A credit card can save you money when booking a vacation rental, but you have to use the right card. That’s because websites that list vacation rentals, including Airbnb and Vrbo, don’t currently have loyalty programs. And these websites don’t have branded credit cards either, which means you have to use general travel credit cards.

Even if you want to stay off the beaten path, the cards on this list will help you maximize your rewards to help you save on the cost of your next vacation rental.

-

Navigate This Article:

Best Cards to Use For Vacation Rentals

Whether you plan to stay in a highrise penthouse in Manhattan or a luxury home in the Swiss Alps, vacation rental cards come with lots of benefits that make your trip better. Not only do they often earn higher cash back rates on travel, but they also tend to come with trip insurance and other perks.

Consider the following cards for the best experience while booking vacation rentals.

Best For No Annual Fees

Some of the best vacation rental credit cards come with no annual fee, making them an easy way to save. But these cards come with additional perks, including welcome offers and bonus cash back categories. These cards are worth a look if you prefer to avoid annual fees.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card is our top pick for no-annual-fee cards for vacation rentals. This is thanks to its combination of bonuses on everyday spending and on travel.

It earns bonus cash back in a category of your choice: travel, dining, gas, drug stores, online shopping, or home improvement/furnishings. That means you can use this card to earn extra cash back on your travel purchases.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Double Cash® Card is a great choice if you don’t want to be limited to certain categories. Its signature benefit is that you earn cash back twice — once when you spend, and once when you make a credit card payment.

You earn cash back in the form of ThankYou® Points with this card. You can redeem your points as a statement credit, direct deposit, check, gift cards, for travel, or by shopping with points on Amazon.com.

Mid-Tier Travel Cards

Travel cards in this tier have great benefits with a modest annual fee. The annual fee entitles you to higher earning rates, more generous welcome offers, and additional perks. These cards often give you excellent value for a relatively low fee.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Chase Sapphire Preferred® Card is an excellent midtier travel card to use for vacation rentals. For instance, you can transfer your points at a 1:1 ratio to one of Chase’s hotel or airline partners or redeem them for extra value in the Chase portal. Alternatively, you can redeem points for cash back, a gift card, or a statement credit.

In addition, you’ll never have to pay a foreign transaction fee with this card. The card also includes partner benefits like bonus points from Lyft and subscriptions for Instacart and DoorDash’s Dashpass.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$95

|

Excellent, Good

|

The Capital One Venture Rewards Credit Card is perfect for spending on everyday items. There are no categories to track — just use your card and earn rewards on everything you buy. There are no foreign transaction fees, so you can use it stress-free while traveling abroad.

You can book a trip using your points through Capital One Travel. Alternatively, you can use your points to reimburse yourself for past travel. The card includes benefits including 24-hour travel assistance, auto rental collision waiver, and travel accident insurance.

Premium Travel Cards

Premium travel cards pull no punches, offering some of the best credit card earning rates on vacation rentals, welcome offers, and perks. They also have some of the highest annual fees, but taking full advantage of the card’s benefits could be well worth it.

Plus, these cards often include a travel credit, which can offset a large portion of the annual fee.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The Chase Sapphire Reserve® is Chase’s most premium travel card. It upgrades the Chase Sapphire Preferred with even better benefits and perks. This includes better earning rates on things like travel and dining, plus an annual travel credit. You can also get credits to use toward Global Entry, TSA PreCheck, or NEXUS.

Membership rewards from this card include complimentary lounge access via Priority Pass™ Select, room upgrades, and daily breakfast at participating hotels. The card also comes with trip cancellation/interruption insurance, auto rental collision damage waiver, lost luggage reimbursement, and purchase protection.

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$395

|

Excellent

|

The Capital One Venture X Rewards Credit Card has some of the same benefits as the Chase Sapphire Reserve, including favorable earning rates when you book flights, hotels, and rental cars through Capital One Travel. You’ll also earn a bonus when booking vacation rentals through Capital One’s portal.

There is an annual travel credit as with the Chase card. But the annual fee on the Venture X is lower, which makes it easier to access premium card benefits. This card also currently offers a limited-time statement credit of up to $200 for vacation rentals (e.g., Airbnb and Vrbo) during the first cardholder year.

Best For Bad Credit

The credit cards mentioned so far generally require borrowers to have good to excellent credit, and not everyone clears that hurdle. If your credit score is less than 670, you may need to work on that number before applying for the best credit cards.

In that case, consider applying for a secured credit card while you work on raising your score. These cards typically require you to put a security deposit down, which can increase your approval odds despite a not-so-good credit score.

- No annual or hidden fees, and you can earn unlimited 1.5% cash back on every purchase, every day. See if you’re approved in seconds

- Put down a refundable $200 security deposit to get a $200 initial credit line

- Building your credit? Using a card like this responsibly could help

- Enjoy peace of mind with $0 Fraud Liability so that you won’t be responsible for unauthorized charges

- You could earn back your security deposit as a statement credit when you use your card responsibly, like making payments on time

- Be automatically considered for a higher credit line in as little as 6 months with no additional deposit needed

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% (Variable)

|

$0

|

Limited, Bad

|

If you have at least fair credit, you may qualify for the Capital One Quicksilver Secured Cash Rewards Credit Card. This secured credit card earns cash back on every purchase, letting you rack up more points on vacation rentals. There is no annual fee or any other hidden fees.

This card has a minimum deposit, and you may find it has a higher minimum than other secured credit cards. On the plus side, the deposit becomes your credit line and is refundable if you upgrade to an unsecured Quicksilver card later. You can also qualify for an automatic credit line increase after six months with no additional deposit required.

What is a Vacation Rental Credit Card?

A vacation rental credit card is a credit card that earns bonus points when you make a reservation on platforms such as Airbnb and Vrbo. While there are currently no credit cards with higher earning rates for these platforms, using a travel card to book a reservation with Airbnb or Vrbo is often coded as travel. Thus, you can still earn a bonus when booking a vacation rental with a travel card.

Vacation rental cards come in many varieties, from no-annual-fee cards to ultra-premium travel cards. Some are secured cards, meaning you don’t need the best credit to qualify.

Top-recommended vacation rental cards:

These credit cards often include perks that may be useful while traveling, such as trip cancellation or interruption insurance. Generally, vacation rental credit cards with higher annual fees have more generous perks.

If you regularly book vacation rentals and need a new credit card, you may want to consider a credit card with travel rewards or other benefits that apply to rentals.

What Credit Score Do I Need For a Travel Credit Card?

Travel credit cards typically require borrowers to have good to excellent credit. But there are notable exceptions, including the Capital One Quicksilver Secured Cash Rewards Credit Card. This card may be available to those with only fair credit (or worse). Check your credit report on AnnualCreditReport.com to see where you stand.

Here is a general breakdown of your approval odds for a travel credit card depending on your credit scores:

- Excellent credit: If your credit score is 800 or higher, you should qualify for most travel credit cards, including premium cards. These cards typically have the most generous welcome offers, earning rates, and extra perks.

- Good credit: With a credit score between 670 and 799, you will still be eligible for many travel cards. But you may not qualify for the most premium travel credit cards.

- Fair credit: Your options begin to dwindle when you have a credit score between 580 and 669. Cards for which you qualify may have lower rewards rates and offer fewer perks, and you may have to consider a secured card.

- Poor or no credit: If your credit score is below 580 or you have no credit history, you are unlikely to qualify for an unsecured travel credit card. You may only qualify for a secured credit card, and you should focus on repaying your existing debts or consider a credit-builder account to improve your credit score.

Remember that your credit score is just one factor in the approval process. Each credit card company may also consider your income, employment, payment history, and other factors. Your credit scores may vary depending on the credit scoring model, such as FICO or VantageScore.

What is the Best Vacation Rental Company to Use?

Vacation rental companies abound these days, and the best choice will depend on price, availability, and the amenities you want. Here are a few of the most popular vacation rental platforms:

- Airbnb: Undoubtedly one of the most popular vacation rental platforms, Airbnb has 6.6 million active listings in 220+ countries. The platform hosts various types of dwellings, including entire houses, apartments, rooms, and atypical accommodations like treehouses and yurts.

- Vrbo: Unlike Airbnb, Vrbo specializes in vacation rentals that feature entire properties rather than shared spaces. This can make Vrbo a good option for families traveling together or those who prefer more privacy.

- Booking.com: While the platform is known for hotel reservations, Booking.com also features a range of properties. These include apartments, vacation homes, and unique stays.

- Homestay: Locals on this platform host rentals and often include shared living spaces, which allow you to engage directly with the local culture. This makes Homestay ideal for those who want a more immersive experience.

Each vacation rental company has its strengths and offers different types of accommodations for a range of travelers. Your budget and the availability of a property will determine the price of accommodations whether you use Airbnb or choose another vacation rental platform.

Do the Sapphire Cards Cover Vacation Rentals?

Chase Sapphire cards have travel purchase protection plans that may apply to vacation rentals in some situations. Here are a few key travel protections available with the Chase Sapphire cards:

- Trip cancellation/interruption insurance: If your trip is canceled or cut short by sickness, severe weather, or other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per person for prepaid, non-refundable travel expenses, including passenger fares, tours, and hotels.

- Travel accident insurance: When you pay for your air, bus, train transportation, or cruise with your card, you can receive accidental death and dismemberment coverage of up to $500,000 for the Sapphire Preferred and up to $1 million with the Sapphire Reserve.

- Rental car insurance: Sapphire cards offer primary rental car insurance, which is applied before your own car insurance. It provides reimbursement of up to the actual cash value of the vehicle in case of theft or collision damage for rental cars in the US and abroad.

Chase insurance policies don’t explicitly mention vacation rentals, but these policies can be useful in some situations. Also note that vacation rentals count toward travel credits, including the annual travel credit you get with the Chase Sapphire Reserve.

Which Credit Cards Does VRBO Accept?

Vrbo accepts Visa, Mastercard, and American Express. You can book a property when the listing states 24-hour Confirmation or Instant Book.

To pay for a property using these payment methods, follow these steps:

- Find the property you want to book.

- Enter your check-in and check-out dates and the number of guests.

- Select book now.

- Enter your contact information and write a message to the host.

- Review and accept Vrbo’s rules and policies.

- Enter payment details and select book now.

Note that the available payment methods may vary depending on the country and the specific property, as the owner may have set restrictions on the payment methods they will accept.

Does Airbnb Take Discover?

Airbnb accepts Discover as a payment method, but only in the United States. As with Vrbo, accepted payment methods may vary by country. In most countries, Airbnb accepts Visa, Mastercard, American Express, JCB, and debit cards that can be processed as credit cards.

But it does not accept Discover outside the United States. Other payment methods Airbnb often accepts include Apple Pay, Google Pay, and PayPal.

Does Airbnb Count as Travel With Capital One?

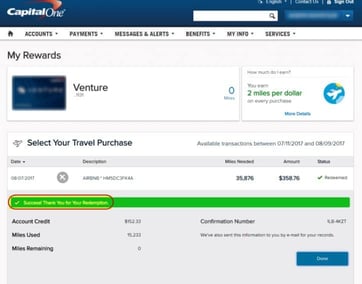

Capital One counts Airbnb purchases as travel expenses, which means you can redeem Venture miles without a reduction in point value. Venture miles are worth one cent each when you redeem them for Airbnb purchases.

You can also cover past purchases with Venture miles, allowing you to pay for past Airbnb stays. But only hotel rooms are available to book in Capital One Travel.

Find the Right Vacation Card For You

Finding the best credit card for vacation rentals isn’t necessarily about finding the one most often recommended on financial websites and blogs. Vacation rental cards include everything from secured credit cards for bad credit to premium, high-annual-fee cards for those with excellent credit.

Remember to consider your budget, how often you travel, and the perks you want from a credit card as you compare cards. This will help you find the card that makes the most sense for you and your unique circumstances.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![9 Best Credit Cards With Car Rental Insurance ([updated_month_year]) 9 Best Credit Cards With Car Rental Insurance ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-With-Car-Rental-Insurance.jpg?width=158&height=120&fit=crop)

![7 Best Vacation Credit Cards ([updated_month_year]) 7 Best Vacation Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/vacation.png?width=158&height=120&fit=crop)

![7 Best Vacation Credit Cards ([updated_month_year]) 7 Best Vacation Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/04/Best-Vacation-Credit-Cards.jpg?width=158&height=120&fit=crop)

![5 Travel Credit Cards For Bad Credit ([updated_month_year]) 5 Travel Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Travel-Credit-Cards-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Chip-and-PIN Credit Cards ([updated_month_year]) 7 Best Chip-and-PIN Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/Chip-and-PIN-Credit-Cards.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards to Use in Europe ([updated_month_year]) 8 Best Credit Cards to Use in Europe ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/europe.png?width=158&height=120&fit=crop)

![13 Best Credit Cards for Cruises ([updated_month_year]) 13 Best Credit Cards for Cruises ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/cruise-credit-cards-feat-1.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for Free Flights ([updated_month_year]) 9 Best Credit Cards for Free Flights ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Credit-Cards-for-Free-Flights.jpg?width=158&height=120&fit=crop)