Maybe you’re planning a lengthy overseas trip or a major home remodel and need a credit card that can accommodate the increased expenses. Unfortunately, for many of us, the best credit cards for high spenders also happen to be the hardest to qualify for.

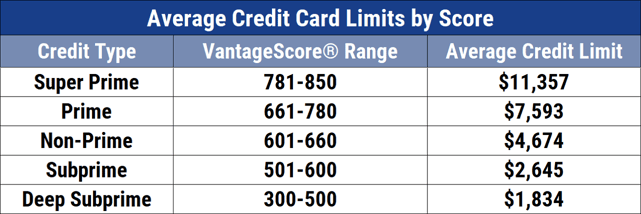

According to data analyzed by the credit rating agency Experian, consumers with the top credit scores of 781 to 850 had an average credit card limit of $9,543 per card. That’s compared to an average limit of just $5,209 per card for those with a “good” score of 661 to 780. That’s quite a difference in spending power.

A high-limit credit card can provide a cushion in case of emergency, and can also help lower your overall credit utilization rate. But keep in mind that a lot goes into determining your spending limit, and credit card companies are notoriously tight-lipped about how they calculate this figure. That said, here are some of the best credit cards for high spenders in a variety of categories.

Rewards:

Cash Back | Miles | Points | Dining | Hotels

Issuers:

Amex | BoA | Capital One | Chase | Citi | Discover | Wells Fargo

Best Cash Back Card for High Spenders

As a cash back credit card, you’d struggle to find a better value than the Discover it® Cash Back card. The generous introductory APR period makes a good all-around card for everyday use. Add up the cash back rewards and you can see how the Discover it® Cash Back card earns its accolades.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

Although Discover doesn’t advertise its credit limits, there are reports of initial limits of up to $15,000. This card is intended for consumers with good to excellent credit, and, of course, the better your score, the higher your credit limit is likely to be.

Other factors that will help determine your credit limit include payment history, annual income and expenses, the length of time you’ve had credit, and your credit utilization rate.

Best Miles Card for High Spenders

If you’re looking for a high-value card that will also earn you plenty of air miles for that overseas vacation, the Capital One Venture Rewards Credit Card is worth a look. With its one-time bonus miles offer after account opening, it’s easy to see why this card was named “Best Travel Card of 2018” by CNBC.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

Capital One is known to offer generous credit limits to well-qualified card applicants. For the top tier of consumers, this can mean an initial credit line of $20,000 or more. Of course, you’ll need good to excellent credit to be offered the highest limit, along with a lengthy credit history and an impressive debt-to-income ratio.

Best Points Card for High Spenders

Frequent credit card users who want to make the most of their spending will appreciate the Chase Sapphire Preferred® card for its combination of rewards, bonus points, and low annual fee.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

This card also offers a fairly high initial credit limit of at least $5,000 and an average of around $10,000. About 10% of cardholders report a credit limit of more than $20,000, and there are reports of credit limits of $100,000 or higher. A good to excellent credit score is required, along with an overall healthy credit profile.

Best Dining Card for High Spenders

If you’re looking for a card that gives you more cash back at restaurants, the Capital One® Savor® Cash Rewards Credit Card could be just what you’re after. This is a great card for those high spenders who regularly pick up the tab.

4. Capital One® Savor® Cash Rewards Credit Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Information for this card not reviewed by or provided by Capital One.

As a “food and fun” card, it’s hard to beat the Capital One® Savor® Cash Rewards Credit Card. Of course, you’ll need good to excellent credit to be approved, and your score will help determine your credit limit. Cardholders report spending limits ranging from $1,000 to $10,000.

Best Hotel Card for High Spenders

The Capital One Venture Rewards Credit Card is a top choice for those who want to earn free hotel stays, and there are no rotating or tiered categories to keep track of.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

The cost of the annual fee is offset by the ability to receive up to a $100 credit for Global Entry or TSA PreCheck®. The available signup bonus is a quick way to earn your first few free nights (or one night at a super-fancy hotel). Venture cardholders have reported credit limits as high as $50,000, but $10,000 seems to be the starting average.

Best American Express Card for High Spenders

Recognized as the premier credit card for serious cardholders and travelers, The Platinum Card® still carries a certain cachet. Of course, with its high annual fee, some may question whether the card is worth the cost. But consider this: There’s a generous signup bonus offer, several credits and reimbursement offers that regularly change, and top-notch travel insurance.

The real value of holding The Platinum Card® is the Membership Rewards points you earn on flights booked through American Express Travel or directly through an airline.

As for the spending limit, The Platinum Card® doesn’t actually have one — at least, theoretically. That’s because you’re expected to pay off the charged balance each month in full. In practice, however, there is a limit to what you can charge, and it has to do with your income level, card usage, and payment history. If you do apply for a Platinum card, don’t be surprised if you’re invited to apply for a Green or Gold card instead, as the standards for Platinum are quite high.

Best Bank of America Card for High Spenders

The Bank of America® Customized Cash Rewards credit card is a great way to earn a lot without paying a lot. You’ll earn the most cash back in a category of your choice that you can change every month. But you should note that the higher cash back tiers are subject to quarterly caps.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Other attractive features of this card include an introductory APR for purchases and balance transfers. In addition, Bank of America Preferred Rewards members can earn 25% to 75% more cash back on every purchase. Initial credit limits with this card are moderate, as you may expect. But there are reports of spending limits as high as $25,000 over time.

Best Capital One Card for High Spenders

It takes just a quick glance to see why the Capital One Venture Rewards Credit Card is the leading credit card offered by Capital One. You can transfer the miles you earn to more than a dozen leading loyalty programs.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

Applicants seeking the Capital One Venture Rewards Credit Card should have a good to excellent credit score and strong credit history. There are reports of cardholders being approved with scores in the mid-600s, but don’t count on it. As for the initial credit limit, it’s going to depend on your personal credit history, of course, but the average seems to be around $10,000 to start. There are reports of credit limits above $30,000 and even one reviewer who claimed to have received a $50,000 limit.

Best Chase Card for High Spenders

As the premier Chase credit card, the Chase Sapphire Reserve® card has everything high spenders could want. From generous rewards on dining and entertainment to airport lounge access through Priority Pass® Select, it’s no wonder the Sapphire Reserve® was named “Best Premium Travel Credit Card” for 2018 by Money® Magazine. This elite card also comes with an annual travel credit and up to $100 credit for TSA Precheck or Global Entry Pass.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Qualifying for the Sapphire Reserve® is only for those with excellent credit scores and a spotless payment history. For those who do get approved, you can expect a minimum starting credit limit of $10,000. However, depending on factors like income and debt ratios, you could end up with a much higher starting limit. Many users report starting limits of $20,000 to $30,000 with a few in the plus $60,000 range.

Best Citi Card for High Spenders

The Citi Double Cash® Card may not offer the glitz and glamor of some other cards on this list, but it offers the highest flat-rate of cash back you can receive from a card (that we know of) with no purchase cap.

Additional Disclosure: Citi is a CardRates advertiser.

With no rotating or tiered categories to keep track of, this card makes sense for the easy-going spender. You may be approved for an initial credit limit of up to $10,000, but as with most cards, the credit limit you receive for the Citi Double Cash® Card will vary based on personal financial factors.

Best Discover Card for High Spenders

For high spenders who don’t mind keeping track of and activating quarterly rotating reward categories, the Discover it® Cash Back card can prove a valuable way to maximize your rewards.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

Card issuers seldom advertise the credit limits available, and Discover is no different. However, as this is Discover’s flagship card, plenty of cardholders have been willing to share their personal experiences with this card’s credit limits online. The range of credit limits is broad, with a low of $300 and an average initial limit of $3,000 reported. Initial credit limits higher than $8,000 are few and far between, with no reports of limits higher than $20,000.

Best Wells Fargo Card for High Spenders

As an all-purpose go-to card for everyday use, the Wells Fargo Visa Signature® Card may not be the best choice, but if used wisely, it can have a lot of hidden value.

12. Wells Fargo Visa Signature® Card

But it can be very lucrative when redeeming the points you’ve earned in those six months. If you book an airline ticket through Wells Fargo Go Far Rewards®, you’ll get 50% more for your reward points. That means at least $625 if you max out at the $12,500 mark.

- 5X rewards points earned for up to $12,500 spent in select categories for the first six months

- 0% introductory APR period

- No annual fee

If you’re not a high spender, there are probably a few cards with better perks than the Visa Signature Card. But, if you have other Wells Fargo cards in the Go Far Rewards program, you can transfer those points to the card and take advantage of the 50% value increase. So, if you’re not averse to a little credit card shuffling and you spend a lot on gas and groceries, maybe this card can work for you.

Which Credit Cards Give the Highest Starting Limit?

It should be stated upfront that there is really no such thing as a guaranteed high starting credit limit. It’s also worth noting that when you apply, no one is sitting at a desk and poring over every detail of your application to determine your initial credit limit. No, it’s far more banal than that.

The credit limit you receive is determined by an algorithm that factors in things such as your credit score, income, total debt, length of credit history, payment history, and any negative marks on your credit report. It also depends on the type of card you’re applying for.

That said, here are some of the cards that offer high starting limits as reported by individual cardholders.

Chase Sapphire Reserve® — This card comes with a minimum starting limit of $10,000 and reports of $20,000 to $30,000 are common. Less common but still notable are reported occurrences of $50,000+ starting limits.

Capital One Venture Rewards Credit Card — Average starting limits of around $10,000 with some cardholders reporting $30,000 or more.

Chase Freedom Unlimited® — Regular reports of starting limits in the $20,000 to $30,000 range.

Discover it® Cash Back — Although the average starting limit is just $3,000, qualified applicants have reported $12,000 to $15,000 initial limits.

Plenty of anecdotal evidence suggests that some credit unions and many loyalty program cards frequently approve high starting limits for well-qualified applicants. Examples include Navy Federal Credit Union, Chase Hyatt, Chase Southwest, AMEX Delta Gold, and Hilton HHonors.

Also, cards issued under the Visa Infinite brand apparently have a minimum starting limit of $10,000 and can go as high as $50,000. These cards are very limited, and only the most high-end cards come with this branding.

Which Credit Card is the Most Prestigious?

For a certain type of high spender, the preferred credit card is one that speaks for itself. Think about the legendary American Express “Black” Card, also known as the Centurion® Card. For a time, carrying this card was the pinnacle of prestige and accomplishment. More recently, other card issuers have created their own exclusive offerings that have a similar cachet.

The Platinum Card® — This premium Amex card is exclusive, while still being accessible. Enjoy all the benefits of many invite-only cards, along with a generous rewards program.

Mastercard® Gold Card™ — This top-tier Mastercard is also known as the Luxury Card, and for good reason. If you’re not dazzled by its actual 24K gold plating, then perhaps the exceptional cash back and airfare redemption rewards will do the trick.

Chase Sapphire Reserve® — Perhaps lacking the ostentatiousness of some others, the Sapphire Reserve® is still recognized as a prestige card that’s not available to just anyone. This is the card to try for as you aspire to the super-premium class.

Of course, there are other cards that signify you’re among the elite class, although these premier cards are available by invitation only. Here are the top cards you can aspire to attain through lots of hard work (and money).

J.P. Morgan Reserve Card — Formerly known as the Chase Palladium Card, this premium card is packed with features and benefits — but only if you’re among the upper tier of high net worth individuals, and a J.P. Morgan Global Wealth Management client.

Citi Chairman American Express Card — Requiring potential cardholders to have significant investments in a Citigroup brokerage account is how this card maintains its exclusivity. Credit lines are rumored to be $300,000+.

Centurion® Card from American Express — Few other cards have the same mystique as the legendary Black Card. If you want to know whether you qualify for this ultra-exclusive card, asking the question alone means you’re not there yet.

High Spending Deserves High Rewards

Whether you’ve made it into the upper echelon of high spenders, or just use your card regularly for personal and business expenses, you want the most you can get from it. That means finding the right balance between fees and rewards while maximizing your perks and benefits. Some cardholders don’t mind using different cards in different situations, while others want simplicity.

How you use your credit card or cards will determine which are best for you. If you travel a lot, a miles card may suit you well. If you regularly eat out, then a dining rewards card may be best. If you don’t mind keeping track of your benefits on each card, then a combination may work for you.

The bottom line is this: The more you spend, the more you should be rewarded. Just be sure not to overpay to get rewards or benefits.

Remember the wise words of Winston Churchill: With great power comes great responsibility — and the more responsible you are with these high-power cards, the more you’ll be rewarded.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Best Credit Cards for Light Spenders ([updated_month_year]) 8 Best Credit Cards for Light Spenders ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/light.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for High Credit Scores ([updated_month_year]) 9 Best Credit Cards for High Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Best-Credit-Cards-for-High-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![7 Credit Cards For High Debt-to-Income Ratios ([updated_month_year]) 7 Credit Cards For High Debt-to-Income Ratios ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/01/shutterstock_232260670.jpg?width=158&height=120&fit=crop)

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year]) 7 Best High-Limit Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/fair-credit-limits-art.jpg?width=158&height=120&fit=crop)

![16 High Limit Credit Cards for Excellent Credit ([updated_month_year]) 16 High Limit Credit Cards for Excellent Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/highlimitcover.jpg?width=158&height=120&fit=crop)

![12 Best High-End Credit Cards ([updated_month_year]) 12 Best High-End Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/09/high-end-3.png?width=158&height=120&fit=crop)

![12 Best Credit Cards to Transfer High Balances ([updated_month_year]) 12 Best Credit Cards to Transfer High Balances ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/best-credit-cards-for-transferring-high-balances-feat.jpg?width=158&height=120&fit=crop)