Homebuyers are well-advised to be mindful of their credit usage when applying for a home loan and waiting for it to close. But does that mean you can’t use your credit cards at all during this time?

Not exactly.

While there are some specific card-related activities you should avoid when buying a home, you can continue to use your cards to make everyday purchases as you normally would.

The activities you should avoid directly affect your credit scores or debt-to-income (DTI) ratios — two important parts of your financial life that factor into your ability to be approved for a mortgage. Disrupt them, and your home closing could be delayed or, worse, canceled by your lender.

How Card Use Affects Your Credit Scores

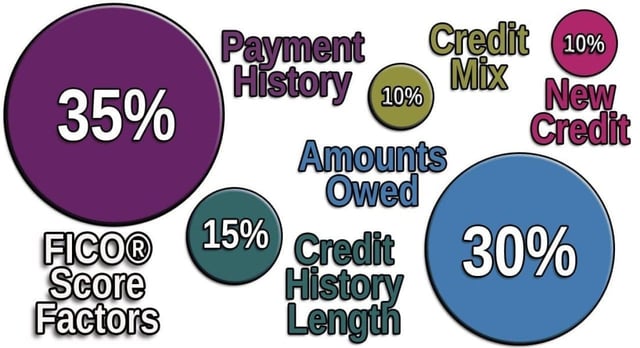

It’s no secret that credit card debt can affect your credit scores. In fact, card debt can affect every aspect of your scores, including your payment history, your utilization ratio, the length of your credit history, the mix of types of credit you’ve used, and whether you’ve recently applied for more new credit.

If you have excellent credit, small changes in your credit scores while waiting for your home to close probably won’t have a material impact. It’s when your credit scores are closer to the danger zone that you’ll need to be careful.

Your lender should be able to give you some insights into how well you’ve managed your credit and whether a dip in your scores — even if it’s temporary — may adversely affect your home closing.

The details can be complicated and involve a lot of variables. To keep things simple, your lender may advise you not to use your cards at all, even though that drastic step may not be necessary.

How Card Usage Affects Your DTIs For a Home Loan

Your DTI helps your lender determine whether you earn enough income to afford your minimum payments for your existing debts plus your new home loan.

Most lenders use two DTIs. The “front-end” DTI is calculated as the expected housing expenses (e.g., mortgage payment, property tax, homeowner insurance premium) divided by your gross income.

The “back-end” DTI includes your expected housing expenses, plus your minimum monthly payments for your car loans, student loans, credit cards, personal loans, and other debt. As you can see, credit card debt doesn’t affect your front-end DTI, but it can affect your back-end DTI.

When lenders calculate DTIs, they don’t all use the same guidelines to determine what counts as income (e.g., salary, bonus, dividends) or debt (e.g., mortgage, auto, student, credit cards).

Those differences mean calculating DTIs generally isn’t a doable DIY project for homebuyers. You’ll need to ask your lender for details.

DTIs can be a factor in more than just whether you’ll qualify and whether your home loan will close. They can also affect the type of loan, annual percentage rate (APR), and maximum loan amount you’ll be offered when buying a home.

What DTIs Do Home Lenders Require?

There’s no one specific DTI you must have to qualify for a home loan. Instead, the DTIs you’ll need will depend on your credit scores, your down payment as a percentage of your new home’s purchase price, how much cash you’ll have after your loan closes, and the type of loan you want, among other factors.

Some lenders and loan programs are more flexible than others. Using your credit cards could be riskier if your DTIs are very close to the margin between qualifying or not qualifying for the loan amount and interest rate you want.

You’re not out of the woods on this issue once you’ve been prequalified for your loan. That’s because your lender will probably take a last look at your credit scores and DTIs a few days before your closing.

If your scores or back-end DTI deteriorated because you ramped up your card use and spiked your minimum monthly payment, your final loan approval could be delayed or even canceled.

The same caution applies to other types of debt, such as a new car loan, personal loan, student loan, store cards, or another home loan. In all cases, it’s wise to wait until your home loan closes before you apply for additional credit.

As you count down the days until your closing, you may be tempted to make big purchases or apply for new cards because you think they won’t affect your credit scores or DTI until after your home loan closes.

That thinking could prove risky because real estate closings are often delayed for various reasons. If your closing is pushed off, even for just a day or two, your seemingly last-minute transactions or new credit applications may not be as safe as you thought.

Two other activities you may want to delay until after your home loan closes are asking your card companies for higher credit limits and closing any of your card accounts. Those activities could affect your credit scores or DTIs, which, again, your lender may double-check before your loan receives final approval.

For most homebuyers, the goal isn’t to zero out their card balances or rocket their credit scores into the stratosphere. The goal is to keep your credit situation stable and within your lender’s guidelines until your loan closes.

Best Cards For New Homebuyers

As a new homeowner, you’ll have many excellent choices for new cards to update your home, purchase more furniture, and earn cash back, points, or travel rewards along the way.

Some cards offer attractive card benefits for new homeowners, including cash signup bonuses, promotional 0% APRs, and extra rewards for shopping at warehouse clubs. You can also use your cards to buy tools and materials for home improvement projects or pay home improvement or repair contractors for their services.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

Making your new mortgage payments on time every month may even help boost your credit scores further and give you access to even better cards with premium perks, benefits, and rewards.

Waiting to buy new furniture, appliances, and other goods for your new home until after your loan closes may seem like a hardship. But remember, the delay is only temporary.

As soon as your home loan closes, you can apply for new cards, request higher limits, and move forward with your plans — and purchases — for your new home.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year]) 3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/closecard.png?width=158&height=120&fit=crop)

![8 Best Home Improvement & Repair Loans ([updated_month_year]) 8 Best Home Improvement & Repair Loans ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/09/Best-Home-Improvement-Repair-Loans.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying Gift Cards ([updated_month_year]) 7 Best Credit Cards for Buying Gift Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Best-Credit-Cards-for-Buying-Gift-Cards-Feat.jpg?width=158&height=120&fit=crop)

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year]) 4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/biznocredit.png?width=158&height=120&fit=crop)