Whether you currently have a negative or positive net worth, credit cards can help you create and increase your wealth when used the right way. All cards have credit lines you can use to your economic advantage, and many have valuable rewards programs that can result in a bigger bank account balance.

Here are nine proven strategies that can leverage the power of credit cards. Put even a couple of them into action, and your net worth can grow faster than you think.

1. Maximize Big Welcome Bonuses

Many credit cards offer lucrative welcome bonuses to new cardholders. For example, the Capital One Venture Rewards Credit Card and Chase Sapphire Preferred® Card both offer a significant signup bonus after meeting the required spending amount.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% - 29.99% (Variable)

|

$95

|

Excellent, Good

|

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

It’s very important to meet the minimum spending requirement and pay the entire bill amount, so think in advance about what you need to buy and have the money to pay off the balance.

You’ll get the highest redemption value when you use miles and points for travel expenses rather than converting them into cash. Therefore, pay for flights and hotels with the rewards, then pocket the money you would have spent on them.

2. Rack Up Cash Rewards

Cash back cards are great too and can augment your bottom line when used purposely.

Let’s say you have a credit card that offers a flat 2% back for each dollar you charge, such as the Citi Double Cash® Card. Add up all the expenses you can charge on the card that you can afford to pay with cash on hand. Examples include groceries, dining out, entertainment, clothes, gas, car repairs, vet bills, tuition, child care expenses, and utilities.

Charge these items to your card instead of using the cash in your checking account. After each transaction, pay the bill with the funds you have set aside so you don’t max out your credit limit (this can hurt your credit scores) or charge more than you can afford to repay. Otherwise, interest will be added to the bill, nullifying the value of the rewards.

Here’s an example of how it can work in your favor: If you regularly charge $5,000 a month and get 2% cash back on everything you buy, you’ll earn $1,200 in cash back over the course of the year!

3. Always Pick Up The Check

No matter which type of rewards cards you have — whether miles, points, or cash — you can boost your rewards by taking on the role of the primary payer. Every time you go out with other people, whether it’s for dinner, to the movies, or a sporting event, use your credit card and have them pay you back right away.

Or, if a trustworthy friend or relative doesn’t have a credit card and needs to make a large purchase, offer to do it for them, as long as they will pay you with cash immediately. Not everybody has a credit card or likes to use it, so this method can be a favor to them.

Always pay the bill when you’re with a group and request they pay you back immediately, whether via cash or a money transfer app. This way, you’ll accrue all the rewards for the money spent on the card.

Just be sure to deposit their funds into your credit card account so you never accumulate debt. The valuable rewards, however, will be all yours.

4. Invest Your Rewards

Imagine you came out $1,250 ahead with a welcome bonus from one credit card and earned $1,200 in cash back with that or another card. You would then have $2,450 not just to save but to invest in the stock market.

Open a brokerage account, deposit that money into a stock mutual fund, and commit to adding $100 per month. With a conservative 7% rate of return, you will have amassed $22,333 in 10 years!

Consider using a credit card that’s linked to a brokerage account, like the Fidelity® Rewards Visa Signature® Card, and you can seamlessly deposit your rewards into the money-making account.

5. Buy Low, Sell High

Every credit card comes with a credit line, which is the total amount you can charge. With that credit line, you can purchase undervalued items and then quickly turn around and sell them for their rightful price.

You’ll have to be pretty savvy to do this, but it can work. For example, if you have a good eye for antiques, scour swap meets and identify items you know have a greater value or negotiate the price down further to increase the margin.

Purchase items with your credit card and resell them for a profit. Just be sure to pay the balance within the interest-free grace period.

Buy and sell the items within your credit card’s interest-free grace period, which is typically 25 to 30 days. Not only will you collect the profits, but if you use a rewards card, you’ll also accumulate the points, miles, or cash.

6. Pay For a Course That Will Give Your Salary a Bump

Stuck in the paycheck-to-paycheck hamster wheel because you’re not qualified for a position with a higher salary? Look into classes that will put you on the fast track to an elevated income. A credit card can come in handy if you don’t have enough money to make it happen.

Charge the cost of the class and develop a feasible plan to repay it by or before 12 months (credit card debt, even in the best circumstances, should be short-term). If you cover a $1,500 course with a credit card that has a 22% APR and send fixed payments of $140, you’ll be out of debt in a year, and the interest will be just $184. Not bad at all.

The employment platform Monster.com identified 10 occupations that have significant pay increases with a certificate. For example, an actuary with a certificate earns 75% more on average than one who doesn’t.

7. Start a Business With a 0% APR Promotion

If you have an entrepreneurial drive and are certain your business idea will result in a revenue stream, consider opening a credit card that offers 0% APR for a fixed amount of time. It can provide necessary funding for your small business at no extra charge.

For example, maybe you want to finally start selling your famous muffins at the local farmers market but don’t have enough savings to pay for the marketing, equipment, ingredients, and stall fees right now. A credit card with a long interest-free introductory deal — such as the Citi® Diamond Preferred® Card — can be just what you need to jump-start the venture.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

As long as you pay off any remaining balance before the regular purchase APR kicks in, your credit card can be the conduit to a profitable endeavor!

8. Upgrade Your Property So It Commands a Higher Price

If you’re looking to sell your home but it needs some remodeling or repairs, you can use the funds from a credit card to pay for what your home needs before putting it on the market.

The added value can be dramatic.

According to Realty Times, there are at least 10 excellent returns on investment, including cleaning and decluttering, which alone can add $1,990 to the price of your home. Home staging, which replaces your furniture with updated or more generic furniture for open houses, can cost around $550, but it can increase the price of your home by $2,194. And a landscaping project that costs $540 can translate into a $1,505 price increase. Not insignificant sums.

9. Buy Everything Possible On Discount Sites

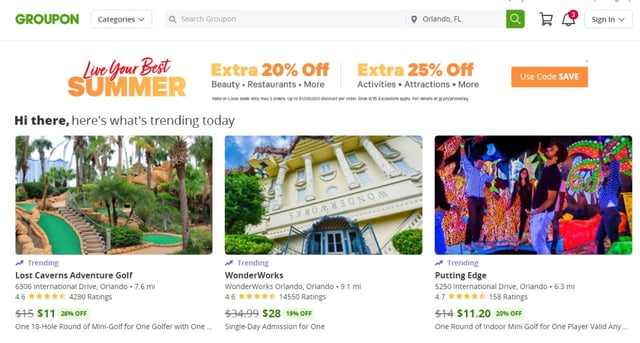

Haircuts, clothes, oil changes, restaurants…. the list of consumer items and services available on daily deal platforms such as Groupon are often deeply discounted — sometimes by 50% or more.

Score deals on services, merchandise, activities and attractions using sites like Groupon.

If you know you’re going to be buying these items anyway, use your credit card to take advantage of the time-sensitive opportunities when they arise. As you do, calculate what you would have spent.

For example, imagine you wanted to go on a Hawaiian vacation that normally costs $3,000. If you purchase it through one of these discount companies, you may be able to get it for half off. Then you can add the $1,500 savings to your investment account.

Turn Your Credit Card Into an Asset

You can clearly use your credit card to build wealth, but it often starts with getting the best credit account for you. One credit card might do, but a few may be better, especially if you use some for points and miles and others to amass cash back.

Just be careful to only apply for the accounts you qualify for and that you will use advantageously. All the methods described above are potential money-makers, but you can lose wealth by carrying over an expensive balance for too long — which is easy to do if you take your eye off the ball.

Therefore, when the intention is greater wealth, consider each charge before you make it, and review all your account activity regularly to track spending. With this kind of commitment, there is no reason a credit card (or several) can’t translate into positive assets rather than negative liabilities.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year]) How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/how-to-build-business-credit1.png?width=158&height=120&fit=crop)

![9 Best Credit Cards For Wealth Management ([updated_month_year]) 9 Best Credit Cards For Wealth Management ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/08/Best-Credit-Cards-For-Wealth-Management.jpg?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![5 Best Secured Credit Cards to Build Credit ([updated_month_year]) 5 Best Secured Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/07/Best-Secured-Credit-Cards-to-Build-Credit.png?width=158&height=120&fit=crop)

![5 Prepaid Cards That Build Credit ([current_year]) 5 Prepaid Cards That Build Credit ([current_year])](https://www.cardrates.com/images/uploads/2021/03/Prepaid-Cards-That-Build-Credit.jpg?width=158&height=120&fit=crop)

![9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year]) 9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/without2.png?width=158&height=120&fit=crop)