Most people have experienced heading out to the supermarket, a department store, or the mall, to pick up one or two items and leave instead with four bags full of stuff. Sometimes a sale is just too good to pass up. That’s why consumers often look for the best credit cards for shopping.

And while 90% of retail shopping in the U.S. still takes place in brick-and-mortar stores, experts forcast that online shopping will account for 20% of all sales by the year 2025. That means having a credit card that rewards you for your transactions is increasingly important, and why we did the research to find the best options to match your shopping needs.

Overall | Online | Groceries | Retail | International | Cash Back | Big Purchases | FAQs

Best Overall Cards for Shopping

Buying something for yourself is a fun experience. Buying something for yourself — and getting rewarded for making the purchase — is downright thrilling. That’s why it’s key to have a good rewards card in your shopping arsenal.

These cards can lower the cost of your items at the register or reward you with cash back equal to a percentage of your overall purchase price. Check out our top choices below for the cream of the crop.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

With the Chase Freedom Unlimited® card, you’ll earn cash back rewards on all of your purchases. Add to that an introductory period with 0% interest and you may just have your best option for that big purchase you need to make. This card charges no annual fee, and your rewards won’t expire as long as the account is open.

Not only does the Discover it® Cash Back card offer one of the highest cash back terms in the business, but Discover is also known for their incredible bonus potential at the end of your first year. Cardholders can activate quarterly categories that unlock bonus cash back and maximize their earnings potential in rotating categories that include gas stations, grocery stores, restaurants, and wholesale clubs.

- Earn 5% cash back at Aamzon.com and Whole Foods market

- Earn 2% cash back at restaurants, gas stations, and drugstores, 1% back on all other purchases

- Exclusively for customers with an eligible Prime membership

- Get a $100 Amazon Gift Card instantly upon credit card approval

- See your rewards balance during checkout at Amazon.com and easily use rewards to pay for all or part of your purchase — no minimum rewards balance to redeem rewards

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

14.24% - 22.24%

|

$0 (Prime Membership Required)

|

Good/Excellent

|

Amazon.com generates more than $1 billion in revenue every month, which means that a lot of people turn to the online retailer for their shopping needs. The Amazon Prime Rewards Visa Signature Card makes it easier to complete your purchase and save a little money if you’re an Amazon Prime member.

While the 5% discount for Prime members is a pretty big deal, remember that membership will still cost you the price of an annual Prime membership. Unless you make a lot of purchases with the online giant, the cost of the membership may not be worth the discount.

Best Cards for Online Shopping

Cash is still king in most commercial circles, but it won’t do you a lot of good online. If you’re the type of person who makes a lot of purchases online, you already know the importance of a good credit card. But is your current card as good as our top choices below? If not, you may want to consider adding one.

- $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

- Earn 3% cash back in the category of your choice, automatic 2% at grocery stores and wholesale clubs (up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases) and unlimited 1% on all other purchases.

- Choose 3% cash back on gas and EV charging station, online shopping/cable/internet/phone plan/streaming, dining, travel, drug store/pharmacy or home improvement/furnishing purchases.

- If you're a Bank of America Preferred Rewards® member, you can earn 25%-75% more cash back on every purchase. That means you could earn 3.75%-5.25% cash back on purchases in your choice category.

- No annual fee and cash rewards don’t expire as long as your account remains open.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% - 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- Contactless Cards - The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% - 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Cash Rewards Credit Card allows cardholders to choose a category that will yield them the most cash back. These categories include online shopping, which provides even more money back for purchases you’re already making. Who doesn’t love free money?

The Discover it® Cash Back card offers rotating quarterly categories you can activate that provide bonus cash back up to the purchase limit. These categories include online shopping destinations such as Target and Walmart. Cardholders can also automatically use their cash back rewards at checkout when purchasing from Amazon.

If you’re already an Amazon Prime Member, then the Amazon Prime Rewards Visa Signature Card can make your membership even more rewarding. All cardholders earn 3% cash back at Amazon.com and Whole Foods, but that number jumps to 5% if you’re a Prime Member.

This card has great utility whether you’re a Prime Member or not, but consider the cost of the membership if you’re wanting to boost your rewards.

Best Cards for Grocery Shopping

Everyone’s had the experience of buying groceries and watching the screen in the checkout lane as the total steadily increases with every item scanned. As that number grows, so, too, do the savings you can obtain with the right credit card.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% - 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® offers cash back rewards on all purchases. You can use the cash back to visit your favorite restaurant when you don’t feel like cooking or apply it as a statement credit to help lessen the cost of your grocery purchases.

- Earn $250 back in the form of a statement credit after you spend $3,000 in purchases on your new Card within the first 6 months of Card Membership.

- Earn 6% cash back at U.S. supermarkets on up to $6,000 per year on purchases (then 1%). Also earn 6% cash back on select U.S. streaming subscriptions.

- Earn 3% cash back on transit, including U.S. gas stations, taxis/rideshare, parking, tolls, trains, buses, and more. All other purchases earn 1% cash back.

- $120 Equinox Credit - Use your Blue Cash Preferred Card to pay for Equinox+ at equinoxplus.com and receive $10 in monthly statement credits. Enrollment required.

- 0% intro APR for 12 months from the date of account opening, then a variable APR applies

- $0 intro annual fee for the first year, then $95

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 12 months

|

N/A

|

18.49% - 29.49% Variable

|

$0 intro annual fee for the first year, then $95

|

Excellent Credit

|

The Blue Cash Preferred® Card from American Express offers the highest savings on groceries we’ve seen. Better yet, you won’t accrue interest on your grocery purchases for the first year of card ownership.

Whether you’re single or have a big family, the huge cash back savings makes this card worth the annual fee. Spending an average of $132 on groceries each month will cover the cost of the annual fee.

9. Target REDcard

The Target REDcard increased its value for frequent shoppers when many Target locations added a grocery department. Not only does this card offer a competitive interest rate, but you’ll instantly get 5% off your total purchase at checkout in stores and online.

- Save 5% on qualifying purchases in-store and online

- Free 2-day shipping on items at Target.com, extended returns on purchases made with your REDcard

- No annual fee

What’s more, Target lets you use coupons for your grocery shopping purchases in conjunction with the 5% discount. That could greatly decrease your food bill and give you more money to shop for everything else you want at Target.

Best Retailer Cards for Shopping

Many retailers offer their own branded cards that provide savings at the checkout or cash back on your total cost, as well as the opportunity to pay for your purchases over time. Many chain stores also offer special discounts and perks to cardholders. Check out the list below to see our top retailer cards for shopping.

- Easy application! Get a credit decision in seconds.

- Build your credit history – Fingerhut reports to all 3 major credit bureaus

- Use your line of credit to shop thousands of items from great brands like Samsung, KitchenAid, and DeWalt

- Not an access card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See Issuers Website

|

$0

|

Poor Credit

|

The Fingerhut Credit Account is a great choice for online shopping if you have damaged credit or want to establish a credit history. That’s because this credit account isn’t actually a credit card. Instead, you can limit the temptation to spend since you can only use your account to purchase items online through Fingerhut and its partner websites.

You can get just about anything you need on Amazon.com. And the Amazon Prime Rewards Visa Signature card makes it easier to get what you want without leaving your house — all while increasing the cash back savings for Amazon Prime members.

Amazon doesn’t charge an annual fee for card membership and cardholders receive special financing deals on all orders of $149 or more — which is easy to spend at the internet megastore.

12. Target REDcard

Target is one of the leading all-purpose stores in America for good reason. Not only does the chain provide great merchandise at great prices, but its Target REDcard increases savings by automatically deducting 5% from your total purchase price at the register.

- Save 5% on qualifying purchases in-store and online

- Free 2-day shipping on items at Target.com, extended returns on purchases made with your REDcard

- No annual fee

Target also accepts coupons, which will maximize your savings when you use your card to make purchases. Just be sure to pay your balance in full as soon as you can because the APR on this card is a bit higher than the average APR.

Best Cards for International Shopping

Whether you’re a collector, bargain hunter, or on the lookout for a rare item that you just can’t seem to find, you can often spot great deals from overseas sellers. But some credit cards charge extra for shopping with international retailers in the form of foreign transaction fees. The cards below have no annual fees, low APRs, and don’t charge foreign transaction fees.

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 17.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% - 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Cash Back card has friendly international terms that won’t stop you from shopping internationally. Plus, you’ll earn cash back for qualifying purchases, and if you take advantage of the rotating categories, you can really maximize your earnings potential each time you spend.

The Capital One VentureOne Rewards Credit Card doesn’t charge annual fees or foreign transaction fees, which means you can use your card anywhere in the world without worrying about surprise charges.

Every Capital One Quicksilver Cash Rewards Credit Card member earns an unlimited cash back on every purchase he or she makes with the card. Capital One also offers regular signup bonuses and introductory interest-free periods that make this card an attractive option to the frequent shopper, all with no foreign transaction fees for overseas purchases.

Best Cash Back Cards for Shopping

What’s better than finding an item you’ve always wanted? How about finding that item and getting cash back for purchasing it on your credit card. Our top cash back cards below not only give you that warm and fuzzy money-back feeling, but they offer other great perks that make shopping even more enjoyable.

This card is currently not available. Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.16. Chase Freedom Flex℠

The Chase Freedom Flex℠ has long been one of our favorite overall credit cards, which makes it an easy choice for our best credit cards for shopping. New cardholders start with a 0% introductory APR and earn cash back on all purchases.

The Discover it® Cash Back has become a favorite with shoppers because of its robust rewards program and earnings potential. If you’re a regular shopper (or even a bill payer) and take advantage of those rotating categories, that cash back can add up quickly.

This card is currently not available. Additional Disclosure: Information for this card not reviewed by or provided by Capital One.18. Capital One® Savor® Cash Rewards Credit Card

The Capital One® Savor® Cash Rewards Credit Card is a foodie’s best friend. And after a long day of shopping, who doesn’t enjoy a nice meal?

Best Cards for Big Purchases

Try as you may, you can’t stop your appliances from dying or your car from giving up. And when these things happen, big bills often follow. Thankfully, there are credit cards that offer long introductory periods without interest charges to lessen the impact of a big purchase. Check out our top choices below.

New Chase Freedom Unlimited® credit card members start with an interest-free introductory period, which makes this card perfect for making — and paying off — a big purchase without added charges. Along with the intro APR offer, you’ll earn unlimited cash back rewards on all purchases.

This card is currently not available. Additional Disclosure: The information related to Chase Freedom Flex℠ credit card has been collected by CardRates.com and has not been reviewed or provided by the issuer of this card.20. Chase Freedom Flex℠

Not only does the Chase Freedom Flex℠ offer a 0% introductory period, but you’ll also earn a signup bonus after you spend the minimum required on purchases in your first 3 months from account opening. That means you can get near-instant savings with any big purchase you make with the card.

- 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that the variable APR will be 18.24% - 28.99%, based on your creditworthiness. Balance transfers must be completed within 4 months of account opening.

- There is a balance transfer fee of either $5 or 5% of the amount of each transfer, whichever is greater

- Get free access to your FICO® Score online.

- With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

- No Annual Fee - our low intro rates and all the benefits don’t come with a yearly charge.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% 12 months on Purchases

|

0% 21 months on Balance Transfers

|

18.24% - 28.99% (Variable)

|

$0

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

Citi has a history of offering terrific interest-free deals to help new cardholders make big purchases or pay off existing debt through balance transfers. The Citi® Diamond Preferred® Credit Card is among the issuer’s best cards for balance transfers.

How Do You Shop with Credit Cards?

Credit card companies want you to use their cards, so they make it as easy as possible to swipe, insert, or tap and be on your way.

The majority of businesses accept most credit cards. But not every retailer accepts every credit card network. That’s why it’s vital to choose a card that your favorite shopping destinations accept.

When you use your credit card to make a purchase, the credit card issuer typically gives you a 30-day grace period after the purchase to pay off the charge without interest. Once that time passes, you’ll begin to accrue interest fees on your purchase.

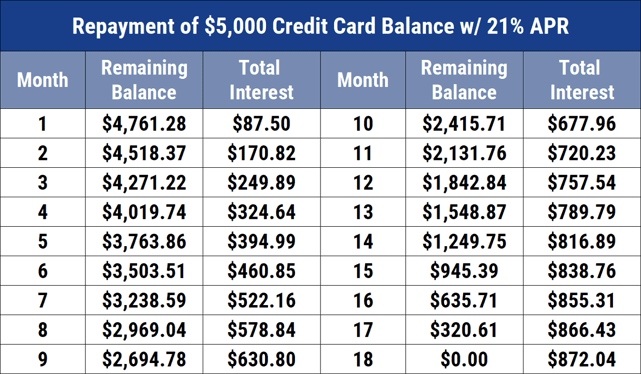

The fees will vary depending on your credit card. Below is an example of interest fees on a credit card with a $5,000 balance and 21% APR.

To avoid these fees, never make a purchase using your credit card that you can’t afford to pay off within one month.

Shopping with a credit card is the easiest and most convenient way to make online purchases. Just about every e-tailer accepts the various credit card networks and offers a checkout page where you can enter your credit card information (card number, expiration date, and security code on the back of your card) to complete your purchase.

Before you give your number to an online store, make sure you’re shopping at a secure location. You can tell if a website uses the latest security technology by looking at the address bar in your browser. If there’s a picture of a little padlock to the left of the URL, your credit card information will travel an encrypted and safe path to the network that processes your payment.

Which Stores Help Build Credit?

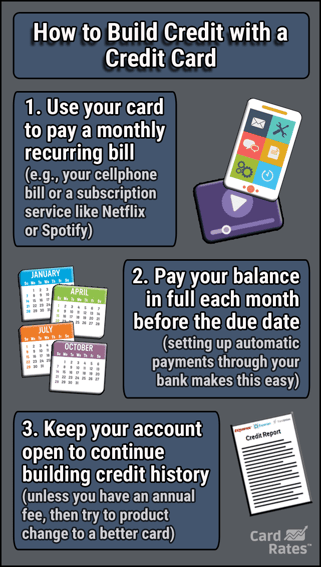

Credit cards — not stores — help you build credit. While many stores offer their own branded credit cards, it’s the bank that issues the card that will help you build credit.

The store simply accepts the card to complete your transaction and receives payment for the purchase from the bank that issued your card. You then owe the bank. The bank then reports your payment history and amount owed to the three major credit reporting bureaus, which can help establish or rebuild your credit profile.

The Fingerhut Credit Account is a great way to build credit while shopping online. This isn’t a traditional credit card. You can only use it online at Fingerhut.com and its partner websites to purchase name-brand merchandise at discounted prices.

Fingerhut’s issuing bank, WebBank, will report your payment history to the credit bureaus.

When you make on-time payments, the bank lets these bureaus know that your account is in good standing.

Continued on-time payments will help improve your credit score. If you miss a payment by only a few days, it typically won’t harm your credit score, though you may have to pay a hefty late fee.

When your late payment extends 30 or more days past the due date, the bank typically reports the delinquency to the credit bureaus. When this happens, your score will drop — possibly by 150 points or more.

These late payments live on your credit report for up to seven years. But as they get older, their impact on your credit score lessens. If you continue to make on-time payments, the positive history will eventually push the negatives further down your credit report, and your credit score will increase.

Is it Better to Buy Cash or Credit?

This depends on the size and scope of your purchase. You’ll never have a problem finding a retailer or service provider that accepts cash. Most prefer it because they don’t have to pay processing fees on the transaction.

And that’s okay if you’re stopping at the gas station to buy a drink and a candy bar. But if you’re doing some grocery shopping or making a big purchase, you may not want to carry around that much cash on you.

Many consumers prefer to carry credit cards because they’re easy to cancel if they’re lost or stolen, and many provide cash back or other benefits for every transaction. Some also offer purchase protection that can extend your warranty and give you added peace of mind.

But credit cards can also provide a tremendous temptation to spend money you may not have. Credit cards require a great deal of responsibility and restraint to keep you from accumulating debt — and paying heavy interest charges on your purchases. Some people choose to keep their credit cards at home, unless they know they’re making a big purchase that requires the card.

If you’re confident you can resist the temptation to spend that comes with a credit card, then you’ll certainly find that carrying one provides an easy and safe payment method that won’t overload your wallet and emergency funding when the inevitable happens.

Shop Your Way to Savings and Rewards

No matter what payment method you use, you’re going to have to go shopping at some point. After all, you’ll eventually need groceries, clothes, or toilet paper.

If you’re going to buy these things anyway, why not add one of the best credit cards for shopping in your wallet? That way, you can earn cash back or take advantage of other perks and discounts that will make those shopping trips easier on your wallet.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![8 Best Credit Cards for Online Shopping ([updated_month_year]) 8 Best Credit Cards for Online Shopping ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/online.png?width=158&height=120&fit=crop)

![5 Facts About the Shopping Cart Trick for Credit Cards ([updated_month_year]) 5 Facts About the Shopping Cart Trick for Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/carttrick.png?width=158&height=120&fit=crop)

![9 Best Credit Cards for Walmart Shopping ([updated_month_year]) 9 Best Credit Cards for Walmart Shopping ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Walmart-Shopping.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards For Christmas Shopping ([current_year]) 8 Best Credit Cards For Christmas Shopping ([current_year])](https://www.cardrates.com/images/uploads/2021/11/Best-Credit-Cards-For-Christmas-Shopping.jpg?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards For Building Credit ([updated_month_year]) 7 Best Credit Cards For Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-For-Building-Credit.jpg?width=158&height=120&fit=crop)