If you’ve ever wondered, “How does credit card interest work?” read on — it’s not as complicated as it may seem. If you understand the formulas involved, calculating important personal finance numbers typically requires no more advanced skills than those of simple arithmetic.

In many cases, the apparent difficulty of finance-related mathematics is due more to a confusion of concepts and terms than the need for calculus and derivations. This is particularly apparent when one cracks open the can of worms that is the concept of the interest rate. An integral part of just about every aspect of finance, interest rates can represent how much you’ll earn — or how much you’ll owe. All in all, calculating an interest rate isn’t inherently hard once you figure out what type of interest you’re calculating.

In the world of consumer credit cards, for instance, your interest rate is the cost of carrying a balance and is often expressed as your APR (annual percentage rate). Of course, it’s a little more complicated than that.

APR vs. Interest | Fee Calculation | How to Avoid Interest | Rate Determination

The Difference Between APR & Interest

Although not typically thought of as a loan, your credit card represents a line of credit, the same as a mortgage, auto, or personal loan. When you use your card to make purchases, you are essentially borrowing the issuing bank’s money to do so, with the understanding that you will pay it back in a reasonable period of time.

Because the bank cannot invest those funds in other money-making ventures while you’re using them, it charges you interest on the money instead. Along those lines, your credit card’s interest rate and APR are referring to the same thing: the fee you’ll be charged for borrowing the card issuer’s money.

When getting down to the details, however, your APR and interest rate can actually end up referring to two different numbers. This is because, your APR can effectively be thought of as the nominal interest rate, which is the most basic version of your interest rate. On the other hand, your overall interest rate, or effective interest rate, is what will actually determine the amount you pay.

In terms of credit card interest, the main difference between your nominal interest rate and effective interest rate is that your effective rate takes compound interest into account. Given that most credit cards compound interest on a daily basis, not an annual one, your nominal APR (which says “annual” right in the name) won’t actually give you the whole interest story.

You Have Multiple APRs

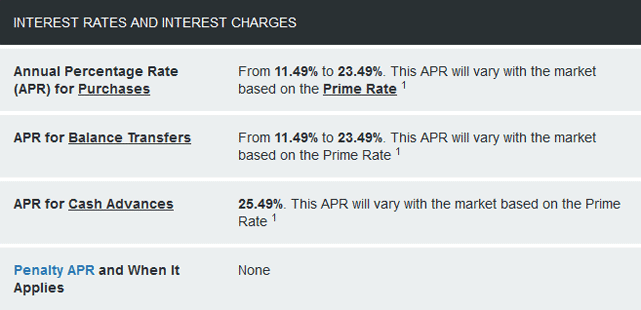

To add more confusion to the pile, your credit card will likely come with multiple APRs, with the particular rate depending on the nature of your charge. You’ll need to check your cardholder agreement to determine which APR applies in a particular situation. Your cardholder agreement will typically arrive in the same package as your new card, and can often be downloaded digitally through the bank’s online portal.

Probably the most important APR for many will be the purchase APR, which is the rate that applies to any new purchases you make with your card and is generally listed at the top of the page. If you’ve qualified for an introductory offer that includes a temporary lower interest rate on new purchases, the APR listed here will be the default APR after your initial offer terms expire.

Balance transfers will also have their own APR, though it may be the same rate as your purchase APR for some cards. As with introductory offers for new purchases, cards offering lower introductory balance transfer APRs will list the default rate that will apply after your offer ends.

Balance transfers will also have their own APR, though it may be the same rate as your purchase APR for some cards. As with introductory offers for new purchases, cards offering lower introductory balance transfer APRs will list the default rate that will apply after your offer ends.

Also listed in your agreement will be the separate cash advance APR. One of the very worst ways to use your card, a credit card cash advance is the only direct way to obtain cash from your credit card. Unfortunately, you pay a high price for this privilege — typically with interest rates as high as 25% or more.

Depending on the nature of the card, you may also have what is called a penalty APR. In most cases, the penalty APR will be applied when a cardholder breaks the cardholder agreement by making a late payment (or missing a payment altogether). With APRs ranging north of 30%, penalty APRs certainly add extra incentive to pay on time.

Your Rates are Variable

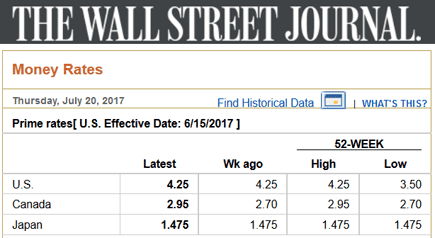

Another important distinction to make in regards to credit card interest rates is that your stated APR isn’t written in stone. In fact, most credit card APRs are actually variable rates, meaning they can fluctuate throughout the year as the market changes. The most common type of variable credit card APR is based on what’s known as the Wall Street Journal Prime Rate (WSJ Prime Rate).

The WSJ Prime Rate is a measure of the US Prime Rate, which the WSJ determines by looking at the prime interest rates being charged by each of the 30 largest US banks. While not technically set by a government body, the Prime Rate is heavily influenced by the federal funds rate set by the Federal Reserve’s Federal Open Market Committee (FOMC). Historically, the Prime Rate tends to stay approximately three percentage points above the federal funds’ rate.

Changes in the federal funds rate can occur as often (or rarely) as determined necessary by the economy and may go several years without seeing a change — or see several changes during a single year. For the most part, rates decrease during flagging economies and increase during periods of economic growth.

For instance, the Prime Rate hit its lowest point in decades after the Great Recession of 2008, and didn’t start to increase again until 2015. The current WSJ Prime Rate is set at 4.25%.

So what does all of this actually mean for your credit card APR? Well, when the FOMC increases (or decreases) the federal funds rate, the major banks tend to follow suit by changing their own prime interest rates. When the majority of the biggest banks (23 out of 30) have adopted the new rate, the WSJ updates its printed Prime Rate to reflect the change.

Because your credit card’s variable APR is likely based on the WSJ Prime Rate, an increase in the Prime Rate means your APR will also see an increase. For example, consider an initial APR of 18.25% with a Prime Rate of 3.50%. If the Prime Rate sees a typical increase of a quarter point (0.25%), then your new credit card APR will reflect that increase, becoming 18.50%.

How Rates & Fees Are Calculated

To go about calculating your interest payments, the first step is to determine exactly which of your card’s APRs will apply to your balance. If you have a combination of charge types, such as having both new purchases and a transferred balance on the same card, you may want to calculate the payment for each portion of your balance separately.

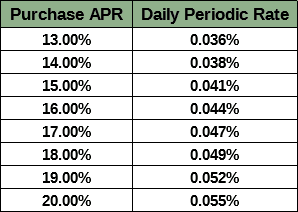

Once you know which APR to use, you need to adjust it to account for the daily compounding interest of your card. That means dividing your APR by 365 — or 360, depending on the specific issuer — to produce your daily periodic rate.

As an example, consider a hypothetical cardholder, Sue, whose card has a 17% purchase APR. Dividing by 365, Sue’s daily periodic rate would be 0.00047 or 0.047%. (While your daily periodic rate may seem small, it adds up much faster than you may think).

In the same way your APR must be adjusted for daily compounding, so too must your balance. This is done by determining your average daily balance. For cards on which you are not currently making new purchases, this is simply your balance at the start of the statement period. However, if you are making new purchases on the card or tend to make multiple payments throughout the month, determining your daily balance becomes a little trickier.

For instance, if hypothetical Sue started the statement period with a carried-over balance of $2,500 and she doesn’t make any purchases or payments in that time, her average daily balance would be $2,500. On the other hand, if Sue were to make a $1,000 payment on the card halfway through the statement period, her average daily balance will reflect that change. In that case, Sue’s average daily balance would be: ([$2,500 * 15] + [$1,500 * 15]) / 30 = $2,000.

With your daily periodic rate and average daily balance in hand, you can now calculate your daily interest by multiplying the two numbers. So, if Sue’s daily periodic rate is 0.047% and her average daily balance is $2,500, then her daily interest would be: $2,500 * 0.00047 = $1.18. For the case in which Sue makes a payment during the statement, her daily interest comes out to: $2,000 * 0.00047 = $0.94.

Moral of the story? The earlier you pay, the less interest you’re charged.

Of course, although credit card companies compound your interest on a daily basis, they only charge you for it once a statement period. This means you’ll need to multiply you daily interest payment by the number of days in the billing period (which will vary by month) to determine your total interest payment. So, with a daily interest charge of $1.18, Sue would pay $1.18 * 30 = $35.40 to carry her $2,500 for a month.

Here’s another example: the average US household carries more than $6,600 in credit card debt at any given time. Assuming a steady $6,600 balance throughout a statement cycle and an average APR of 17%, that means a typical household pays $6,600 * 0.00047 * 30 = $93 a month in credit card interest fees.

Two Ways to Avoid Paying Interest Fees

If you don’t relish the idea of paying an additional $100 a month (or more) on purchases simply for the pleasure of making them with your credit card, you’re hardly alone. About 30% of Americans have yet to adopt the credit card, many of whom cite interest fees as a reason for abstaining.

Thankfully, you may have several options for avoiding paying interest fees on your credit card, both for short-term and long-term balances. Which method you select (or qualify for) may depend on both your personal spending behaviors and current level of creditworthiness.

1. Pay Within the Interest Rate Grace Period

The most consistent way to avoid paying interest fees on your credit card balance is simply to pay it off in its entirety each statement cycle. This is because most credit card issuers provide what’s known as a grace period on new purchases, refraining from charging interest on balances paid before the due date for the billing cycle.

For example, say Sue’s balance is $1,000 at the end of May’s statement cycle. If Sue were to pay her entire balance by the due date, typically 23 to 25 days after the close of the billing period, she won’t pay any interest on that $1,000. If Sue only makes a minimum payment or otherwise does not pay her entire balance, she will be charged interest as usual.

Keep in mind that some other caveats apply to this method. Firstly, not every issuer provides a grace period on interest payments. In particular, some subprime issuers specializing in credit cards for bad credit may begin charging interest as soon as transactions post. You’ll need to consult your cardholder agreement for the specific policies offered by your issuer.

Secondly, interest rate grace periods typically apply only to new purchases. This means that other transaction types, such as balance transfers and cash advances, may start accumulating interest as soon as the transaction posts. Again, consult your cardholder agreement for details on when you will be charged interest.

2. Use 0% APR Introductory Offers

While the grace period plan works well if you are able and willing to pay your full balance each month, some purchases may require a little longer to pay off entirely. In these cases, the best cards for the job are those with an introductory 0% APR offer. Typically offered with terms of 12 months or more, an introductory 0% APR card offer can be used for new purchases and balance transfers.

These offers provide interest-free revolving credit for the length of the introductory period, eliminating the cost of carrying a balance on your card while terms last. Our top picks for 0% APR credit cards provide terms of at least 15 months on both your new purchases and transferred balances. Adding icing to the proverbial cake, you won’t be stuck paying an annual fee for our favorite cards, either.

When it comes to selecting an introductory offer, look at the length of the 0% APR offer, as well as the default APR you’ll pay when your terms expire. You should also keep in mind that no interest fees doesn’t mean no fees at all. Most credit cards will charge a balance transfer fee, generally 3% of the amount you transfer to your new card. You’ll also need to keep an eye out for the other usual fees, including annual fees and fees for special services.

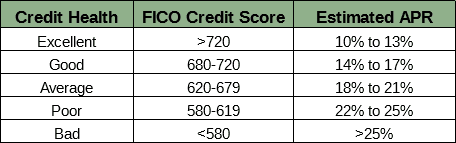

One thing to note is that your ability to qualify for a low-interest credit card offer will be highly dependent upon your personal creditworthiness. The most favorable interest rates and offer terms will be offered to those with the best credit, and 0% APR offers are generally reserved for those with good to excellent credit (FICO of 700 and up).

How Banks Determine Your Rates

With so much money potentially riding on your credit card’s APR, it naturally begs the question of how your APR is actually determined in the first place. Well, as with just about everything else in the credit realm, it all comes down to risk.

To begin with, each specific credit card will have an initial range of purchase APRs from which your individual rate will be set. For instance, a prime travel card might come with an APR range of 13% to 21%, while a subprime card might range from 22% to 30%.

The ranges vary because of the different levels of risk represented by the card’s demographic — prime cardholders are statistically less likely to default than subprime cardholders. Similarly, where you fall within the particular card’s range will also depend almost entirely on your creditworthiness. The better your credit, the lower your APR (and vice versa).

Although these numbers might seem high when looking at other credit types, such as the average 4.1% APR for a 30-year mortgage loan, risk plays a major role here, too. With a mortgage or auto loan, the house or vehicle acts as collateral for the loan. If you default (can’t make your payments) the bank can recuperate some of its losses by selling the property. With a credit card, lenders have no such recourse, making credit card debt much riskier for the bank to carry.

Given that your APR is based on your credit, the obvious way to improve the APR for which you qualify is to, well, improve your credit. In particular, if you can improve your poor credit enough to qualify for prime cards, rather than subprime cards, you’ll see a major interest rate decrease. Even within the prime card spectrum, you can see a decrease of 5% or more by improving your credit.

Demystifying Your Credit Card Interest

Despite its perceived complexity, mastering most aspects of personal finance doesn’t require you to have a degree in mathematics. Few consumers need to break out the old calculus book to balance the budget — or to determine their credit card interest payments.

Once you understand the different types of interest and how it accrues, you can calculate interest for just about any card. By knowing the real cost of your credit card purchases, you can make better, more informed credit decisions, and never be caught by surprise by your interest payments again. And remember, the easiest way to avoid interest while still being able to use your credit cards is to pay off the balance in full each statement cycle.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![What is Deferred Interest & How Does it Work? ([updated_month_year]) What is Deferred Interest & How Does it Work? ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/12/shutterstock_1759160015.jpg?width=158&height=120&fit=crop)

![How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year] How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year]](https://www.cardrates.com/images/uploads/2016/10/how-does-a-secured-credit-card-work.jpg?width=158&height=120&fit=crop)

![How Does a Prepaid Credit Card Work? ([updated_month_year]) How Does a Prepaid Credit Card Work? ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/01/How-Does-a-Prepaid-Credit-Card-Work.jpg?width=158&height=120&fit=crop)

![When Does Interest On a Credit Card Start? ([updated_month_year]) When Does Interest On a Credit Card Start? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/When-Does-Interest-On-a-Credit-Card-Start.jpg?width=158&height=120&fit=crop)

![Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year]) Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Credit-Card-Travel-Insurance-2.png?width=158&height=120&fit=crop)

![How Long Does It Take to Get a Credit Card? ([updated_month_year]) How Long Does It Take to Get a Credit Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/howlong2--1.png?width=158&height=120&fit=crop)

![“Does Chase Have a Secured Credit Card?” ([updated_month_year]) “Does Chase Have a Secured Credit Card?” ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/Does-Chase-Have-a-Secured-Credit-Card.jpg?width=158&height=120&fit=crop)

![What Credit Bureau Does Chase Use? ([updated_month_year]) What Credit Bureau Does Chase Use? ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/What-Credit-Bureau-Does-Chase-Use-Feat.jpg?width=158&height=120&fit=crop)