Credit scores are an important part of everyday financial life in America. Do you want to buy a house? Do you need to finance a new or used vehicle? Are you looking for a loan, credit card, or insurance coverage?

If you answered “Yes” to any of these questions, it’s almost certain that some business will use a credit score or several of your credit scores to evaluate whether it’s a safe investment to work with you. That same business will also probably use a credit score to decide how much to charge you in interest if you qualify for financing.

Yet despite how dependent the modern banking world has become on credit scores, there was a time when these tools didn’t exist. And it wasn’t that long ago relative to how long lending and credit bureaus have existed.

When you dig deeper into the fairly short history of the credit score, you’ll learn who created the first credit bureau risk score, when lenders started to use them on a widespread basis, and how you can keep your credit scores in the best shape possible.

Life Before Contemporary Credit Scoring Models

First things first, we need to agree on some terminology. A credit score is formally referred to as a credit bureau-based scoring system. The credit scores with which we are generally familiar are these types of scores, which almost entirely fall under either the FICO or VantageScore brands.

These are the scores that are sold by the credit bureaus and are entirely dependent on the information in your credit reports.

Before this type of credit score, applying for financing was a very different process. It was often difficult, and sometimes impossible, for certain consumers to borrow money.

In the past, bankers would make individual judgment calls for each applicant that requested a loan. Even with the help of credit reports, deciding who would qualify for a loan — and who would be denied — was subjective.

Between a lack of consumer protection laws and a lack of credit scores, you could be turned down for a loan due to factors that would be considered unconscionable in today’s lending environment. It also took a very long time to respond to certain loan applications, like mortgages, because the process of assessing risk was manual and unscientific.

If you think these ancient lending evaluation methods weren’t entirely fair to all consumers, you’re right. But by blocking opportunities for potential profits, the system didn’t optimally serve lenders either.

Without the predictive insights that credit scores would later offer, banks turned down a lot of applicants who would likely have repaid their debts (plus interest fees) as promised. The point being, there was plenty of room for improvements.

Introducing the FICO® Score (1958)

In 1956, Bill Fair and Earl Isaac founded Fair, Isaac and Company. You’re more likely to recognize the company by its more commonly used acronym FICO, for Fair Isaac Corporation.

Fair and Isaac were way ahead of their time. They had the idea that data could empower businesses to make smarter lending decisions. So, in 1958, FICO developed the first credit scoring system to be used by a U.S. lender.

And, in 1989, the first credit bureau-based score was introduced in partnership with Equifax. By 1991, FICO’s credit bureau scores were available from all three of the major credit bureaus.

The FICO Score range (or “scale”) has always been 300 on the low end and 850 on the high end, although there are some exceptions to this rule. If a consumer earned a higher score, it meant that he or she was more likely to pay their credit obligations in a timely manner.

If the consumer earned a lower credit score, it meant the opposite. All of this remains true even today, some 30 years later.

Another milestone for the FICO Score took place in 1995. That’s the year Fannie Mae and Freddie Mac recommended the use of FICO scores for mortgage lending. As a result, FICO’s scores transcended lending of all types, from mortgages to credit cards to personal loans to auto loans.

Introducing the VantageScore Credit Score (2006)

Lenders have used FICO’s credit bureau scores for many years. But in 2006, the three major credit reporting agencies formed VantageScore Solutions, which offered another credit score option.

VantageScore holds the intellectual rights to the VantageScore credit score, just as FICO holds the rights to the FICO credit score.

The first two versions of the VantageScore credit score featured a range of 501 to 990. But VantageScore’s latest models (3.0 and 4.0) share the same 300 to 850 scale as FICO’s scores. That means both of the commonly used scoring models are scaled the same, making it easier for lenders and consumers to interpret the three-digit scores.

The scoring model continues to grow in popularity and relevance in the lending world. Billions of VantageScore credit scores are used every year by thousands of lenders. The myth that VantageScore isn’t used and is just an educational score has never been true, and its market penetration has proven that.

VantageScore also played an integral role in another shift in the credit scoring world. In the past, consumers didn’t have the ability to access their credit scores with relative ease as exists today. Instead, credit scores were largely available to only lenders, unless you want to buy them.

In 2008, several websites began to give away free credit scores to consumers. In large part, those free scores were VantageScore’s credit scores. The trend continued and now it’s easy for consumers to access free credit scores — both VantageScore and FICO — from many different websites, credit card issuers, and more.

How to Earn a Good Credit Score

With credit scores having such an influence over your financial life, it’s wise to work toward earning and maintaining the best scores possible. You don’t have to aim for a perfect 850. But if you can earn an excellent score, it may make it easier to qualify for competitive financing offers, including premium rewards credit cards and lower interest rates.

There’s no single path to good credit. Your action plan will vary based on where you’re starting. However, everyone can follow some good rules of thumb when it comes to wise credit management.

1. Pay Your Bills On Time

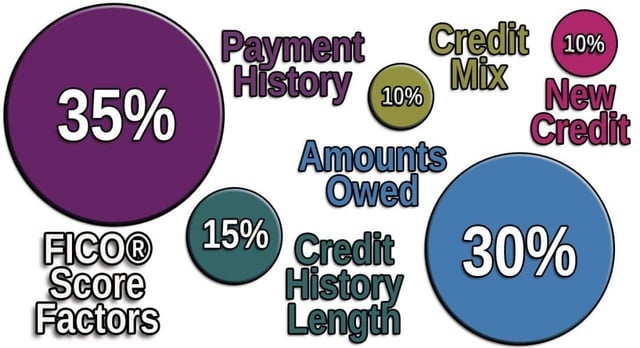

A clean payment history is essential with both FICO and VantageScore credit scores. Late payments, especially recent delinquencies, have the potential to lower your credit score quickly and for many years.

2. Watch Your Credit Card Utilization Ratio

Credit utilization is a term that describes the relationship between your credit card limits and your credit card balances. When the balance on your credit card begins to climb, your utilization ratio will climb as well.

High utilization can hurt your credit scores, even if you pay your monthly bill on time every month. Optimally, you want to use less than 10% of your available credit limits. That will keep you in good shape regardless of the credit score being used by your lender.

3. Consider Establishing New Accounts If You Need Them

FICO and VantageScore pay attention to the mix of accounts on your credit report. It’s best to have both revolving accounts (i.e., credit cards) and installment accounts (i.e., loans) that you manage well.

If you’re just starting out, it may be best to focus on secured credit cards or starter credit cards. These options tend to be easier to qualify for than credit cards, which have stricter qualification requirements. Likewise, credit builder loans can be worth considering on the installment account side for the same reason.

4. Look Into Experian Boost

One of the major credit reporting agencies — Experian — offers a free program with the potential to improve your credit scores. With Experian Boost, you can give the credit bureau permission to access your bank account information.

The program will comb through your account to look for payments you make monthly toward utilities, mobile phones, or streaming services. Eligible on-time payments can be added to your Experian credit report and have the potential to help your Experian-based credit scores, both FICO and VantageScore.

Modern Credit Scores Empower Consumers

Life since the inception of credit scores is a much better place. Modern credit scores empower more consumers to qualify for financing and to access the money they need or want faster than ever. And credit scoring models only consider credit report data, so no extraneous data is influential.

When you take the time to learn how credit scores work, it can give you an advantage. Good credit scores can make it easier to get the things you need and want, and to save money at the same time.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Best Credit Cards for Low Credit Scores ([updated_month_year]) 5 Best Credit Cards for Low Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/04/credit-cards-for-low-credit-scores-feat.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year]) 8 Best Credit Cards for 600 to 650 Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-600-to-650-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards for High Credit Scores ([updated_month_year]) 9 Best Credit Cards for High Credit Scores ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/10/Best-Credit-Cards-for-High-Credit-Scores-Feat.jpg?width=158&height=120&fit=crop)

![Credit Scores Needed for Chase Cards in [current_year] Credit Scores Needed for Chase Cards in [current_year]](https://www.cardrates.com/images/uploads/2019/05/credit-score-needed-for-chase-cards-feat.jpg?width=158&height=120&fit=crop)