Your credit score is more than a number — it’s a magic key needed to unlock the door to a better life. When managed wisely, your credit can help you reach various goals and milestones, like buying a house or starting a business, and it can provide access to many conveniences that allow for a more comfortable life.

On the flip side, poorly managed credit can keep you from getting ahead in life by limiting access to important daily essentials and increasing the cost of borrowing money and opening accounts.

Organizations use credit scores to determine how responsible you are with money and how likely you are to repay a loan or pay your bills on time. The better your score, the less risk you pose, and the more likely that company is to do business with you.

The impact credit plays in your everyday life may not be obvious, but it has far-reaching consequences when you aren’t keeping it in tip-top shape.

Here are eight ways credit affects outcomes across several areas of your life.

1. Borrowing Money

If you’re hoping to buy a home or car, start a business, or go to college, you may need to borrow money to do so.

Any time you approach lenders for a loan, your credit will be the first and most important piece of information they assess to determine your likelihood of paying back the money and interest. If your credit score is on the lower end of the range, your loan request may be denied.

Even if you get approved for a loan, it’s going to cost you more money if your credit score is languishing.

A study from the Urban Institute found that borrowers with subprime credit scores pay nearly $400 more in interest for a $550 emergency loan over three months. They’ll also pay $3,000 more in interest for a $10,000 used-car loan over four years than borrowers with prime credit scores.

Higher interest fees and other charges are used to offset the risk you pose to lenders when you have a less-than-excellent credit score, with costs rising the worse your score is.

2. Renting a Home

Landlords take on a lot of risk when they welcome new tenants into their homes. As a result, they need to fully vet the potential candidate’s ability to pay rent every month, thus requiring a credit check for all applicants.

Those with less than a good score will likely be denied unless they can get someone to co-sign on the lease. Otherwise, it will be difficult to find housing, and options will be limited.

3. Qualifying For Robust Rewards

As long as you pay your balance off in full each month, a credit card is a helpful financial tool that can offset costs of travel and other purchases.

Cards offer cash back, air miles, or points for your everyday spending, thanks to the many rewards programs offered these days.

However, the best rewards programs are limited to consumers with tip-top credit scores. These types of offers can truly help you get ahead, but a low credit score will keep you from getting approved to a top-tier rewards card.

4. Opening a Utility Account

Basic living necessities, including utilities such as water, gas, electricity, and internet, can be denied or become more costly to access if you have bad credit.

Since these service providers face a risk that you may not pay your bill in full or on time every month, they may slap you with fees to offset that possibility.

You won’t be on the hook to pay interest, but you will likely be required to make a security deposit to open a utility account. Otherwise, you may need a co-signer for your account to be approved.

5. Setting Up a Cellphone Plan

Major wireless carriers require a credit check when opening a new cellphone plan, and those with bad credit may be denied account approval.

To offset the risk of taking on a customer with bad credit, these cellphone companies often request steep deposits. If you don’t have enough money for the deposit, your only option may be a prepaid phone plan.

6. Signing Up For Insurance

A perfect driving record may not be enough to offset the cost of a low credit score when it comes to auto insurance.

TheZebra.com found that drivers with bad credit paid $1,500 more than those who had identical driving records but excellent credit scores. Renters and homeowners insurance can also cost more if your score is less than stellar.

7. Landing a Job

Credit scores can even get in the way of landing a new job. According to a CareerBuilder.com survey, 29% of employers run credit checks on potential candidates to ensure they’re the right fit for the position and to avoid costly issues that can come with hiring the wrong person.

A credit check may be required of candidates applying for management roles and those whose duties include handling company money. A bad credit score can keep you from taking the next step in your career and growing your income.

8. Finding Love

Bad credit can be a dealbreaker when it comes to finding love. Research by Experian found that half of Americans responding said that credit scores are important when choosing a partner.

Another study from FreeCreditScore.com reports that around 30% of women and 20% of men surveyed said they would not date someone with a low credit score.

Regularly Monitor Your Credit Reports & Scores

Although credit plays a crucial role in people’s everyday lives, many Americans don’t take an active role in managing and monitoring their credit scores or credit files. Only 33% of consumers reviewed their credit files in 2020.

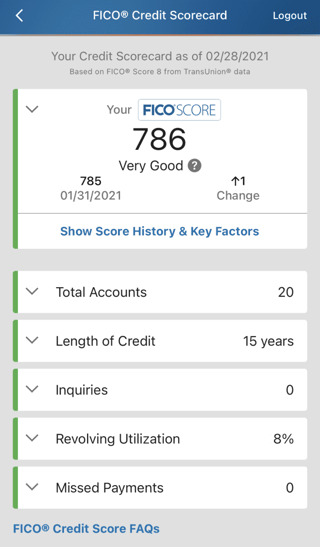

It’s easier than ever to stay on top of your credit as many financial institutions, including banks and credit cards, have programs that allow you to closely monitor your score.

For example, Capital One’s CreditWise and Discover’s Credit Scorecard program monitor your credit score and send you notifications when they detect changes. Plus, you don’t have to be a cardmember — these services are free for anyone to use.

Another site worth signing up for is Credit Karma, which sends email notifications when it detects a credit score change (good or bad), so you can take action immediately when necessary.

Equally important is reviewing your credit reports. A recent study by Consumer Reports found that over a third of Americans had at least one error on their credit report, and since no one else is going to catch or fix these mistakes for you, it’s on you to take charge.

You can get a free credit report every year from each of the three credit reporting agencies, Experian, Equifax, and TransUnion. However, during the pandemic, these bureaus are continuing to offer free weekly online credit reports that you can check on AnnualCreditReport.com.

Quick Credit Fixes

There are many negative consequences of having bad credit, but don’t let this discourage you. The good news is that you can always improve your credit and work toward obtaining the new financial benefits of having an excellent score.

Here are six ways to begin rebuilding your credit score:

- If your credit history is limited, consider opening a new account to diversify your credit mix.

- Make payments on time each month and enable autopay if you’re forgetful.

- Pay off debt faster by paying double to triple the minimum due on credit card or loan accounts.

- Use no more than 30% of your available credit at any time. Paying your balances down will help improve your credit utilization ratio, which accounts for 30% of your FICO credit score.

- Request a credit limit increase on one of your credit cards – this is an easy way to reduce your credit utilization ratio.

- Check your credit reports and dispute errors that could be lowering your credit score.

These actions can help give a quick boost to your credit score and pave the way for better interest rates and loan terms.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How the Chase 5/24 Rule Works & Which Credit Cards It Affects ([updated_month_year]) How the Chase 5/24 Rule Works & Which Credit Cards It Affects ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/5242.png?width=158&height=120&fit=crop)

![5 Ways a Credit Card Can Rebuild Your Credit ([updated_month_year]) 5 Ways a Credit Card Can Rebuild Your Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/08/5-ways-last-try.jpg?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)

![3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year]) 3 Ways Closing a Credit Card Can Hurt Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/closecard.png?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![5 Wise Ways to Use Credit When Planning a Wedding ([updated_month_year]) 5 Wise Ways to Use Credit When Planning a Wedding ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/06/wise-ways-to-use-credit-when-planning-a-wedding-feat.jpg?width=158&height=120&fit=crop)