Opening a commercial credit card in your company’s name has many benefits. Commercial cards, more commonly referred to as business credit cards, can provide convenience, help with cash flow, and sometimes even offer rewards or cash back on your everyday business purchases.

And in some limited cases, business credit cards may also help you build personal credit. Here’s how.

Corporate Cards vs. Small Business Cards

There are two types of commercial credit card accounts — small business credit cards and corporate credit cards. And although the two types of accounts are similar, they have some key differences you’ll want to be aware of.

- Corporate Credit Cards: To qualify for a corporate credit card, your company may need to bring in a high annual revenue (often several million dollars per year). You may also need to spend a certain amount on business expenses, depending on the card issuer’s requirements. Think of this as your company adding you as an authorized user on its account with the card issuer.

- Small Business Credit Cards: Many companies (sole proprietors included) will find it easier to open a small business credit card than a corporate card. You should be able to open a business credit card without any problems if your personal credit meets the card issuer’s minimum requirements and you can satisfy all other qualification criteria.

There may be a difference in liability where the two types of commercial credit cards are concerned. With small business credit cards, the business owner must typically provide a personal guarantee or “PG” to open the account. If the business fails to repay according to the terms of the credit card agreement, the bank can hold the business owner personally liable for the debt.

But corporate credit card issuers may not require a personal guarantee to open an account. If no personal guarantee is required, you may not be held personally liable in the event of a default or other detrimental credit event.

A Commercial Credit Card May Help Build Credit

One of the primary factors that determines whether a commercial credit card can help you build credit is the card issuer’s policy regarding credit reporting, formally referred to as data furnishing.

Different credit card issuers may report:

- All account activity for all cardholders to the major consumer credit bureaus (Experian, TransUnion, and Equifax)

- All account activity for the primary cardholder to the consumer credit bureaus

- Negative account activity only for all cardholders to the consumer credit bureaus

- Negative account activity only for the primary cardholder to the consumer credit bureaus

- All account activity to one or more business credit bureaus

- No activity to any consumer or business credit bureau

As you can see, commercial credit card issuers can have a wide range of credit reporting policies. If a credit card issuer reports all activity to any consumer or business credit bureau, then the account has credit-building potential for cardholders or businesses.

It’s a different story if a credit card company opts not to report any activity to a credit bureau or only reports account activity in the event of a default or other negative event. In either of these scenarios, the commercial credit card will not help you build credit and may work against you if the card goes into default.

A Commercial Credit Card May Have a Negative Credit Impact

Many people wonder whether a business credit card or corporate credit card will help them establish credit. But there’s another potential outcome that deserves some attention, as well. In some situations, a commercial credit card may negatively affect your credit score.

Here are some scenarios where a commercial credit card may negatively impact your credit:

- Late Payments: If you fall far enough behind on your payments, the card issuer may report the late payments (30 days, 60 days, etc.) to the commercial and/or consumer credit bureaus. Late payments have the potential to damage your credit scores. Paying your business credit card after the due date can also trigger fees and default interest rates, among other negative consequences.

- Default: Once you fall 90 days or more behind on a credit card account, the issuer may consider you to be in default. A late payment of this severity may have a greater negative impact on your personal and business credit scores.

- Credit Utilization: If a commercial credit card appears on your personal credit reports, a credit scoring model may consider the account’s balance-to-limit ratio (aka credit utilization). Using a high percentage of the credit limit can decrease your credit scores.

- Average Age of Credit: With personal credit scoring models, including FICO, the length of credit history is one of the factors that influence the calculation of your credit score. A new credit card account will lower the average age of accounts on your credit reports, and this action may damage your credit scores, at least until the card ages.

- Credit Inquiries: The issuing bank may check your personal credit reports when you apply for a commercial credit card. This credit access (aka a credit inquiry) may hurt your credit scores — though usually to a small degree, if at all.

How to See If a Commercial Credit Card Is Affecting Your Credit Scores

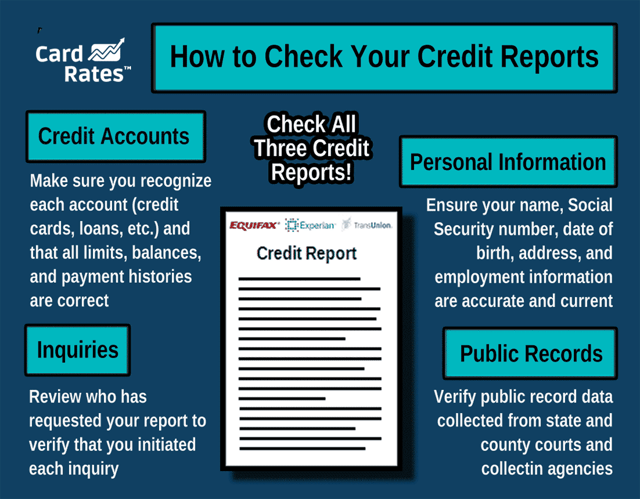

If you are a primary cardholder or an authorized user on a commercial credit card, there’s an easy way to find out if the account is affecting your credit scores. You can check your credit reports from all three consumer credit bureaus to see if the account is present.

To access your credit reports, you can visit AnnualCreditReport.com. This website allows you to claim a free report from each consumer credit reporting agency once every 12 months thanks to the Fair Credit Reporting Act. But consumers can get their credit reports weekly from this website through at least the end of 2022 thanks to the credit bureaus adjusting their policies.

Both consumer and business credit scores are based on the information in your credit reports. If a business credit card shows up on one or more personal credit reports, then the account can influence your credit scores.

If the credit card is not on one of your credit reports, it’s not affecting you. Credit scoring models cannot see or consider information that is not on your credit reports.

But keep in mind that even if an account isn’t present on one of your credit reports now, that doesn’t mean the situation won’t change in the future. Some credit card issuers will only report commercial credit cards to the credit bureaus when there’s a problem, such as a default.

You’ll want to manage your credit cards responsibly to protect your credit scores from potential harm now and in the future.

Contact Your Card Issuer For More Information

Some commercial credit cards do have the potential to help you build credit if you use them responsibly. If credit-building potential matters to you when choosing a credit card, you may need to do some research before you start filling out credit card applications.

It may require a bit of extra legwork, but you can contact the card issuers to find out about their credit reporting policies in advance. It’s not national security, so they will likely tell you how they determine when to report commercial credit card accounts to the consumer credit reporting agencies.

You’ll be better prepared to choose the business credit card that aligns the closest with your goals.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![What Card is in the Jennifer Garner Credit Card Commercial? ([updated_month_year]) What Card is in the Jennifer Garner Credit Card Commercial? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/jennifer-2.jpg?width=158&height=120&fit=crop)

![How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year]) How to Build Business Credit: 7 Expert Tips to Build Credit Fast ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/how-to-build-business-credit1.png?width=158&height=120&fit=crop)

![9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year]) 9 Expert Solutions: Build Credit Without a Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/without2.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year]) 3 Credit Cards For Kids & Ways to Help Them Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Credit-Cards-For-Kids.jpg?width=158&height=120&fit=crop)

![5 Best Secured Credit Cards to Build Credit ([updated_month_year]) 5 Best Secured Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/07/Best-Secured-Credit-Cards-to-Build-Credit.png?width=158&height=120&fit=crop)