The best home improvement & repair loans can quickly transform your home from the outhouse to the penthouse.

You can fund your home repairs or upgrades with a personal loan or a home equity loan. And, depending on your credit score or the equity in your home, you may get an affordable interest rate, monthly payment, and repayment term that makes the debt more manageable.

And while we may not be handy with a hammer and nail, we definitely know a thing or two about loans.

-

Navigate This Article:

Personal Loans For Home Improvement & Repairs

You can use the proceeds of an unsecured personal loan any way you wish. That means you can pay a contractor or buy the materials and complete the job yourself.

The networks below are not lenders. They partner with lenders around the country that can approve your loan request in a matter of seconds. You may receive multiple loan offers to choose from within minutes of submitting your loan request — and you can have money in your account by the next business day to jump-start your home projects.

1. MoneyMutual

- Short-term loans up to $5,000

- Online marketplace of lenders

- Funds available in as few as 24 hours

- Simple online form takes less than 5 minutes

- Trusted by more than 2 million customers

- Not available in NY or CT

The lenders that partner with MoneyMutual have no minimum credit score requirements for loan approval. These lenders give the same consideration to every homeowner, whether they have excellent credit or a bad credit history.

Each loan offer you receive from MoneyMutual will come with a different loan term, interest rate, and monthly payment. Be sure to study each financing option carefully to choose the one that’s right for you.

2. CashUSA.com

- Loans from $500 to $10,000

- All credit types accepted

- Receive a loan decision in minutes

- Get funds directly to your bank account

- Use the loan for any purpose

You can get approved for a home renovation loan quickly through the CashUSA lender network. This group offers both secured loan and unsecured loan options with a fixed rate of interest that makes your loan terms easy to understand.

The loan amounts offered will vary by lender, as will any origination fee or other charges added to your loan. A borrower with a good credit history will qualify for a lower interest rate, but this network will consider borrowers with bad credit.

3. BillsHappen®

- Quick loans of up to $5,000

- Submit one form to receive multiple options without harming your credit score

- All credit ratings welcome to apply

- Requires a driver's license, bank account, and SSN

- Get your funds as soon as tomorrow

The BillsHappen network of lenders can help you get the home renovation loan you need with an annual percentage rate that works for you. The entire process can take less than one hour to complete, and you can have money in your account by the next business day.

And with both secured loan and unsecured personal loan options available, your chances of finding a lender to work with significantly increase when you tap into this vast network.

4. CreditLoan®

- Loans from $250 to $5,000 available

- Cash deposited directly into your account

- Get money as soon as tomorrow

- Bad Credit OK

- More than 750,000 customers since 1998

CreditLoan.com maintains two credit networks — one for consumers who have good credit or excellent credit, and another for those who have fair credit or poor credit. This means your loan application will only go to lenders ready and willing to work with you.

And unlike a bank or credit union, these lenders offer various loan options tailored to your needs and budget. That means a fair annual percentage rate and potentially more than one financing option to choose from.

- Loan amounts range from $500 to $10,000

- Compare quotes from a network of lenders

- Flexible credit requirements

- Easy online application & 5-minute approval

- Funding in as few as 24 hours

BadCreditLoans.com is a good home repair loan option for consumers with a poor credit history who may struggle to get a loan from a bank or credit union. This network only partners with lenders that specialize in bad credit loans, which can be used for home improvement financing.

Your loan request will take less than five minutes to complete, and you may receive loan approval within minutes of applying. Each loan option presented to you will have different terms and loan amounts.

- Loan amounts range from $1,000 to $35,000

- All credit types welcome to apply

- Lending partners in all 50 states

- Loans can be used for any purpose

- Fast online approval

- Funding in as few as 24 hours

PersonalLoans.com offers the largest loan amounts on this list, which may be enough to serve as a construction loan for heavy-duty renovations. Thanks to automated underwriting, the lenders that partner with this network can process a homeowner’s loan request at any time of the day or night.

That means you don’t have to wait around for normal business hours to find out whether you’re approved. That puts the power back into your hands and makes it easy to find a home improvement loan on your schedule.

Home Equity Loans For Home Improvement & Repairs

The mortgage servicers below are a great option for any homeowner who has equity in their home. That’s because you can tap into a home’s equity to get a loan or a home equity line of credit (HELOC) with a lower interest rate than that of the personal loans listed above.

7. eMortgage®

- Refinance loans, new home purchase, and reverse mortgages

- Compare lenders with no obligations or fees

- Simple and secure form

- Receive up to 5 free rate quotes in 2 minutes and see what you can save on your payment.

- Rates are at historic lows

You can submit a refinance or cash out refinance request through eMortgage to be partnered with a direct lender that can help you tap into your home’s equity.

You don’t have to pay to use this service, which makes it easy to compare home equity loan terms, including the closing costs and refinance fees.

- Options for home purchase or refinance

- Get 4 free refinance quotes in 30 seconds

- Network of lenders compete for your loan

- Trusted by 2 million+ home loan borrowers to date

- Interest rates are near all-time lows

The FHA Rate Guide can help you find a mortgage loan, a rehab loan, a home equity loan, or any other type of home loan. This network specializes in helping borrowers find government-backed FHA home loans with lower closing costs and down payment requirements.

FHA Rate Guide provides an affordable and safe way to secure a home repair loan without blowing your budget — and, as a homeowner, you certainly know how easy it can be to overspend.

Can I Use a Personal Loan For Home Improvements and Repairs?

You can use a personal loan for any purpose you choose, including home improvements and repairs.

Personal loans are popular because they’re far more flexible than any other loan type. For instance, you can’t use an auto loan as a home loan or to fund a vacation.

A personal loan puts money into your account and allows you to spend it in any way that you choose. That means you can send it to a contractor to pay for home repairs or to buy the materials to do the job yourself. If there’s money left over, you can save it or spend it at your discretion.

But depending on where you apply for a personal loan, the loan amounts and fees will vary wildly. Some lenders offer personal loans as small as $200, and others set a cap at $100,000 or more. You may encounter varying origination fees and your interest rate could be anywhere from 1% to 36% and beyond.

This broad spectrum of amounts and terms takes into account the needs of a large cross-section of consumers, making these loans accessible to many people — regardless of their credit history or financial background.

How Do I Apply For a Home Improvement Loan?

You can get the funding you need for any home improvement job — big or small — by applying for a personal installment loan or by tapping into your home equity with a loan or line of credit.

Either will provide you with cash for your job, but the application process is a bit different for each.

How to Apply For a Personal Loan

The easiest way to apply for a personal loan for your home improvement project is to work with an online lending network, such as those listed above.

These networks partner with numerous lenders throughout the U.S., which means your single loan request will be seen by several lenders. These lenders will then compete for your business — which means you’ll get their best offer without needing to negotiate.

You can submit a loan request to any network without harming your credit score. That’s because each network uses a soft credit pull to access a modified version of your credit history to send to each lender.

Your initial loan request will take less than five minutes to complete. Thanks to automated underwriting, you can submit this request at any time of the day or night and receive a credit decision within seconds. You’ll often receive an email within minutes of submitting your loan request, and it may contain multiple loan offers from which to choose.

Once you choose the offer that suits your needs, the network will forward you to the lender’s official website to complete your loan agreement. After that, the lender will sign off on your loan during normal business hours and initiate a funds transfer to deposit the borrowed funds in your bank account by the next business day.

This is important to note because your loan may take longer to process if you apply during a weekend or holiday.

Online lending networks provide several advantages that traditional lenders can’t match. For one, your loan request reaches many lenders at once. When you apply for a loan with a bank or credit union, you’ll only work with that one provider. That means you’ll potentially receive only one take-it-or-leave-it offer.

When you leverage your spending power and work with many lenders at once, you’ll benefit from competing offers designed to win your business.

Also, the lenders that partner with lending networks are often trained in special finance packages and can work with consumers who have any type of credit history. That simply isn’t the case with traditional brick-and-mortar bank lenders that look to avoid risk by only working with clients who have excellent credit histories.

How to Apply For a Home Equity Loan

A home equity loan or line of credit allows you to reclaim some of the difference between your home’s value and your mortgage loan balance. For instance, if your home is valued at $300,000 and you owe $80,000 on your loan, you have $220,000 in equity in the property.

While most home equity loans don’t allow you to borrow 100% of your equity, you can often acquire a sizable loan or line of credit that makes up a majority of your equity.

A home equity loan has affordable interest rates and requires a monthly payment to satisfy the debt. A home equity line of credit is similar to a credit card in that it provides you with a credit line that you can draw from. You only repay what you use, just like a credit card.

Many banks and credit unions provide both of these home equity products and allow you to apply in a branch or online. The drawback of this method is that your application is only considered by the institution you’re applying to.

Instead of limiting your options, the mortgage networks listed above can connect you with multiple lending sources ready and willing to work with you.

How Can I Affordably Finance a Home Improvement Project?

The fastest way to finance your home improvement project is with a personal loan.

Also known as an installment loan, these financial products allow you to borrow a set sum of money and repay your debt over a series of monthly payments — also known as installments.

When you satisfy your debt over time, you’re making small payments that won’t stretch your monthly budget beyond its means. And since the online lending networks listed above offer very competitive interest rates on their loan packages, you won’t have to overpay for finance charges.

And the lenders that partner with the networks can move fast to ensure you have access to the money you need — often within one day.

With eMortgage or FHA Rate Guide, you can fill out a short form specifying what you’re looking for, and each network will use it to source the most affordable mortgage loans among its partners. While FHA Rate Guide specializes in government-backed FHA and HUD loans, eMortgage is a refinance expert and has a large network of lenders that can refinance your home or help you tap into your equity.

Once you choose a lender and loan option, the network will forward you to that lender’s website, where you will complete your loan paperwork. Unlike a personal loan, a home equity loan is a more detailed process that may take two to six weeks to complete.

What’s the Best Type of Loan to Fund Home Repairs?

An unsecured personal loan is one of the best types of loans to fund home repairs. This loan does not require collateral for approval, and you won’t have to risk your personal property to get the loan you need.

A secured loan, including some forms of home equity loans, may use your home as collateral. If something happens and you cannot repay your debt on time, the lender has the legal authority to foreclose on the loan and take possession of your home. That’s a very risky proposition for any family to take.

However, home equity loans and lines of credit provide much lower interest rates than do personal loans, especially if you have bad credit. The savings may be significant and is worth considering if you have equity in your home.

An unsecured personal loan only requires your signature on a legally binding document that guarantees repayment of the loan. That’s why these loans are often referred to as signature loans.

Thankfully, through the online lending networks listed above, lenders are available that offer unsecured loan options to all consumers, even those with bad credit. With these loans, you can affordably fund your home improvement project and begin the process of rebuilding your credit score with timely payments.

How Much Will a Home Improvement Loan Cost?

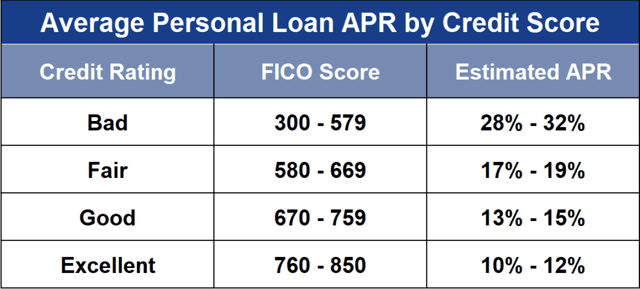

The total cost of your home improvement loan will depend on several factors — including the amount of your loan, the lender’s fee structure, and your credit score.

Some lenders charge specific fees that other lenders don’t. This can change the overall cost of your loan. You may find that the interest rate for your loan is lower — and more affordable — if you have good credit.

Those who have bad credit or recent negative marks on their credit report may encounter more fees that the lender puts in place to offset the risks involved with the loan. Typical loan fees include:

- Interest charges: This is a sliding scale charge that depends on your credit score. And the lower your rate, the less expensive your loan. Longer loans will cost more because they extend the number of payments — including interest payments — you make to satisfy your loan.

- Closing costs: Home equity lenders usually charge closing costs intended to cover the time and expense that goes into processing and preparing your loan. This fee is usually 2% to 5% of your overall loan amount.

- Origination fees: These are similar to closing costs, only this fee covers the time and effort it takes to prepare and process your loan application. Consider these the same as an application fee or a processing fee.

- Late payment fee: If you submit your monthly payment after its due date, you’ll likely have to pay a late payment fee. This is either a flat fee that’s added to your current or next monthly payment or a percentage of the overall payment amount.

Your loan may include all of these fees or just one. The only way to know for sure how much you’ll pay to satisfy your loan is to study the loan offer.

When Will I Receive My Loan Funds?

The online lending networks listed above can all fund your approved personal loan within one business day. The best time to apply for an online loan is early on a weekday. By doing so, you can complete the entire process during normal business hours and have money in your account by the next morning — if not earlier.

The application process typically takes less than five minutes to complete. Within minutes, you could receive multiple loan offers to choose from. Once you choose a loan offer that suits your needs, the network will forward you to the lender’s official website, where you’ll spend the next hour completing the loan agreement.

The lender will sign off on your loan during normal business hours. It will then release the funds to your checking or savings account and it will arrive within one business day. Some lenders can expedite your loan processing and have the money in your account immediately for an additional fee.

Just remember that you may have to wait longer to receive your money if you apply for your loan during a weekend or holiday. But you can still apply for a loan at any time of the day or night using the network’s website.

These networks are prepared to process your loan request 24/7 and provide a rapid loan decision within a matter of seconds.

A home equity loan or line of credit is a more involved process that requires communication with your original mortgage lender and substantial paperwork to prove your creditworthiness and financial abilities.

On average, a home equity loan will take between two and six weeks to complete. The amount of time you’ll need to close your loan will depend on the quality of your record-keeping and the amount of the loan you require.

Will I Need Collateral For a Home Improvement Loan?

You will not need collateral if you accept an unsecured personal loan or any other form of unsecured loan.

A secured loan requires collateral to back the loan in case of default. There are several types of secured loans and each requires varying types of collateral.

A home equity loan or line of credit is a secured loan that uses your home as collateral. These loans give the lender permission to foreclose on your home if you stop making payments on your debt.

Other forms of secured loans require collateral for approval, including auto loans and pawnshop loans. To avoid these loans, only apply for unsecured loans — also known as signature loans or installment loans — that will lend you money without the need of risking your valuable possessions.

Study each loan offer carefully before accepting one to make sure you agree to a loan that you’re comfortable with.

The Best Home Improvement & Repair Loans to Get Your Project Moving

Home repairs are essential for maintaining a safe, healthy, and happy lifestyle. Whether you need to make immediate repairs or add a room to your home for a new addition to your family, the job must be done right — and on time.

You can ensure this happens with one of the best home improvement & repair loans listed above. When you get access to a personal or home equity loan, you can get the money you need to pay for the necessary job.

And as with most things in the homeownership world, money talks. These loans are the easiest way to get your job started and completed without headaches or lost sleep.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Auto Repair Loans For Bad Credit ([updated_month_year]) 7 Auto Repair Loans For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/12/Auto-Repair-Loans-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![5 Best Credit Repair Companies ([updated_month_year]) 5 Best Credit Repair Companies ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/09/shutterstock_1668079426.jpg?width=158&height=120&fit=crop)

![5 Best Credit Cards for Auto Repair ([updated_month_year]) 5 Best Credit Cards for Auto Repair ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Car-Repair-Credit-Cards.jpg?width=158&height=120&fit=crop)

![10 Credit Repair Credit Cards ([updated_month_year]) 10 Credit Repair Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/11/Credit-Repair-Credit-Cards.jpg?width=158&height=120&fit=crop)

![Can I Use Credit Cards Before Closing on a Home? ([updated_month_year]) Can I Use Credit Cards Before Closing on a Home? ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Can-I-Use-My-Credit-Card-Before-Closing-on-a-Home.jpg?width=158&height=120&fit=crop)

![7 Best Low-Credit-Score Loans ([updated_month_year]) 7 Best Low-Credit-Score Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Low-Credit-Score-Loans-Feat.jpg?width=158&height=120&fit=crop)

![5 Auto Loans For Fair Credit ([updated_month_year]) 5 Auto Loans For Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/02/Auto-Loans-For-Fair-Credit-5.jpg?width=158&height=120&fit=crop)