If you prioritize cybersecurity (and you should!), this review of 15 credit cards with disposable numbers should soothe some of your concerns. Disposable (or virtual) card numbers are designed to frustrate the efforts of hackers and shady merchants because any credit card information they steal will be of little or no use.

Read on to see how five different credit card issuers implement their disposable card number strategies, followed by descriptions of their top-rated cards.

Capital One | Discover | Chase | Citi | Amex

Capital One Cards With Disposable Numbers

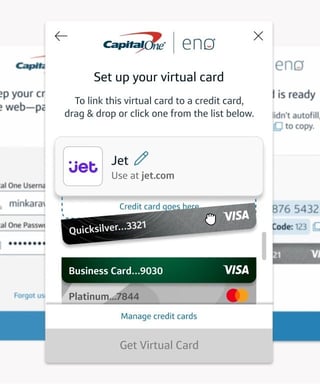

Eno generates an instant card number upon request to stand in for your actual credit card number, thereby guarding you against hacking and fraud when you shop online. Capital One Bank provides its free Eno browser extension to its cardmembers to help keep their credit cards more secure.

Eno supports virtual credit card number generation for our three top-rated Capital One cards reviewed below. It can generate an instant card number right at the checkout page, without any extra effort on your behalf.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

You start by installing the Eno extension into your browser. When you’re ready to check out, Eno pops up and allows you to sign in, after which it generates a merchant-specific virtual credit card number tied to your credit card account. Eno saves the virtual number for your future in-store and online purchase activity with the merchant and lists the online purchase transactions separately on your credit card statement.

Discover Cards With Disposable Numbers

Discover cards implement virtual card numbers through any of several compatible digital wallets, including Apple Pay, Google Pay, and Samsung Pay. A digital wallet is an app for your tablet, smartphone, wearable, and other devices, letting you check out purchases online or in-store without your physical card.

All Discover credit cards, including the three reviewed below, provide digital wallet integration to protect your card’s account number.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

A digital wallet uses tokens to substitute for account numbers whenever you use it to make a purchase. This prevents merchants and online hackers from stealing your real card information, either individually or through a massive data breach.

Chase Cards With Disposable Numbers

Chase recently decommissioned its Chase Pay digital wallet, but you can still use eligible Chase credit cards with several wallets, including Google Pay, Apple Pay, and Samsung pay. These digital wallets substitute one-use tokens for your account number when you make purchases online or in-store.

Our top-three Chase cards reviewed below all work with eligible digital wallets.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

You can add your card directly to a digital wallet or through the Chase mobile app. For instance, to directly add a Chase card to your Google digital wallet, you snap a picture of the card or enter the details manually.

Citi Cards With Disposable Numbers

A select group of Citi credit cards support disposable account numbers in two ways. You can enroll your eligible card to create virtual account numbers for online and mail-order purchases. Alternatively, you register an eligible Citi credit card with a digital wallet such as Apple Pay, PayPal (PayPal key required) Samsung Pay, or Google Pay to generate disposable tokens for online or in-store purchases.

You can enroll select Citi cards, including the two featured below, to use disposable account numbers. The credit card company generates virtual account numbers, making it almost impossible for a hacker to steal your real account number through individual targeting or via a large data breach.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

- Earn 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening.

Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024. - Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou® Points are redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% (Variable)

|

$95

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

The virtual credit card number feature uses randomly generated account numbers to substitute for your real account number. Purchases made this way appear separately on your monthly credit card statements along with the virtual account numbers used.

American Express Cards With Disposable Numbers

American Express has three separate paths to virtual numbers. Amex virtual card numbers can be used without the physical credit card for online checkouts displaying the Click to Pay icon, or you can use your Amex card in the popular wallets that substitute tokens for account numbers.

The following three top-rated American Express cards can be used for purchases with disposable account numbers. Participating digital wallets include Apple Pay, Fitbit Pay, Google Pay, and Samsung Pay.

- Earn 150,000 Membership Rewards® points after you use your new card to make $8,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 140 countries.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% Pay Over Time

|

$695

|

Excellent

|

- Earn 90,000 Membership Rewards® points after you spend $6,000 on purchases on your new card in your first 6 months of card membership

- Earn 4X Points at U.S. supermarkets on up to $25,000 per calendar year in purchases. Also earn 4X Points at restaurants, including takeout and delivery, and 3X points on flights when booked directly with airlines or on amextravel.com. All other eligible purchases earn 1X point.

- No foreign transaction fees

- Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Delight your senses when you book The Hotel Collection with American Express Travel. Get a $100 experience credit to use during your stay. Minimum 2-night stay is required.

- $250 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% Pay Over Time

|

$250

|

Excellent

|

- Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of card membership

- Earn 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com, 1.5X points on business categories and purchases of $5,000 or more on up to $2 million per calendar year, and 1X point for each dollar you spend on other purchases.

- Get up to $400 back per year toward U.S. purchases with Dell Technologies, up to $360 back per year for purchases with Indeed, and $120 back per year for wireless telephone service purchases on the Business Platinum Card, plus additional credits. Enrollment is required for all.

- Access to more than 1,400 lounges across 140 countries and counting with the American Express Global Lounge Collection®

- Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to your Business Platinum Card® Account.

- $695 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.49% - 28.49% Pay Over Time

|

$695

|

Excellent

|

Corporate Amex cards can also get virtual account numbers through American Express Global Business Travel, where clients can make use of Virtual Payment Expert and Conferma Pay to generate disposable account numbers instantly.

What is a Disposable Credit Card Number?

A disposable, or virtual, credit card number is a temporary account number or token used for either a single transaction or for a single merchant.

You can generate disposable credit card numbers using an online service from the issuer or through a digital wallet. Although the technology enabling virtual card numbers generated by a credit card company differs from that for digital wallets, the effect is the same: To limit circulation of your real account number and reduce your exposure to hacking and theft.

Virtual card numbers protect cardholders from fraudulent transactions.

Digital wallets do not share your real account number with merchants. A cardholder can use digital wallets to make in-store purchases at participating merchant locations. Some apps support digital wallets for in-app purchases, and many online sites offer a digital wallet option when checking out without a physical card.

By the way, some debit card issuers also provide virtual card numbers to protect your bank account data, including the checking account number.

In addition, some prepaid card issuers offer virtual card numbers. One such prepaid card issuer is Netspend. We are not aware of any virtual card number features for gift card transactions.

Where Can I Get a Virtual Credit Card?

First, understand that almost all credit cards can generate virtual account numbers — the only prerequisite is that the card must be compatible with one or more digital wallets. The wallet sends merchants a token instead of a real account number, making your transactions more secure and convenient.

If you would rather use a temporary credit card number supplied by the card issuer, your choices are more limited. Citi and Capital One Bank generate a temporary credit card number on demand for select cards, but this approach requires more steps than are required for a digital wallet.

Some co-branded cards, including those from Amazon.com, Apple, Target, and Walmart, support virtual card numbers as well. If you are a cardholder of any of these, check the procedures for generating a virtual card number.

Which Banks Offer Virtual Account Numbers?

Only Citi and Capital One offer free virtual account numbers upon cardholder request.

To obtain a virtual account number, Citi customers must log onto their account and find the Virtual Account Numbers feature. Upon request, the feature will generate a virtual account number, expiration date, spending limit, and three-digit CVV/CVC.

Citi and Capital One are the only issuers that offer free virtual account numbers by request.

You can use the temporary virtual account number as often as you wish and can replace it with another one at any time. Simply provide the virtual number wherever you would use your actual credit card number when making a payment online, in-app, through the mail, or over the phone. Your real credit card number is part of the transaction.

Eno from Capital One generates merchant-specific virtual credit card numbers. You can lock and unlock the virtual account number at any time. Access to Eno is available through online banking, via the Eno web-browser extension, and through the Capital One Bank mobile apps.

Is Entering Credit Card Numbers Online Safe?

We’ll go out on a limb to say that it’s pretty safe to enter credit card numbers online. However, online shopping with a credit card can be dangerous if you inadvertently do business with a shady merchant or are attacked by a hacker.

Here are steps you can take to reduce the risk considerably:

- Privacy: Shop on a private device away from prying eyes. The last place you want to shop from is a communal computer available to the public. Hackers may have placed malware on the computer to harvest credit card account numbers and passwords. If you don’t already have one, load a virtual private network tool onto your devices and use it whenever you log into an unsecured WiFi network.

- Links: Do not click on links embedded in an email, even if they appear to come from a trusted source. The links could represent a phishing attack attempting to steal your credit card information and other data. Instead, go to the sender’s website and continue from there. If you are shopping online, look for a lock symbol just before the site’s URL displayed in your browser. This ensures the identity of a remote computer and proves your identity to a remote computer.

- Payments: Whenever possible, use your digital wallet instead of your real credit card number when you check out online, in-store, or in-app. This will ensure you use a one-time token of little value to fraudulent merchants and hackers. If you use a Citi or Capital One credit card, you can obtain merchant-specific virtual account numbers from the issuer online that will limit your exposure to credit card fraud, even if the website doesn’t accept digital wallets.

- Authentication: Two-factor authentication requires you to respond to a message or email before you can access your credit card account online. This prevents thieves who’ve stolen your account details from getting into your account. Always use unique passwords for each account and don’t reuse those passwords elsewhere. Also, most credit cards will let you request account alerts for online purchases, allowing you to immediately spot unauthorized use of your credit card.

- Maintenance: Use strong passwords and change them regularly. Make sure your browser, apps, and malware protection software are up to date. Review your credit card statements for any activity you don’t recognize. Consider using personal financial software, such as Quicken and Moneydance.

No one is 100% safe from all cyber threats, but following these five steps can minimize your exposure to online risks.

Credit Cards With Disposable Numbers Provide an Added Layer of Security

You can increase your security against credit card fraud and hacks by using credit cards with disposable numbers. Citi and Capital One offer virtual card numbers on demand, while almost all credit cards can work with digital wallets to provide disposable account numbers.

It’s a risky world out there, but virtual account numbers can make it a little safer.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Credit Card Reconsideration: Phone Numbers, Tips & Options ([updated_month_year]) Credit Card Reconsideration: Phone Numbers, Tips & Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/recon.jpg?width=158&height=120&fit=crop)

![How to Get Card Numbers Online Now ([updated_month_year]) How to Get Card Numbers Online Now ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/number--1.png?width=158&height=120&fit=crop)

![11 Best Credit-Building Credit Cards ([updated_month_year]) 11 Best Credit-Building Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/build.png?width=158&height=120&fit=crop)

![How Many Credit Cards Should I Have for Good Credit? ([updated_month_year]) How Many Credit Cards Should I Have for Good Credit? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/howmany.png?width=158&height=120&fit=crop)

![7 Credit Cards With Free Credit Monitoring ([updated_month_year]) 7 Credit Cards With Free Credit Monitoring ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Credit-Cards-With-Free-Credit-Monitoring.jpg?width=158&height=120&fit=crop)

![10 Credit Repair Credit Cards ([updated_month_year]) 10 Credit Repair Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Credit-Repair-Credit-Cards.jpg?width=158&height=120&fit=crop)