Even the best credit cards for wealth management are not going to suddenly thrust you into the billionaire’s club. But almost anyone can profit by investing credit card bonuses and rewards.

Whether you plow your cash back into an FDIC-insured savings account or invest it in options on uranium futures, these credit cards can help you as you build and manage your wealth.

-

Navigate This Article:

Best Cash Back Cards For Wealth Management

The following variable APR (annual percentage rate) credit cards all offer signup bonuses and/or cash back rewards that you can invest. What’s more, you can earn your cash back rewards without having to fork over an annual fee. Consider getting one or more of these cards if you can afford to save and invest your rewards instead of spending them.

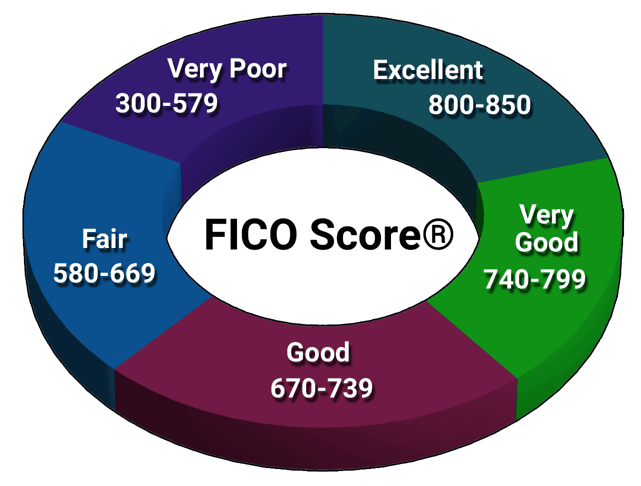

If your credit score is too low to qualify for these cards, consider getting a secured card first. You can use a secured card to build a good credit score by paying your bills on time and keeping your balances low.

1. Wells Fargo Active Cash℠ Card

This card is currently not available.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

N/A

|

N/A

|

N/A

|

The Wells Fargo Active Cash℠ Card offers a high unlimited cash back rewards rate on top of a modest signup bonus. If you wish, you can conveniently siphon your cash back from this Visa credit card account into a WellsTrade® Online Brokerage account that has a $0 minimum to open.

This allows you to build your relationship with Wells Fargo Bank while enjoying commission-free online stock and ETF trades.

(The information related to Wells Fargo Active Cash℠ Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

- Earn a one-time $200 cash bonus after you spend $500 on purchases within 3 months from account opening

- Earn unlimited 1.5% cash back on every purchase, every day

- $0 annual fee and no foreign transaction fees

- Enjoy up to 6 months of complimentary Uber One membership statement credits through 11/14/2024

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus, cash back won’t expire for the life of the account and there’s no limit to how much you can earn

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

Every cardmember can earn a small signup bonus and a high cash back rate with the Capital One Quicksilver Cash Rewards Credit Card. Capital One Investing accounts migrated to E*Trade in 2018, but if you have a spare $100,000 to invest, you can now open a new Capital One Investing account to manage your finances.

This new investment option includes some interesting features, including a personal risk score, financial planning, and advanced spending analysis.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

We’ve always been big fans of the Discover it® Cash Back card because of its unique Cashback Match program. Discover® Bank also offers several savings products, including online savings, CDs, and money market accounts, where you can put your cash back to work earning you interest income.

The bank even offers traditional and Roth IRAs to help you build your retirement nest egg.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

The high Chase Ultimate Reward points (that are easily cashed in) and modest signup bonus provided by the Chase Freedom Unlimited® card can be directly funneled into the investment accounts offered by J.P. Morgan. These include commission-free online trading accounts and traditional and Roth IRAs, all with a $0 minimum balance.

Or, with a $500 starting balance, you can hire the bank’s robo-advisor service for automated investing matched to your risk profile, time horizon, and specific goals.

- Earn $200 back in the form of a statement credit after you spend $2,000 in purchases on your new card in your first 6 months

- Unlimited 1.5% cash back on every purchase

- 0% intro APR on purchases and balance transfers for 15 months from the date of account opening, then a variable APR applies

- Rental car loss and damage insurance when you use your eligible card to reserve and pay for the entire rental and decline the collision waiver at the rental company counter

- Find out if you prequalify for the Cash Magnet® Card or other offers in as little as 30 seconds.

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

18.49% – 29.49% Variable

|

$0

|

Good/Excellent

|

We’re attracted to the simplicity of the Cash Magnet® Card from American Express, which offers a good unlimited cash back rate on all eligible purchases and an extended signup bonus period. On the downside, it charges a foreign transaction fee.

Amex groupies will find it easy to put their rewards to work with American Express high-yield savings or CD accounts that have no required minimum deposit. You can also hold your IRA plan at American Express.

- Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

- Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24.

- Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be 19.24% – 29.24%, based on your creditworthiness.

- Balance Transfers do not earn cash back. Intro APR does not apply to purchases.

- If you transfer a balance, interest will be charged on your purchases unless you pay your entire balance (including balance transfers) by the due date each month.

- There is an intro balance transfer fee of 3% of each transfer (minimum $5) completed within the first 4 months of account opening. After that, your fee will be 5% of each transfer (minimum $5).

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% Intro APR Period 18 months on Balance Transfers

|

19.24% – 29.24% (Variable)

|

$0

|

Excellent, Good, Fair

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Double Cash® Card lets you earn an outstanding cash back rate. If you’re a fan of Citibank, you can invest your cash back in a Citi Self Invest self-directed account that features no-cost trading of stocks and ETFs while charging no account minimums.

For added convenience, you can manage all your accounts in the Citi Mobile App, supplemented by live support available 24/7.

Brokerage Cards That Automatically Invest Rewards

The following three brokerages offer credit cards that seamlessly move your cash back rewards into your investment account. The cards charge no annual fees (although some charge a foreign transaction fee) and offer the same kinds of benefits you would receive from a rewards card issued by a bank or credit union.

- Unlimited 2% cash back. Every eligible net $1 spent equals 2 Reward Points. No limits on total Reward Points and no restrictive categories.

- Deposit your rewards into one eligible Fidelity account or divide them among several. You can even use your rewards to fund a loved one’s account. Choose from up to 5 eligible accounts.

- Enjoy hotel and transportation discounts, a best available rate guarantee, beverage credits, and special offers at premium retailers.

- Access 24-hour complimentary assistance with everything from booking travel to getting concert tickets for your favorite musician.

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

18.49% (Variable)

|

$0

|

Good/Excellent

|

The Fidelity® Rewards Visa Signature® Credit Card offers a generous 2% cash back on all eligible net purchases. You can link this Visa credit card account to any of the seven Fidelity account types, including brokerage, cash management, and retirement accounts.

The card is enabled for digital wallet use and has no reward limits, no annual fee, no restrictive categories on everyday purchases, and a reasonable credit line.

- The Schwab Investor Card® from American Express is only available to clients who maintain an eligible Schwab account.

- Earn an unlimited 1.5% cash back automatically deposited into your eligible Schwab account for purchases made with your Card.

- Earn a $200 Card Statement Credit after spending $1,000 in purchases on your Schwab Investor Card® from American Express in the first 3 months of Card Membership.

- 0% introductory APR on purchases for 6 months starting from the date of account opening. After that, your APR will be a variable rate, 18.24% to 21.24%, based on your creditworthiness and other factors.

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 6 months

|

N/A

|

18.24% to 21.24% variable

|

$0

|

Good/Excellent

|

If you have a Schwab investment account, you can get the Schwab Investor Card® from American Express. It features a signup bonus of a $200 statement credit when you spend $1,000 on purchases during the first three months, plus 1.5% cash back on all eligible net purchases.

You can link this no-annual-fee card to your Schwab One® or Schwab General Brokerage account, as well as a Schwab traditional, Roth, or rollover IRA. Schwab also offers a Platinum Card, which is an exclusive credit card with a high annual fee.

- Earn up to 2% Cash Back Rewards when you redeem into an eligible TD Bank Deposit Account

- Bonus Cash Back: Earn $100 Cash Back in the form of a statement credit when you spend $1,000 within the first 90 days after account opening

- Earn unlimited cash back – no rotating categories, no caps or limits as long as your credit card account is open and in good standing

- 0% introductory APR balance transfers for the first 18 billing cycles after account opening.

- $0 Annual Fee

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

0% for 15 months

|

19.24%, 24.24% or 29.24% (Variable)

|

$0

|

Good/Excellent

|

The TD Double Up℠ Credit Card with a variable APR pays you an additional 1% cash back above the normal 1% cash back rate when you deposit your rewards into a TD Bank Deposit Account. You also can earn a $150 statement credit by spending $1,000 during the first 90 days after account opening.

You can earn a paltry 0.02% to 0.05% from a TD savings or money market account, where monthly maintenance fees or high account minimums apply.

How Do I Use a Credit Card For Wealth Management?

The concept behind the reviewed cards is to parlay your cash back rewards into a savings or investing account. Each card issuer offers one or more such accounts that usually provide automatic transfers of your cash back rewards.

Naturally, you are not limited to the investment accounts offered by the card issuer. What the issuers offer is the convenience of hassle-free transfers to in-house accounts.

It’s a compelling idea to compound your rewards by investing them and earning interest, dividends, and/or capital gains through your investment accounts. It’s also a luxury that many cardholders can’t afford — they may depend on their rewards to help pay the bills.

Who Qualifies For These Cards?

The cards in this review are aimed at consumers with average or good credit scores (or a score reflecting excellent credit) and a clean credit history.

None of the reviewed cards charge annual fees, which means they are not premium, exclusive credit card offerings festooned with various preferred rewards and perks.

All the cards offer at least 1.5% cash back on purchases, with several in the 2% club. A couple offer even higher rewards on select net purchases, as well as perks like 0% intro balance transfer transactions (with a balance transfer fee) or a high credit limit. That’s not bad for a regular, non-business credit card.

To get the three cards offered by investment brokers, the Fidelity® Rewards Visa Signature® Credit Card, Schwab Investor Card® from American Express, and TD Double Up℠ Credit Card, you must have an investment or similar account with the brokerage. It’s very easy to transfer the preferred rewards from these cards to your investment account automatically.

Moreover, the investment accounts linked to these cards have no minimum amounts, and some commissions are waived. There is no secured credit card in this group, although some issuers separately offer a secured credit card.

The six bank-issued credit cards offer consumers an array of investment options, with almost none requiring a minimum deposit or commissions on certain online trades.

If you are a Wells Fargo Active Cash℠ Card, Citi Double Cash® Card, or Chase Freedom Unlimited® cardmember, you can link up with inexpensive online brokerage accounts offered by the card issuers.

By transferring your cash back or bonus points to a brokerage account, you have the opportunity to invest in stocks, bonds, mutual funds, exchange-traded funds, and other securities.

All offer some type of savings account or fixed income investing. If you aren’t familiar with investing, consider seeking out a qualified financial advisor.

What Is the Best Way Credit Cards Help You Get Rich?

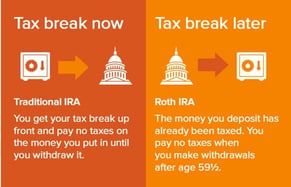

Perhaps the most persuasive reason to invest your cash back rewards (or rewards point offers easily converted to cash back) is to help build your retirement nest egg via an IRA. You can contribute the lesser of your work earnings or $6,000 ($7,000 if you’re 50 or older) into your IRAs.

Understand that your cash back rewards do not count as work earnings for IRA purposes — you must have salary or wages that match your IRA contributions up to the legal limit. Nonetheless, by contributing your rewards, you free up some of your wages for other uses.

It may be psychologically easier for some cardmembers to use their rewards to purchase risky investments.

I think the right attitude is to treat your cash back the same as your work income, not as casino money to be bet on wild speculation. But hey, if you want to buy risky stocks or other investments with your cash back, enjoy the ride!

On the other hand, putting your cash back into a savings account earning 0.02% interest (as available through the TD Double Up℠ Credit Card) won’t even keep up with inflation, especially if the interest is taxable. You’d probably be better off spending your cash back on goods and services before their prices go up.

Unless you’re a big spender, you’re not likely to accumulate big cash back over the course of a year — with the possible exception of the Cashback Match cards from Discover.

For example, if you spend $2,000 per month on your rewards card and earn 1% cash back, you will earn $20 per month or $240 per year. Double that to $480 in Year One if you happen to have a new Discover it® Cash Back card.

That’s not exactly a jackpot, but it can help you build your wealth slowly and steadily. Plus, a few good investments might pay high returns.

If you deposit your rewards into a traditional IRA, you can also take a tax deduction that can increase their after-tax value by 10% or more (depending on your tax bracket). Plus, your earnings grow tax-deferred until withdrawn later on.

Or you can use a Roth IRA, which doesn’t provide a tax deduction but does offer tax-free growth and withdrawals.

Some rewards point credit cards allow you to cash out your points quickly and conveniently. They are just as convenient as true cash back cards.

Many cards, such as the Apple Card, let you transfer your cash rewards to your bank or credit union account. The Apple Card pays Daily Cash rewards that you can transfer through its mobile wallet.

Because your annual cash back rewards will probably be modest, consider depositing them into one or more mutual funds, preferably those with very low fees. Doing so lets you achieve immediate investment diversification, which would be hard to do through individual small stock purchases.

What are the Drawbacks of Using Credit Cards For Investing?

You’ll find that most brokerages do not allow you to buy securities with a credit card. You can get around this restriction in a few ways, but it may not be a very good idea because of the costs and risks involved.

The most straightforward way to buy stocks with a credit card is to take a cash advance and send the money to your brokerage account. However, the APR on cash advances is usually higher than 25%, and there’s also a 3% to 5% transaction fee.

Your investment would have to produce a profit above these costs to make the deal worthwhile. That’s almost a foolproof method for losing money, even if your stock goes up.

Moreover, if your investment actually loses money, you’ll have to reach into your own pocket to pay back the principal on the cash advance, much less the interest.

Some online brokerages accept payment in the form of gift cards, which you could buy with your credit card. Once again, you’ll be starting in a hole created by the fees, which typically are 3% for using the credit card plus $1 to $3 per gift card.

Another drawback of funding your investments with your credit cards is that it will increase your credit utilization ratio (i.e., credit used divided by total credit available). Your credit score will suffer when your CUR exceeds 30%, which may happen if you make a large stock purchase.

To make matters worse, you won’t earn cash back rewards on cash advances, gift cards, and other non-eligible purchases. In addition, the U.S. Securities and Exchange Commission has issued alerts regarding scam artists pressuring victims into buying stocks with their credit cards and then stealing the money.

All of these problems disappear if you purchase securities using only the cash back rewards from your credit card. Of course, you’ll still face the risks of possible losses, but at least it won’t plunge you into credit card debt or mar your credit history on your credit report.

Compare the Best Credit Cards For Wealth Management

If you’d like to begin investing in securities, our review of the best credit cards for wealth management should help you get started. You can use the cash back rewards offered by these cards to fund purchases of stocks, mutual funds, ETFs, and other investments without creating new credit card debt or fees.

You may want to take a safer route by using your cash back rewards for insured savings products, such as CDs, savings accounts, and money market funds. This can be a good habit even if the sums are small.

To learn more about each of the reviewed cards, simply click on the APPLY HERE links and read all the fine print before applying.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How to Leverage Credit Cards to Build Wealth ([updated_month_year]) How to Leverage Credit Cards to Build Wealth ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/06/How-to-Leverage-Credit-Cards-to-Build-Wealth.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Buying Gift Cards ([updated_month_year]) 7 Best Credit Cards for Buying Gift Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Best-Credit-Cards-for-Buying-Gift-Cards-Feat.jpg?width=158&height=120&fit=crop)

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards for Building Credit ([updated_month_year]) 12 Best Credit Cards for Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/BUILD.jpg?width=158&height=120&fit=crop)

![9 Credit Cards that Use Equifax Credit Reports ([updated_month_year]) 9 Credit Cards that Use Equifax Credit Reports ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/equifax2.png?width=158&height=120&fit=crop)

![7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year]) 7 Credit Cards for Fair Credit: No Annual Fee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/credit-cards-for-fair-credit-with-no-annual-fee-feat.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for Students with No Credit ([updated_month_year]) 8 Best Credit Cards for Students with No Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-4.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)