Just in case you weren’t entirely convinced about the growing wealth gap in America – and the rest of the world for that matter – credit cards that cater to the ultra-rich are popping up everywhere. These exclusive cards often offer the best rewards and elite perks, like access to private jets and personal shoppers, that allow high net worth individuals to reward themselves for all their hard work.

With some of these prestigious cards being made out of actual gold or other precious metals and encrusted with diamonds, they may just be the ultimate status symbol. But if you’re thinking of rushing out and grabbing one of these top-tier credit cards, think again. Most are available only by invitation and only to those whose vacation budgets exceed the annual income of the average American.

So just what credit cards are millionaires using? Keep reading to see our list of some of the most prestigious credit cards used by millionaires, and for those of us who aren’t raking in seven figures a year (hi), we offer links to some perk-packed cards for the more common consumer.

1. Chase Sapphire Reserve®

Regarded as one of the best premium travel cards on the market, the Chase Sapphire Reserve® is in the pockets of millionaires and more modest cardholders alike.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™; Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

22.49%-29.49% Variable

|

$550

|

Good/Excellent

|

The card earns 3X Membership Rewards® points per dollar on travel and dining, and it comes with a valuable signup bonus. Points can be redeemed for travel at a flat rate of 1.5¢ through Chase, or transferred to airline and hotel loyalty programs for even more value.

While the card has a big annual fee, the yearly travel credit takes out a big chunk. Cardholders also receive a ton of travel perks, including airport lounge access, primary rental car insurance, trip delay and cancellation coverage, and extended warranty coverage.

2. Ink Business Preferred® Credit Card

The Ink Business Preferred® Credit Card is a card respected by business owners of all revenue sizes, offering 3X rewards points per dollar in several useful business categories.

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

|

Intro (Purchases)

|

Intro (Transfers)

|

Regular APR

|

Annual Fee

|

Credit Needed

|

|---|---|---|---|---|

N/A

|

N/A

|

21.24%-26.24% Variable

|

$95

|

Good/Excellent

|

While the Ink Business Preferred® Credit Card does have annual spending caps on its bonus rewards that might chafe businesses with millions in cost each year, it will likely be ideal for the well-to-do small business that can maximize their rewards and don’t want to deal with a corporate card.

In addition to rewards, the card comes with a number of valuable perks, including trip delay and cancellation coverage, primary rental car insurance for business rentals, and extended warranty coverage.

3. JP Morgan Chase Palladium Visa

This exclusive credit card is one of the more impressive ones you’ll see. It’s made of actual palladium and gold, etched with the cardholder’s information and account number.

It is available only to those high net worth individuals who have an investment banking relationship with JP Morgan’s wealth management brokerage.

With a fee of only $595 a year, cardholders are lucky enough to not be charged for foreign exchanges, late payments, cash advances or overdrafts. There isn’t a spending limit, either.

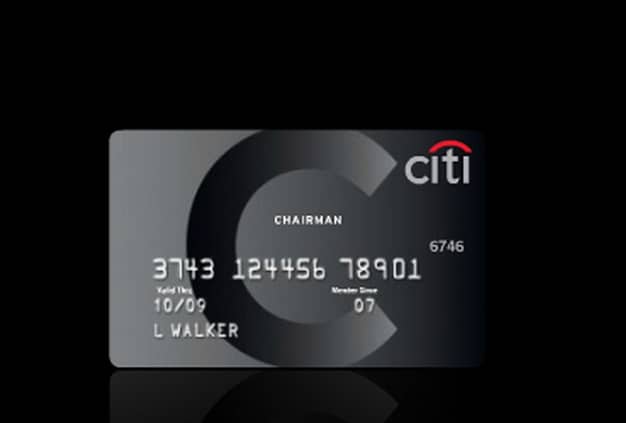

4. Citigroup Chairman Card

Similar to the Chase Palladium card, the Citi Chairman Card is open only to holders of a Citigroup brokerage account. It comes with a $300,000 credit limit and a relatively low annual fee of $500.

This card also has perks such as 24-hour concierge service, travel upgrades, access to private airport lounges and more.

If you weren’t approved for a Chairman Card, consider opening one of our awesome travel cards to get excellent perks of your own.

(The information related to Citigroup Chairman Card has been collected by CardRates.com and has not been reviewed or provided by the issuer or provider of this product or service.)

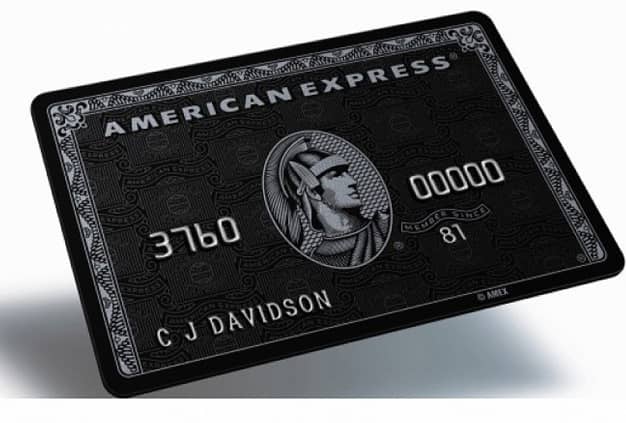

5. American Express Centurion Card

This is the official name of the legendary American Express “Black” Card – arguably the prestige card that started it all. In order to qualify, a holder of the also prestigious American Express Platinum Card would need to have charged $250,000 or more in the previous year.

If they’ve met that impressive goal, invitees will have the privilege of paying a one-time fee of $7,500 and an annual membership fee of $2,500. Of course, they’ll also have the honor of holding one of the most exclusive credit cards in the world.

Naturally, the benefits that come with the card are impressive: a dedicated concierge and travel agent, complementary travel tickets for companions, free nights at select hotels, access to numerous airport clubs and plenty more.

6. Stratus Rewards Visa

In contrast to the Black card (although nearly as exclusive) is the Stratus Rewards Visa “White” card.

This card is also only available by invitation and only to high net worth individuals, although membership is a relatively affordable $1,500 a year. For this fee, cardholders get reward points they can use for things like private jets or charter flights, as well as luxury hotel upgrades and other perks.

7. Coutts World Silk Card

While Americans may not be familiar with Coutts Bank, it’s known in the U.K. as the bank to the Royal Family. The Coutts World Silk Card is therefore suitably exclusive and rare. To be invited to carry this card, an individual must have at least $1 million in a Coutts account.

It goes without saying the perks are equally outrageous: concierge services, extensive worldwide travel insurance, access to more than 700 exclusive airport lounges and numerous VIP offers with travel and retail companies.

If you’re not royalty yourself, you can still find credit cards with awesome points and rewards.

8. Bank of Dubai First Royale MasterCard

Undoubtedly the most ostentatious of all prestige cards, the Dubai First Royale Card is trimmed in gold, with a diamond set in its center.

As you might expect, this card comes with no preset spending limit and is obviously intended for people who don’t need to worry about interest rates or annual fees.

As for the card’s perks, the bank simply states that its round-the-clock team attempts to meet the cardholder’s requests, no matter what they are. Nice.

Final Thoughts

Since most of us will never need to worry about carrying one of these ultra-prestigious cards ourselves, we can only imagine the luxurious uses they get put to. But you don’t have to be a millionaire to carry a card that unlocks prestigious perks.

Some of the top-tier consumer credit cards, like the highly rated Chase Sapphire Reserve®, offer many of the same elite bonuses, including lounge access and travel benefits. The card is even made with metal, giving it the same exclusive feel as many of its invite-only competitors.

So, while cards made of gold or titanium may be out of reach for many of us, there are a number of solid options to help you enjoy some everyday luxury — without paying thousands in annual fees. Thinking about opening a credit card of your own now? Check out our hand-picked favorites!

Photo credits: mindless-marketing.com, luxury-design.com, creditcardexpert.net, pengeportalen.com, clubdelux.pt, dubayblog.com

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![7 Best Credit Cards for Buying Gift Cards ([updated_month_year]) 7 Best Credit Cards for Buying Gift Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2019/11/Best-Credit-Cards-for-Buying-Gift-Cards-Feat.jpg?width=158&height=120&fit=crop)

![5 High Credit Line Credit Cards for Fair Credit ([updated_month_year]) 5 High Credit Line Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/07/High-Credit-Line-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![9 Best Credit Cards For Rebuilding Credit ([updated_month_year]) 9 Best Credit Cards For Rebuilding Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/rebuildcredit.png?width=158&height=120&fit=crop)

![4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year]) 4 Tips: Getting Business Credit Cards with No Personal Credit Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/10/biznocredit.png?width=158&height=120&fit=crop)

![7 Easy-to-Get Store Credit Cards for Bad Credit ([updated_month_year]) 7 Easy-to-Get Store Credit Cards for Bad Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/storecards-2--1.png?width=158&height=120&fit=crop)

![3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year]) 3 Balance Transfer Credit Cards for Fair Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/12/Balance-Transfer-Credit-Cards-For-Fair-Credit.jpg?width=158&height=120&fit=crop)

![9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year]) 9 Best Loans & Credit Cards: 400-450 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/05/bestloans.png?width=158&height=120&fit=crop)

![7 Best Credit Cards & Loans: 800-850 Credit Score ([updated_month_year]) 7 Best Credit Cards & Loans: 800-850 Credit Score ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/11/850.png?width=158&height=120&fit=crop)