Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

One of the first steps you may want to take when starting your own business is to apply for a business credit card. With a business card, you can charge everything from startup costs to expenses associated with day-to-day operations. But the card’s issuing bank will consider several factors for qualification.

In addition to the industry you’re in, the size and structure of your company, and the amount of revenue you’re bringing in, the issuer will usually require a personal guarantee.

Here we’ll look at what a personal guarantee is, why a bank would expect it, what it means for you, and the various ways you can offset potential problems. We also offer a few suggestions if you would rather not have a business credit card with a personal guarantee.

What Is a Personal Guarantee?

Almost all banks that issue business credit cards require a personal guarantee. When you sign an application with such a guarantee in place, you agree to be personally responsible for the account. Any debt you accrue will be yours to pay.

This can come as a shock to business owners who believe they are financially and legally protected from collections when a resulting debt was acquired strictly for business expenses.

There are two basic types of personal guarantees:

- Limited liability: This means the bank has the right to collect only on a fixed dollar limit.

- Unlimited liability: This means the bank has the right to pursue you for the entire amount due, which often includes all associated fees that may have been added as a result of your falling behind on payments.

The limited liability guarantee is in your best interest because you have less to lose if things go wrong. Check the terms and conditions listed in the application to understand the type of personal guarantee clause the card you are interested in has.

If you are confused about the guarantee and what it all means, contact the credit card issuer before you submit your application. The representative can talk you through all of the details.

Why Banks Require Personal Guarantees

Banks require personal guarantees for business credit cards to protect their financial interests.

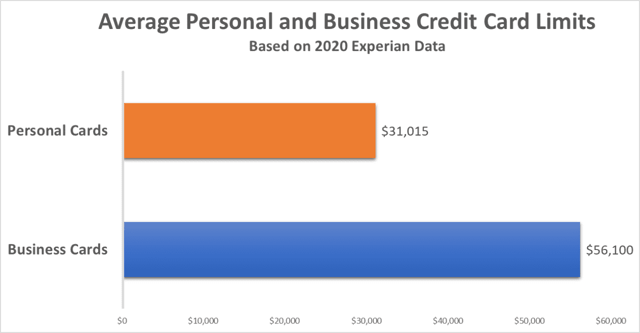

Unfortunately, small businesses are inherently riskier than larger, more established businesses, as many startups and low-revenue ventures don’t make it past the first few years. Additionally, business credit cards often come with a credit limit that can easily exceed $25,000, and some can go much higher.

That means you can run up a substantial amount of debt that can make a bank uneasy. Most of these credit cards are not secured, so if you fall behind and don’t pay the bill, the issuer will have to sue you to collect the amount you owe.

What a Personal Guarantee Means For You

The general concept for cardholders is pretty simple. The card is yours, even if it’s in the company’s name. It doesn’t matter if you are a sole proprietor, in a partnership, or have an LLC.

But when the card carries the name of your business, it can start to feel detached from your individual responsibility. It’s not. Remember that.

The great news is that none of this will matter if the account is kept in good standing. That includes making your payments on time as per the agreement, and not falling behind on the debt causing the account to go into default. By using the card responsibly, you will gain all the benefits of business credit card ownership and experience none of the problems.

On the other hand, let’s say you run up a large debt on your business credit card, but due to unforeseen and unavoidable circumstances, you do not have the money to make even the minimum payments. In fact, you fall so far behind that the account goes into default. Because you signed the application with a personal guarantee, the bank can pursue you for the money owed.

The bank doesn’t just get to swoop in and take what is owed to them overnight. It has to sue you in a court of law and win a judgment first. At that stage, the court will review all of your inventory – including personal property and business holdings – to gain an understanding of what and how much can be liquidated to satisfy the amount you owe.

If that is not enough to pay back what you owe, the creditor can impose a wage garnishment (in which the creditor can claim part of your wages if you are working as an employee), or put a lien on your property so when you go to sell it, a portion of the proceeds must be turned over to the creditor.

How to Offset Potential Problems

It may make you nervous to use a credit card for your business expenses when you know a personal guarantee means your personal and business assets are at risk, but you shouldn’t be. You got the card for a reason, and you can use it wisely so you do not put yourself or your company in jeopardy.

- Use the card effectively. Credit cards are not for every expense but rather for those you plan and can pay off quickly. Always have a short-term plan for repayment. This should be no more than six months to zero out the balance. As you’re charging, you will almost certainly be racking up rewards, too. If you have a cash back credit card, you can usually use what you earned as a statement credit, which will lower your payment. Many rewards cards that offer points also allow you to convert them to cash.

- Track your charges. Always keep a running total of the amount you have charged. Stop spending with the card when you can no longer handle paying the account in full or in a few installments. Make this a weekly habit and you will never be surprised by just how high the balance has escalated.

- Lower your debt. If the balance has grown out of control, review ways to reduce it. There may be assets you can voluntarily sell off so you can substantially lower the debt. And although it may be difficult, consider getting a part-time job that offers a steady income stream that you can use to pay down what you owe. This can help you avoid the severe consequences of not paying your business card. After all, it’s not just your assets at risk, but your credit rating.

- Contact the creditor for assistance. No credit card issuer wants you to fall behind and not pay. Yes, the card issuer can sue you for the amount you owe, but it’s not the ideal situation. After all, you may not have the money to pay even after the judgment, and you may even be able to file for bankruptcy protection which would allow you to get out of paying at all. That’s why most banks are motivated to help you manage the account when times are tough.

Do not hesitate to reach out and ask your card issuer for help if you need it. It is in their best financial interest to work with you.

How to Get a Business Card Without a Personal Guarantee

It is very difficult to find a business credit card that does not require a personal guarantee, though a few exist. They come in two basic categories:

- Business cards backed by your bank account: These are essentially secured credit cards. You can charge with the card up to the amount that you have deposited in the bank. The difference between a secured business card and a personal secured credit card is that secured business cards have very high reward structures.

- Corporate credit cards. These credit cards are not usually for the small business owner, but if your company does make enough revenue to meet the qualifications, you may be able to swing one. Only the company’s assets are on the line if the account goes into default.

A couple of card options to consider include the Brex Mastercard and the SVB Innovators Card.

The Bottom Line on Personal Guarantees

Personal guarantees may sound scary, but if you are going into business to turn a profit, you take a risk whenever you borrow funds, whether from a loan or a credit card.

You are also banking on your venture. And when you have a business credit card account with a personal guarantee attached to it, you become even more vested in your company’s success. With each charge you make, just ask yourself if it is putting you in the position of losing money — or making it.

![7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year]) 7 Business Credit Cards With & Without Personal Guarantee ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/05/cover-5--1.jpg?width=158&height=120&fit=crop)

![Game Over: Here’s Why the Best Credit Card Rewards May End Soon ([updated_month_year]) Game Over: Here’s Why the Best Credit Card Rewards May End Soon ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/01/game-over-credit-card-rewards.jpg?width=158&height=120&fit=crop)

![4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year]) 4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/biznocredit.png?width=158&height=120&fit=crop)