Emergencies never provide a courtesy warning and usually require funds at the ready. With one of the best credit cards for emergencies, you can pay for what you need easily and move onto whatever’s next, given the circumstance.

But if you don’t already have a credit card stored away for such events or another source of quick funds, the situation can become even more stressful. That’s why we’ve deemed the best credit cards for emergencies those that can give you access to your new credit line fast.

The cards below have a quick approval process, expedite the shipping of your new card, and may even give you access to your new credit line as soon as you’re approved.

Rush Shipping | Immediate Use | FAQs

Best Cards with Expedited Delivery for Emergencies

Many credit card issuers take between seven and 10 business days to process your approved application, print your card, and deliver it to your home. Chase and Discover greatly reduce that time with expedited processing and shipping that can put your new card in your wallet within one to three business days, and there’s no added fee for rush service.

Discover Ships All Cards Priority Mail (1 to 3 Days, Location Depending)

Discover ships all its cards via USPS Priority Mail, which guarantees delivery anywhere in the U.S. in one to three business days, depending on your location. That means you can get access to your credit faster and start to resolve your emergency in less time.

Here are our choices for the top Discover cards.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Your account may not always be eligible for balance transfers. Balance transfer eligibility is determined at Discover’s discretion.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 6 months

|

0% Intro APR for 18 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers - only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% - 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

Chase Provides Free Expedited Shipping Upon Request

Chase gives truth to the adage, “You will never know unless you ask.” The issuer provides expedited processing and shipping at no extra charge for new cardholders — but only if you ask for it.

Once approved, you can have your new card in one to two business days upon request. Here are our favorite Chase cards.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

Best Immediate-Use Cards for Emergencies

Most emergency situations require funding to resolve, but they won’t always require a physical credit card to make payment. The card issuers below allow virtual access to your credit line immediately after approval, albeit with a few restrictions.

Bank of America Cards Can Be Loaded onto a Digital Wallet

If you apply and are approved for a Bank of America card via its mobile app, you can instantly upload your account information — including your new credit card number, expiration date, and CVC security number — to a digital wallet. You can then use the card online or at any merchant that accepts card-not-present payments.

If you apply and are approved for a Bank of America card via its mobile app, you can instantly upload your account information — including your new credit card number, expiration date, and CVC security number — to a digital wallet. You can then use the card online or at any merchant that accepts card-not-present payments.

This only works when done through the Bank of America mobile app, though.

American Express Will Provide Temporary Information

New American Express cardholders can request a temporary card number upon approval. You can use the number to make online purchases or payments until your physical card arrives within seven to 10 business days.

New American Express cardholders can request a temporary card number upon approval. You can use the number to make online purchases or payments until your physical card arrives within seven to 10 business days.

Your permanent card will have a different number than the temporary one issued after approval.

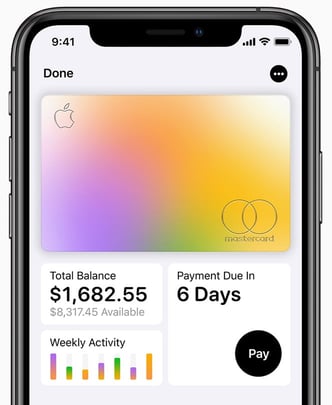

The Apple Card Can Be Used Immediately for iPhone Users

This card markets itself as the card you can apply for and use in minutes. That’s because the new Apple Card lives in the iPhone Wallet app and can be used right away upon approval via Apple Pay.

This card markets itself as the card you can apply for and use in minutes. That’s because the new Apple Card lives in the iPhone Wallet app and can be used right away upon approval via Apple Pay.

But, of course, this only benefits iPhone users.

USAA Provides Immediate Access, but with a Lower Limit

USAA will also provide temporary card information for immediate use, however, your maximum credit limit is restricted to $1,000 until your physical card arrives.

USAA will also provide temporary card information for immediate use, however, your maximum credit limit is restricted to $1,000 until your physical card arrives.

If you need more than that to respond to your emergency, this isn’t your best option.

Is it a Good Idea to Have a Credit Card for Emergencies?

Even though we all know we should have a cash emergency fund, very few of us do. In fact, most Americans don’t have the necessary savings to cover an unexpected $1,000 expense.

If you’re living paycheck to paycheck — or close to it — setting a few thousand dollars aside for a rainy day may not be realistic. That’s why an emergency credit card may be the next best thing to having an emergency savings.

This ensures you’ll have access to funds if you get into a jam. You’ll also have an available credit line with a zero balance reported to the credit bureaus, which may increase your credit score.

If you’re thinking about adding an emergency credit card to your financial portfolio, consider the following:

- Keep the card out of reach. An emergency credit card shouldn’t live in your wallet. Store it in a safe place and only take it out when you need it. Temptation can sometimes convince you to use the card when you don’t need to.

- Find a card without an annual fee. Since you (hopefully) won’t use the card often, you shouldn’t pay an annual fee for your card. Find a good card with no added charges you can stash away for a rainy day.

- Don’t let the card go inactive. Although you don’t want to use the card for non-emergency purchases, you may have to occasionally. That’s because credit cards go inactive if they aren’t used. Every issuer has a different time frame in which it considers a card to be inactive. If your card becomes inactive, the issuer can cancel your account without notice. That’s not something you want to learn about during an emergency. You can avoid this if you use the card every few months to make a small purchase, or set it up to pay a small recurring fee each month and put the account on autopay.

- Rewards are a nice perk. If you can get a rewards card with no annual fee as your emergency card, do it. Why not earn a little cash back you can apply as a statement credit to your purchases when the time comes?

What is the Best Credit Card for Emergencies?

This depends greatly on the type of emergency you experience. If you’re in a jam right now and need access to funds as soon as possible — you can’t go wrong with a card from Discover or Chase.

These cards provide rush processing at no additional charge that can put the card in your hands in one to three business days. With Bank of America, you can load your new card onto your digital wallet and start using the credit card as soon as you’re approved, but only when you apply for the card in the Bank of America mobile app.

If you’re thinking ahead and want to add a card in the event of an emergency, then you can take your time and find the card with the best options. That will include a card with no annual fee, a low ongoing APR, and, preferably, some sort of rewards structure.

By choosing a card with these three features, you’ll lower your credit costs while maximizing your earning potential whenever the time comes to use your card.

But that doesn’t mean you’ll have to overpay if you need an immediate emergency credit card. Discover, for example, ships all its cards via USPS Priority Mail with a guaranteed one- to three-day delivery.

That said, if you don’t plan on using your emergency card soon, you may not be in a position to maximize your Cashback Match potential. You’ll still earn a competitive cash back or miles rate on every purchase — which can add a little light to a gloomy situation.

Which Credit Cards Give You Instant Access?

While several credit card issuers will provide instant access to your new credit card number, you may find a few caveats that keep you from getting the immediate credit you need.

Barclays, for example, offers approved applicants of some of its co-branded cards instant access to their credit card information. These include the Frontier Airlines World Mastercard® and the JetBlue Card. The catch, though, is that you can only use the temporary card number to make purchases with the company that’s branded on the card.

This could work if you need to purchase an emergency flight. But any other purchases must wait between seven and 10 days until your new card arrives in the mail.

The Apple Card is one option that can be used immediately — but only if you’re an iPhone user.

The same goes for Citi-branded cards, such as the Citi® / AAdvantage® Executive World Elite Mastercard® or one of the AT&T-branded cards.

New American Express cardholders are also issued a temporary card number that can be used for purchases until your card arrives in the mail. This isn’t a viable option if you need a physical card.

The Apple Credit Card allows approved applicants to load their new credit card number onto their iPhone’s wallet application for immediate use.

USAA credit cards provide new users with a temporary credit card number and a $1,000 maximum credit limit until their physical card arrives.

Before you apply for an emergency credit card, contact the issuer to find out how soon after you’ve been approved you can access your new card number and whether the bank places any restrictions on how you use your account before the physical card arrives in the mail.

Don’t Let a Financial Emergency Catch You Off Guard

Emergencies happen. How you react and handle situations in your life that require immediate action will play a big role in determining your well-being and financial freedom.

If your emergency requires you to take on debt, you should consider one of the best credit cards for emergencies listed above. Many allow instant access to your new card number to help address your situation faster, and, hopefully, you can at least be rewarded for your troubles.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year]) What is Credit Card APR? 9 Best 0% APR Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/05/what-is-apr.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying a Car ([updated_month_year]) 7 Best Credit Cards for Buying a Car ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Credit-Cards-for-Buying-a-Car-Feat.jpg?width=158&height=120&fit=crop)

![11 Best Credit Cards With Price Protection ([updated_month_year]) 11 Best Credit Cards With Price Protection ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Credit-Cards-with-Price-Protection-Feat.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Auto Repairs ([updated_month_year]) 7 Best Credit Cards for Auto Repairs ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Auto-Repairs.jpg?width=158&height=120&fit=crop)

![11 Best Credit Cards For Subscriptions ([updated_month_year]) 11 Best Credit Cards For Subscriptions ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Best-Credit-Cards-for-Subscriptions.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards for Extended Warranties ([updated_month_year]) 12 Best Credit Cards for Extended Warranties ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/Best-Credit-Cards-for-Extended-Warranties.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying Gift Cards ([updated_month_year]) 7 Best Credit Cards for Buying Gift Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Best-Credit-Cards-for-Buying-Gift-Cards-Feat.jpg?width=158&height=120&fit=crop)

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)