When Capital One was established in 1994, it was a monoline bank, with all of its revenue coming from its line of credit cards. While typically considered to be a risky business model, Capital One found success by offering products designed with specific consumers in mind.

For instance, Capital One was among the first major issuers to offer blackout-free travel rewards through its popular Capital One Venture Rewards Credit Card. The card issuer has also worked to simplify credit card rewards in other ways, namely through its Capital One Quicksilver Cash Rewards Credit Card, which provides a flat-rate earnings structure that makes earning rewards simple.

In another consumer-centric move, Capital One doesn’t limit rewards to its most qualified applicants, either. While the card requires good to excellent credit, its sibling, the Capital One QuicksilverOne Cash Rewards Credit Card card is available to a wide range of credit types. In the article below, we explore the Capital One Quicksilver Cash Rewards Credit Card, credit score considerations, and look at a few other cards that may be worth considering as well.

Average Score | Rewards | Other Options

Average Cardholder Has A FICO Score Between 700-750

Whether we like it or not, the fact is the best credit products come to those who have the best credit scores, and the Capital One Quicksilver Cash Rewards Credit Card is no exception.

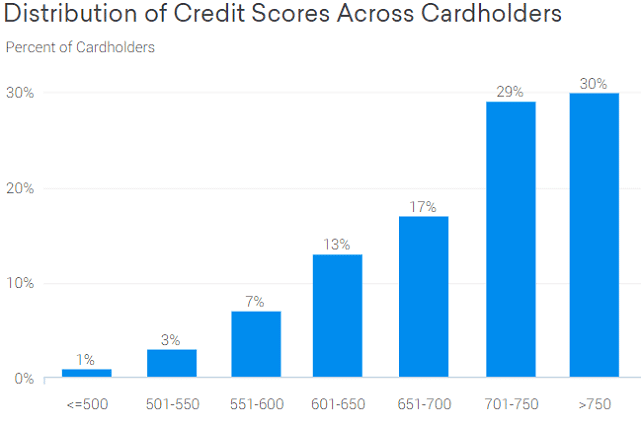

The bulk of Capital One Quicksilver Cash Rewards Credit Card cardholders reporting to Credit Karma have credit scores above 700, with a full 30% the card’s members having credit scores above 750.

Given the data, it’s safe to say your chances of being approved for the Capital One Quicksilver Cash Rewards Credit Card card are best if your credit score is firmly in the “Good” range. That’s not to say, of course, that you can’t qualify with a lower credit score. Around 40% of the reviewers had credit scores below 700, with as many as 7% of the cardholders having scores between 601 and 650, which is right in the “Fair” credit range.

As shown in the graph from Credit Karma, the average Capital One Quicksilver Cash Rewards Credit Card cardholder has a credit score above 700.

If you’re worried your score won’t be enough to earn a Capital One Quicksilver Cash Rewards Credit Card you can check for pre-approval before officially applying. Pre-approval uses a soft credit inquiry to estimate your approval chances and won’t impact your credit.

For prospective cardholders who don’t qualify for the Capital One Quicksilver Cash Rewards Credit Card based on their credit scores, the Capital One QuicksilverOne Cash Rewards Credit Card may be a good option. The Capital One QuicksilverOne Cash Rewards Credit Card provides the same unlimited rewards as its sibling, but accepts riskier applicants thanks to its higher APR and annual fee.

In fact, Credit Karma reviewers of the Capital One QuicksilverOne Cash Rewards Credit Card card report being approved with credit scores in the mid-500s, which puts them well into the “Poor” credit range. While these users also report being given very low limits — typically around $300 — they also mention receiving regular credit limit increases with responsible card use.

Furthermore, several Capital One QuicksilverOne Cash Rewards Credit Card cardholders have reported being able to upgrade their Capital One QuicksilverOne Cash Rewards Credit Card card to an annual-fee-free Capital One Quicksilver Cash Rewards Credit Card.

Those most likely to qualify for an upgrade have improved their credit scores and maintained their Capital One QuicksilverOne Cash Rewards Credit Card accounts in good standing for at least five months.

Cardholders Enjoy Unlimited Cash Back Rewards

In the modern credit card market, a well-qualified candidate can choose from dozens upon dozens of rewards credit cards, each with its own bells and whistles. But few are as simple and straightforward as the rewards offered by the Capital One Quicksilver Cash Rewards Credit Card and Capital One QuicksilverOne Cash Rewards Credit Card cards.

Rather than making you remember special bonus categories or requiring you to activate — and track — rotating rewards, both cards provide simple, flat-rate 1.5% cash back rewards on every purchase. Even better, those rewards are completely unlimited, with no quarterly or annual spending caps to cut your earnings short.

To really make the most of your rewards, you can also take advantage of the Capital One Quicksilver Cash Rewards Credit Card card’s signup bonus, which offers a lump sum of cash back rewards. The card also has a long introductory 0% APR offer, with a 19.99% - 29.99% (Variable) APR after that.

To become eligible for the signup bonus, simple meet the easily-attainable minimum spending requirement within your first 90 days. Unfortunately, while the Capital One QuicksilverOne Cash Rewards Credit Card offers the same cash back on new purchases, it doesn’t offer a signup bonus.

Alternative Card Options for Lower Credit Scores

For some consumers, poor credit scores and a rocky credit history may disqualify them from both the Capital One Quicksilver Cash Rewards Credit Card and Capital One QuicksilverOne Cash Rewards Credit Card cards. This can be particularly true if you have a string of negative items — or one big bankruptcy discharge — recently added to your credit reports.

In this case, your best bet may be to apply for an unsecured subprime credit card or a secured credit card. Both types of cards are designed for applicants who need to rebuild their credit scores and provide flexible credit requirements. Start your search with our expert-rated card picks below.

+See More Cards for Bad Credit

When comparing cards for rebuilding your credit, the main choice you’ll need to make is whether you want a secured credit card or an unsecured credit card. Secured credit cards will require an initial deposit to open your account, while unsecured credit cards don’t require a deposit but typically have higher rates and fees.

Although many consumers prefer unsecured credit cards due to the lack of a deposit, secured credit cards may provide the opportunity to obtain a higher credit limit, as the size of your credit limit is dictated by the amount you deposit (up to the maximum allowed by the specific card). Plus, unlike unsecured card fees, your secured card’s deposit will be returned to you when you close the account, provided the account is in good standing.

Cash In with the Capital One Quicksilver Cash Rewards Credit Card

For a relatively young company, Capital One has certainly made its mark on the consumer credit world, earning its spot as one of the top 10 credit card issuers in the world. Part of how the bank has achieved its credit card success is by offering credit cards designed with the consumer in mind, providing things like blackout-free travel and unlimited cash back that truly appeal to potential cardholders.

While Capital One’s card selection can be tempting, remember that you can only have two Capital One credit cards at any given time. So, if you think you’ll want to grab up multiple Capital One cards, you’ll want to do your research ahead of time to ensure you get the best cards for your purchasing needs.

Pairing unlimited rewards with no annual fee, the Capital One Quicksilver Cash Rewards Credit Card offers a solid place to start your Capital One collection. If your credit score isn’t quite ready for the card, the Capital One QuicksilverOne Cash Rewards Credit Card offers the same great unlimited cash back rewards while providing responsible card users with a good way to build credit.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![[card_field card_choice='39321' field_choice='title'] vs. [card_field card_choice='31445' field_choice='title'] Review ([updated_month_year]) [card_field card_choice='39321' field_choice='title'] vs. [card_field card_choice='31445' field_choice='title'] Review ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/ink.png?width=158&height=120&fit=crop)

![[card_field card_choice='5853' field_choice='title'] vs. [card_field card_choice='5855' field_choice='title'] ([updated_month_year] Review) [card_field card_choice='5853' field_choice='title'] vs. [card_field card_choice='5855' field_choice='title'] ([updated_month_year] Review)](https://www.cardrates.com/images/uploads/2018/03/shutterstock_1190829136.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='68495' field_choice='title'] vs. [card_field card_choice='5909' field_choice='title'] ([updated_month_year] Comparison) [card_field card_choice='68495' field_choice='title'] vs. [card_field card_choice='5909' field_choice='title'] ([updated_month_year] Comparison)](https://www.cardrates.com/images/uploads/2018/02/chase2.png?width=158&height=120&fit=crop)

![[card_field card_choice='5856' field_choice='title'] VS. Discover it® (4 Key Differences) [card_field card_choice='5856' field_choice='title'] VS. Discover it® (4 Key Differences)](https://www.cardrates.com/images/uploads/2016/02/capital-one-quicksilver-vs-discover-it.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='5859' field_choice='title']: Review & Credit Score Needed ([updated_month_year]) [card_field card_choice='5859' field_choice='title']: Review & Credit Score Needed ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/01/shutterstock_1023516253-1.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year]) [card_field card_choice='11298' field_choice='title']: Review & Credit Score Needed([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/unlimited-cover.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='22068' field_choice='title'] Review: Credit Scores, Limits & Rewards ([updated_month_year]) [card_field card_choice='22068' field_choice='title'] Review: Credit Scores, Limits & Rewards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-2.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='5853' field_choice='title'] Credit Score Requirements ([updated_month_year]) [card_field card_choice='5853' field_choice='title'] Credit Score Requirements ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/shutterstock_465713531.jpg?width=158&height=120&fit=crop)