To a certain extent, cash back rewards are basically credit card rewards on “easy” mode. While you can still work to maximize your rewards with tiered bonus categories and other tools, redeeming cash back is often as simple as clicking a few buttons to receive a statement credit, with no points to transfer or values to calculate.

It’s that ease of use that makes cash back credit cards popular among cardholders who don’t want to jump through hoops to earn and redeem rewards. And that popularity is obvious to the issuers, which have created dozens of cash back credit card options to meet a variety of needs and spending styles. In this article, we’ll explore some of the best cash back credit cards available today. You can click in this section to view the top picks for each category or scroll down to see the full list.

- Best Overall: Chase Freedom Unlimited®

- Best Unlimited: Chase Freedom Unlimited®

- Best Bonus Cash Back: Discover it® Cash Back

- Best Signup Bonus: Discover it® Cash Back

- Best No Annual Fee: Chase Freedom Unlimited®

- Best for Gas: Discover it® Chrome

- Best for Groceries: Capital One SavorOne Cash Rewards Credit Card

- Best for Dining: Capital One® Savor® Cash Rewards Credit Card (Information for this card not reviewed by or provided by Capital One.)

- Best for Entertainment: Capital One® Savor® Cash Rewards Credit Card (Information for this card not reviewed by or provided by Capital One.)

- Best for Students: Discover it® Student Cash Back

- Best for Businesses: Ink Business Cash® Credit Card

- Best for Fair Credit: Capital One QuicksilverOne Cash Rewards Credit Card

- Best for Bad Credit: Discover it® Secured Credit Card

While we think these cards stand out from the crowd, the sheer number of cash back credit cards means there’s no shortage of options. You can explore the top three cards for each category — plus our honorable mentions — by using the navigation below.

Overall | Unlimited | 5% Back | Signup Bonus | No Annual Fee | Gas | Groceries | Dining | Entertainment | Students | Businesses | Fair Credit | Bad Credit

Best Overall Cash Back Cards

Finding the very best cash back rewards card can be a tough challenge, mostly because the reasons for seeking out a cash back card can be very different. For example, if pure ease of use is your criteria, then a flat-rate unlimited cash back card is likely to be the best fit since you won’t need to track or activate categories.

However, cardholders who want to maximize their cash back rewards are more likely to prefer a card with tiered bonus categories that offer higher rates of return on specific types of purchases. But, even the realm of tiered-bonus cards has several different types of earning structures designed for very different types of consumers.

If you’re looking for a simple, easy-to-use cash back rewards card, you can’t really go wrong with this pick. Cardholders earn unlimited cash back rewards on every purchase without tracking and activating rotating categories. It also has no annual fee, an introductory 0% APR, a competitive signup bonus, and a host of secondary benefits like extended warranty coverage and purchase protection.

This card is a great choice for maximizing cash back rewards when you take advantage of its quarterly rotating bonus categories. With a low APR and friendly introductory terms, it’s particularly attractive to those who want the benefits of a robust rewards program without breaking the bank on interest payments. What’s more, Discover is known to have excellent customer service, with a toll-free 24/7 phone line, a handy mobile app, and online support.

This card is currently not available. Additional Disclosure: Information for this card not reviewed by or provided by Capital One.3. Capital One® Savor® Cash Rewards Credit Card

With three broadly defined bonus categories, this card has something for just about anyone. You can earn 4% cash back on dining and entertainment — the latter including everything from sporting events to movie theaters — as well as 2% cash back on grocery store purchases. And it’s all unlimited, with no category caps. The first year’s annual fee is waived, and the signup bonus is a good value.

Honorable Mentions: Our three top cards offer a little bit of everything, but if you’re still looking for the right fit, check out the Amex Blue Cash Preferred® Card — which is great for groceries and gas — the Citi Double Cash® Card (a good flat-rate card), and the U.S. Bank Cash+ Visa Signature® Card, which lets you pick your own 5% cash back categories each quarter.

Best Unlimited Cash Back Cards

Although bonus cash back categories are a great way to maximize your credit card rewards, not every purchase fits neatly into a common rewards category. For the rest of your purchases, a flat-rate unlimited cash back card can offer a better-than-base-level earnings rate that doesn’t depend on the type of purchase.

With a few exceptions, most of the flat-rate cash back cards come with the same 1.5% cash back rate, so choosing one is often more a matter of the peripherals than anything else. Almost every major issuer has its own version, so choose the issuer and extra features that make the most sense for your lifestyle.

While this card has a similar cash back structure as many other cards, it has a leg up for cardholders who also have a Chase card that earns Ultimate Rewards® points. Essentially, with both accounts active, users can turn the cash back into rewards points, unlocking the opportunity for very valuable travel redemption through the Chase Travel program.

5. Wells Fargo Cash Wise Visa® Card

This card has a few points in its favor beyond its 1.5% cash back, including a larger signup bonus and the fact that new cardholders can enjoy 1.8% back on mobile wallet purchases for the first year.

- Receive 0% APR on new purchases and balance transfers for 12 months

- Receive up to $600 in cellphone protection

- Pay $0 annual fee

Plus, pay your mobile phone bill with your card to be eligible for up to $600 in cellphone protection against covered damage or theft.

(The information related to Wells Fargo Cash Wise Visa® Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

If you’re not eligible for a Chase card due to the 5/24 Rule and you don’t want to go the Wells Fargo route, this card is a solid option for 1.5% flat-rate unlimited cash back rewards. Plus, pay no annual fee, no foreign transaction fees, and a fairly long introductory 0% APR deal.

Honorable Mentions: This category is simply bursting with options, and many offer the same 1.5% rate, making any a decent choice. However, we had a couple of standouts that didn’t quite make the cut, such as the Alliant Cashback Visa® Signature, which offers 2.5% cash back, but, since it’s a credit union, you must become a member to be a cardholder. The Citi Double Cash® Card was also a strong contender, but its lack of signup bonus gave the other cards the edge.

Best 5% Cash Back Cards

While rewards credit card competition has been driving rewards rates higher and higher, the number of cards offering 5% cash back (or, rarely, more) is still pretty limited. That said, a number of strong options exist — with a few caveats.

First, most cash back cards with a 5% (or more) cash back category have limits on the amount of bonus cash back you can earn in a specific quarter or year. You may also have to pick or activate your 5% bonus category each quarter depending on the card, but that’s often a small price to pay for 5% back.

This card was one of the first rotating category cards, and it still reigns as a top choice for cash back rewards. Categories rotate each quarter and need to be activated before you can earn the bonus, and the bonus cash back rate is limited each quarter.

This card is currently not available. Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.8. Chase Freedom Flex℠

This is another rotating category card that offers a new top-tier cash back category each quarter. Similar to other rotating category cards, you’ll need to activate each bonus category and rewards are capped at a set purchase limit.

9. U.S. Bank Cash+™ Visa Signature® Card

The U.S. Bank Cash+™ Visa Signature® Card offers two 5% cash back categories and a 2% bonus category. Rather than rotate each quarter at the issuer’s will, this card allows users to select their own 5% cash back categories each quarter from a list of 12 options.

-

-

- Earn 5% cash back in two categories of your choosing, plus 2% cash back in an additional category you select

- Earn 1% cash back on all other purchases

- Pay no annual fee

-

While you’ll need to select your bonus categories each quarter, you can keep the categories you like year-round, or explore new categories as your spending needs change. Bonus rewards are limited to the first $1,500 in category purchases per three months.

Honorable Mentions: Few cards meet the high rewards rates of our top three, but the Amex Blue Cash Preferred® Card’s 6% cash back on groceries earns it an honorable mention (capped at $6,000 in qualifying purchases each year). You can also earn 5% back on branded purchases with a number of store cards, including the Amazon Prime Rewards Credit Card, and the Target REDcard and Lowe’s Consumer Card both provide a 5% discount at checkout.

Best Cash Back Card Signup Bonuses

Given that the consumer credit card market has more options than most folks know what to do with, card issuers have had to come up with ways to set their cards apart from the competition. Enter: the signup bonus. Similar to the free toasters that used to come with a new checking account, signup bonuses are new cardholder incentives offered by credit cards.

Most rewards cards now come with some type of signup bonus, many of which can be worth hundreds of dollars. These bonuses have minimum spending requirements that must be met, and the size of spending requirements tends to scale with the size of the bonus. Cards with annual fees often offer the best bonuses, but bonuses from some fee-free cards can also be fairly valuable.

Discover has a unique signup bonus you earn in your first year after your account anniversary. If you take full advantage of the rotating categories each quarter, the year-end bonus will make your diligence that much more worth it. While this bonus doesn’t offer as much instant gratification as a traditional bonus, it has a lot of potential.

This card is currently not available. Additional Disclosure: Information for this card not reviewed by or provided by Capital One.11. Capital One® Savor® Cash Rewards Credit Card

This card’s signup bonus is one of the largest among cash back cards, and the spending requirement shouldn’t be too much of a stretch for most families, particularly when considering the card’s dining, entertainment, and grocery store bonus categories. Plus, the first year’s annual fee is waived.

12. Wells Fargo Cash Wise Visa® Card

While this card is a mild-mannered 1.5% unlimited cash back card at first glance, it has a few extras going for it — including a signup bonus that beats most of its 1.5%-earning competitors.

- Receive 0% APR on new purchases and balance transfers for 12 months

- Receive up to $600 in cellphone protection

- Pay $0 annual fee

New cardholders can also enjoy extra cash back on mobile wallet purchases and intro-APR offer on new purchases and balance transfers.

(The information related to Wells Fargo Cash Wise Visa® Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

Honorable Mentions: Our top three are some of the highest and most interesting cash back card signup bonuses, but we do have a few honorable mentions, such as the Bank of America® Cash Rewards Credit Card and the Blue Cash Everyday® Card.

Best Cash Back Card with No Annual Fee

When you talk to any credit card aficionado, they’ll likely tell you that some cards are entirely worth the annual fee. Cards with extremely high rewards rates and useful secondary benefits can make the annual fee seem like a bargain (provided you use the card responsibly).

But, in today’s credit card market, you don’t have to pay an annual fee to earn competitive rewards in nearly any spending category, especially if you have good credit. You can find cash back cards that offer flat-rate cash back rewards, as well as cards that provide tiered bonus categories so you can maximize your earnings.

This card is one of the more popular choices for cash back rewards; while many cards offer the same base cash back rate, this card can be paired with a second Chase card that earns Ultimate Rewards®, which allows cardholders to turn their cash back into rewards points, increasing the value.

Discover pioneered the cash back card, and its current offering is still one of the best for tiered rewards. Users get free FICO tracking and all purchases earn cash back, be it at the bonus rate for the quarterly categories or a standard reduced rate for all other purchases.

A fine choice for foodies, this offering comes with unlimited 3% cash back on dining and entertainment, and you also earn 3% cash back on grocery store purchases. The card even comes with a signup bonus and an introductory 0% APR deal as extra incentive to give the card a try.

Honorable Mentions: While these three are some of our favorite options for no annual fee, copious options abound for great fee-free cash back cards. Some honorable mentions in the category include the U.S. Bank Cash+ Visa Signature® Card, the Amex Blue Cash Everyday® Card, and the Citi Double Cash® Card.

Best Cash Back Cards for Gas Rewards

Few things in the consumer world seem to fluctuate quite as much as gas prices, which can vary by 50¢ per gallon or more each year. As a result of the variable prices, gas station co-branded cards that provide a set discount of a few cents per gallon aren’t actually the best way to earn rewards when filling your tank.

Thankfully, most major issuers offer a card with bonus cash back rewards for gas station purchases, most of which provide better return than co-branded gas station cards. Make sure to note any category caps that may limit your rewards, however, as well as any annual fees that may eat into your earnings.

Travelers looking for a simple way to earn cash back may like this card, which offers an elevated cash-back rate for gas purchases. Discover also boasts the top-rated customer service in the biz, so you can rest assured if an issue ever arises.

This card is currently not available. Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.17. Chase Freedom Flex℠

This card offers quarterly rotating bonus categories that change every three months, but the card has historically offered at least one quarter of gas bonus rewards every year (and two quarters in 2018). Be sure to activate your bonus category to earn the higher rate and watch for spending caps.

- Earn $250 back in the form of a statement credit after you spend $3,000 in purchases on your new Card within the first 6 months of Card Membership.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year on purchases (then 1%). Also earn 6% cash back on select U.S. streaming subscriptions.

- Earn 3% cash back on transit, including U.S. gas stations, taxis/rideshare, parking, tolls, trains, buses, and more. All other purchases earn 1% cash back.

- $120 Equinox Credit - Use your Blue Cash Preferred Card to pay for Equinox+ at equinoxplus.com and receive $10 in monthly statement credits. Enrollment required.

- 0% intro APR for 12 months from the date of account opening, then a variable APR applies

- $0 intro annual fee for the first year, then $95

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

19.24% - 29.99% Variable

|

$0 intro annual fee for the first year, then $95

|

Excellent Credit

|

The Blue Cash Preferred® Card from American Express is primarily known as a grocery rewards card, but it also has a solid 3% cash back rate for gas purchases, with no limits on how much you can earn.

As with most rewards cards, non-category card purchases earn an unlimited 1% cash back, as will grocery store purchases above the yearly bonus rewards cap. The signup bonus is large enough to cancel out the annual fee for a couple of years, though rewards on even modest grocery and gas spending should be enough to more than pay for the card in subsequent years.

Honorable Mentions: While some of the best gas rewards cards are points-based, plenty of quality cash back cards have gas bonuses. If our top three don’t work for you, take a look at the Bank of America® Cash Rewards, the U.S. Bank Cash+ Visa Signature® Card, or the Discover it® Cash Back.

Best Cash Back Cards for Grocery Store Rewards

Modern technology has impacted the way we shop for many things, and groceries are no exception. These days, we not only can order our groceries online, but we can also have them delivered to our doorstep. Regardless of how you get your groceries, however, the chances are good that they take up a significant part of your budget.

As an everyday necessity, grocery store purchases have been a popular rewards card offering for years, and many issuers offer some option for earning bonus cash back on your grocery bill. Keep in mind that discount and warehouse stores, including Walmart and Target, typically don’t qualify as grocery stores when it comes to credit card rewards.

While the annual-fee version of this card may offer higher rates for the card family’s main bonus categories, this fee-free option offers 3% cash back on grocery store purchases. Add that to the 3% cash back on dining and entertainment, and you have a solid option for earning cash back in a number of useful categories.

This card is currently not available. Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.20. Chase Freedom Flex℠

This card doesn’t provide year-round bonus rewards for grocery store purchases, but it does have a long history of offering at least one quarter of bonus cash back on groceries. You’ll need to activate your category to earn bonus rewards and rewards are limited to a purchase limit in that category each quarter.

The Blue Cash Preferred® Card from American Express offers the highest rate of bonus cash back for grocery store purchases of any cash back card on the market, providing 6% cash back on up to $6,000 in groceries each year.

Besides grocery store purchases, this card also offers unlimited 3% back on gas station purchases. And while the annual fee may seem a little high, most families will likely spend enough on groceries to make up for the fee and then some.

Honorable Mentions: As you might expect from such a popular category, nearly every major issuer has some sort of grocery rewards card. In addition to those on our list, you can check out the U.S. Bank Cash+ Visa Signature® Card or the American Express Blue Cash Everyday® card. Additionally, the Discover it® Cash Back frequently has at least one quarter of grocery store bonus rewards, and the Amazon Prime Credit Card is a solid pick for Whole Foods shoppers.

Best Cash Back Cards for Dining Rewards

Americans spend over $61 billion at restaurants and bars each year, a figure that is likely to keep on growing considering that only around 10% of us actually like to cook. Given the thousands of dollars a year we plunk down on dining, it makes plenty of financial sense (and cents) to make sure you’re earning rewards on those purchases.

Happily, a wide range of cards offer cash back rewards on dining purchases, though definitions of “dining” can vary broadly. For example, some cards may include bars, while others will only count sit-down or take-out restaurants. You’ll need to check the terms and conditions for each card to see the specifics.

This card is currently not available. Additional Disclosure: Information for this card not reviewed by or provided by Capital One.22. Capital One® Savor® Cash Rewards Credit Card

With 4% cash back on dining purchases, this card has the highest unlimited cash back rate for dining purchases of the cards we reviewed. Plus, cardholders also earn 4% back on select entertainment purchases and 2% back on grocery store purchases. And the annual fee is waived the first year, making it a no-brainer for frequent diners and cash back fans to give the card a try.

Alright, so you won’t get year-round bonus cash back on dining purchases with this card, but you can generally look forward to at least one quarter of bonus cash back on restaurant purchases when you activate your bonus.

24. Uber Visa Card

The Uber Visa Card is a co-branded card issued by Barclays that, oddly enough, doesn’t focus on Uber purchases. Instead, its largest cash back rewards category is the 4% back on dining, which includes restaurants and bars as well as UberEATS delivery.

-

-

-

-

- Earn 4% cash back on dining purchases, including restaurants, takeout, bars, and UberEATS

- Earn 3% cash back on hotel & airfare, 2% for online purchases

- Pay no annual fee

-

-

-

In addition to big dining rewards, this card is also a solid option for travelers who want to earn cash back, offering 3% back on hotel and airfare and 2% back on Uber purchases and other online transactions. The card also comes with cellphone protection when you pay your bill with your card.

Honorable Mentions: Dining has long been a popular credit card rewards category, and tons of issuers offer cards with dining bonuses. While our top picks have some of the highest rates and broadest definitions, you can also check out the U.S. Bank Cash+ Visa Signature® Card — choose “Fast Food” & “Restaurants” for best results — the Capital One SavorOne Cash Rewards Credit Card, and the Marvel Mastercard® for cash back on dining.

Best Cash Back Cards for Entertainment Rewards

Until recently, only a few credit cards rewarded cardholders for entertainment purchases, but the current credit card market now has a number of solid options for earning cash back rewards on nearly all of your leisure activities.

Whether you want season tickets to your favorite sports team or to see the new releases on opening night, you can find a card that offers bonus cash back on your purchases. Each card has its own limitations, however, so be sure you read the terms and conditions carefully to see what purchases qualify as “entertainment” for a specific rewards program.

This card is currently not available. Additional Disclosure: Information for this card not reviewed by or provided by Capital One.25. Capital One® Savor® Cash Rewards Credit Card

With this card, users can earn 4% cash back on a wide range of entertainment purchases, a broad category that includes things like tourist attractions, amusement parks, and sporting events, as well as movie theaters, bowling alleys, and dance halls. Plus, cardholders earn 4% cash back on dining purchases, and all cash back is unlimited.

This card is the lighter version of its annual-fee sibling, offering 3% cash back on the same dining and entertainment purchases as the Capital One® Savor® Cash Rewards Credit Card with no annual fee. Both cards also earn the 3% cash back on grocery store purchases and offer a solid signup bonus. (Information for this card not reviewed by or provided by Capital One.)

27. Marvel Mastercard®

The Marvel Mastercard® is a solid entertainment card that focuses on media experiences, offering 3% cash back on everything from movie theater purchases to game and software downloads and other digital entertainment.

-

-

-

-

- Earn 3% cash back on dining, select entertainment, and eligible Marvel merchandise purchases

- Earn unlimited 1% cash back on all other purchases

- Pay no annual fee

-

-

-

Cardholders can also earn 3% cash back on dining purchases, as well as unlocking steep discounts on purchases at MarvelShop.com, on Marvel Unlimited digital comics, and at the Marvel Avengers S.T.A.T.I.O.N. in Las Vegas.

Honorable Mentions: While the number of cash back cards with dedicated entertainment categories is limited, a few cards offer bonus cash back on certain types of entertainment. The U.S. Bank Cash+ Visa Signature® Card, for example, allows cardholders to pick their categories, including movie theaters and electronics stores. And, of course, the Amazon Prime Rewards Credit Card offers 5% cash back on Amazon.com purchases, including digital media downloads.

Best Cash Back Cards for Students

Although having fair or limited credit can make finding a quality credit card a challenge, being a student can make that search a lot easier. Most banks and credit unions offer student credit cards in an effort to get in with cardholders early on in their credit journeys.

Student credit cards are designed specifically for students, meaning they have flexible credit requirements that take into account the thin or nonexistent credit history of most young people. Student cards also often come with student-centered perks and special benefits that can save money and help make the credit-building process easier.

One of the few student cards that’s actually as good — or, arguably, better — than its non-student counterpart, this card offers the same quarterly rotating bonus cash back categories as the regular consumer version, plus Discover will provide a reward in the form of statement credit for approved referrals.

Another solid student option, this card is aimed at students who spend a lot of time on the go. The card also comes with free FICO credit score tracking and Discover’s unique year-end bonus program for new cardholders.

Honorable Mentions: While nearly every major credit card issuer has at least one student card, only a handful offer cash back rewards with those cards. Besides those cards already on our list, the Bank of America® Cash Rewards for Students and the Wells Fargo Cash Back College℠ Card are worth checking out.

Best Cash Back Cards for Businesses

If having a credit card has become a virtual necessity for consumers, that may be doubly true for small businesses. A reliable, affordable line of credit that can help your business buy supplies and make other important purchases can go a long way toward helping your business stay consistent through cyclical revenue or sporadic invoices.

What’s more, most business credit cards offer some form of purchase rewards that can be great tools for adding a little extra padding to your bottom line. You can find business cards that have flat-rate cash back as well as tiered cash back with bonus categories, making it simple to customize your card portfolio and maximize rewards.

This card is one of the best business credit cards on the market, and not just for its rewards — though those are substantial, offering 5% cash back in several useful categories, as well as 2% cash back on everyday necessities.

In addition to lots of cash back rewards, the card also charges no annual fee, comes with free employee cards, and has an introductory 0% APR deal on new purchases. Cardholders can also access many money-saving card benefits, including primary auto rental insurance and extended warranty protection.

This card is currently not available. Additional Disclosure: Information for this card not reviewed by or provided by Capital One.31. Capital One Spark Cash for Business

Offering unlimited, flat-rate 2% cash back rewards, this card is a good pick for businesses that have a lot of non-category spend. The annual fee is waived the first year, and the signup bonus should balance out the fee for a few years after that.

32. SimplyCash® Plus Business Credit Card

The SimplyCash® Plus Business Credit Card is a tiered cash back card that offers big bonuses on office supply store and wireless purchases. Plus, pick your own 3% cash back category from a list of popular options.

-

-

-

-

- Earn 5% cash back on purchases at U.S. office supply stores and with wireless service providers

- Earn 3% cash back on purchases in a category of your choice

- Pay no annual fee

-

-

-

In addition to charging no annual fee, this card comes with an introductory 0% APR offer good on new purchases and free employee cards. Plus, your cash back is automatically applied to your account as a statement credit each billing period, meaning you don’t need to waste time tracking or redeeming your rewards.

Honorable Mentions: The business credit card market is robust, with a ton of options, including many that offer some sort of cash back. If our top three don’t inspire you, consider the annual-fee-free Capital One Spark Cash Select for Excellent Credit or Ink Business Unlimited® Credit Card for flat-rate cash back, or the U.S. Bank Business Cash Rewards World Elite Mastercard® for tiered cash back.

Best Cash Back Cards for Fair Credit

Every consumer with a credit profile has had fair credit at one point or another, whether it was due to a thin credit history while starting to build credit, or due to a few mistakes later in your credit journey. Either way, responsible use of a credit card can help you build credit and boost your score.

While fair credit is better than bad credit, you’re still not really at the top of the issuers’ lists, so the options for cash back rewards are a little limited. The field of options is wider than for those with bad credit, however it does overlap in a few places, particularly the world of secured credit cards.

This card is designed specifically for people with fair or limited credit, and it’s one of the few unsecured cards from a major bank with flexible credit requirements and cash back rewards. The card charges an annual fee, however, so make sure the rewards you earn will be worth the cost before applying.

Although a secured card, this option is great for anyone who can afford to make at least the minimum required deposit, as it provides cash back rewards on every purchase. Plus, your account will be evaluated automatically for eligibility to be upgraded to an unsecured account.

This card is currently not available.35. Credit One Bank® Visa® Credit Card with Cash Back Rewards

The exact terms you’re offered for this card will depend entirely on your creditworthiness, with everything from the details of the rewards program to the annual fee to the interest rate varying based on your credit profile. Applicants with the best qualifications will receive the lowest rates and fees.

Honorable Mentions: While a fair credit score means you aren’t stuck with only subprime cards, secured credit cards are still likely the best option for affordable rewards cards. If you’re a student with fair credit, you can try a student card for more options. And don’t forget to check out your local credit union.

Best Cash Back Cards for Bad Credit

Although each lender and scoring agency has their own definition of good and bad credit, it’s usually not too difficult to tell when you fall into the bad credit category — they tend to spell it out in your denial notices.

With a few (expensive) exceptions, you’ll likely need to go with a secured credit card if you want to earn rewards while working on improving your bad credit. At the same time, any card available to subprime consumers will likely have a high APR, so be sure not to make purchases you can’t repay simply for the rewards.

This card is easily one of the best secured card options around. It’s a rarity in that it is a secured card with cash back rewards on purchases. The card is also upgradable to an unsecured product with responsible use. Plus, get your free FICO credit score each month to help keep an eye on your progress. Your credit line will be equal to the size of your deposit.

This card is currently not available.37. Credit One Bank® Visa® with Free Credit Score Access

While the exact terms of the rewards for this card will vary based on your creditworthiness, approved applicants will be eligible to earn 1% cash back on qualified purchases that may include gas, groceries, and many popular services. Keep in mind that your APR and annual fee will also vary based on your credit.

38. SunTrust Secured Credit Card with Cash Rewards

The SunTrust Secured Credit Card with Cash Rewards offers 2% cash back on up to $6,000 worth of gas and grocery store purchases each year, plus unlimited 1% cash back on everything else. While the card does have an annual fee, spending just $1,600 on combined gas and grocery stores purchases will put you back in the black.

-

-

-

-

- Earn 2% cash back on up to $6,000 in combined gas and grocery purchases each year

- Earn unlimited 1% cash back on all other purchases

- Pay a $32 annual fee

-

-

-

As a secured card, you’ll need to make a cash deposit to open an account. The minimum deposit amount is $300 for a credit line of the same amount, though you can make a larger deposit for a higher credit line. This card is eligible for an upgrade to an unsecured product with responsible use.

Honorable Mentions: The pool of cards for bad credit that also offer cash back rewards is fairly limited, but you may find better luck at your local credit union, as they tend to have more flexible credit requirements than those set by larger banks.

Who Should Get a Cash Back Credit Card?

Cash back credit cards are designed for people who want to earn purchase rewards with their credit card purchases, but who don’t want to bother with redeeming complicated points. Cash back can be redeemed in a few clicks for a statement credit, which can then be used to cover any of your credit card purchases.

So, in other words, you should get a cash back credit card if you want a simple, no-hassle credit card rewards system. However, there is a caveat — you should only get a rewards credit card (or any type of credit card, for that matter) if you can use it responsibly.

That means not only paying the card on time, but actually paying it in full each month to avoid interest fees. It also means not making purchases you can’t afford to repay simply to earn rewards; most cards charge significantly more in interest than they offer in rewards, so this is a losing bet.

What Are the Different Kinds of Cash Back Cards?

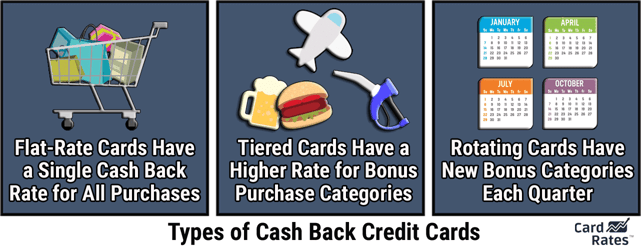

When looking for a cash back credit card, one of the first decisions you’ll need to make is about the type of rewards structure you want the card to offer. In general, cash back cards come with one of three rewards structures: flat-rate rewards, tiered category rewards, or rotating category rewards.

Flat-rate cash back cards offer a single rewards rate on every purchase, no matter where you shop. These cards typically offer fairly low rates — most cards are in the 1.5% to 2% range — but they have no categories to track or activate, making then the simplest to use.

Tiered cash back cards have a low base rate for every purchase (1% is standard), but they also offer one or more bonus cash back categories with a higher rewards rate — some up to 6% cash back on eligible category purchases. These cards can be extremely valuable if you spend a lot in the given bonus categories.

Rotating category cash back cards are essentially tiered category cards, except the bonus categories can change throughout the year. With most rotating category cards, you’ll receive a new bonus cash back category each quarter; these categories are typically fairly broad, covering popular purchases like gas and grocery stores.

How Do You Earn & Redeem Cash Back Rewards?

Many consumers like cash back rewards because earning and redeeming them is simple. To earn cash back rewards, all you need to do is use your cash back credit card to make purchases just as you would any other credit card. The rate at which you earn cash back for those purchases will vary based on the card and the purchase type.

Cash back rewards will typically show up in your online credit card account within six weeks of making a purchase, though it may be much sooner — but, at the same time, it can occasionally take up to 12 weeks.

With some cards, you’ll need to earn a certain amount of cash back before you can redeem — $25 worth of cash back is a common threshold — while other cards let you redeem cash back at any time, in any amount. Some issuers will even automatically credit your cash back to your statement each month or when you hit the threshold.

For cards that don’t automatically redeem, you’ll probably need to go through your online banking account or mobile credit card app to redeem your rewards. Most interfaces are simple, prompting you to specify how much of your available cash back you want to redeem and to which account you want it credited.

How Do You Maximize Your Cash Back?

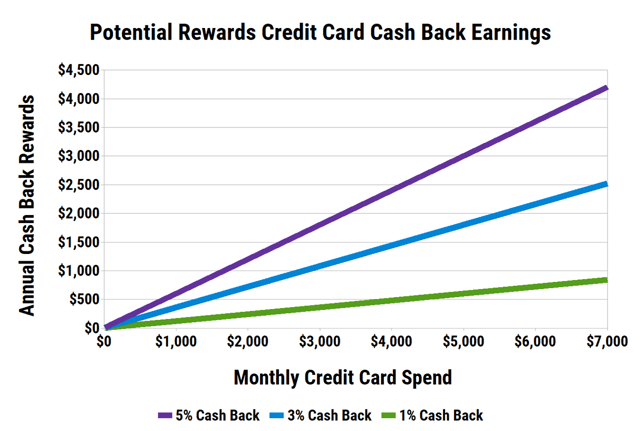

Although many consumers select cash back rewards for their simplicity, that doesn’t mean you can find ways to maximize the cash back you earn — without the level of complexity of maximizing points of miles. With cash back cards, it’s all about complementary bonus categories.

Basically, the goal for maximizing your cash back rewards is to make sure you’re getting the highest earnings rate for all of your purchases. So, you start by determining into which categories the bulk of your purchasing falls. Once you know where you spend most of your money, you can find the credit cards that best match those categories.

Always use the best rewards credit card for each purchase to avoid leaving valuable rewards on the table.

A family of five, for example, may spend a lot on groceries, gas, and utilities, with things like clothing and cellphones rounding out the spend.

In this case, the family should consider a card, like the Amex Blue Cash Preferred®, that offers bonus rewards for gas and groceries. They can pair it with the U.S. Bank Cash+ Visa Signature® Card, which will allow them to select utilities as one 5% category, and clothing stores or cellphone services as their second 5% category.

On the other hand, a young professional will likely have very different spending habits. She or he may spend more on eating out than cooking at home and spend their free time enjoying concerts or other events with friends.

This type of cardholder will want a card that offers bonus rewards on dining and entertainment, like the Capital One® Savor® Cash Rewards Credit Card, perhaps augmented with an Amazon Prime Rewards Credit Card for everyday necessities that won’t require a trip to the store. (Information for this card not reviewed by or provided by Capital One.)

Of course, nearly every consumer also has some sporadic expenses that don’t fit snugly into a common bonus category. Maybe you like subscription boxes, or enjoy crafting — these types of purchases don’t often match with a bonus category. Instead, round out your card portfolio with a solid flat-rate unlimited card to maximize these purchases as much as possible.

What is a Signup Bonus & How Do You Earn One?

In general, a credit card signup bonus is a bonus rewards offer that provides a new cardholder with a lump sum of rewards if the cardholder spends a certain amount of money with their card within a certain amount of time after opening the account.

For example, a common cash back credit card signup bonus provides $150 bonus cash back if you spend $1,000 on your card within the first three months. If you fail to reach the spending requirement by the end of the specified period, you lose out on the bonus and generally won’t be eligible for it again for that account.

The credit card signup bonus can be a win-win for both issuers and cardholders; it’s an incentive for a consumer to sign up for the card, which is good for issuers, plus it’s a nice bit of pocket change for the cardholder. However, signup bonuses are only really worthwhile if you can meet the spending requirement organically.

If you’re buying things you don’t really need, want, or can afford, just to meet the signup bonus, then you’re losing the game.

The specific terms of your signup bonus should be presented when you apply, including the minimum spending requirement and the amount of time you have to meet it. Note that only net new purchases count toward the spending requirement; balance transfers, cash advances, and returned items will not count as eligible spend.

A lot of credit card issuers are implementing strict limitations on how often you can earn a signup bonus for a specific credit card product. Most issuers limit you to one bonus per 24 months, but certain products may require up to 48 months, and American Express only allows cardholders to earn one signup bonus per product per lifetime.

Should You Pay an Annual Fee for a Cash Back Card?

While perusing the array of cash back credit cards on the market, it’s easy to see that consumers have tons of options for good rewards that don’t require an annual fee. So, it begs the question, why bother with an annual fee at all?

The short answer is: don’t. If you can find a card (or cards) that meets your rewards needs and wants without paying an annual fee, well, then don’t pay an annual fee. The longer answer is that it depends on your needs and the cards in question.

That’s because some cards can be well worth the annual fee thanks to high cash back rates or other perks. The Amex Blue Cash Preferred®, for instance, offers 6% cash back on groceries; if you spend $31 or more a week on qualifying grocery store purchases, you’ll make up the $95 fee. Since the average family likely spends at least twice that, the extra rewards can make the fee worth paying.

That said, even if you think you need a card with an annual fee to get the highest rewards rate, make sure you do the math first to ensure the extra rewards are also worth the extra cost. This can be especially important if you’re only talking about one percentage point between a card with a fee and one without the fee.

For example, consider a card with a 3% rewards rate for gas, with no annual fee, and a second card that provides 4% cash back on gas but charges a $95 annual fee. It would take $9,500 worth of eligible gas station spending with the extra 1% cash back to make up that $95 fee.

If you’ll spend more than that amount, or the annual-fee card has extra perks that add to its value, it may still be worthwhile to pay the fee; otherwise, you’ll likely be better off with the card without the fee. Of course, signup bonuses can affect the math here, as can cards that waive the annual fee for the first year, so include all the numbers in your calculations.

How Do You Choose the Best Cash Back Credit Card?

In the end, choosing the best cash back cards for you is a very individualized process that requires taking a close look at your personal spending habits to figure out your wants and needs, starting with the amount of effort you want to put forth into earning rewards.

If you just want a simple rewards card with no frills, go with a flat-rate unlimited card. You can use it for just about any purchases, you won’t need to track or activate bonus rewards categories, and most flat-rate cards for consumers with good credit won’t charge you an annual fee.

If you want to do a little more to maximize your cash back, you’ll likely want at least one good tiered cash back card that offers categories that match your expenses. Start with the card that offers the best cash back rates for the categories in which you spend the most, and work your way down from there.

Consumers whose credit scores leave something to be desired will have more limited options and may want to start with one basic card to build up credit. Once you’ve gotten your score into the good credit range, the card options will open up and you’ll have more ability to pick and choose to fit your lifestyle.

Find Big Savings with the Right Cash Back Cards

Wouldn’t it be nice if every complicated technical process in life had an “easy mode” — something that cut through the nonsense and just simplified the convoluted systems of our modern digital lives.

Yeah, and how about a flying pony while we’re at it?

Sadly, most things in life do not have “easy mode” — but credit cards rewards do, and it’s called cash back. Easy to earn, simple to redeem, cash back credit card rewards take a lot of the complexity out of the rewards game, making it easy for nearly anyone to play.

While cash back may be easy to use, however, it doesn’t erase the potential danger of credit cards themselves. Don’t let rewards lure you into irresponsible card use; only charge what you can afford to pay in full each month, and be sure you pay on time, every time, to avoid credit damage and late fees.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year]) 4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Unlimited-Cash-vs.-Customized-Cash.jpg?width=158&height=120&fit=crop)

![7+ Best “2% Cash Back” Credit Cards ([updated_month_year]) 7+ Best “2% Cash Back” Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/2-percent.png?width=158&height=120&fit=crop)

![11 Best Credit Cards for Cash Rewards ([updated_month_year]) 11 Best Credit Cards for Cash Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/CASHBACKREWARDS.png?width=158&height=120&fit=crop)

![13 Best 5% Cash Back Credit Cards ([updated_month_year]) 13 Best 5% Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/5cash.png?width=158&height=120&fit=crop)

![7 Best Credit Cards for Cash Back & Travel ([updated_month_year]) 7 Best Credit Cards for Cash Back & Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/02/Best-Credit-Cards-for-Cash-Back-Travel.jpg?width=158&height=120&fit=crop)

![12 Best “2% to 5%” Cash Back Credit Cards ([updated_month_year]) 12 Best “2% to 5%” Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Best-2-to-5-Cash-Back-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Best Bank of America Cash Back Credit Cards ([updated_month_year]) 5 Best Bank of America Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/01/Bank-of-America-Cash-Back-Credit-Cards.jpg?width=158&height=120&fit=crop)

![9 Best 3% Cash Back Credit Cards ([updated_month_year]) 9 Best 3% Cash Back Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Best-3-Percent-Cash-Back-Credit-Cards.jpg?width=158&height=120&fit=crop)