Trying to decide whether a cash back or a travel rewards card is right for you? The truth is you don’t have to choose. The best credit cards for cash back and travel allow you to earn and redeem your rewards in a way that fits your individual needs.

Cash back credit cards let you earn back a percentage of your spending in the form of a reward that can be used for whatever you want, including travel. Similarly, rewards earned using travel cards can be redeemed for cash instead of travel, although this may not always be the most efficient use of rewards points.

In either case, the fact is there’s flexibility in how you can redeem your rewards — as long as you choose the right card. Here are our choices for the best cards that can be used for both cash back and travel.

Cash Back | Travel | Business | FAQs

Best Cash Back Cards with Travel Redemption Options

The truth is you can’t go wrong with cash back rewards; they can be used to offset spending on anything, including travel. Cash back cards are a great option if you don’t travel often enough to justify a dedicated travel rewards card, or if you prefer to use budget airlines and hotels.

That’s because most travel cards are affiliated with major airlines and larger hotel chains, while cash back cards have no affiliate limitations. If you want a rewards card that can pull double-duty, here are the ones we recommend.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

In addition to its cash back on all purchases, the Chase Freedom Unlimited® also offers a signup bonus for spending a nominal amount within the first three months of having the card. That’s extra cash that you can redeem for travel using the Chase Travel web portal.

Trips can be booked using your card, your points, or a combination of both. There’s also no annual fee for this card, and your cash rewards never expire.

2. Chase Freedom Flex℠

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.

If you’re looking to maximize your cash rewards, the Chase Freedom Flex℠ card offers top-tier cash back on up to a set limit in combined purchases on rotating bonus categories each quarter. You can also earn a signup bonus after spending a certain amount on purchases within the first three months of having the card.

All of the cash back rewards you earn can easily be redeemed for travel using the Chase Ultimate Rewards® redemption portal. As with other Chase Freedom cards, cash back rewards never expire and can be redeemed in any amount.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Customized Cash Rewards credit card lets you earn 3% cash back in a category of your choice, making it a flexible option for cash back rewards and for travel. Depending on how you use your card, maximum rewards can be earned for gas, online shopping, dining, travel, or other categories.

This flexibility lets you quickly earn cash back that can be used to book travel or to offset travel expenses. This card has no annual fee, and you can earn a bonus cash back reward for spending a minimum amount within the first 90 days of account opening.

- Earn $250 back in the form of a statement credit after you spend $3,000 in purchases on your new Card within the first 6 months of Card Membership.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year on purchases (then 1%). Also earn 6% cash back on select U.S. streaming subscriptions.

- Earn 3% cash back on transit, including U.S. gas stations, taxis/rideshare, parking, tolls, trains, buses, and more. All other purchases earn 1% cash back.

- $120 Equinox Credit - Use your Blue Cash Preferred Card to pay for Equinox+ at equinoxplus.com and receive $10 in monthly statement credits. Enrollment required.

- 0% intro APR for 12 months from the date of account opening, then a variable APR applies

- $0 intro annual fee for the first year, then $95

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

18.49% - 29.49% Variable

|

$0 intro annual fee for the first year, then $95

|

Excellent Credit

|

With one of the most generous cash back reward percentages in the industry, the Blue Cash Preferred® Card lets you earn a high rate of cash back at U.S. supermarkets on up to $6,000 a year.

You can also earn 6% back on select streaming services, 3% back on taxi, rideshare, and other transit options, 3% back on gas, and 1% on everything else. It’s the perfect card for busy families, and can also be used to book travel through American Express Travel Services. This card has an annual fee, which can be easily offset by the generous cash back rewards.

Best Travel Cards with Cash Back Redemption Options

Travel reward cards are a great way to rack up the mileage points, but what if you need to cash them in? Although these cards deliver their maximum benefits when used for travel-related expenses, redeeming points for cash is also a viable option.

Many premium travel cards let you accrue more points per dollar spent than with a standard card, meaning they’ll deliver the rewards faster. Here’s our list of travel cards that let you redeem for cash when needed.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

A card for frequent travelers who have excellent credit, the Chase Sapphire Reserve® card offers exceptional travel benefits and a generous rewards program. However, consider the rather steep annual fee when calculating whether it’s the right choice for you.

The card earns elevated points on travel and dining, and there is an annual travel credit to help offset the fee. Points earned with the Sapphire Reserve® card can be redeemed for cash at a 1:1 ratio, meaning each point is worth one cent. Redeeming 10,000 points will get you $100, however, if you redeemed the same amount of points for travel, you’d get $150 in value, at least.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

Similar to the Sapphire Reserve card but with an annual fee of just $95, the Chase Sapphire Preferred® card is a great way to accumulate a lot of reward points. Aimed at less frequent travelers, the Sapphire Preferred card earns 2X points on travel and dining expenses.

When redeeming for cash, points transfer at the same 1:1 ratio, but when used for travel 10,000 points will equal $125 in value.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

If there’s a single word to describe the Discover it® Miles credit card, it is simplicity. The card earns miles for every dollar spent on anything, and the rewards never expire. There are no blackout dates or airline restrictions when redeeming for travel.

Miles can be redeemed in any amount and can be issued as a statement credit or as cash. One thing to note is the unique first-year bonus Discover offers its cardholders.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

The Capital One Venture Rewards Credit Card lets you earn an unlimited 2X miles on every purchase made. There’s also an opportunity to earn big bonus miles if you meet the minimum spending requirement in the set time frame from account opening. There is also a $100 credit for global entry or TSA Precheck.

Reward points can be redeemed in several ways, including for cash, gift cards, or statement credits. Redemption value is one penny per point when redeemed for cash or cash equivalent.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don't expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want - you're not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

Plus, if you’re a Preferred Rewards® member, you can automatically earn 25% to 75% more points. When it comes time to redeem your points, you can simply log in to your card account and redeem them for statement credits against travel purchases or for cash.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% - 29.99% (Variable)

|

$0

|

Excellent, Good

|

Although the Capital One VentureOne Rewards Credit Card doesn’t offer the most miles for your dollar at just 1.25X, it does have a lot of useful features for infrequent travelers. New cardmembers enjoy a low introductory APR, along with bonus miles for meeting minimum spending requirements, all with no annual fee.

Capital One Venture Miles® never expire, and you can redeem them for cash or a statement credit anytime.

Best Business Cards for Cash Back & Travel

Business travelers know what’s important when it comes to choosing a credit card for cash back and travel, and that’s flexibility. You want a card that offers top performance no matter what you happen to use it for.

The best of these cards offer rewards for the categories in which you spend the most, and the cards let you choose how to redeem them as you need. Here are our choices for the best cash back and travel business cards.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

With its huge potential signup bonus and 3X points on major business purchases, the Ink Business Preferred® Credit Card from Chase is one of the best business cards for cash back and travel. And, to make this card an even better deal, the points you earn are worth 25% more when redeemed for travel through Chase Travel℠.

The card charges an annual fee, which is more than compensated by business perks like zero foreign transaction fees, free employee cards, and the option to redeem points for cash back.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

Offering similar business benefits to those of its sibling but without the annual fee, the Ink Business Cash® Credit Card gives cardholders 5% cash back on up to $25,000 in business purchases annually. It also provides 2% cash back on up to $25,000 in purchases made at gas stations and restaurants annually, and unlimited 1% back on everything else.

Cash back can be used for travel or redeemed as cash, for gift cards, or as a statement credit.

13. Capital One® Spark® Miles Select for Business

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

Additional Disclosure: Information for this card not reviewed by or provided by Capital One.

As business travel cards go, the Capital One® Spark® Miles Select for Business is a solid partner for small business owners. With its unlimited 1.5X miles on all purchases, you don’t have to worry if you’re using the right card. Plus, you’ll earn 5X miles on hotels and rental cars when you book through Capital One Travel.

An introductory low APR offer and a welcome bonus may be available for new cardholders. There’s no annual fee for this card, and miles can be redeemed for flights, hotels, vacations, or transferred within the travel partner network.

- Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase made for your business

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- Earn rewards faster with employee cards at no additional cost. Set individual spending limits for greater control.

- Round-the-clock monitoring for unusual credit card purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 12 months

|

N/A 12 months

|

18.49% - 24.49% Variable

|

$0

|

Good/Excellent

|

The Ink Business Unlimited® Credit Card combines features of the company’s other two Ink business cards with no annual fee, a potential cash back welcome bonus, and unlimited 1.5% cash back on purchases. There’s also a low introductory APR on purchases for new cardmembers.

Rewards can be redeemed for cash, gift cards, or travel through Chase Ultimate Rewards. Additional employee credit cards for authorized users are also available at no extra cost.

Which Credit Card Gives the Most Cash Back?

When choosing a cash back card, you want the one that gives you the biggest reward; but since we all use our cards differently, understanding which one gives the most cash back isn’t so straightforward.

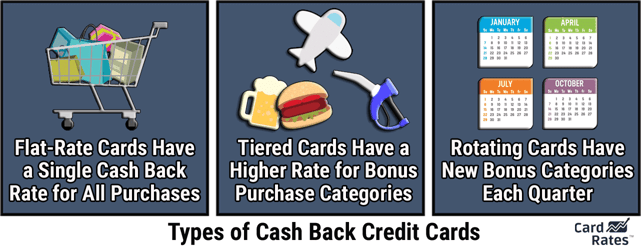

There’s bonus cash back if you meet minimum spending requirements, rotating bonus categories, and, of course, category-specific cards that give maximum rewards for travel, entertainment, groceries… you get the picture.

What we can help identify, however, are the cards that give you the most cash back for certain common spending scenarios. Here are some of the best cash back cards we’ve identified for specific situations.

- Best Introductory Cash Bonus: The Ink Business Cash® Credit Card currently offers a large cash back intro bonus for spending at least a set purchase amount within the first 90 days of account opening. That’s cash you can use as a statement credit, or you can transfer it to your bank account and use it however you want (bonus offers change frequently, and you should verify the status of any promotional offer).

- Best Category-Specific Rewards Card: The Blue Cash Preferred® Card from American Express currently offers 6% cash back rewards on up to $6,000 in purchases at U.S. supermarkets annually. This 6% back offer is also available on select streaming services.

- Best Cash Back in Rotating Categories: The Chase Freedom Flex℠ card and Discover it® Cash Back card both offer bonus cash back in rotating categories that you must activate. Both cards also offer signup bonuses (promotional offers can change, so check with the card issuers for current offers).

- Customizable Cash Back Rewards: The Bank of America® Customized Cash Rewards credit card allows you to choose your own 3% cash back category, from gas to online shopping, dining, travel, home improvement, etc. This lets you maximize your cash back based on how you use your card.

Which Credit Card Gives the Best Travel Rewards?

Similar to cash back cards, travel reward cards also come in different forms. There are cards that earn lots of miles, cards that offer signup bonus miles, cards for frequent travelers, and, of course, cards for those who take only the occasional trip or vacation.

The point is no single travel card is the best choice for everyone. With that said, some cards stand out in a few common travel mile scenarios.

- Best Travel Card Signup Bonus: The Chase Sapphire Preferred® Card card currently offers a top signup bonus after you spend $4,000 in the first three months of account opening. Though points can be redeemed for cash, points are worth even more money when redeemed through Chase (bonus offers like this change frequently, so check the current status of any offers).

- Best Card for Frequent Travelers: The Chase Sapphire Reserve® card offers bonus points on travel and dining, while also giving a huge signup bonus, an annual travel credit, and more value per point when redeemed for travel through the Chase Ultimate Rewards portal.

- Best Card for Infrequent Travelers: The Capital One Venture Rewards Credit Card lets you earn unlimited 2X miles on every purchase. You’ll also get a $100 annual credit for Global Entry or TSA Precheck® and won’t be charged foreign transaction fees.

- Best Card for Business Travelers: The Ink Business Preferred® Credit Card earns business travelers 3X points on business purchases (on up to $150,000 spent annually) plus a massive sum of bonus points for spending $15,000 in the first three months (this bonus offer can change, so check the current status for this card).

Is it Worth Getting a Cash Back Credit Card?

Cash back credit cards may seem like an awesome deal — you get paid for buying things you need anyway. But the truth is most of us either don’t take full advantage or don’t use our cash back cards correctly.

Deciding on a cash back credit card requires a lot more thought and analysis than most people put in. For example, in choosing whether a card is right for you, it’s important to understand what you use your card for, how often you use it, and whether you will carry a balance.

You should also consider whether the card charges any fees that can completely wipe out your cash back rewards. That includes annual fees, late payment fees, transaction fees, etc. Then there are considerations such as cash back redemption options and restrictions.

Here are a few more things that people contemplating a cash back card may want to keep in mind.

First, the APR for cash back cards tends to be higher than for cards that offer fewer or no rewards. That means if you carry a balance and are paying interest on it, your cash back is for naught.

If your card has a 23% APR, your 2% cash back simply reduces your rate to 21%. You could find a card without rewards that charges 16% interest and be better off.

Second, many cards with high cash back rewards only pay the maximum on purchases made in specific categories. Others pay only up to a certain amount, then the maximum payout drops to 1% or less. Be sure to thoroughly read any restrictions in the cardholder agreement.

Finally, holders of these reward cards tend to spend more simply because they know they’re earning cash back. However, spending $100 to earn $2 back rarely makes sense.

Make the Most of Your Spending

When all things are considered, if you’re a disciplined card user that pays off your balance each month and is not susceptible to frivolous spending, a cash back or travel reward card can be a good choice. Many of these cards offer rewards that are quite lucrative.

The best credit cards for cash back and travel let you make the most of your spending while earning something extra along the way. Just be sure to use them wisely.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year]) 4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Unlimited-Cash-vs.-Customized-Cash.jpg?width=158&height=120&fit=crop)

![5 Travel Credit Cards For Bad Credit ([updated_month_year]) 5 Travel Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Travel-Credit-Cards-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![8 Best Travel Credit Cards for Students ([updated_month_year]) 8 Best Travel Credit Cards for Students ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Best-Travel-Credit-Cards-for-Students-1.jpg?width=158&height=120&fit=crop)

![9 Best Travel Credit Cards ([updated_month_year]) 9 Best Travel Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/08/travelcards.png?width=158&height=120&fit=crop)

![12 Best Business Credit Cards for Travel ([updated_month_year]) 12 Best Business Credit Cards for Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/03/business-credit-cards-for-travel-feature.jpg?width=158&height=120&fit=crop)

![7 Best 0% APR Travel & Air Miles Credit Cards ([updated_month_year]) 7 Best 0% APR Travel & Air Miles Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-0-APR-Travel-Air-Miles-Credit-Cards.jpg?width=158&height=120&fit=crop)

![3 Best Bank of America Credit Cards for Travel ([updated_month_year]) 3 Best Bank of America Credit Cards for Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/03/Best-Bank-of-America-Credit-Cards-For-Travel.jpg?width=158&height=120&fit=crop)

![12 Best Travel Credit Cards For Beginners ([updated_month_year]) 12 Best Travel Credit Cards For Beginners ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/06/Best-Travel-Credit-Cards-For-Beginners.jpg?width=158&height=120&fit=crop)