Blackout dates are specific dates when you can’t use your travel rewards for flights or hotel stays. These dates tend to take place around busy holidays and peak travel seasons. Blackout dates are unacceptable to travelers who rightly expect to redeem their credit card rewards for a trip.

This review covers credit cards with rewards that never expire nor restrict travel reward redemptions based on the calendar. But as we explain below, airlines have ways to limit the availability of reward seats, producing the same effect as blackout dates.

-

Navigate This Article:

No-Blackout-Date Cards With $0 Annual Fee

These cards support flexible travel plans without charging high annual fees. They also happen to be great travel cards that deserve consideration for an honored spot in your wallet.

- Earn unlimited 1.5 points per $1 spent on all purchases, with no annual fee and no foreign transaction fees and your points don’t expire as long as your account remains open.

- 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – that can be a $250 statement credit toward travel purchases.

- Use your card to book your trip how and where you want – you’re not limited to specific websites with blackout dates or restrictions.

- Redeem points for a statement credit to pay for travel or dining purchases, such as flights, hotel stays, car and vacation rentals, baggage fees, and also at restaurants including takeout.

- 0% Intro APR for 15 billing cycles for purchases, and for any balance transfers made in the first 60 days. After the Intro APR offer ends, a Variable APR that’s currently 18.24% – 28.24% will apply. A 3% Intro balance transfer fee will apply for the first 60 days your account is open. After the Intro balance transfer fee offer ends, the fee for future balance transfers is 4%.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means instead of earning an unlimited 1.5 points for every $1, you could earn 1.87-2.62 points for every $1 you spend on purchases.

- Contactless Cards – The security of a chip card, with the convenience of a tap.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 billing cycles for purchases

|

0% Intro APR for 15 billing cycles for any balance transfers made in the first 60 days (Balance Transfer Fee 3% for 60 days from account opening, then 4%)

|

18.24% – 28.24% Variable APR on purchases and balance transfers

|

$0

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

We rank the Bank of America® Travel Rewards credit card as this group’s best travel credit card with no annual fee. It lets you redeem your reward points without travel restrictions, and you can apply these points as a statement credit for flights, hotel stays, dining purchases, and other travel expenses. The card offers an extended intro 0% APR for purchases and balance transfers.

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% for 15 months

|

0% for 15 months

|

19.99% – 29.99% (Variable)

|

$0

|

Excellent, Good

|

If you prefer a no-annual-fee card, the Capital One VentureOne Rewards Credit Card obliges with unrestricted travel rewards that never impose blackout dates. You can redeem your miles to reimburse any trips you’ve already made or to book travel ahead of time through Capital One Travel.

- UNLIMITED BONUS: Unlimited Mile-for-Mile match for all new cardmembers – only from Discover. Discover gives you an unlimited match of all the Miles you’ve earned at the end of your first year. For example, if you earn 35,000 Miles, you get 70,000 Miles. There’s no signing up, no minimum spending or maximum rewards. Just a Miles-for-Miles match.

- Automatically earn unlimited 1.5x Miles on every dollar of every purchase

- No annual fee

- Turn Miles into cash. Or redeem as a statement credit for your travel purchases like airfare, hotels, rideshares, gas stations, restaurants and more.

- 0% intro APR for 15 months on purchases. Then 17.24% – 28.24% Standard Variable Purchase APR will apply.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Discover is accepted nationwide by 99% of the places that take credit cards.

- Terms and conditions apply.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR for 15 months

|

0% Intro APR for 15 months

|

17.24% – 28.24% Variable APR

|

$0

|

Excellent/Good

|

The Discover it® Miles never charges an annual or foreign transaction fee yet delivers rewards you can use for unrestricted travel. Due to the Discover Miles-for-Miles Match, new cardmembers double the reward miles posted in the first year after account opening. You collect the matched miles after the end of Year One.

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) – worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% – 29.24%.

- No annual fee – You won’t have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

0% Intro APR on Purchases 15 months

|

0% Intro APR on Balance Transfers 15 months

|

20.49% – 29.24% Variable

|

$0

|

Good/Excellent

|

The Chase Freedom Unlimited® offers Ultimate Rewards Points with no travel restrictions. And, if you also own a Chase Sapphire Preferred® Card, you can transfer the points to that card for a higher reward rate when you book through Chase Travel. The card also offers an intro 0% APR on purchases and balance transfers. All this and plenty more for a $0 annual fee.

No-Blackout-Date Cards With $95+ Annual Fee

If you pay an annual fee upwards of $100 or more for a travel credit card, the last thing you’ll tolerate is a card-imposed blackout date interfering with your travel plans. The following cards do not impose travel restrictions and provide top-notch benefits that justify their hefty yearly fees.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.49%-28.49% Variable

|

$95

|

Good/Excellent

|

The Ultimate Rewards points you earn from the Chase Sapphire Preferred® Card have no blackout dates or other travel restrictions. Better yet, they are worth 25% more when you redeem them through Chase Travel for your bookings. The points never expire while the account remains open.

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Miles won’t expire for the life of the account and there’s no limit to how many you can earn

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$95

|

Excellent, Good

|

You can use the miles you earn from the Capital One Venture Rewards Credit Card to pay for any flight on any airline at any time without any card-imposed travel restrictions. These miles never expire, and you can stockpile them to your heart’s delight. You can also transfer your points to more than 15 partner airlines.

- Earn 60,000 bonus ThankYou® Points after you spend $4,000 in purchases within the first 3 months of account opening.

Plus, for a limited time, earn a total of 10 ThankYou® Points per $1 spent on hotel, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ portal through June 30, 2024. - Earn 3 Points per $1 spent at Gas Stations, Air Travel and Other Hotels

- Earn 3 Points per $1 spent at Restaurants and Supermarkets

- Earn 1 Point per $1 spent on all other purchases

- Annual Hotel Savings Benefit

- 60,000 ThankYou® Points are redeemable for $600 in gift cards or travel rewards at thankyou.com

- No expiration and no limit to the amount of points you can earn with this card

- No Foreign Transaction Fees on purchases

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% – 29.24% (Variable)

|

$95

|

Excellent, Good

|

Additional Disclosure: Citi is a CardRates advertiser.

The Citi Premier® Card pays points that can be redeemed on ThankYou.com for travel accommodations with no blackout dates, including flights, hotels, cruises, rental cars, and more. Your points never expire and there’s no limit to the number of points you can earn.

- Receive 60,000 online bonus points – a $600 value – after you make at least $4,000 in purchases in the first 90 days of account opening.

- Earn unlimited 2 points for every $1 spent on travel and dining purchases and unlimited 1.5 points for every $1 spent on all other purchases. No limit to the points you can earn and your points don’t expire as long as your account remains open.

- If you’re a Bank of America Preferred Rewards® member, you can earn 25%-75% more points on every purchase. That means you could earn 2.5-3.5 points on travel and dining purchases and 1.87-2.62 points on all other purchases, for every $1 you spend.

- Redeem for cash back as a statement credit, deposit into eligible Bank of America® accounts, credit to eligible Merrill® accounts, or gift cards or purchases at the Bank of America Travel Center.

- Get up to $100 in Airline Incidental Statement Credits annually and TSA PreCheck®/Global Entry Statement Credits of up to $100, every four years.

- Travel Insurance protections to assist with trip delays, cancellations and interruptions, baggage delays and lost luggage.

- No foreign transaction fees.

- Low $95 annual fee.

- This online only offer may not be available if you leave this page or if you visit a Bank of America financial center. You can take advantage of this offer when you apply now.

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

20.24% – 27.24% Variable APR on purchases and balance transfers

|

$95

|

Excellent/Good

|

Additional Disclosure: Bank of America is a CardRates advertiser.

The Bank of America® Premium Rewards® credit card likes to say “no”: No blackout dates, no expired points, no ineligible airlines, and no foreign transaction fees. The card’s perks, including travel credits and insurance, more than compensate travelers for its moderate annual fee.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The Chase Sapphire Reserve® is the best travel credit card available, boasting excellent rewards and benefits without any blackout dates. Your Chase Ultimate Rewards points go 50% further when you redeem them through Chase Travel. The card’s credits and perks justify its steep annual fee. For example, it reimburses TSA Precheck and Global Entry fees, provides free lounge access, and valuable trip insurance.

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

19.99% – 29.99% (Variable)

|

$395

|

Excellent

|

The Capital One Venture X Rewards Credit Card is the premium travel card from this credit card issuer, providing generous mile rewards that impose no travel restrictions or blackout dates. You earn top rewards by booking flights, hotels, and rental cars through Capital One Travel.

- Earn 150,000 Membership Rewards® points after you use your new card to make $8,000 in purchases in your first 6 months of Card Membership

- Earn 5X Membership Rewards® points for flights booked directly through airlines or American Express Travel, on up to $500,000 on these purchases per calendar year. Also earn 5X Membership Rewards® points on prepaid hotels on AmexTravel.com. Earn 1X points on all other purchases.

- $200 annual hotel credit, $200 annual airline fee credit, $25 monthly Equinox credit, $15 monthly Uber cash credit, $50 bi-annual Saks Fifth Avenue credit, and more.

- Platinum Card Members have unlimited complimentary access to all locations of The Global Lounge Collection, including 1,400 airport lounges across 140 countries.

- Automatic Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status. Enrollment required.

- Choose among three card designs

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24% – 29.24% Pay Over Time

|

$695

|

Excellent

|

The Platinum Card® doesn’t come cheap, but its fans consider the annual fee well worth it. You earn maximum Membership Rewards points (which never have blackout dates) by booking your flights directly with the airline or American Express Travel. The same applies to unrestricted prepaid hotel reservations.

What Does “No Blackout Dates” Mean?

From a credit card standpoint, “no blackout dates” means that the card does not impose any calendar restrictions on the travel and hotel stays you finance with card rewards — points or miles. But remember that airlines may restrict the number of seats available through credit card rewards.

In other words, while no-blackout-date credit cards never prevent you from using your miles for traveling over holidays such as Christmas or Thanksgiving, you may have trouble finding an available seat during these busy travel times.

Airlines set policies dictating the percentage of their seats available through rewards credit cards and frequent flyer programs. A 2015 study by the IdeaWorks Company reveals the availability percentages then in place for the major airlines:

| Seats Available Through Rewards | |

| Airline | Percentage |

| Southwest Airlines | 100.0% |

| JetBlue Airways | 87.1% |

| Alaska Airlines | 80.0% |

| British Airways | 80.0% |

| United Airlines | 75.0% |

| American Airlines | 67.1% |

| Delta Airline | 57.9% |

The data shows that you were more likely in 2015 to get a reward seat on Southwest Airlines than on Delta, through no fault of your credit card. We wouldn’t be surprised if these numbers have changed since the time of the study.

Nevertheless, when you have trouble redeeming your credit card miles or points, blackout dates aren’t the problem; seat availability is.

You can respond to airline seat restrictions in a few ways, including the following:

- Better late than never: Sometimes, you can get a last-minute seat because of passenger cancellations, voluntary bumping, or involuntary bumping. Many airlines maintain standby lists for this eventuality. Also, if you can’t get the seat you want, try to book the flight again a few days before departure, when some airlines release additional reward-eligible seats.

- Consider another carrier: If you are using a credit card with general-purpose miles or points, you may be able to find a suitable seat on another airline. But if you are using a co-branded credit card, your miles are limited to the issuing airline and its partners.

- Get another credit card: If you’re presently using a co-branded airline credit card, consider switching to a general-purpose travel card that doesn’t tie you to one airline. Then, book a regular seat (not a reward one) and pay for it after the fact by cashing in your rewards.

- Use a reward seat app: You can use a third-party app, such as ExpertFlyer or SeatSpy, to check how many reward seats are available on a flight. They can help you narrow your search for non-restricted tickets. Also, some airlines may offer this information online, although you may have to hunt for it.

Blackout dates are frustrating, but a little ingenuity may help you sidestep them.

What Should I Look For in a Travel Card?

A good travel card should offer high reward points or miles that do not expire nor impose travel restrictions. Better (and more expensive) cards offer perks such as travel insurance, travel credits, and access to airport lounges. They require a good or excellent credit score.

Consider the following items when looking for the right travel card:

- Travel rewards: Simply stated, some credit cards offer more travel rewards than others. Take each card’s annual fee into account to make the comparisons fair.

- Travel upgrades: Co-branded travel and hotel cards are more likely to reward your loyalty with free or discounted upgrades — a better seat, a nicer hotel room, etc.

- Bonus rewards: A good travel card provides top rewards on travel purchases. Also, consider cards that increase the number or value of the bonus point or mile rewards you’ll obtain if you use the travel agency of the credit card issuer (e.g., Chase Travel, American Express Travel, Capital One Travel, etc.).

- Signup bonuses: New cardmembers can collect a bonus point or mile windfall through a generous signup promotion. You must spend a set amount on purchases during the introductory period to earn the bonus.

- No foreign transaction fees: We think every decent travel card should waive the foreign transaction fee. Look for travel cards that don’t bother you with this nuisance charge.

- Credits and reimbursements: The more expensive travel cards usually offer one or more travel-related credits that help justify their annual fees. Look for cards providing yearly travel credits and reimbursements for travel expenses, including TSA Precheck and Global Entry fees.

- Access to Airport Lounges: Free access to airport lounges is an increasingly popular travel card benefit, only available on the costlier cards. Check the fine print for limits and co-pays.

- Travel insurance: You may want a card that offers travel-related insurance that covers accidents, interrupted flights, lost luggage, and rental car collisions.

- Free checked bags: Airlines are extracting ever-higher fees for checked bags. Fight back with a credit card that pays for checking one or more bags.

In addition to these travel-related perks, a good travel card may offer benefits on everyday purchases, balance transfers, extended warranties, price protection, purchase protection, and cellphone insurance.

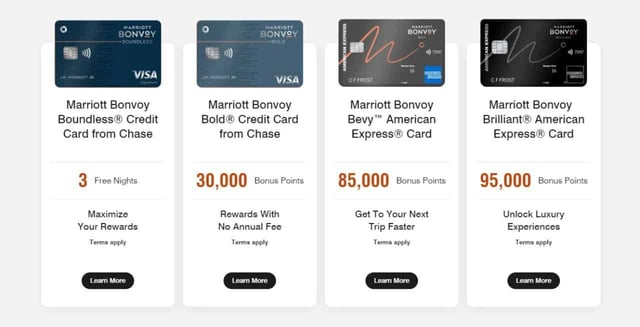

Do Hotels Offer Credit Cards Without Blackout Dates?

Yes, most major hotel chains offer co-branded credit cards without blackout dates to help keep customers loyal. Marriott Bonvoy, Hilton Honors, IHG Rewards Club, World of Hyatt, and other loyalty programs offer co-branded credit cards that provide year-round use, usually without restrictions, to anyone with a good credit score.

If you have eclectic hotel tastes and don’t want to own multiple co-branded cards, consider a general-purpose travel card instead. You can use these to book your hotel stays and/or apply your rewards as a statement credit to reimburse you for your hotel visits.

These cards offer the most flexibility but may not provide the same rewards and upgrades available from co-branded hotel cards.

Never Settle For a Card With Travel Restrictions

Your wallet deserves the best no-blackout-date credit cards. The good news is that many travel cards fit this description. Even better — some charge no annual fee.

We advise you to spend time comparing competing travel cards for their costs and benefits. And never settle for a card that restricts your options to fly when you want and stay where you want.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![5 Travel Credit Cards For Bad Credit ([updated_month_year]) 5 Travel Credit Cards For Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/11/Travel-Credit-Cards-For-Bad-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Travel Rewards Credit Cards ([updated_month_year]) 7 Best Travel Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/07/best-travel-credit-cards.png?width=158&height=120&fit=crop)

![7 Best Hotel Rewards Credit Cards ([updated_month_year]) 7 Best Hotel Rewards Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/01/hotels.png?width=158&height=120&fit=crop)

![7 Best Chip-and-PIN Credit Cards ([updated_month_year]) 7 Best Chip-and-PIN Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/Chip-and-PIN-Credit-Cards.jpg?width=158&height=120&fit=crop)

![12 Best Credit Cards for International Travel ([updated_month_year]) 12 Best Credit Cards for International Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/11/credit-cards-for-international-travel-feat.jpg?width=158&height=120&fit=crop)

![8 Best Credit Cards to Use in Europe ([updated_month_year]) 8 Best Credit Cards to Use in Europe ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/europe.png?width=158&height=120&fit=crop)

![7 Best Credit Cards for Free Hotel Stays ([updated_month_year]) 7 Best Credit Cards for Free Hotel Stays ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-Free-Hotel-Stays-Feat.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards for Domestic Travel ([updated_month_year]) 7 Best Credit Cards for Domestic Travel ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/09/Best-Credit-Cards-for-Domestic-Travel-Feat.png?width=158&height=120&fit=crop)