Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

Credit card statements contain a wealth of information about your cards and how you use them. Delivered monthly, these statements explain how much you owe, how much interest you’ve been charged, and when your payment is due, among other relevant information.

In fact, almost everything you’ll ever need to know about your cards is packed into these important financial documents. Responsible card users read their statements closely and carefully.

Card companies aren’t required to format their statements the same way or include exactly the same information, so what you’ll find in your statements and how the information is displayed will vary from one card to the next. That said, some key pieces of information are typically included.

Payment Information

The payment section of your statement shows:

- The minimum payment you’re expected to make for the most recent payment cycle.

- The total amount you owe as of the date of the statement.

- The date when your payment is due.

Most statements feature two important payment notices. One notice discloses the late-payment fees and penalty annual percentage rates (APRs) you may be charged if you don’t make the minimum payment or more on or before the due date.

The other notice explains that if you don’t pay more than the minimum, you’ll be charged more interest and it likely will take longer for you to pay off your balance.

Account Information

The account section, typically at the top of your statement, shows your name, your account number, and the opening and closing dates of the billing period that’s covered by the statement. Part of your account number may be left off or masked to protect you against fraud if someone else accesses your statement.

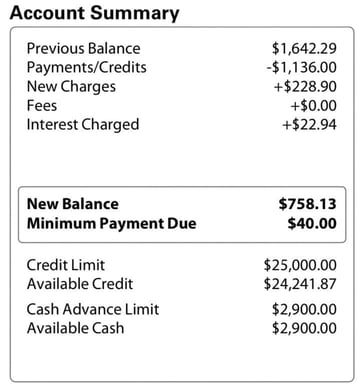

Account Summary

The summary section displays your card balance at the end of the previous statement period and the totals of any payments, credits, purchases, fees, interest charges, cash advances, or balance transfers applied to your account during the period reflected in the statement.

Transactions that were posted to your account after the closing date won’t be included in these amounts until the following month.

The account summary also shows your credit limit for your card and how much of that limit was available as of the statement closing date.

If your card allows cash advances, the amount of your available credit limit you can withdraw for a cash advance may be noted in this section as well.

Rewards Program Summary

The rewards section — if your card offers a rewards program — shows the airline miles, points, cash back, or other perks you’ve earned, including the annual total and the total for the billing period.

This information can help you measure your progress toward accumulating and redeeming your rewards.

Payment Coupon

“Coupon” in this context doesn’t refer to a grocery store discount, but rather the lowest section of your statement, which can be torn off and sent with your paper check if you make your payment via U.S. Mail.

The coupon shows your name, mailing address, all or part of your account number, your payment information, and the mailing address to send your payment. It should also include the name of the card company as it should be written on your check.

If you use the coupon, fill in the amount of your payment in the blank space labeled “amount enclosed” before you mail it.

Payment coupons are designed so you can insert them into an envelope with a transparent window to display the card company’s mailing address. This design makes the coupon convenient to use and helps prevent mistakes that could occur if customers write the mailing address onto their envelopes.

If you make your payment by phone, online, or with a mobile app, you don’t need to use the payment coupon. A helpful tip is to write PAID and the date on the coupon before you file your statement. That notation will remind you that you made your payment even though the coupon is still attached to your statement.

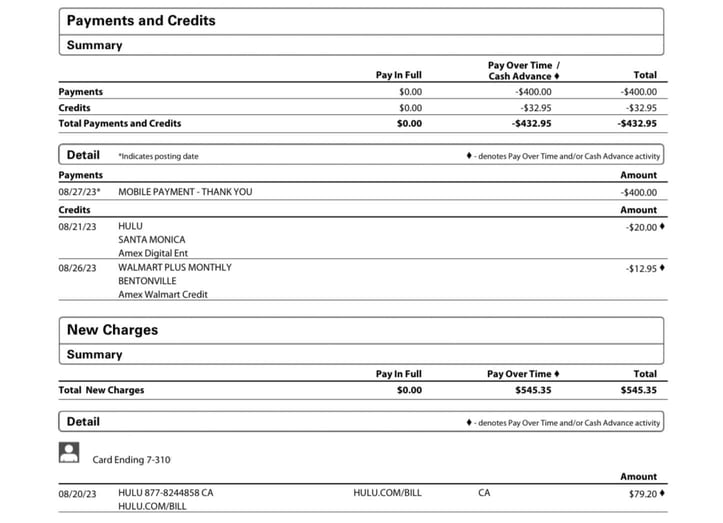

Account Activity

The activity section of your statement is divided into two parts. The first part shows your payment (or payments), returns, and any other adjustments in your favor. The second part lists your purchases in chronological order, along with the merchant’s name and the dollar amount.

It’s a good practice to match each transaction to your records to make sure all of the transactions listed are valid and authorized. Any transaction you can’t match to your records may be an error or fraudulent.

You should contact your card issuer for more information about any transactions you don’t recognize or that appear suspicious as soon as possible. The sooner you report fraud, the sooner your card issuer can cancel your card and replace it with a new one to prevent any further incidents.

Matching your transactions to your receipts or other records can also help you stick to a budget and save money. Look for impulse purchases, overspending at certain merchants, or recurring charges for apps or other services you no longer use.

Interest Charges

If you pay your balance in full and on time every month, you’ll never need to worry about the purchase APR on your card. If you carry a balance, transfer a balance from another card, or obtain a cash advance, you should review your APRs and the portions of your balance to which those rates were applied, and the monthly finance charge applied to your account. That information should be shown in the interest charges section of your statement.

Paper or Paperless? Pros and Cons

Many card companies offer a choice of paper statements delivered by U.S. Mail or electronic statements delivered to an email address. Each option has pros and cons.

Paper statements may be easier to read and reconcile to your receipts. Use them to track spending or business expenses, and file and save them for future reference. But paper statements can also pile up over time, which can create paper clutter and, if enough of them are accumulated, become a fire hazard.

Electronic statements may help reduce paper clutter and can ensure that statements aren’t lost or stolen in the mail. E-statements are also cheaper for card companies to produce since there’s no need for printing, envelopes, or postage.

Most card statements can be accessed online or through a mobile app, which creates a backup system for either paper or electronically delivered statements.

Which is better: paper and paperless? There’s no clear winner, so you should consider the pros and cons and choose whichever option you prefer.

Shop for Cards that Offer Clarity

Card statements pack a lot of information into just a few pages. While it may seem challenging to read and digest, taking time to review your statement each month is a smart financial habit.

If your card statements are confusing or missing key information, you may want to shop for new cards that will give you these important insights in a well-designed format.

![9 Best Credit Cards to Pay in Full Monthly ([updated_month_year]) 9 Best Credit Cards to Pay in Full Monthly ([updated_month_year])](https://www.cardrates.com/images/uploads/2023/11/Best-Credit-Cards-to-Pay-in-Full-Monthly.jpg?width=158&height=120&fit=crop)

![11 Ways to Lower Your Monthly Bill Payments ([updated_month_year]) 11 Ways to Lower Your Monthly Bill Payments ([updated_month_year])](https://www.cardrates.com/images/uploads/2022/06/Ways-to-Lower-Your-Monthly-Bill-Payments.jpg?width=158&height=120&fit=crop)

![3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year]) 3 FAQs: ATM Card vs. Debit Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2016/05/atm-card-vs-debit-card-vs-credit-card--1.png?width=158&height=120&fit=crop)

![3 Key Differences: Charge Card vs. Credit Card ([updated_month_year]) 3 Key Differences: Charge Card vs. Credit Card ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/03/charge-card-vs-credit-card.jpg?width=158&height=120&fit=crop)

![Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year]) Can You Pay a Credit Card with a Credit Card? 3 Ways Explained ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/02/card-with-card-2.png?width=158&height=120&fit=crop)