It’s commonly understood that your credit scores can make or break your chances of qualifying for a loan or other forms of credit. Yet, it may come as a surprise to learn that the impact of your credit scores can go much deeper than the initial approval or denial, the binary decision made by prospective lenders.

Lenders don’t just use credit scores to decide whether to approve or deny your new financing applications. If you do qualify for financing, your credit score may also affect many different aspects of your loan or credit card offer, such as the terms associated with the newly opened account.

It begs the question, exactly how does your credit score affect loan terms?

What Your Credit Score Indicates to Lenders

Before a lender or credit card issuer agrees to work with you, it needs to determine whether loaning you money is a good investment for them.

Are you likely to pay back the money you borrow, plus the interest fees that make the arrangement worthwhile for the lender? That’s really the ultimate question the lender needs answered.

The concept is easy to understand if you put yourself in the lender’s shoes. After all, you probably wouldn’t want to loan money to someone who isn’t likely to pay you back as promised. You may want to better understand the risk of lending your money before you choose to lend it to someone you don’t know and have never met.

Similar to the scenario above, the lender doesn’t know the person asking for a loan. So, it needs help figuring out whether an applicant is likely to make late payments or, worse, default on the loan altogether.

Credit scores offer a solution to this problem and have for over 30 years.

Your credit report or “history” is a record of how you’ve managed accounts when you borrowed money in the past.

Did you pay on time? Did you fall behind on your payments? How much debt do you have? How many accounts with balances are you currently managing?

The details can all be found in your credit reports, and they’re all predictive of your credit risk.

A credit scoring model can look at your credit report, see how you’ve managed past credit obligations, and predict how you may handle credit in the future. It summarizes the detailed analysis into a three-digit score that’s easy for lenders and others to use and understand. When a lender understands the risk of doing business with you, it can make more informed decisions, including how to price your loans.

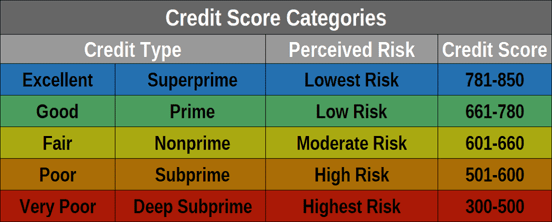

FICO and VantageScore, the credit scores that lenders most commonly use, range from 300 to 850. If your score falls on the higher end of that scale, you’re statistically less likely to make late payments on your credit obligations in the next 24 months.

However, a score that falls on the lower side of that 300 to 850 scale indicates the opposite. A lower score indicates elevated credit risk.

Your Credit Scores and Your Loan Terms

Lenders can also use credit scores to make sure they set your loan terms wisely. Interest rates, loan amounts, and repayment schedules are ways lenders adjust terms based on the risk of lending money to consumers with lower or higher credit scores.

What follows are some of the loan terms that a lender may adjust based on your credit score:

- Interest Rates: Your interest rate is one of the most important components of a loan. It affects the amount of your monthly payment and the overall cost you pay to borrow money. A good credit score is your friend where interest rates are concerned — lower interest is always better.

- Loan Amounts: Lenders base the amount of money you can borrow, known as your borrowing capacity, on three primary factors — your income, your existing debts, and your credit scores. With a good credit score, banks may be comfortable approving you for larger loan amounts and higher credit card limits. If you have bad credit (but not so bad as to exclude you from qualifying), you may find yourself approved to borrow less.

- Length of Repayment: Some loans come with standard repayment options. For example, in the mortgage world, 30-year and 15-year loans are the norm (even though some other choices may be available). With personal loans and auto loans, however, the length of time you have to repay a loan can vary even more.

In general, better credit scores open the door to potentially longer repayment terms. But keep in mind, longer repayment terms could lead to higher overall interest fees, and they may keep you in debt longer.

Be sure to do the math before you commit to a longer loan term, even if it’s available to you. It’s usually best to repay a debt as quickly as you can afford to do so. The point being, shorter payback periods are usually less expensive.

How Much Money Could Better Credit Save You?

Better credit scores can lead to better loan terms. But does locking in a lower interest rate really save you that much money?

In most cases, the answer is most certainly, yes.

Good credit has the potential to save you thousands of dollars in interest fees. With larger loans, like mortgages, the savings potential can easily climb to five figures, and sometimes more.

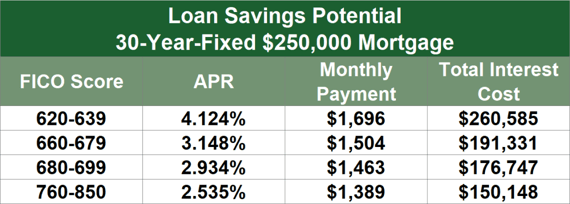

What follows is an example of how much a good credit score could save you on a $250,000 home loan, based on rates on or about the date of this article’s publication.

In the example above, improving your FICO Score from 639 to 760 would save you $307 per month. Over the life of the 30-year mortgage loan, your total savings would be an astonishing $110,437.

That type of credit score increase — 121 points — will typically take time and some hard work. Yet, the effort is well worth it when you consider the perks a higher credit score can bring about.

How to Improve Your Credit Scores

If your current credit scores leave something to be desired, you can work to improve them. Below are three simple credit score improvement strategies to help you get started.

- Pay down your credit cards. Your credit utilization ratio, the relationship between your credit card limits and balances, is an important factor in the calculation of your credit scores. High credit card utilization can cause your credit scores to decline. Therefore, if you can pay down your credit card balances and lessen your credit utilization, your scores may rebound.

- Clean up credit report errors. Negative information on your credit reports can hurt your credit scores, even if it’s incorrect. So, it’s important to keep an eye on your three credit reports to make sure they contain accurate information. If you discover credit report errors, the Fair Credit Reporting Act empowers you to dispute them. If your dispute is successful and gets a negative, incorrect item deleted from your credit reports, there’s a chance your credit scores could go up as a result.

- Become an authorized user. When you become an authorized user on a credit card, there’s a good chance the card will show up on your credit reports with Equifax, TransUnion, and Experian. If the account is positive (i.e., there’s no late payment history and the credit utilization rate is low), the account may have a positive impact on your credit scores.

Excellent Credit Can Pay Off Big

Your credit scores aren’t the only factor that matters when you apply for financing, but it is certainly an important detail. In general, lenders reserve the lowest interest rates and the most attractive loan terms for people with excellent credit scores. Working to earn excellent credit scores has the potential to pay off in big ways throughout your life.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![How the Chase 5/24 Rule Works & Which Credit Cards It Affects ([updated_month_year]) How the Chase 5/24 Rule Works & Which Credit Cards It Affects ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/5242.png?width=158&height=120&fit=crop)

![9 Loans & Credit Cards: 450 to 500 Credit Score ([updated_month_year]) 9 Loans & Credit Cards: 450 to 500 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/450500.png?width=158&height=120&fit=crop)

![9 Loans & Credit Cards: 550 to 600 Credit Score ([updated_month_year]) 9 Loans & Credit Cards: 550 to 600 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/550-to-600-Credit-Scores.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards & Loans: 800-850 Credit Score ([updated_month_year]) 7 Best Credit Cards & Loans: 800-850 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/850.png?width=158&height=120&fit=crop)