Opinions expressed here are ours alone, and are not provided, endorsed, or approved by any issuer. Our articles follow strict editorial guidelines and are updated regularly.

There is no shortage of strategies to maximize the financial benefit of credit card accounts. Most of them are generally positive in nature, with little to no downside. But one strategy that threatens to damage your credit reports and credit scores, both short and long term, is the so-called credit card churning — and it should be approached with caution.

Credit Card Churning is the Pursuit of Signup Bonuses

Credit card churning is the process whereby a consumer applies for and opens new credit card accounts in a short period of time and scoops up the various introductory bonuses and rewards offered by credit card issuers, with no real intent on using the card long term.

Once a churner’s credit card application has been approved and they’ve met the minimum spending requirements to receive the signup bonuses, they eventually close the credit card account or otherwise never use it again. It is a bit of a game of credit Russian Roulette, but it can be effective.

The Downsides of Churning

Applying for a bunch of credit card accounts at the same time to earn signup bonuses can lead to considerable problems downstream. And these problems can cost a whole lot more than the upside value of your rewards. These potential problems are, in no particular order:

Negative Impact of Hard Inquiries

When you apply for a bunch of credit cards, your actions are going to leave behind a considerable amount of evidence. Each time you apply, the card issuer is eventually going to pull at least one of your credit reports and credit scores. This is going to leave behind a hard credit inquiry on at least one of your credit reports.

Hard credit inquiries will remain on your credit report/s for up to 24 months. In fact, it is a statutory duty placed upon the credit bureaus that they maintain a list of companies that have accessed your credit reports. The point being, there will be evidence of your churning activities for two years after the fact, and anyone or any company that pulls your credit reports during that time will be able to see it.

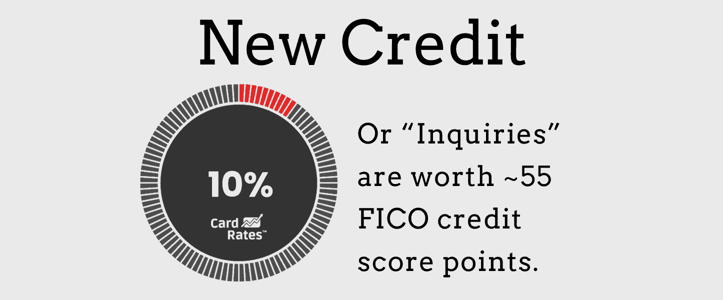

Credit scoring models will see the hard inquiries and they may cause you to have a lower credit score. While the impact of hard inquiries ranges from nothing to de minimis, it is better to have higher than lower credit scores. And credit scoring models consider hard credit card inquiries for their first 12 months on your credit report so any impact to your scores, albeit minor, will last up to one year.

Also, just because a credit scoring model no longer considers hard inquiries after 12 months does not mean they cannot still be problematic. Lenders can still see hard inquiries that are 13-24 months old and may hold them against a consumer as part of their underwriting processes.

Being denied credit just because of a few credit inquiries is almost unheard of, but credit inquiries can be considered along with other aspects of a consumer’s application and can play some role in a lender’s decision.

Negative Impact of Newly Opened Accounts on Your Average Account Age

When you apply for and open new credit card accounts, those accounts are eventually going to be reported to the credit bureaus. Unlike credit card inquiries, which only show up on the credit report that was pulled by the card issuer, newly opened accounts are almost guaranteed to end up on all three of your credit reports. This is likely to happen almost immediately and certainly within 30 days of your account being opened.

When a new account is added to your credit reports, it immediately becomes fair game to credit scoring systems. This means the next time your scores are calculated, those new accounts are going to be part of the scoring process.

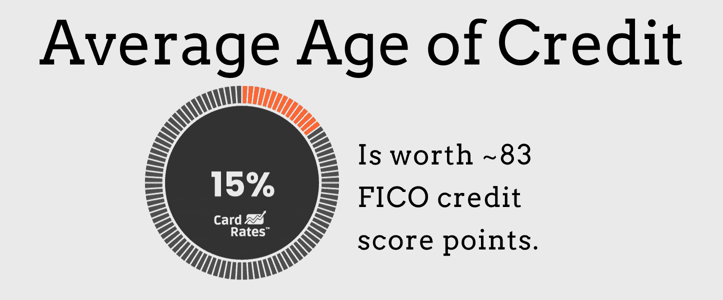

There is one particular metric in credit scoring systems that will be severely penalized by churning activities. That metric is the “average age of trade” metric.

The average age of trade is the average age of all of the credit accounts (not collection accounts or public records) on your credit report, whether they are open, closed, in good standing, in default, whatever. If it is on your credit report, it is considered in this metric.

The calculation is simple math. You take the sum of the age of all of your accounts and divide that value by the number of accounts. For example, if you have two accounts on your credit report, one 12 months old and the other 48 months old, your average age of trade is 30 months, or 2.5 years. The younger your average age of trade, the lower your scores.

When you constantly add new accounts to your credit reports, you are going to make them look younger. And, the more new accounts you add, the more you are going to magnify the problem. You need an average age of trade closer to 15-20 years to max out your credit scores. You will simply never get there if you churn.

While this may seem like a benign issue, the age of credit group of metrics is actually worth 1.5 times the value of the inquiry-related metrics. So if you are concerned about the impact of credit inquiries, you should be more concerned about the impact of a bunch of newly opened accounts. Their impact is greater and lasts longer than the impact of inquiries.

Should I Churn or Not?

While there is certainly nothing illegal about applying for credit as often as you like, it can lead to lower credit scores for a really long time. If you value credit card rewards more than you value your credit scores, then churn away. But if you are going to be in the market for a home loan or an automobile loan in the near future, you may want to skip the churning.

I generally do not give my opinion on these types of things and let adults make adult decisions. But from a financial perspective, a lower-priced mortgage or auto loan is clearly more financially valuable than a few free airplane tickets.

![Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year]) Does My Credit Card Have Travel Insurance? How to Check ([updated_month_year])](https://www.cardrates.com/images/uploads/2015/11/Credit-Card-Travel-Insurance-2.png?width=158&height=120&fit=crop)

![How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year] How Does a Secured Credit Card Work? (+ 5 Best Cards) – [updated_month_year]](https://www.cardrates.com/images/uploads/2016/10/how-does-a-secured-credit-card-work.jpg?width=158&height=120&fit=crop)

![How Does Credit Card Interest Work? ([updated_month_year]) How Does Credit Card Interest Work? ([updated_month_year])](https://www.cardrates.com/images/uploads/2017/07/interestworks.png?width=158&height=120&fit=crop)

![How Long Does It Take to Get a Credit Card? ([updated_month_year]) How Long Does It Take to Get a Credit Card? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/03/howlong2--1.png?width=158&height=120&fit=crop)

![When Does Interest On a Credit Card Start? ([updated_month_year]) When Does Interest On a Credit Card Start? ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/10/When-Does-Interest-On-a-Credit-Card-Start.jpg?width=158&height=120&fit=crop)