Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

A statement credit is money applied to your credit card account that can lower your balance or be applied to future charges. A statement credit is typically an option when cardholders want to redeem their card rewards. Issuers may also apply statement credits as a bonus when cardholders open an account or reach certain spending thresholds within a set period after account opening.

-

Navigate This Article:

How Statement Credits Work

A statement credit is money that an issuer applies to your credit card account. Your account may be credited when you take certain actions, such as redeeming rewards.

Some issuers provide credits you can use for specific purchases. Technically, these are not statement credits, but since you will not be paying for those things with a charge, in effect they also lower your balance.

Examples of Statement Credits

You may have a statement credit on your account for a variety of reasons. With cash back and rewards credit cards, you can earn cash, points, and miles as you use them for transactions. In addition to other redemption options, most issuers will allow you to use those earnings as a statement credit. Here are the most common sources of statement credit:

- Merchant refund: You receive a statement credit when a merchant refunds you for a purchase made with your card. For example, if you charged an item that cost $150 but returned it, that charge would be credited to your account.

- Chargeback: Credit cards come with consumer protection, including the ability to request a payment reversal — called a chargeback. You may request one if you purchased something online, but it never arrived, or the item arrived damaged or with parts missing. In that case, you could contact your credit card issuer and request that the transaction funds be returned to your credit card account.

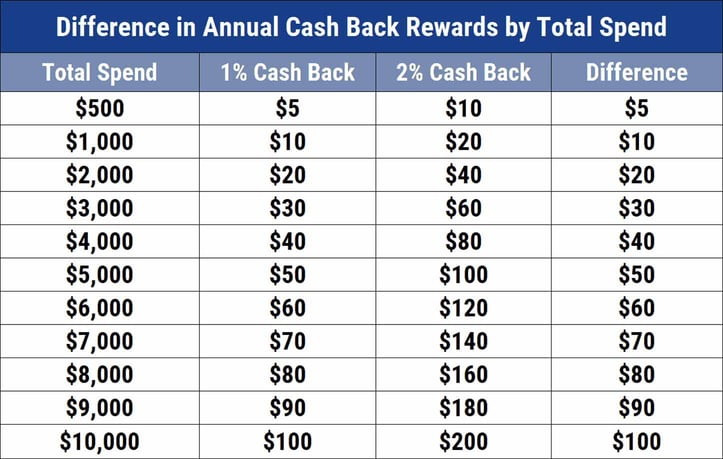

- Cash back: If you have a cash back credit card, you will build up rewards when you charge eligible purchases. For example, if you spend $5,000 with a card that provides you with 2% cash back on every eligible purchase and has a statement credit option, you can apply the $100 you earned to your debt.

- Miles and points: With rewards credit cards, the cash equivalents you earn as you charge may be counted as miles or points. How you can redeem those rewards depends on the issuer and the card, but their value can often be used for statement credits.

- Welcome bonus: Some credit cards give a welcome (or sign-up) bonus of cash or rewards after you open a new account and charge a minimum amount within a set number of months. If the issuer allows you to use these rewards as a statement credit, they can go toward reducing your bill.

Some credit cards come with account perks in the form of credits that you can use for certain purchases, such as streaming services, food and drinks at hotels, and airport security programs. These credits can only be redeemed for those products and services. Though they aren’t technically statement credits because they don’t reduce the amount you owe, the charges will be removed from your balance when you apply the credit for these purchases.

When Statement Credits Are Applied

The date that a statement credit will be applied to your account depends on what type of credit it is as well as the credit card issuer. Here are some common statement credit scenarios and their typical timeframes:

- Welcome bonus: The bulk of cash, points, or miles may appear on your statement the same week that you meet the minimum spend, but in some cases, it can take a couple of billing cycles.

- Earned rewards: Credit card issuers will credit your account with earned cash, points, or miles the same day or a few days after you make a purchase.

- Refunds: Merchants typically process refunds in one to seven days. When they do, the statement credit will appear on your account.

- Chargebacks: Statement credits for chargebacks usually take one to two business days to appear on your account statement.

- Credits as account perks: There is no wait time for credits attached to your credit card account as perks. They will be available until you use them or until they expire.

Most statement credits are applied quickly, so if you are expecting one and don’t see it within the time frame it is typically issued, contact your issuer.

How They Affect Your Credit Card Balances

If you received a statement credit for a merchant refund or chargeback, your balance will be lowered by that amount immediately.

On your billing statement, you will see the amount you charged and the same amount that was credited back to your account. If you ordered $800 worth of electronics but received a chargeback because the package was stolen from your porch, you would be credited with that same sum immediately. You don’t have to do anything other than check your statement for accuracy.

For rewards that you redeem as statement credits, your account will show the decrease in balance that same billing period — or the following.

Earning and Redeeming Statement Credits

You can earn money and rewards that can be redeemed as statement credits by using a cash back or rewards card. Here are some things to keep in mind:

Types of Rewards Programs

With cash back cards, you may automatically earn a percentage back each time you make a qualified charge. It might be a flat rate, such as 1.5% of every purchase. If it’s tiered, you can earn more for purchases in certain categories. Once you earn the money, you can request to use it as a statement credit.

Rewards credit cards allow you to earn points or miles as you charge. They can be general-purpose cards, travel cards, co-branded cards (for specific airlines and hotel chains), retail cards (for specific stores), or gas cards (for specific stations), among others.

The reward program differs by issuer and card. For example, you may receive a $100 credit for Global Entry or TSA PreCheck®, or $50 in statement credits each quarter for purchases made directly with a property in a co-branded hotel chain.

Some credit card issuers have dedicated shopping and travel portals where you can trade in your cash and rewards for discounts on products and services, such as flights, hotels, and gift cards.

How to Maximize Your Earnings

When you have a cash back or rewards card, you can make the most of them by paying attention to the terms of the account and taking advantage of their benefits.

- Use a cash back card when you are seeking a simple percentage back from your charges.

- Use rewards cards when you can earn points or miles that will translate into the most rewards for your goal.

- Use tiered credit card rewards programs when you will earn the most in that category.

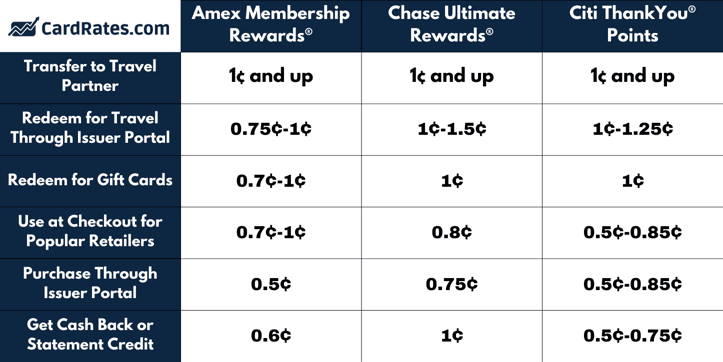

- Redeem cash back and rewards for their highest value.

Sometimes, statement credit isn’t the most lucrative redemption option, so you may want to go another route to save money in the long run.

Common Pitfalls to Avoid

Statement credits can be an excellent way to keep your balances from escalating out of control. To keep it positive, be aware of these common pitfalls:

- Not cashing in your statement credits. Unless your card issues automatic credits, you will have to notify the issuer that you want to use the money as a statement credit.

- Allowing credits to expire. If your account comes with quarterly or annual credits to use for certain products or services, they may not be available again until the next year.

- Charging just for the rewards. Carrying over debt instead of paying it off every month will result in interest charges that will reduce or nullify the benefits of a statement credit.

Also remember that if you avoid using your credit card, especially for strategic purchases, you won’t earn the cash or rewards that come with the program.

The Difference Between Statement Credit and Cash Back

Statement credits reduce a credit card balance, while cash back is money you can use for anything — including statement credit when the issuer allows.

When a statement credit is applied, you will pay less in interest on revolving debt because your balance will be lower. If you take the cash out or use rewards to make other purchases, you will benefit, but you will still need to pay off the balance in full to avoid interest.

Statement Credits vs. Other Redemption Options

Once you have a certain amount of money due to you as a credit, you can decide how you want to use it. There are pros and cons for each decision.

- Reducing a balance: Using rewards to lower your balance with a statement credit will reduce your payment. It will also reduce the amount you pay in interest should you carry the debt over to the next month. However, you will be unable to use that money for anything else you may want.

- Cash: Taking earned money out and having it deposited into your checking account can be a great way of adding extra funds to your budget. The only downside is if you keep a running balance that racks up more fees.

- Travel: Airlines and hotel cards typically offer the best redemption rate for using your credits to purchase flights and accommodations. Trade them in for other things and you won’t get the most out of your points or miles.

- Products: Some credit card issuers have dedicated shopping portals through which you can make purchases. Although it can be a convenient way to shop without using cash from your checking account, you may not get as much from your rewards as you would if you redeem them in other ways.

- Gift cards: Turning credits into gift cards can be particularly fruitful because many offer promotions with discounts. For example, you may be able to purchase a $100 gift card for $75 worth of cash back or rewards. Just make sure these are retailers you often shop with or you may end up spending money on things you don’t need.

Stay updated on your credit card issuer’s policies, promotions, and programs to ensure you get the most out of your earned rewards. Categories and benefits can change, so keep an eye out.

How to Make the Right Choice for You

As a regular credit card user, turning cash and rewards into statement credits can be an excellent strategy. You know that each time you earn when you make a purchase, it can lower your balance.

This can give you a sense of relief. Yes, you may have just charged $7,000 for new furniture, but you only have to pay $6,860 because $140 was already taken off the top. If you seek a steady stream of discounts, this method is for you.

On the other hand, you may want to use earned rewards for something else important or that you have been saving for. A great example is if you are an avid traveler. You could open a couple of co-branded cards, one for flights and the other for hotel accommodations. For both, you would get the welcome bonus after meeting the minimum spend and then continue to earn rewards as you charge.

Look for credit cards that offer credits for products and services that you already pay for. For example, you might want a card that offers an annual credit for a streaming service or for food delivery services. These cards will save you money because you won’t have to use your own funds to pay for them.

Cash back cards often win the day for ease of use. You always know that money is accumulating in your account when you use the card to make qualified purchases — and that extra credit should help you keep the account balance paid off.

Financial Considerations of Statement Credits

A statement credit will reduce the amount you owe on a credit card debt, relieving financial pressure. When money is tight, every little net positive can help.

You will also benefit from statement credits when you are not charged for the things you return or for chargebacks. That will reduce unnecessary financial waste, but follow up to confirm you receive the credits.

Review your account statements to ensure you redeem any outstanding statement credits, too. There is no benefit to having a $200 annual airline credit if you don’t use it.

Budgeting with Statement Credits

If you use your credit card to accumulate cash or rewards that you redeem for statement credits, have a plan in mind. With each charge, recognize that the purchase price will be lowered by the value of the statement credit.

Imagine you have one cash back credit card that gives you 3% back on gas and online shopping, but only 1% on everything else. You want to use that card to fill up your tank and for online purchases. You would use another card that has a higher reward rate for groceries or whatever else you want to buy.

By using the card that offers the highest rewards rate, you will build up the most statement credit value. That can keep your overall costs down.

Impact on Credit Utilization Ratio and Scores

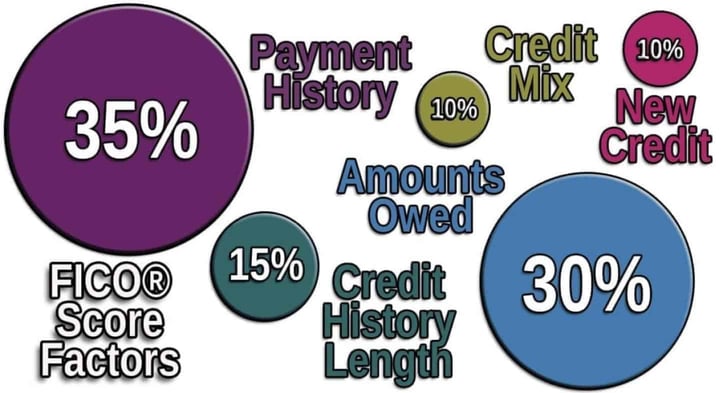

Credit scoring companies take the information found on consumer credit reports, and input it into algorithms that produce scores based on risk. Some pieces of information are weighted more heavily than others.

The most commonly used credit scoring system is the FICO Score, and though payment history is the most important factor, amounts owed is a close second — which includes your credit utilization ratio. The less you owe on revolving credit products, such as credit cards, the better.

For this reason, statement credits can help your credit score. When you use the money you have earned to lower a card’s balance, it can help keep your credit utilization ratio in a healthy place. Although carrying no debt is ideal, credit card debt that is less than 30% of your total credit limit — both per card and in aggregate — is generally considered positive.

General Tax Implications

A major benefit of credit card cash back and rewards programs is that the money or cash equivalent that you earn when you charge is not taxable by the IRS. That’s because they are considered rebates or discounts, not taxable income.

An exception to this rule is if you did not have to meet a minimum spend to receive a welcome bonus, but that is a rare occurrence. In almost all cases, you would have to charge a certain amount within a set time frame to earn the bonus — which would then be tax-free.

To cardholders, the impact of a non-taxable gain is especially positive. If you earn $300 from using your credit card, that sum can be used to lower the price of something you purchased with the card.

Statement Credits: A Rewarding Feature of Credit Cards

When used correctly, statement credits can be great for your budget.

Some statement credits are simply a reversal of charges for certain purchases to guarantee that you won’t waste money on things you don’t want or didn’t receive. Other statement credits are perks of the card and can take the place of cash for certain products or services.

Although you can certainly use what you earn with a cash back or rewards card for many purposes, whittling the balance down with a statement credit can put you in a positive financial position. That can be just what you need to make sure your money goes far.

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)