Identity theft shows no signs of abating, which explains the usefulness of the best virtual credit cards as protective tools.

Most cardholders can access virtual account numbers these days thanks to digital wallets. Using virtual card numbers provides you with an extra layer of security without compromising your ability to pay for, return, exchange, or earn rewards on the items you buy. Normally, there is no monthly fee for generating virtual account numbers.

Capital One | Chase | Amex | Citi | Mastercard | Visa | FAQs

Best Capital One Virtual Credit Cards

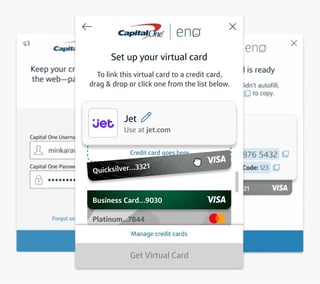

We rank Capital One on top because its Eno browser extension allows you to create a virtual number for any online merchant. You begin by clicking the Install Now button at the Eno website.

This free extension, which pops up when you visit an online checkout page, creates and saves a merchant-specific virtual card number linked to your credit card account.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won't expire for the life of the account and there's no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

When prompted for your card number, Eno will fill in the virtual number instead of your regular card number. You should save your receipt in case you want to return the purchase, but otherwise, the virtual card number operates just like the real one, including earning rewards and fulfilling any signup bonus purchase requirements.

Note that only some Capital One cards offer virtual number functionality.

Best Chase Virtual Credit Cards

You can access virtual card functionality using the Chase Pay digital wallet, which stores information about all your Chase Visa consumer virtual debit credit and credit card holdings (Chase Pay doesn’t work with business credit cards or Mastercard).

To start, sign onto the Chase.com website and add Chase Pay as a virtual payment preference under Profiles & Settings. You can now choose Chase Pay at the checkout page of participating online merchants and merchant apps, although it isn’t available for in-person purchases at store checkout lines.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

No one can use your Chase Pay wallet without knowing your Chase user ID and password. When you make a purchase using Chase Pay, the mobile wallet communicates with Visa Token Service to create a unique token that replaces your card number for the online transaction, thereby protecting your real account number from exposure.

You can also use Chase Pay at selected gas stations that feature their own virtual payment apps, including Conoco, Phillips 66, Shell, and Gulf.

Best Amex Virtual Credit Cards

Amex Express Checkout was a digital wallet that allowed you to use your eligible American Express card to make online and in-app purchases. However, it’s been replaced by Click to Pay, a universal digital wallet for American Express, Discover, Visa, and Mastercard.

You can register your American Express cards with American Express Click to Pay before using the digital wallet.

- Earn 150,000 Membership Rewards® points after you use your new card to make $8,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 140 countries.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% Pay Over Time

|

$695

|

Excellent

|

- Earn 90,000 Membership Rewards® points after you spend $6,000 on purchases on your new card in your first 6 months of card membership

- Earn 4X Points at U.S. supermarkets on up to $25,000 per calendar year in purchases. Also earn 4X Points at restaurants, including takeout and delivery, and 3X points on flights when booked directly with airlines or on amextravel.com. All other eligible purchases earn 1X point.

- No foreign transaction fees

- Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Delight your senses when you book The Hotel Collection with American Express Travel. Get a $100 experience credit to use during your stay. Minimum 2-night stay is required.

- $250 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% Pay Over Time

|

$250

|

Excellent

|

- Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of card membership

- Earn 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com, 1.5X points on business categories and purchases of $5,000 or more on up to $2 million per calendar year, and 1X point for each dollar you spend on other purchases.

- Get up to $400 back per year toward U.S. purchases with Dell Technologies, up to $360 back per year for purchases with Indeed, and $120 back per year for wireless telephone service purchases on the Business Platinum Card, plus additional credits. Enrollment is required for all.

- Access to more than 1,400 lounges across 140 countries and counting with the American Express Global Lounge Collection®

- Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees, such as checked bags and in-flight refreshments, are charged by the airline to your Business Platinum Card® Account.

- $695 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.49% - 28.49% Pay Over Time

|

$695

|

Excellent

|

When you pay with Click to Pay, the wallet substitutes a unique token for your account number, thereby limiting the information available to the merchant. Click to Pay only works at participating merchants for online and in-app transactions — you can’t use it (yet) for in-store purchases.

American Express also offers temporary virtual account numbers on newly approved cards that allow you to make card-not-present purchases until your physical card arrives.

Best Citi Virtual Credit Cards

Some Citi cards offer virtual account numbers you can use for online and mail-order purchases, with no monthly fee for the service. You must enroll with Citi before you access this feature.

Each time you want a virtual account number, you visit the Citi website and request one.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% - 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% - 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

- Earn 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening.

Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024. - Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou® Points are redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% - 29.24% (Variable)

|

$95

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

The virtual number is random and temporary, but it will appear on your monthly statement every time it’s used in a transaction. Your real Citi account number is protected from theft when you use a Citi virtual account number to make purchases.

Citi virtual numbers don’t work for in-store or in-app purchases.

Best Mastercard Virtual Credit Cards

Masterpass from Mastercard was a digital wallet service that was used for virtual Mastercard account numbers or any other credit card account, including those that used competing online payment networks (i.e., Visa, American Express, or Discover).

However, the virtual Mastercard service Masterpass has evolved into Click to Pay, a universal digital wallet service collectively created by and serving the four credit card online payment networks.

Click to Pay creates a unique random token for each online transaction that takes the place of the card’s real account number. You can use Click to Pay at checkout wherever the service’s logo is displayed.

To begin, you must register one or more cards with Mastercard Click to Pay, which requires you to create and use a password or PIN by entering the card’s account number and other identifying information. Once set up, you can use Click to Pay online or in-app (but not in-store) to make purchases at participating merchants.

Best Visa Virtual Credit Cards

The Visa Checkout digital wallet was similar to Mastercard’s Masterpass, but it too has been replaced by the multinetwork Click to Pay service that lets you register credit cards or a Visa debit card. Click to Pay generates a unique token for each online or in-app transaction that replaces a card’s account number.

You register your credit cards on Visa Click to Pay and then select the website’s Click to Pay logo for your purchase.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

You don’t need to remember your credit card information when you use Click to Pay. You simply provide the email address you registered with Click to Pay and the digital wallet does the rest.

Click to Pay offers one-click online purchasing as conveniently as its competitors (Apple Pay, Samsung Pay, Google Pay, PayPal, etc.) do.

What is a Virtual Credit Card?

A virtual credit card is one that lets you use unique virtual account numbers (or tokens) in place of your card’s real account number when making purchases. A virtual credit card provider (e.g., Citi) issues virtual account numbers upon request. However, most virtual account numbers are created using digital wallets.

The four payment networks — American Express, Discover, Mastercard, and Visa — use a jointly developed digital wallet called Click to Pay that you can use for your online shopping with participating merchants.

Click to Pay, along with Google Pay, Samsung Pay, PayPal, Apple Pay, Eno, and others, provides unique tokens to replace your card number for purchases at participating merchants. All the digital facilities for virtual account numbers work for online purchases, while some can also be used for in-app and/or in-store purchases.

How Do Virtual Credit Card Numbers Work?

The technology that implements virtual credit card numbers depends on the credit card or digital wallet you use. There are two types of virtual card numbers: those provided by the virtual credit card provider and those provided by digital wallets.

Whichever solution you choose, you must register your credit card(s) ahead of time or at checkout. You can do this online or through a mobile app.

Virtual Card Numbers from Issuers

As mentioned earlier, select Citi credit cards provide a temporary virtual number when you request one from its website. You then use the virtual account number to complete an online purchase.

Eno creates a merchant-specific virtual card number linked to your Capital One account.

Capital One offers its Eno browser extension through which you can request, use, lock, unlock, and delete merchant-specific Capital One virtual card numbers.

In addition, many American Express cards offer instant virtual card numbers that expire when your physical credit card arrives. You can use the virtual number for card-not-present transactions starting on the same day Amex approves your card application. You can request a virtual card number from Amex customer service.

A small number of store and co-branded cards offer virtual card numbers for instant access, including the Apple Card, Target REDcard, Amazon.com cards, and the Walmart Rewards Card. In some cases, you are issued a barcode on your receipt that allows you to use a new card at a retailer before it arrives in the mail.

Virtual Card Numbers from Digital Wallets

Nowadays, digital wallets are the main provider of virtual card numbers, in the form of numeric tokens available for single-click transactions.

The Click to Pay digital wallet is used by all four of the payment networks (American Express, Discover, Mastercard, and Visa), meaning that any credit card can be added to a digital wallet. As of this writing, American Express has yet to enable its signup site, but your existing Amex credit cards may be automatically enrolled if they participated in the now-defunct Amex Express Checkout program. Alternatively, you can enroll your card at checkout.

You can use a digital wallet for checkout wherever the appropriate logo is displayed. You simply select the logo, enter your user ID and/or PIN, choose a credit card if you have more than one in your digital wallet, and then let the wallet do the rest of the work. The wallet will complete the transaction using a generated token in place of your account number.

When you get your monthly credit card statement, you should be able to easily identify your virtual card number transactions. Each transaction should disclose the token used as well as all the standard information.

How Do I Get a Virtual Credit Card?

A virtual credit card provider will issue you a virtual credit card number upon request.

This usually applies when you’ve been newly approved for a card and you want a temporary card number until the physical credit card arrives. Getting a virtual number requires either speaking to a customer rep or making an online request.

Digital wallets are apps that hold information about one or more credit cards (or a virtual debit card, prepaid debit card, ATM card, etc.). You register your credit cards with a digital wallet ahead of time or, in some cases, when you are making a purchase. Once registered, you can use the mobile wallet to provide a virtual card number (or numeric token) for purchase transactions.

A digital wallet’s virtual card number features works with participating merchants and is generally available for online purchases. Some wallets can also be used for in-app and/or in-store purchases.

- Online purchase: This is a purchase you make at the checkout page of a website. Normally, you would simply enter your credit card information to complete your purchase. However, the checkout page may permit you to pay with one or more digital wallets, such as PayPal, Click to Pay, Apple Pay, Google Pay, etc., that provide virtual account numbers or tokens to replace your actual account number. A token is a unique virtual account number, usually for one-time use. However, some wallets let you reuse merchant-specific virtual account numbers. When you click on the checkout page’s wallet icon, you may be prompted for your user ID and password/PIN. After verifying your identity, the wallet completes the purchase transaction using a virtual card number/token. Your actual card details are never exposed to the merchant, making it much harder for theft to occur.

- In-app purchase: Many apps support sales and have an in-app purchase facility. Some of these apps work with digital wallets — just click on the appropriate icon. The wallet is usually preconfigured to provide a virtual account number for the transaction.

- In-store purchase: Some digital wallets work in the checkout line at brick-and-mortar stores. You simply tap the card reader with your smartphone instead of using your plastic credit card.

Digital wallets are increasingly being accepted in store checkout lines and mobile apps.

Which Banks Have Virtual Credit Cards?

The number of banks that offer virtual credit cards has dwindled to two: Capital One and Citi. The main reason for the near extinction of virtual bank credit cards associated with a bank account is that they are somewhat clunky to use and are redundant since virtual account number functionality is built into most digital wallets.

Because every bank-issued credit card will work with at least one digital wallet, banks have little incentive to offer their own virtual card number functionality.

Big banks Chase and Wells Fargo have decided to work with digital wallets to provide virtual card numbers. Bank of America discontinued its ShopSafe virtual credit card operation in 2019.

Where Can I Use a Virtual Visa Card?

You can use a virtual Visa card (available from Citi and Capital One) for card-not-present purchases at merchants and apps that accept Visa. Furthermore, you can use Visa Click to Pay for an online and in-app virtual card payment anywhere the Click to Pay icon is displayed.

Virtual Visa cards can be used anywhere the Visa Click to Pay icon is displayed.

Certain digital wallet apps, including Apple Pay and Google Pay, allow you to register Visa cards and then use the wallets in brick-and-mortar stores equipped with NFC card terminals.

Are Virtual Credit Cards Legal?

Any virtual credit card that is linked to a real account is perfectly legal. In fact, virtual credit cards and virtual account numbers are excellent to have because they reduce the risk that your account number will be stolen. Virtual account numbers also allow you to use a new credit card immediately rather than waiting for it to arrive in the mail.

However, there is another form of a virtual credit card, namely a virtual card not linked to a real account. These unlinked cards are the product of credit card generator software that create account numbers in a pattern that passes verification at checkout. The same card generators used for real cards can also be used to create fake ones.

Why would someone want to create a fake virtual credit card number? In some instances, you may use one when a company requires a credit card number even though you aren’t making a purchase. In this way, you may be able to browse websites and find out whether they are legitimate before using your real credit card.

Fake cards cannot be used to purchase goods or services since they aren’t connected to any real accounts. It is illegal to attempt to use fake cards for real purchases.

For example, hotels sometimes run your credit card when you check in but don’t seek payment until you check out. It would be illegal to book a hotel stay online using a fake virtual card, especially if you planned to depart without making a virtual card payment. Hotels solve this problem by charging you daily.

The Best Virtual Credit Cards Keep Your Info Safe

Virtual credit cards, virtual account numbers, and tokens all provide a layer of security that helps to protect you from credit card fraud and identity theft. With a virtual number, the information necessary to purchase an item on your credit card is kept at arm’s distance from merchants, who only see your virtual card number.

You can assign different virtual card numbers to different merchants and place amounts and/or time limits on their use. You can also specify that a virtual card number is for a single use.

These are all strategies that make it virtually impossible for your account to fall into the wrong hands.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Get a Virtual Credit Card Number ([updated_month_year]) How to Get a Virtual Credit Card Number ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/virtual--1.png?width=158&height=120&fit=crop)

![7 Virtual Prepaid Card Options ([updated_month_year]) 7 Virtual Prepaid Card Options ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Virtual-Prepaid-Card.jpg?width=158&height=120&fit=crop)

![11 Best Credit-Building Credit Cards ([updated_month_year]) 11 Best Credit-Building Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/build.png?width=158&height=120&fit=crop)

![How Many Credit Cards Should I Have for Good Credit? ([updated_month_year]) How Many Credit Cards Should I Have for Good Credit? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/howmany.png?width=158&height=120&fit=crop)

![7 Best Credit Cards For Building Credit ([updated_month_year]) 7 Best Credit Cards For Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-For-Building-Credit.jpg?width=158&height=120&fit=crop)

![7 Credit Cards With Free Credit Monitoring ([updated_month_year]) 7 Credit Cards With Free Credit Monitoring ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Credit-Cards-With-Free-Credit-Monitoring.jpg?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![5 Best Secured Credit Cards to Build Credit ([updated_month_year]) 5 Best Secured Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/07/Best-Secured-Credit-Cards-to-Build-Credit.png?width=158&height=120&fit=crop)