Before airplanes regularly dotted the skies and automobiles congested the highways, many travelers chose to see the world by boat. At one time, consumers considered cruise vacations as reserved only for the ultra-wealthy. But with one of the best credit cards for cruises, just about anyone can take to the seas.

So, isn’t it about time you get in on the fun?

Travel Rewards Cards | Cruise Line Cards | FAQs

Best Travel Rewards Cards for Cruises

You can use several methods to turn your credit card rewards into a trip on the high seas. Whether you use a dedicated rewards portal, such as the Chase Ultimate Rewards program, or you redeem your miles as statement credits to reimburse your cruise costs, it’s easier than ever to plan your next adventure.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The Chase Sapphire Reserve® allows new cardholders to earn significant bonus points when you charge a preset amount to the card in your first three months. That bonus alone is worth a nice discount toward your next trip. And, since the Chase Ultimate Rewards platform lets you choose how you spend your points, you can save them for your cruise fare, off-shore excursions, or any other cruise-related expense.

With the Chase Sapphire Preferred® card you can earn 2X points on travel and restaurant charges worldwide and one point per $1 spent everywhere else. That means your travel purchases will accrue rewards faster — and can help you get to your next cruise sooner.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

The Capital One Venture Rewards Credit Card pays out an unlimited 2X miles on every purchase — and your miles never expire as long as you keep your account open and in good standing. You can redeem your miles for statement credits that reimburse all or part of your travel purchases, including cruise fare and other expenses.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Miles card not only pays you miles for every dollar you spend using the card, but Discover also has a unique and impressive year-end bonus program for new cardholders. By making regular purchases and saving your miles — then paired with your first year’s bonus — you can potentially earn enough rewards to pay for an entire trip.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

With the Capital One VentureOne Rewards Credit Card, you’ll earn unlimited miles for every dollar you charge to the card, and you won’t pay an annual fee. This card also provides a long introductory period with 0% interest and lets you transfer your earned miles to more than a dozen travel loyalty programs to maximize their value. This is handy if you’re not coastal and need to catch a flight to take your cruise.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Don’t let the Bank of America® Travel Rewards credit card fool you. It’s not just your average bank credit card. In addition to flat-rate points earned on every purchase, if you meet the minimum spending requirement within the first 90 days of account opening, Bank of America will award you a signup bonus you can use as a statement credit toward travel purchases, including cruise fares.

Best Cruise Line Co-Branded Cards

If you’re a hard-core fan of cruising and have a preferred cruise line, then you may want to consider that company’s branded credit card. These cards provide great perks, but typically only allow you to redeem your rewards for cruise-related purchases with that brand.

They’re also a bit limiting in that you usually only earn more than one point per $1 spent on purchases with that brand, whereas general travel cards provide bonus points in frequent spending categories, such as gas and dining. This can add up to many more cruise rewards faster.

7. Disney® Premier Visa® Card

The Disney® Premier Visa® Card works like a key to a special club during your Disney Cruise Line voyage. You’ll have access to exclusive discounts, experiences, and character photo opportunities on your cruise and in the parks.

- Earn 2% back in Disney Rewards Dollars for card purchases in select categories, 1% on everything else

- $200 statement credit after you spend $500 in the first 3 months

- $49 annual fee

This card will net you 2% back in Disney Rewards Dollars when used at gas stations, grocery stores, restaurants, and most Disney locations, as well as unlimited 1% back on all other purchases.

(Non-Monetized. The information related to Disney® Premier Visa® Card was collected by CardRates.com and has not been reviewed or provided by the issuer of this product. Product details may vary. Please see issuer website for current information. Product details may vary. Please see issuer website for current information. CardRates.com does not receive commission for this product/card.)

8. Royal Caribbean Visa Signature® Card

The Royal Caribbean Visa Signature® Card makes it easy to earn onboard credits, discounts, and other perks when you sail with Royal Caribbean. With MyCruise points, you can redeem your rewards for a host of options – including upgrades and free trips.

- Earn 2X points on qualifying Royal Caribbean purchases, 1X point on everything else

- Redeem your MyCruise points for onboard credit, discounts, and vacations

- Pay no annual or foreign transaction fees

This card often provides signup bonus options for new cardholders, so make sure you find the best deal before you apply. Most offers provide onboard credits when you meet certain spending thresholds with the card.

9. Celebrity Cruises® Visa Signature® Credit Card

The Celebrity Cruises® Visa Signature® Credit Card allows you to earn MyCruise points you can redeem with Celebrity Cruises and its sister companies. You can use your points to purchase discounts, upgrades, onboard credits, and several other perks.

- Earn 2X MyCruise points for every $1 spent with certain cruise lines such as Celebrity Cruises and Royal Caribbean®

- Earn 1X MyCruise points on all other purchases

- Pay no annual or foreign transaction fees

This card also offers a small signup bonus that pays out $100 in onboard credits after you make your first qualifying transaction on the card within 90 days after opening your account.

10. Carnival® World Mastercard®

Carnival® is one of the world’s most popular cruise lines, and the Carnival® World Mastercard® is the easiest way to earn FunPoints that get you even closer to your next adventure.

- Earn 2X FunPoints per $1 spent with Carnival and World’s Leading Cruise Lines

- Earn 1X FunPoints per $1 spent on all other purchases

- Pay no annual or foreign transaction fees

You can also earn 20,000 FunPoints — a $200 value — toward your next cruise as a reward for making your first qualifying purchase with the card. That’s a great signup perk for a card that doesn’t charge an annual fee. Redemptions start at 5,000 FunPoints for a $50 statement credit toward a Carnival Cruise Line purchase.

11. Norwegian Cruise Line® World Mastercard®

You won’t pay an annual fee with the Norwegian Cruise Line® World Mastercard®, but you’ll still earn a ton of rewards for making purchases. Start with 3X WorldPoints® on every Norwegian purchase and 1X points on all other purchases, and you can quickly accrue enough rewards for discounts and free cruises.

- Earn 3X WorldPoints® rewards points for every $1 spent on Norwegian purchases

- Earn 1X WorldPoints® points per $1 spent on all other purchases

- Pay no annual fee

New cardholders also earn a 10,000-point bonus — a $100 value — when you make your first qualifying purchase using the card within 90 days of opening the account. Redemptions begin at 2,500 points.

12. Holland America Line Rewards Visa® Card

The Holland America Line Rewards Visa® Card from Barclays offers competitive interest rates that start at 15.74%, with no annual fee and generous rewards. You can redeem your rewards for onboard credits and discounts through the popular Holland America Cruise Line.

- Earn 2X points per $1 spent on Holland America purchases, 1X point on everything else

- 5,000-point bonus after your first purchase

- Pay no annual or foreign transaction fees

The card also offers a 5,000-point bonus — worth $50 in onboard credits — after you complete your first qualifying purchase with the card. If you don’t feel like cruising, you can also use your rewards points as a statement credit toward airfare.

13. Princess Cruises® Rewards Visa® Card

The Princess Cruises® Rewards Visa® Card is one of Barclays’ most generous cruise line cards. New cardholders can earn 10,000 bonus points — good for $100 in onboard credits — after making their first purchase with the card. Since you’re not paying an annual fee, that’s free money for regular Princess travelers.

- Earn 2X points per $1 spent on all Princess purchases, 1X point on everything else

- Earn 10,000 bonus points after making your first purchase

- Pay no annual or foreign transaction fees

Besides cruise rewards, onboard credits, and special cruise amenities, you can also redeem your earned points for discounted airfare and other travel rewards — which makes this a flexible option for the on-again, off-again cruiser.

Are Cruise Credit Cards Worth It?

This depends greatly on your travel plans, spending habits, and savings goals. If you’re a regular cruise line passenger and have a preferred brand, then a co-branded cruise line card may be your best choice. These cards offer the ability to earn onboard credits, cardholder discounts, and potential upgrades.

But if you only cruise occasionally, or you’re thinking about planning your first cruise, you may find more utility from an all-purpose travel credit card.

An all-purpose travel card will let you accrue miles or points that give you complete control over how you redeem your rewards. That means you can use your rewards to pay for a cruise, get cash back to pay bills or apply them to other travel-related expenses, such as flights and hotel stays. It’s up to you.

That level of flexibility is why we often recommend cards issued by Chase, Capital One, and Discover. Through the Chase Ultimate Rewards program, you have a tremendous number of options when redeeming your rewards — and you can even transfer them to several partnered airline loyalty programs.

Capital One and Discover travel cards allow you to redeem your accrued rewards for statement credits, meaning your rewards can reimburse some or all of your previous travel purchases. These purchases can include cruises, flights, hotels, car rentals, ride-sharing services, and several other expenses.

Some cruise line branded credit cards allow you to redeem your rewards for discounted airfare, but most penalize you by lowering the value of the rewards when you choose that option. These cards want to build brand loyalty — and increase your spending with the cruise line — so most make it difficult to use your rewards outside of the company.

But that isn’t always a bad thing. If you take multiple cruises each year, you can take advantage of the discounts, onboard credits, and other perks these cards can provide on your voyage. But, when you’re walking on dry land, the cards aren’t quite as lucrative as other travel credit cards.

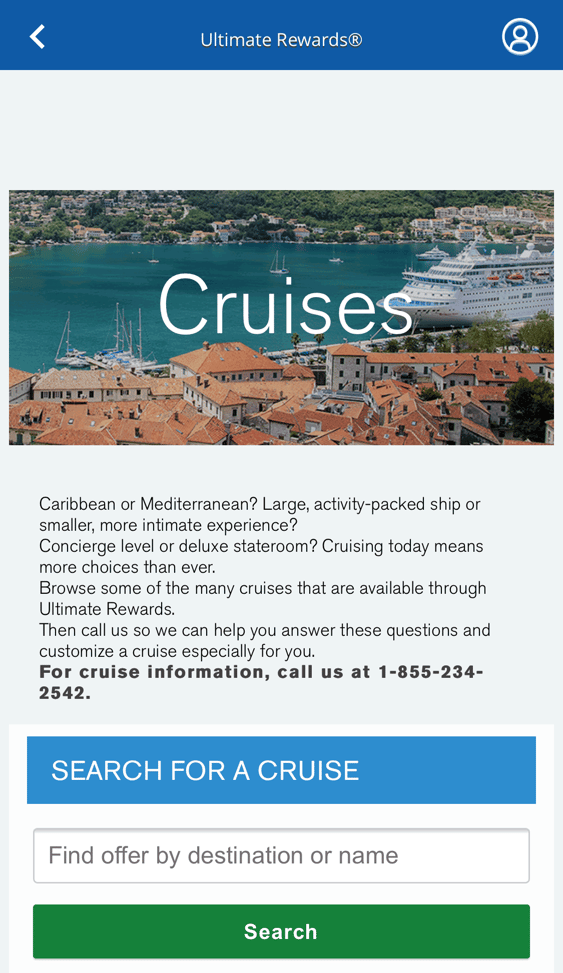

How Do I Use Chase Ultimate Rewards Points for a Cruise?

The Chase Ultimate Rewards program provides tons of travel options when redeeming your rewards points and miles — but you won’t find cruises listed among your choices.

You can browse available cruise itineraries in the Chase Ultimate Rewards portal.

But that doesn’t mean you can’t use your rewards to book a cruise. After you’ve researched and found the best cruise for you, you can call the Ultimate Rewards booking hotline and talk directly to the cruise department. A representative can work with you to book the cruise using your rewards.

Call (855) 234-2542 to reach a specialist Monday through Friday between 9 a.m. and 9 p.m. and on Saturday from 9 a.m. to 5 p.m., Eastern Time. Your travel specialist will book the cruise for you and allow you to choose how many rewards points you want to use toward the purchase.

Just keep in mind that booking your travel this way may make your points slightly less valuable than if you chose a different travel option. Chase places unique point values on different types of purchases.

For example, requesting cash back will net you 1¢ per point. Your points are worth between 1.25¢ and 1.5¢ each when you redeem them for travel using the online portal.

If you choose to transfer your points from Chase to a partnered loyalty program, you’ll find they’re worth between 0.3¢ and 6¢ each. The value depends on Chase’s agreement with each loyalty program.

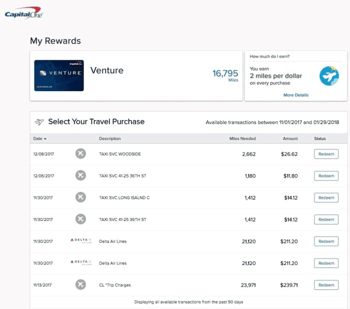

How Do I Use Capital One Miles for a Cruise?

Capital One makes it easy to use its travel rewards credit cards to get exactly what you want when you’re vacationing or traveling for business.

Many travel credit cards impose restrictions, blackout dates, and other hurdles that cardholders must jump over to redeem their rewards. Capital One lets you pick your favorite cruise line, airline, hotel brand, rental car agency, or any other company you prefer to do business with.

This is because the issuer doesn’t allow cardholders to redeem their rewards directly for travel purchases. Instead, you use your card to make a qualifying purchase and apply your awards as statement credits that cover all, or part, of the purchases.

Some consumers shy away from this type of rewards program and instead want to find a card that allows them to make direct purchases with rewards. While that may seem more convenient, it can also be more expensive and time-consuming.

Apply your available miles to eligible travel purchases at a redemption rate of 1 cent per point. Image courtesy of www.thepointsguy.com.

Using a rewards redemption portal requires you to shop for your desired purchase on the issuer’s website. You’ll find no wiggle room in the prices and many airlines and cruise lines only offer limited accommodations on these portals — meaning you’ll have to find another date to book your trip if your desired date sells out.

A card that provides statement credits allows you to shop on any website, with any travel agency or in-person merchant you choose. You will likely find more options this way and won’t be limited to your card issuer’s partnerships.

To redeem your rewards, you can simply log in to Capital One’s website or mobile app. After a few taps or clicks, the bank applies your miles to your balance. Within 24 hours, your card’s balance adjusts to reflect the amount covered by your rewards, making it one of the simplest redemption options available.

What Cruise Line Has the Best Rewards Program?

If you’re looking for the best rewards — in any credit card — you’ll want to first look at flexibility. Card issuers began dishing out rewards to build brand loyalty and incentivize customers to use their cards instead of cash.

But over the years, some of these cards have become too specialized. That’s where flexibility comes into play.

When you’re researching the best cruise line rewards program, you should first look at your preferred brand. After that, you should identify exactly how the card allows you to earn and redeem your rewards.

Some will limit you so that you can only redeem your rewards for onboard credits. That could come in handy if you’re always on a ship — but most of us don’t have that luxury.

The Princess Cruises® Rewards Visa® Card, for example, allows cardholders to redeem their rewards for discounted fares, upgrades, onboard credits, and even discounted airfare on any airline you choose.

The Princess Cruises® Rewards Visa® Card, for example, allows cardholders to redeem their rewards for discounted fares, upgrades, onboard credits, and even discounted airfare on any airline you choose.

Still, you’ll find the point values decrease when you choose to redeem them for purchases with merchants other than the cruise line. That flexibility, though, makes the Princess card a top option.

The Celebrity Cruises® Visa Signature® Credit Card allows you to earn MyCruise points you can redeem with Celebrity Cruises and its sister brand, Royal Caribbean. You can earn the same rewards and apply the same redemption options with the Royal Caribbean Visa Signature® card.

You should also look at any signup bonuses offered to new cardholders. All the cards listed in this review offer a signup bonus. For example, you’ll receive enough bonus rewards for $100 in onboard credit after you make your first purchase with the Carnival® World Mastercard®.

What’s nice about this type of signup bonus is that all it requires is a one-time purchase within a specified period after opening the account. Many general-purpose travel cards require new cardholders to meet a minimum spending threshold to achieve the bonus, though the signup bonuses are often greater.

Swipe to Sail and Save

You may need your passport and boarding pass to set sail on your next cruise vacation, but you should also bring along one of the best credit cards for cruises. That’s because these cards can be your ticket to discounts, upgrades, and the type of memories that every vacationer strives to create.

But before you click the apply button for a cruise line co-branded card, make sure it provides enough year-round value to make it worth your while. You may find that a good all-purpose travel rewards credit card gets you aboard your next ship much faster.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Travel Credit Cards For Bad Credit ([updated_month_year]) 5 Travel Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Travel-Credit-Cards-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Chip-and-PIN Credit Cards ([updated_month_year]) 7 Best Chip-and-PIN Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/Chip-and-PIN-Credit-Cards.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards to Use in Europe ([updated_month_year]) 8 Best Credit Cards to Use in Europe ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/europe.png?width=158&height=120&fit=crop)

![7 Best Credit Cards for Free Hotel Stays ([updated_month_year]) 7 Best Credit Cards for Free Hotel Stays ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-Free-Hotel-Stays-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for Free Flights ([updated_month_year]) 9 Best Credit Cards for Free Flights ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Credit-Cards-for-Free-Flights.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards To Use Abroad ([updated_month_year]) 7 Best Credit Cards To Use Abroad ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-to-Use-Abroad.jpg?width=158&height=120&fit=crop)

![5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year]) 5 Best Air Miles Credit Cards: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Air-Miles-Credit-Cards-With-No-Annual-Fee.jpg?width=158&height=120&fit=crop)

![12 Ways Credit Cards Help Save on Vacations ([updated_month_year]) 12 Ways Credit Cards Help Save on Vacations ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/05/Ways-Credit-Cards-Help-You-Save-on-Summer-Vacations.jpg?width=158&height=120&fit=crop)