The Mercury Credit Card must be doing something right. It appeared in 2018, and now more than a half-million people are Mercury cardholders.

Previously known as the Mercury® Mastercard, and now as the Mercury® Rewards Visa® Card after a network change in 2022, the card targets consumers with past credit issues. We think it merits a further look and a comparison with a few subprime alternatives.

-

Navigate This Article:

The Mercury Credit Card Is Invite Only

The Mercury® Rewards Visa® Card is available by invitation only. Reportedly, you can get the card even if your credit score is as low as 550. An accompanying mobile app lets you manage the card anywhere.

- Variable Purchase APR

- Maximum credit limit: $6,000, depending on creditworthiness

- Annual fee: $0

You can use the card for cash advances and balance transfer transactions. The card features a 23-day grace period at the close of each billing period, during which it does not charge interest on purchases if you pay your entire balance by the due date each month.

The grace period does not apply to cash advances and balance transfer transactions — they accrue interest beginning on the transaction date and charge fees for each instance.

The card also imposes a foreign transaction fee, as well as charges for stopped payments, expedited card delivery, late payments, and returned checks or payments. The issuer permits you to add authorized users to the card account.

The card’s variable APR varies with the Prime Rate. Any point of sale (POS) system compatible with an integrated card reader (such as Odoo POS) can process Mercury Credit Cards.

The Mercury® Rewards Visa® Card reports payments to all three credit bureaus. Details about the card are hard to get, given it is invitation-only. All Mercury Rewards Visa accounts offer a minimum of 1% cashback rewards. Other perks include no annual fee, a free FICO Score, cash back on eligible purchases, fraud protection, and its mobile app.

5 Alternatives to the Mercury Credit Card

Don’t feel snubbed if you haven’t yet received your invitation for a Mercury Card, as there are plenty of worthwhile alternatives. Here are five that you can apply for without the hassle of obtaining an invite beforehand.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- All credit types welcome to apply!

- Monthly Credit Score – Sign up for electronic statements, and get your Vantage 3.0 Score Credit Score From Experian

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

- See if you’re Pre-Qualified without impacting your credit score

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

See website for Details

|

See website for Details

|

29.99% APR (Variable)

|

$75 – $125

|

See website for Details*

|

The Surge® Platinum Mastercard® is the best credit card in the group. It offers basic benefits such as $0 fraud protection, global payment coverage, and worldwide acceptance. You can manage the card online and via a mobile app. Optional credit protection, available for an extra fee, pays some or all of your card balance if you die, lose your job, undergo hospitalization, or become disabled.

- Greater access to credit than before – $700 credit limit

- Get a Mastercard accepted online, in store and in app

- Account history is reported to the three major credit bureaus in the U.S.

- $0 liability* for unauthorized use

- Access your account online or from your mobile device 24/7

- *Fraud protection provided by Mastercard Zero Liability Protection. If approved, you’ll receive the Mastercard Guide to Benefits that details the complete terms with your card.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

See terms

|

See terms

|

Fair/Good

|

Its name, Milestone® Mastercard®, declares the card’s target audience to be consumers with bad credit. It takes only a few steps to apply for the card, and if that fails, the credit card company may recommend other cards for you to consider. This Mastercard offers mobile access and does not charge a monthly maintenance fee.

- Earn 3% Cash Back Rewards* on Gas, Groceries and Utility Bill Payments

- Earn 1% Cash Back Rewards* on all other eligible purchases

- Up to $1,000 credit limit subject to credit approval

- Prequalify** without affecting your credit score

- No security deposit

- Free access to your VantageScore 4.0 score from TransUnion®†

*See Program Terms for important information about the cash back rewards program.

** Prequalify means that you authorize us to make a soft inquiry (that will not affect your credit) to create an offer. If you accept an offer a hard inquiry will be made. Final approval is not guaranteed if you do not meet all applicable criteria (including adequate proof of ability to repay). Income verification through access to your bank account information may be required.

† Your credit score will be available in your online account starting 60 days after your account is opened. (Registration required.) The free VantageScore 4.0 credit score provided by TransUnion® is for educational purposes only. This score may not be used by The Bank of Missouri (the issuer of this card) or other creditors to make credit decisions.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% or 36% Fixed

|

As low as $85

|

Fair

|

The Aspire® Cash Back Reward Card welcomes near-prime consumers, or those with credit scores in the low 600s. It offers quick prequalification with no harm to your credit score. The card waives the cash advance fee for the first year, imposes no signup or monthly maintenance charges, and offers cash back rewards on eligible purchases.

- Up to $1,000 credit limit doubles up to $2,000! (Simply make your first 6 monthly minimum payments on time)

- See if you’re Pre-Qualified with no impact to your credit score

- All credit types welcome to apply

- Access to your Vantage 3.0 score from Experian (When you sign up for e-statements)

- Initial Credit Limit of $300 – $1,000 (subject to available credit)

- Monthly reporting to the three major credit bureaus

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

29.99% APR (Variable)

|

$75 – $125

|

Bad, Fair, or No Credit

|

The Reflex® Platinum Mastercard® is a virtual clone of the Surge® Platinum Mastercard®. You can prequalify for the card in less than a minute without harming your credit score. The card features $0 fraud liability and a 25-day interest-free grace period following the end of a billing cycle.

- Earn 1% cash back rewards on payments made to your Total Credit Card

- Checking Account Required

- $300 credit limit (subject to available credit)

- No security deposit, simply pay a one-time $95 program fee to open your account.*

- User friendly Mobile App.

- *See Rates, Fees, Costs & Limitations for complete offer details

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

35.99%

|

$75.00 1st year, $48.00 after

|

Fair, Bad Credit

|

You can get the Total Visa® Card despite having below-average credit, or even bad credit. It takes only a minute to apply and receive a decision. The card waives its monthly servicing fee for the first year. Its low initial credit limit may help you afford your monthly payments.

How Do I Get a Mercury Credit Card?

You can get the Mercury Credit Card only if you receive a preapproved offer or reservation code from the issuer. The invitation hinges upon satisfying specific Mercury financial criteria and should result in an approved application unless:

- You have had an adverse change in your credit profile.

- You do not meet other pre-established standards that the issuer could not review before pulling your credit, such as a high debt-to-income ratio.

- The issuer is unable to verify your identity.

When you apply for the Mercury Credit Card, you must provide the reservation code that came with the application invitation. You will need to answer a few questions and verify the pre-filled personal information.

After reading the fine print, you can submit your application and, in most cases, receive an immediate decision. If one is not forthcoming, contact the card’s Technical Support Department.

Who Issues the Mercury Credit Card?

The First Bank & Trust in South Dakota, under license from Mercury Financial LLC, issues the Mercury® Rewards Visa® Card. The bank’s private holding company, Fishback Financial Corporation, has roots that date back to 1880 in the United States.

That’s when Horace Fishback and his uncle, Bert Olds, met the demand for banking services in Brookings, South Dakota, by opening a check-cashing station at the back of their general store. This customer service grew to become the Security National Bank, which later became First Bank & Trust.

The bank offers financial services to 17 communities with 22 branches in South Dakota and Minnesota.

Mercury Financial LLC (formerly CreditShop LLC) owns the Mercury® Rewards Visa® Card and several other North American businesses (but no US or Canadian banks). It operates out of Austin, Texas, has more than 160 employees, and claims to be the largest non-bank credit card company in the United States. It changed its name from CreditShop LLC in 2021.

What Credit Score Is Necessary For a Mercury Credit Card?

It’s hard to pin down the card’s credit score requirements. Some sources put the minimum score at 550, while others claim the card targets consumers with fair credit (580 to 669 on the FICO Score scale). Several reports on Credit Karma indicate that the issuer rejects many applications, even though all applicants are prequalified invitees.

How Do I Pay My Mercury Credit Card Bill?

The Mercury payment system offers several payment methods to Mercury cardholders:

- Online: You can pay online using a debit card or a bank account. Click Make a Payment on your Account Summary page to make an online payment.

- Mobile app: The card’s mobile app accepts payments from a debit card or bank account.

- Automated phone service: You can call Customer Service using the number on the back of your card to make a Mercury payment from your checking or savings account.

- Autopay: Enrolling in AutoPay on the Account Summary page allows you to avoid late fees. You can use the Mercury payment system to automatically pay your monthly minimum, statement balance, or a fixed amount on your credit card payment due date. You may cancel a credit card payment payment up to three days before the due date.

- Mail: Send your Mercury payment to Card Services, PO Box 70168, Philadelphia, PA 19176-0168. Include your name as it appears on your account and the last four digits of your credit card number to ensure proper crediting to your account. Allow seven to 10 days mailing time.

Like many other North American businesses, the bank accepts overnight payments at its lockbox address.

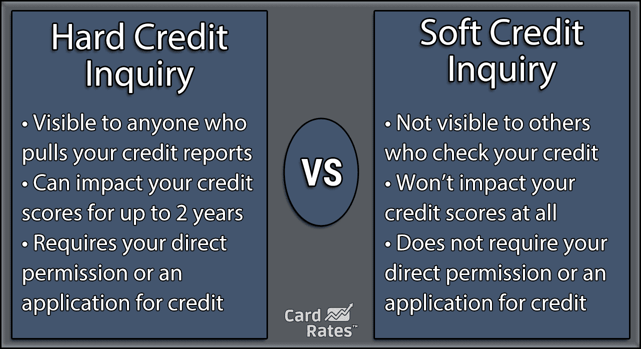

Does the Mercury Credit Card Perform a Hard Inquiry?

The bank does not make a hard inquiry when it sends you an invitation. But if you apply, the credit card company will perform a hard credit pull.

Your credit score may drop by a few points when you apply due to the hard inquiry. The impact is minor and lasts no longer than a year, although the application remains on your credit report for two years.

Consider Alternatives to the Mercury Credit Card

There’s some mystery surrounding the Mercury® Rewards Visa® Card. But what we do know is that it offers cash back rewards, has no annual fee, and gives you a free FICO Score. That’s not bad since many of the reviewed alternatives impose a yearly fee and several other charges.

We always recommend you read the fine print in the cardmember agreement before applying for any credit card.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![Instacart Credit Card: Review & 5 Alternatives ([updated_month_year]) Instacart Credit Card: Review & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/09/Instacart-Credit-Card.jpg?width=158&height=120&fit=crop)

![Surge Credit Card: Review & 5 Alternatives ([updated_month_year]) Surge Credit Card: Review & 5 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/11/surgecard.jpg?width=158&height=120&fit=crop)

![Cerulean Credit Card: Review & 3 Alternatives ([updated_month_year]) Cerulean Credit Card: Review & 3 Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Cerulean-Credit-Card-Alternatives-Feat.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='22068' field_choice='title']: Review & Alternatives ([updated_month_year]) [card_field card_choice='22068' field_choice='title']: Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/09/caponesavor2.png?width=158&height=120&fit=crop)

![[card_field card_choice='68438' field_choice='title' link_type='none'] Review & Alternatives ([updated_month_year]) [card_field card_choice='68438' field_choice='title' link_type='none'] Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/03/Citi-Secured-Credit-Card-Review.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='16924' field_choice='title' link_type='none'] Review & Alternatives ([updated_month_year]) [card_field card_choice='16924' field_choice='title' link_type='none'] Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Surge-Mastercard-Reviews.jpg?width=158&height=120&fit=crop)

![[card_field card_choice='31445' field_choice='title']: Review & Alternatives ([updated_month_year]) [card_field card_choice='31445' field_choice='title']: Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/preferred.png?width=158&height=120&fit=crop)

![Chase’s [card_field card_choice='39321' field_choice='title']: Review & Alternatives ([updated_month_year]) Chase’s [card_field card_choice='39321' field_choice='title']: Review & Alternatives ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/inkcash.png?width=158&height=120&fit=crop)