Have you ever heard of the shopping cart trick for credit cards?

Although it’s a little counter-intuitive to some, applying for new credit can cause your credit score to drop by several points. That’s because of the hard credit inquiry added to your credit reports when lenders check your credit.

While a single hard inquiry has only a small impact, multiple hard inquiries within a short period of time can cause more significant damage. As a result, it’s always best to minimize the number of hard inquiries that show up on your reports.

One such method — called the shopping cart trick — is rumored to work with certain store credit cards, allowing you to apply online while skipping the hard inquiry. But, there are a few facts you should know before trying to trick your way to new credit.

1. It May — or May Not — Really Work

The first thing to note about the shopping cart trick is that it may not even work. While there are a number of reports in blogs and forums online that claim the trick works to avoid hard pulls, other online sources describe the trick as merely a way to get you to contact them.

A lot of people misuse the term, saying it’s a way to actually get approved for store credit cards from Comenity Bank, Synchrony Bank, and Wells Fargo without a hard inquiry. But that’s just not true. WalletHub confirmed with all three issuers that you can’t get approved for one of their cards without a hard inquiry. — WalletHub.com

Additionally, even those cardholders who say the trick works as promised are careful to point out that it’s never 100%, going on to describe the somewhat complex process that you need to follow to perform the trick correctly and avoid an unintentional hard credit pull.

For example, you’ll first need to be opted into credit card offers — you’re opted in by default, but if you’ve joined the Opt-Out list, you’ll need to take yourself back off to perform this trick (and get ready for a full mailbox).

Also, don’t forget to turn off your browser’s pop-up blockers. Most store card offers during check out will appear as a pop-up. You may also need to clear your browser cache and cookies, according to some sources.

Next, you may or may not need to join the store’s loyalty program (reports are divided on this one), being sure to enter your name and address exactly as they appear on your credit report.

Then, it’s time to shop; you’ll need to add a few items to your online shopping cart — no hard data on how many items will work, but most references are plural. Some reports indicate a certain dollar value ($100 is the most common) will have the best luck.

When it works, the shopping cart trick should result in a pop-up credit card offer from the retailer.

Once your cart is full, you can start the checkout process. Again, be sure to enter your information as it appears on your report. If everything goes as planned, you should receive a store card offer sometime before hitting the final payment page.

If you don’t receive an offer before then, the trick didn’t work. This could either be because you skipped a step and need to try again — or because, well, it just didn’t work.

2. Only Specific Store Cards Are Reportedly Eligible

One of the most common reasons the shopping cart trick reportedly doesn’t work is that the store card in question isn’t eligible. Only specific store cards, most of which come from Comenity Bank, are said to work with the shopping cart trick.

Some of the cards that reportedly have the highest chance of success are:

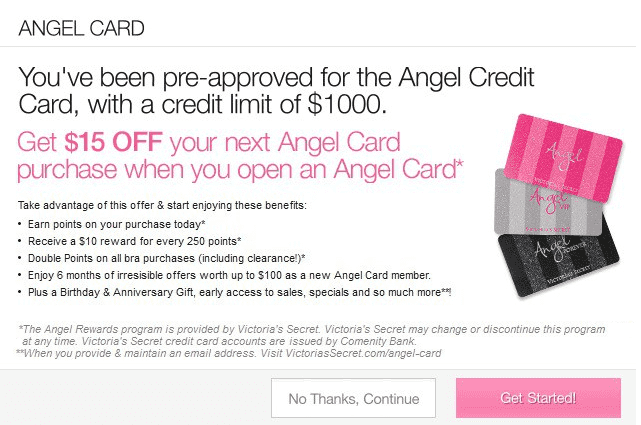

Victoria’s Secret Angel Card

The Victoria’s Secret Angel Card offers a decent 4% rewards rate, with every 250 points earning a $10 Angel Rewards certificate.

- Earn 1X point per $1 spent on eligible Victoria’s Secret purchases made with your card

- Receive exclusive offers & bonus buys

- Pay no annual fee

Though competitive for a store card, the 25.99% APR charged by the Victoria’s Secret Angel Card is anything but angelic. Always pay off your purchases before your due date to avoid being hit with large interest fees.

Boscov’s Credit Card

Unlock most store cards, the Boscov’s Credit Card won’t provide any purchase rewards until you hit the minimum $300 spending requirement, at which point you’ll receive 1% back in rewards on Boscov’s purchases.

- Earn 1% back on Boscov’s purchases after spending at least $300 on your card

- Unlock higher rewards by spending more

- Pay no annual fee

You’ll need to spend at least $1,500 a year to unlock the next rewards tier and earn 2% back in rewards. Spend at least $3,000 in a year to unlock the highest tier and receive 4% back in rewards.

New York & Company Credit Card

The New York & Company Credit Card offers purchase rewards and branded benefits for regular New York & Company shoppers.

- Earn a $10 Rewards for every $200 you spend on your card at New York & Company

- Enjoy select free shipping days

- Pay no annual fee

New York & Co’s credit card is best for shoppers who spend a lot with the company each year and can unlock the extra benefits of Premier status.

3. Approval Isn’t Guaranteed

Even if you pick a commonly successful card and follow all the steps exactly, the trick is said to still be hit or miss. Most advice is to try the trick again, perhaps varying the amount you put into your shopping cart in an effort to trigger an offer.

Of course, there’s no actual guarantee you’ll be approved for the card no matter what you do. You can perform the trick correctly, bypassing the hard credit pull, but still not be approved for the card thanks to your credit profile.

In other words, the credit card issuer is still going to look at your credit report, even if it won’t result in a hard credit pull. The soft credit pull issuers use to gauge your risk can still show them major red flags that can stop you from being approved.

4. There Are Still Credit Impacts

Suppose the shopping cart trick works exactly as expected, and you wind up with a new store credit card and no hard inquiry, your credit score isn’t out of the woods. There are credit report and score impacts from a new credit card far beyond the initial inquiry.

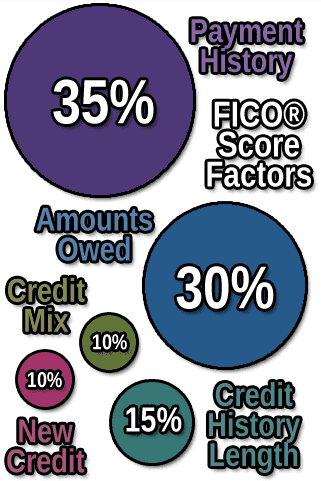

For example, each new credit account lowers your average account age, a factor that, along with the total length of your credit history, factors into 15% of your FICO credit score. If you open too many new accounts, the average age drop can cause a corresponding drop in your credit score.

Then there are the long-term impacts of adding another line of credit that must be used responsibly. But the more bills you have to keep track of, the more risk there is of forgetting a due date. Late payments not only come with big fees, but they can also cause significant credit damage if reported to the bureaus as delinquent.

Plus, store credit cards have notoriously high APRs that typically rival subprime credit cards, and most cards will charge the same outrageous APR regardless of your credit score. This means that carrying a balance on your new store credit card can get expensive fast.

Moreover, given that most store credit cards have low limits — many store card credit limits start out in the $300 range — carrying even a small balance could result in your credit utilization rate skyrocketing. Since utilization can contribute to as much as 30% of your score, this can mean a significant decrease in your credit score.

Moral of the story? A hard credit inquiry is the least of your worries when it comes to the credit impacts of a new credit card — and, in most cases, the most short-lived of them. Always be cognizant of all of the potential consequences when opening any new lines of credit.

5. Store Credit Cards Have a Lot of Limitations

Outside of all of the credit implications, the real question should actually be one of whether you need a store card in the first place. The reality is that store credit cards are so encumbered by limitations that they’re rarely worth the time and effort to add them to your wallet, hard inquiry or no hard inquiry.

For example, most store cards can only be used to make purchases with their brands. So, a Boscov’s Credit Card can only be used to make purchases at Boscov’s stores. And the same goes for their rewards — store card rewards can usually only be used to make more branded purchases.

So, unless a significant part of your expenses is with one brand, store credit cards rarely make sensible additions, hard inquiry or no. Instead, take advantage of the fact that hard inquiries are minor and fleeting inconveniences and go for an open-loop rewards card that will offer much more value and utility.

Additional Disclosure: Bank of America is a CardRates advertiser.

Of course, while hard inquiries aren’t major negatives in and of themselves, you still want to avoid a large number of them on your reports.

Don’t Play Games with Your Credit

When you’re trying to build your credit score, the small point drop from a new hard inquiry can seem like a major problem. But, at the end of the day, hard inquiries — when accrued in moderation — aren’t the worst thing you can do to your credit score.

So, even if the shopping cart trick works (which still seems to be up in the air), it may not be in your best interest. Every new credit card should be opened with due consideration to the potential consequences above and beyond the initial inquiry. Your credit score is something to be cultivated and maintained, and the road to excellent credit presents a long journey for many people — but with the right moves, it is an achievable goal.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year]) 4 Facts: Bank of America Unlimited Cash vs. Customized Cash ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/04/Bank-of-America-Unlimited-Cash-vs.-Customized-Cash.jpg?width=158&height=120&fit=crop)

![6 Facts: How to Transfer Money From One Credit Card to Another ([updated_month_year]) 6 Facts: How to Transfer Money From One Credit Card to Another ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/08/transfer--1.png?width=158&height=120&fit=crop)

![9 Best Credit Cards for Walmart Shopping ([updated_month_year]) 9 Best Credit Cards for Walmart Shopping ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/12/Best-Credit-Cards-for-Walmart-Shopping.jpg?width=158&height=120&fit=crop)