Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

There’s no question that being in credit card debt is a bad deal financially. Credit card debt, especially if it’s too close to your credit limits, can damage your credit score. Having made that point, it’s not entirely impossible to still have respectable credit even if you have balances on one or more of your credit card accounts.

If you’re working to pay down your credit card debt, which you should, you may be wondering just how serious your situation is in terms of the impact on your credit scores. A common misconception is that you are doomed to a bad credit score until you pay your credit cards off.

But just how much does credit card debt affect your credit scores?

How Credit Card Debt Impacts Your Credit Scores

Maintaining outstanding balances on your credit cards, as in cards that you don’t pay in full each month, can negatively impact your credit scores in a variety of ways.

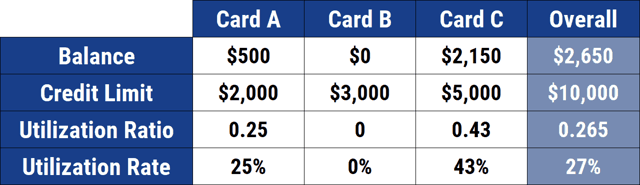

- Individual Credit Card Utilization: Credit scoring models like FICO and VantageScore measure your credit utilization ratio (CUR) on your individual credit card accounts. As that balance-to-credit limit ratio rises on your credit reports, you are going to earn fewer credit score points. This is going to be a common theme as it pertains to credit card balances and credit limits.

- Aggregate Credit Card Utilization: Your aggregate or overall credit utilization ratio also matters where your credit scores are concerned. In fact, this is the ratio on which most of us focus when discussing credit score impact. The aggregate utilization ratio is the balance-to-credit limit ratio of all your credit cards combined. Again, lower is better where this percentage is concerned. All you have to do to calculate your CUR is divide the sum of your balances by the sum of your credit limits, and multiply that by 100.

- The Number of Accounts with Balances: This is so important, and it flies almost entirely under the radar when people think about the impact credit card debt has on their credit scores. Having fewer credit card accounts with balances is better for your credit scores. So, when you owe a balance on multiple credit cards, it could hurt your credit scores even if you always pay your bills on time and even if your balances are low relative to your limits.

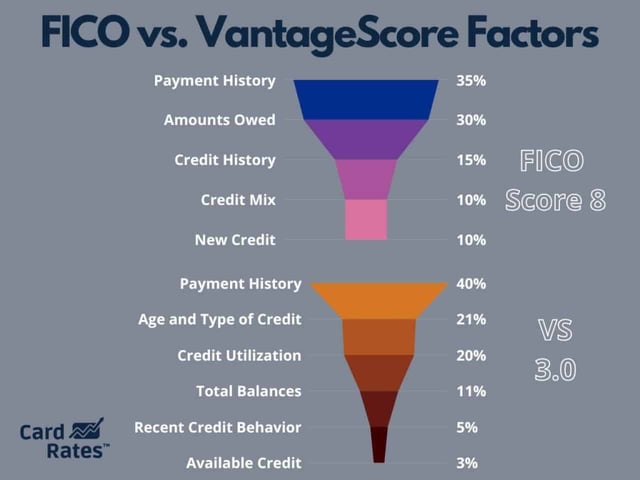

That said, it’s worth pointing out that the “Amounts Owed” category is only worth 30% of your FICO score points, and your CUR is not worth the entire 30%. There is a common myth that the aggregate credit card utilization ratio, by itself, is worth 30% of your score points. That’s factually inaccurate.

And while the above factors are significant and can help or harm your scores, they are certainly not the only credit scoring metrics. In fact, about two-thirds of the points in your FICO scores have nothing to do with your debt.

Other Factors That Affect Your Credit Scores

We’ve covered several ways that credit card debt may prevent you from earning higher credit scores. Now let’s consider other factors that can affect your credit scores, both positively and negatively.

The most important credit score category is your payment history. I like to call this the “presence or lack of bad stuff” category.

Some 35% of your FICO score points and at least 40% of your VantageScore credit score points come from whether you have negative information on your credit reports. This is directly tied to how you pay your credit obligations, including your credit cards.

Do you make a habit of always paying your bills on time? If so, you can build a solid foundation for your credit scores. On-time payments alone may not be enough to earn great credit, but it certainly is a great place to start.

Another factor that impacts your credit scores is the amount of time you’ve had credit, measured by the age of accounts on your credit reports. Credit scoring models consider the age of your oldest accounts, along with the average age of all your accounts combined. Older is better.

If you’re new to credit or you recently opened a lot of new accounts, your credit scores may suffer in this category. But if you have a friend or family member who’s willing to add you as an authorized user to an older credit card account, this may help you out.

(Note: The credit card issuer will need to report authorized users, and the account should be paid on time and have a low utilization rate for it to have the best chance of helping you.)

Much smaller portions of your credit scores have to do with new credit. Credit inquiries and new accounts have the potential to negatively impact your scores, although that’s not always the case. If you apply for new credit too frequently, it could be a problem. But if you limit your new credit applications to only when you really need or want new credit, you’ll probably be fine.

Also, you never have to be afraid to check your own credit report since doing so won’t harm your credit scores.

How to Achieve Good Credit With Credit Card Debt

Yes, you can earn and maintain good (or better) credit scores even if you have credit card debt. You may not hit an 850 FICO, but who cares? You don’t need anything close to 850 to get the best deals from lenders.

So, how do you get there?

Focus on paying down your credit card debt. When you revolve or carry a balance from one month to the next, you’re paying interest. And credit card interest is expensive.

Owing balances on your credit cards could also drive up those credit card utilization ratios. If your credit utilization climbs, your credit scores may fall in response. And never, ever miss a payment on anything. Those two categories alone are worth two-thirds of the points in your scores.

And while the target isn’t really 850, a good FICO score is going to be any score that gets you approved at the best terms. That number varies by lender and product. For mortgages, that is going to be 760 or higher. For auto loans, it is 720 or higher. For credit cards, where interest is optional, the number varies and can be much lower.

Next Steps

Paying down your credit cards to zero should be your ultimate goal. (Repaying the full statement balance each month is the most responsible way to use a credit card.) Yet, it can take time to accomplish this task, especially if you owe a large amount of debt.

On a positive note, your credit scores will likely start to improve long before your credit cards reach a zero balance.

As you make strides toward lowering your credit card debt, your credit utilization ratio may begin to come down as well. If this happens, your credit scores will start to rebound little by little. Plus, you should start saving interest charges in smaller increments as well. So, your debt elimination efforts can begin to pay off long before you reach the end of your journey.

![[current_year] Credit Card Debt Statistics (Average U.S. Debt) [current_year] Credit Card Debt Statistics (Average U.S. Debt)](https://www.cardrates.com/images/uploads/2018/04/shutterstock_243114739-edit.jpg?width=158&height=120&fit=crop)

![9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year]) 9 Best Ways to Pay Off Credit Card Debt (From Expert Beverly Harzog) ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/Beverly-9Best.jpg?width=158&height=120&fit=crop)

![Average Credit Card Debt in American Households ([current_year]) Average Credit Card Debt in American Households ([current_year])](https://www.cardrates.com/images/uploads/2018/01/avgdebt.png?width=158&height=120&fit=crop)

![6 Best Loans to Pay Off Credit Card Debt ([updated_month_year]) 6 Best Loans to Pay Off Credit Card Debt ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/02/loans.png?width=158&height=120&fit=crop)