Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

Your credit scores are calculated and delivered to lenders almost 25 billion times each year. For the sake of comparison, 25 billion is more than three times the earth’s population. Lenders heavily rely on your credit scores as part of their decision-making process, and it’s in your best interest to avoid having bad scores.

But what exactly is a “bad” credit score?

Scores Below 650 Are Generally Considered Bad

Commonly used credit scores, primarily those built by the Fair Isaac Corporation or “FICO,” are designed to predict the likelihood of a consumer paying 90 days late, or later, in the 24 months after the score has been calculated.

That’s a scoring model’s performance definition or its stated design objective. The VantageScore credit score, another popular scoring system, shares the same performance definition.

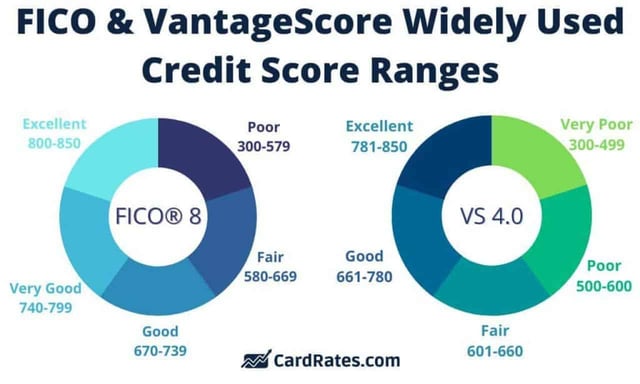

Both FICO and VantageScore’s credit scores have the same published score range, which is 300 on the low end and 850 on the high end. Although we know the actual score ranges vary slightly depending on the model variant and a consumer’s particular credit report. But, for the sake of simplicity, we’ll just stick with 300 to 850.

The average FICO score in late 2022 was 716, the same as it was in 2021. The average VantageScore credit score in 2021 was 695.

These averages should give you a number to compare your FICO and VantageScore credit scores. Anything above those numbers is considered above average, while everything at or below those numbers is considered at or below average.

There are thousands of lenders in the United States, and rarely do they publish their underwriting guidelines. Two notable exceptions would be mortgage giants Fannie Mae and Freddie Mac, which publish their underwriting guidelines in their Selling Guides, which you can see here and here.

But with the exception of mortgage loans, you don’t know your creditor’s guidelines.

That means you don’t know what your non-mortgage creditors consider to be a good score or a bad score. And, respectfully, any article you read that includes ranges of what lenders consider to be good, bad, or excellent scores is speculation. Nobody knows what every one of the several thousand lenders considers to be a bad score, and what is considered a bad score certainly isn’t uniform across all lenders.

Having said that, the lowest average interest rates on auto loans are for people who have FICO scores of 720 and above, according to data on the FICO website. The same data indicates the lowest average interest rates for mortgage loans are for people with FICO scores of 760 and above.

Instead of giving you a chart with ranges that may or may not be accurate, it’s more valuable to indicate that any credit score that results in you not getting the best interest rate from a lender should be considered a score that could use some improvement.

So if you’re looking for a home loan, 760 should be your target. If you’re looking for an auto loan, 720 should be your target. Anything below those numbers means you’ll pay more for either mortgage or auto loans. Here’s how interest rates vary across credit scores and loan types:

| Credit Score | New Auto Loans | Mortgages | Personal Loans |

|---|---|---|---|

| Superprime | 5.18% | 6.19 | 10-13% |

| Prime | 6.40% | 6.41 | 13-16% |

| Nonprime | 8.86% | 6.59 | 17-19% |

| Subprime | 11.53% | 6.80 | 28-32% |

| Deep Subprime | 14.08% | 7.78 | 36% |

Credit cards are a different story. You don’t need a 760 or even a 720 credit score to get a credit card. Plenty of credit card options exist for people with below-average credit scores, well below 700. You may not be able to get an American Express Platinum card, but you can certainly procure some form of credit card, albeit perhaps not with the most favorable terms.

The average FICO score of 716 may surprise you, as most people consider scores above 700 to be good scores. You may be surprised to learn that over the last several years, well over 20% of the scorable population — 40 million to 50 million people — had FICO scores above 800, which is considered elite using any reasonable definition.

The 716 average and the heavy load above 800 mean most people are avoiding the things that can lead to bad credit scores. They’re avoiding late payments, defaults, charging excessive amounts of credit card debt, and limiting the number of credit applications, which limits their hard credit inquiries. They’re doing all of the right things that lead to higher scores, and they’re doing them consistently, not just from time to time.

How Bad Credit Affects You

The news about credit scores certainly isn’t all good. Many people have negative information and excessive credit card debt on their credit reports, and their scores suffer as a result.

According to FICO, about 25% of the population has scores below 650, which includes a considerable percentage who have scores in the 500s. In my 31 years in the industry, I’ve never heard a lender say that FICO scores in the 500s and low 600s were anything but bad.

Scores in these ranges will lead to one of two things, credit denials or approvals with less favorable terms. A denial is, well, a denial. That means the lender cannot find any way of doing business with you because you pose too much of a risk to them. You are considered “subprime,” which is a fancy way of saying you have bad credit.

Being approved with less favorable terms means you’ve fallen into the clutches of risk-based pricing. Risk-based pricing is a lending practice whereby the lender adjusts the terms of your loan or credit card to subsidize your credit risk. They’re going to take a chance on you, so they want to make more revenue as a payoff.

This means higher interest rates, lower credit limits, and more restrictive account management practices. Conversely, if you had strong credit scores, the lender would offer you much better terms because 1) they know other lenders are doing the same and 2) you’re likely to make your payments, so they don’t have to subsidize your risk because you’re not a risky borrower.

How to Fix a Poor Credit Score

Back to the good news about credit scores. Credit scoring models do not have a memory — they don’t remember what used to be on your credit reports at any point in time. So if you had bad credit scores because of negative information on your credit reports, your scores will no longer see or consider that information once it has been purged by the credit bureaus or removed for some other reason.

If you have bad scores because of negative information and excessive credit card debt, your scores will improve as the negative information ages and your debt is reduced. You don’t have to wait for some magical date in the future for your score to suddenly be “good.”

But this doesn’t happen organically. If you want good scores, then you have to earn good scores. If you have good scores, then you have to maintain good scores. That means paying all of your bills on time, all the time.

760+ is the Goal

The takeaway here should be clear. Good credit leads to good deals. Bad credit, which varies by lender, leads to denials and more expensive approvals. Anything below 716 is below average, and scores below 650 are generally considered to be subprime or “bad.”

Although, one could argue that any score that does not lead to you getting the best deal a lender has to offer isn’t a good score. My suggestion has always been to refocus your attention away from the bad and good score ranges and target the scores that will put you in a position where lenders will be fighting over your business.

If you can get to or above 760, you’ve made it. There really isn’t a loan or credit card that requires anything above a 760, at least not one that makes a more rigorous requirement public.

And once you get there, stay there. There’s no point in working to earn 760+ scores and then doing something silly like defaulting on a credit card or not paying your car loan for a few months. If you make all your payments on time and maintain respectable amounts of credit card debt, you can easily hit 760 — and stay there.

![7 Best Credit Cards & Loans: 800-850 Credit Score ([updated_month_year]) 7 Best Credit Cards & Loans: 800-850 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/850.png?width=158&height=120&fit=crop)

![5 Credit Score Ranges for Credit Card Approval ([updated_month_year]) 5 Credit Score Ranges for Credit Card Approval ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/Credit-Score-Ranges-for-Credit-Card-Approval-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards by Credit Score ([updated_month_year]) 9 Best Credit Cards by Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/11/shutterstock_402532915.jpg?width=158&height=120&fit=crop)