For most consumers, the question, “What credit bureau does Chase use?” isn’t top of mind. After all, why should you care about which credit bureau a particular bank or credit card uses?

Oftentimes, it doesn’t matter at all. But if you apply for multiple cards at the same time, this information can make the difference between being approved or denied.

Fans of Chase credit cards may want to obtain more than one card, or have a negative mark on one report that may hinder their odds that doesn’t appear on another. If this describes you, read on to see which cards use which bureaus in which states.

The Credit Bureau Chase Uses Depends on Your Location

Each Chase card has its own credit bureau usage profile that varies from state to state. For example, one Chase card may use Experian in California while another uses TransUnion.

Unfortunately, Chase does not publicize its bureau usage profiles, so indications of which bureaus Chase uses is tenuous.

All credit card issuers choose among the three credit bureaus — Experian, TransUnion, and Equifax — as the primary source of credit history reports when you apply for a card. Specifically, the card issuer does a hard pull (inquiry) of your credit report from its favored credit bureau when it receives your application.

All credit card issuers choose among the three credit bureaus — Experian, TransUnion, and Equifax — as the primary source of credit history reports when you apply for a card. Specifically, the card issuer does a hard pull (inquiry) of your credit report from its favored credit bureau when it receives your application.

Each bureau maintains its own reports, although all three eventually share some information. It takes time for a credit bureau to learn of your credit applications when a different bureau was pulled.

That information “blackout period” is how you can increase your chances of obtaining multiple credit cards at the same time. You see, hard pulls reduce your credit score, especially if your request is denied.

A single pull can shave up to 10 points off your FICO score, but the effect is much bigger when you make several applications at the same time because they indicate to lenders that you may represent an increased credit risk. By spreading your requests across credit cards that use different bureaus, your credit score at each bureau won’t be immediately dinged for all the hard pulls.

Eventually, your hard pulls may be shared, but until that occurs, you have a better chance of getting accepted for each card by delaying the full impact of multiple applications.

Chase Credit Cards and their Associated Credit Bureaus

These are five of the most popular Chase credit cards. Where possible, we indicate their primary credit bureau, but bear in mind that Chase does not release this information.

We have scoured the web for forum comments and compilations of informal information to help identify which bureaus are favored by particular Chase cards. However, you will likely only know for sure when you check all three reports and see which has the timeliest information about your credit applications and payments.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® is an Experian partner but may use the other credit bureaus on a state-by-state basis. You earn cash back on all purchases, every day, plus you receive important travel and purchase benefits. This no-annual-fee card also offers an introductory 0% APR terms for new cardmembers.

This card is currently not available. Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.Chase Freedom Flex℠

The Chase Freedom Flex℠ card may use any of the big three credit bureaus. In some states, like Nevada and Nebraska, the card uses TransUnion only. This card is similar to the Chase Freedom Unlimited® card with respect to introductory benefits. However, it offers top cash back rewards in quarterly rotating categories as well as a tiered rewards system on set categories.

The Chase Sapphire Reserve® is a premium card that primarily uses Experian as its main credit bureau. It offers a generous signup bonus and 3X points on dining and travel, 1X points on all other purchases. Other travel benefits include a $300 annual statement credit to reimburse you for travel expenses and 50% more in travel redemption from Chase.

The Chase Sapphire Preferred® credit card is another of the Sapphire credit cards offered by Chase. It also uses Experian as its primary credit bureau and provides bonus points for a set amount of purchases during the first three months. The card provides 2X points for travel and dining, 1X points on all other purchases, and 25% more in travel redemption value through Chase. You also can perform a 1:1 point transfer to more than a dozen airline and hotel partners.

The Ink Business Preferred® Credit Card uses Equifax in Washington D.C., Maryland, and Ohio, but also uses the other two credit bureaus in other states. It lets you earn 3X points on the first $150,000 spent each year in certain merchant categories, with 1X points on all other purchases. It offers 1:1 point transfers to travel and hotel partners, as well as 25% more value when redeemed for travel through Chase Travel℠.

Which Credit Bureau Does Chase Use Most?

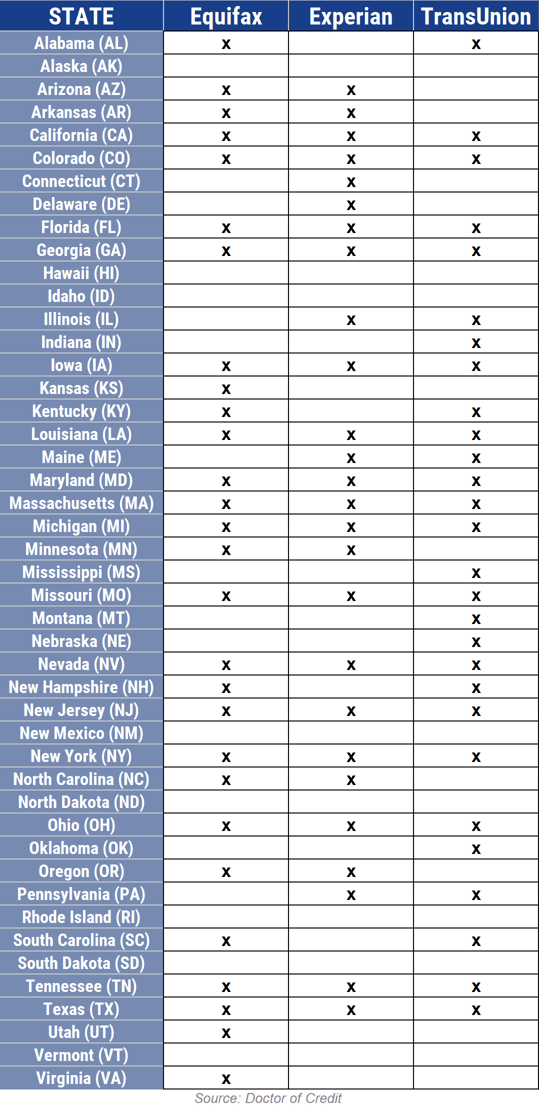

Chase primarily uses Experian as its credit bureau, but also uses TransUnion and Equifax for certain cards in certain states. The following chart shows the combined credit bureau preferences for all Chase cards.

As you can see, several states use all three credit bureaus, while relatively few use only one bureau. In most cases, one-bureau states are primarily associated with Experian.

Several two-bureau states use Equifax and TransUnion, but you can find just about every combination in the table. Some states, such as Vermont, Alaska, Wyoming, and others have no preferred credit bureau.

Why Are My Credit Reports Different?

At first glance, you’d think all three credit bureaus would have the same credit scores and reports since all three use the FICO scoring system. However, the three bureaus are competitors and do not work together unless forced to by law.

Therefore, if you use a credit card that primarily uses a single credit bureau, the report from that bureau may have more information than do the two other competitors. Not surprisingly, the format of each bureau’s report is unique.

The three credit bureaus collect information from lenders, consumer credit providers, retailers, and landlords, among others. They then package the information and resell it to lenders, creditors, employers, landlords, and other interested parties.

Typical data collected include name, address, Social Security number, credit and loan applications, payment history, tax liens, bankruptcies, foreclosures, collections, and other public records.

Because the three bureaus share only limited information, it’s up to you to check all three reports for mistakes. You start by ordering free copies of each report from AnnualCreditReport.com, the only source of free reports that is authorized by federal law.

All three bureaus have error-correction procedures you can use to fix mistakes on your report. You can interact directly with the credit bureaus through written correspondence to dispute data on your report. You can find letter templates online that will help you formulate your correspondence in the most effective way.

Alternatively, you can hire a credit repair company to assist you in fixing report errors. These companies follow effective procedures to dispute and remove derogatory errors from your reports, which should boost your credit scores.

How Can I Get Approved for a Chase Credit Card?

Chase is one of the largest issuers of credit cards in the U.S. That doesn’t mean it has the widest variety of cardholders. On the contrary, Chase favors cardholders who have good or excellent credit scores.

It is difficult to get a Chase card if your credit is fair or worse. Also, Chase does not issue any secured cards. It began issuing its first student credit card in 2019.

We have investigated the credit score needed to acquire a Chase card and found that most of its cards draw the line around a FICO score of 600, the divide between fair and poor credit. While you occasionally see forum reports of Chase cardholders with scores below 600, it’s clear that most Chase cardholders have scores above 600. Some Chase cards set their score minimum in the high 600s.

There are a few strategies you can employ to improve your credit score if it is below 600 and you want to obtain a Chase card, including:

- Make your payments on time, without fail. If possible, pay more than the minimum amount due.

- Reduce your debt by paying down cards and loans. This will lower your credit utilization ratio (CUR), which is the amount of credit used divided by the amount of credit available. High CURs are taken by the credit bureaus to indicate financial distress that will send your credit score downward. One important proviso: Do not close accounts that you have paid off, as this will reduce the average age of your credit history, which is a negative.

- Limit new accounts. Every time you apply for a new account, the lender or creditor will pull your credit history (a hard pull) that damages your credit score. Therefore, limit your applications and spread them out over time.

Check out our top tips for improving your credit card approval odds.

One important thing to keep in mind is Chase’s 5/24 Rule. This rule is meant to limit access to Chase credit cards by churners — people who regularly close card accounts and open new ones to gain introductory rewards.

The rule prevents you from getting a new Chase card if you opened five or more credit or charge cards in the past 24 months. This applies to all credit cards, not just ones from Chase. The 5/24 rule may not always be iron-clad for all cards issued by Chase, but it seems to be broadly implemented across the board.

Know Which Credit Bureau Your Card Reports To

Chase cards are popular, and millions of consumers own one or more. The credit bureau associated with each card can be important to you if you need to apply for multiple cards within a short period or have information on a particular bureau’s report that may hinder your ability to be approved.

Pay attention to the bureau each of your current cards uses because those bureaus will have the most information in their credit reports about you. That’s important to know when you set out to correct your credit reports because you should start with the bureaus favored by your cards.

Eventually, however, you need to review all three reports to root out errors that are hurting your credit score. Finally, if you are worried that your financial data has been hacked, consider freezing your credit reports.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![“Does Chase Have a Secured Credit Card?” ([updated_month_year]) “Does Chase Have a Secured Credit Card?” ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Does-Chase-Have-a-Secured-Credit-Card.jpg?width=158&height=120&fit=crop)

![Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year]) Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Credit-Card-Travel-Insurance-2.png?width=158&height=120&fit=crop)

![How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year] How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year]](https://www.cardrates.com/images/uploads/2016/10/how-does-a-secured-credit-card-work.jpg?width=158&height=120&fit=crop)

![How Does Credit Card Interest Work? ([updated_month_year]) How Does Credit Card Interest Work? ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/interestworks.png?width=158&height=120&fit=crop)

![How Long Does It Take to Get a Credit Card? ([updated_month_year]) How Long Does It Take to Get a Credit Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/howlong2--1.png?width=158&height=120&fit=crop)

![How Does a Prepaid Credit Card Work? ([updated_month_year]) How Does a Prepaid Credit Card Work? ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/How-Does-a-Prepaid-Credit-Card-Work.jpg?width=158&height=120&fit=crop)