mastercard.

Without a physical card in your hand, it can be hard to know which processing network operates a given card — especially when none of the marketing images of the card show a network logo, as seems to be the case with the Capital One® Savor® Cash Rewards Credit Card.

There are a few simple ways to figure out the network on which a credit card operates, starting with a thorough check of the card’s page on the bank’s website. If you can’t find mention of the network on the lander, try clicking the “Apply” button to see if the information is located on the application page.

In the case of the Capital One® Savor® Cash Rewards Credit Card, searching the page results in Mastercard® mentions in the fine print of the benefits. The latter strategy also reveals a Mastercard logo at the top of the application page — a sure sign that the card will operate on the Mastercard network.

Depending on your credit and initial spending limit, you could receive a World Mastercard® or a World Elite Mastercard®. While this may seem trivial to the casual user, credit card aficionados know that this designation makes a big difference when it comes to cardholder perks, as World Elite Mastercard® cardholders receive extra benefits, including exclusive credits and discounts.

Do the Savor Cards Charge Foreign Transaction Fees?

TL;DR: No.

There are 180 recognized currencies in the world — including 22 types of “dollars” — used by 195 different countries. Of all those countries, seven non-U.S. countries have adopted the U.S. dollar, leaving 188 countries where you’ll need to convert your currency to make a purchase.

Credit cards offer a convenient way to make purchases in foreign currencies thanks, in part, to the automatic currency conversion handled by the card network or bank on your behalf. Unfortunately, some credit cards make you pay for that convenience with what’s known as a foreign transaction fee.

Foreign transaction fees can reach up to 5% of your transaction total, and they can apply to any purchases made in a foreign currency, both abroad and at home. And no, foreign transaction fees aren’t the actual cost of currency conversion — they’re simply an extra convenience fee tacked onto your total.

The easiest way to avoid foreign transaction fees is to select a card that doesn’t charge them — a card like the Capital One® Savor® Cash Rewards Credit Card. In fact, not only does the Capital One® Savor® Cash Rewards Credit Card come without foreign transaction fees, so, too, do all of Capital One’s credit cards.

Is the Capital One® Savor® Cash Rewards Credit Card Made of Metal?

TL;DR: It varies.

For decades, metal credit and charge cards were reserved for the exclusive invite-only sect, available only with the top-tier cards like the famous Amex Centurion. These days, however, a number of regular consumer cards — albeit cards mostly aimed at consumers with excellent credit — have fancy metallic compositions and hefty constitutions.

Capital One has been a part of this trend for several years with its popular Capital One Venture Rewards Credit Card travel card, which has been available with a ritzy stainless steel veneer since 2017. The rollout started with new cardholders, with mixed results for existing cardholders who requested an upgrade.

As far as the Capital One® Savor® Cash Rewards Credit Card is concerned, the shift to metal cards has, by all reports, been equally mixed. Whether you receive a metal credit card or a regular plastic card at approval seems to vary significantly, and requesting an existing card be upgraded may also fail.

How the Card Compares to Similar Options

The current credit card market is glutted with great rewards options, and many of these cards offer categories similar to those offered by the Capital One® Savor® Cash Rewards Credit Card. This makes it both easier — and, in some ways, harder — to compare the cards in the Savor family with other card options.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card is a popular pick for dining and travel alike, offering 2X points per dollar on purchases in either category. At first glance, the Chase Sapphire Preferred® Card has a lower rewards rate on dining purchases than the Capital One® Savor® Cash Rewards Credit Card.

But the value of your points will actually vary depending on how you redeem them. Smart use of points can actually net 2¢ to 4¢ per point (or more), making the 2X points potentially worth more than 4% cash back.

While the Capital One® Savor® Cash Rewards Credit Card waives the annual fee the first year, the Chase Sapphire Preferred® Card does not. That said, the signup bonus for the Chase Sapphire Preferred® Card is worth more than the bonus of the Capital One® Savor® Cash Rewards Credit Card, especially when redeemed for travel.

Additional Disclosure: Citi is a CardRates advertiser.

Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024.

The Citi Premier® Card has a lot in common with the Capital One® Savor® Cash Rewards Credit Card, including offering dining as a bonus category. But, the Premier card takes it a step further. Premier cardholders earn top rewards rates in a multitude of common spending categories.

Citi’s ThankYou® Points can be transferred to a number of travel partner loyalty programs. This means the Premier’s bonus categories may — depending on how they’re redeemed — be worth more than the Capital One® Savor® Cash Rewards Credit Card‘s cash back offerings.

Uber Visa Card

The Uber Visa Card is for diners who don’t like annual fees, offering the same 4% cash back on dining as the Capital One® Savor® Cash Rewards Credit Card without ever charging an annual fee. Cardholders also earn 3% back on hotels and airfare, as well as 2% back for online purchases.

- Earn 4% cash back on dining purchases, including restaurants, takeout, bars, and UberEATS

- Earn 3% cash back on hotel & airfare, 2% for online purchases

- Pay $0 annual fee

When comparing the Uber Visa to either the Capital One® Savor® Cash Rewards Credit Card, or the no-fee Capital One SavorOne Cash Rewards Credit Card, the decision likely comes down to the rewards categories. If you spend more on entertainment than on hotel, airfare, or online shopping, then the Savor cards take the cake; otherwise, the Uber card may be the winner.

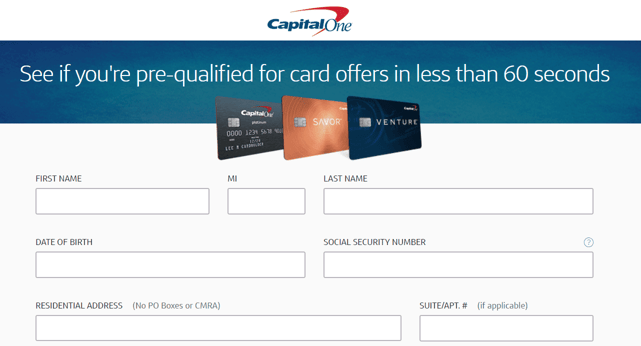

Pre-Qualify for Capital One Savor Cards

Since its makeover in 2018, the Capital One® Savor® Cash Rewards Credit Card has made waves as a top pick for cash back dining rewards, and as one of the few cards to offer entertainment rewards. The recent improvements suggest Capital One seems invested in keeping the card a relevant contender in the rewards market.

Given the many perks of the Savor cards, it makes sense that most approved applicants fall firmly into the good and excellent credit categories. But, as we’ve seen, credit score alone isn’t a perfect indicator of whether you’ll be approved for the Capital One® Savor® Cash Rewards Credit Card or Capital One SavorOne Cash Rewards Credit Card.

If you’re concerned about your approval chances but are still interested in opening a Savor card, then you may want to fill out a Capital One pre-qualification application. Pre-qualification uses a soft credit check that won’t hurt your credit, and it can give you an idea of which Capital One cards best fit your qualifications.

Keep in mind that pre-qualifying for a particular card won’t guarantee your approval if you officially apply. A number of factors, including your income and existing cards, can impact your approval.

Many issuers will let you check for pre-approval offers to get an idea of your approval chances.

Similarly, not being pre-approved for a given card doesn’t guarantee you’ll be rejected for that card if you fill out an application. However, it can be a strong indicator that you won’t be approved, so you may want to consider evaluating your credit reports and fixing any potential issues before applying.

Also remember that Capital One® is known for not reconsidering applications that have been denied unless there have been extenuating circumstances, such as an error on the application. This means that once your application has been turned down, calling customer service will likely do little good.

If your Capital One credit card application has been rejected, you should address any issues over the next six months, then apply again. Of course, keep in mind that Capital One reportedly pulls all three credit reports when considering an application, so you’ll get a hard inquiry on each credit report for applying for a Capital One card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![[card_field card_choice='39321' field_choice='title'] vs. [card_field card_choice='31445' field_choice='title'] Review ([updated_month_year]) [card_field card_choice='39321' field_choice='title'] vs. [card_field card_choice='31445' field_choice='title'] Review ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/ink.png?width=158&height=120&fit=crop)

![[card_field card_choice='5853' field_choice='title'] vs. [card_field card_choice='5855' field_choice='title'] ([updated_month_year] Review) [card_field card_choice='5853' field_choice='title'] vs. [card_field card_choice='5855' field_choice='title'] ([updated_month_year] Review)](https://www.cardrates.com/images/uploads/2018/03/shutterstock_1190829136.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='68495' field_choice='title'] vs. [card_field card_choice='5909' field_choice='title'] ([updated_month_year] Comparison) [card_field card_choice='68495' field_choice='title'] vs. [card_field card_choice='5909' field_choice='title'] ([updated_month_year] Comparison)](https://www.cardrates.com/images/uploads/2018/02/chase2.png?width=158&height=120&fit=crop)

![[card_field card_choice='22068' field_choice='title']: Review & Alternatives ([updated_month_year]) [card_field card_choice='22068' field_choice='title']: Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/09/caponesavor2.png?width=158&height=120&fit=crop)

![[card_field card_choice='5856' field_choice='title'] Review, Credit Score & Rewards ([updated_month_year]) [card_field card_choice='5856' field_choice='title'] Review, Credit Score & Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/shutterstock_119978758.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='5859' field_choice='title']: Review & Credit Score Needed ([updated_month_year]) [card_field card_choice='5859' field_choice='title']: Review & Credit Score Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/01/shutterstock_1023516253-1.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year]) [card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/unlimited-cover.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='11716' field_choice='title'] Review: Benefits, Rewards & Application [card_field card_choice='11716' field_choice='title'] Review: Benefits, Rewards & Application](https://www.cardrates.com/images/uploads/2016/10/gm-card-review.png?width=158&height=120&fit=crop)